One of the best ways you can find an affordable car insurance quote is to shop around. Then you need to compare rates and coverage from several companies. You can get car insurance quotes online by simply entering basic details about your household and car. You need to have car insurance in most states. This post explains what you have to know about car insurance quotes.

Car insurance quotes

A car insurance quote refers to an estimate that shows how much you can pay for an insurance policy. This quote is calculated based on the details you provide, such as your age, your driving history, the car you drive, where you live, and many more.

Insurance companies, such as Youi use their special formula to come up with a car insurance quote. Therefore, if you give the same information to different insurance companies, the quotes may not be the same. This is the reason why you should always get multiple car insurance quotes so that you can find the most affordable insurer for you.

How you can get car insurance quotes

You can get car insurance quotes in various ways. But before you decide to get a car insurance quote, you need to check the reputation of the insurer. You can do this by checking customer satisfaction and complaint records of the potential insurance company.

Also, make sure that you get three car insurance quotes to check whether or not you are getting a fair price for the policy. When comparing car insurance quotes, you also need to check the deductibles and comparable liability limits of each policy.

One of the ways you can get a car insurance quote is over the phone or online. It’s quite easy to get a car insurance quote online. Even better, many insurance companies usually provide free online car insurance quotes. Some of the insurers allow you to begin online and assign you an insurance agent to complete your quote over the phone.

Buying a car insurance policy online or over the phone is considered to be purchasing vehicle insurance directly from the insurance company. It is sometimes a good idea to purchase a car insurance policy directly from the insurer because it allows you to adjust coverage and even check the car insurance quotes for yourself.

Alternatively, you can decide to get car insurance quotes from insurance agents and brokers. This comes in handy when you want to limit yourself to one insurance company. Insurance agents and brokers usually work with several insurance companies and can provide a variety of options for policies. You can get commercial truck insurance quotes online from Royalty Truck Insurance now.

Many small insurance companies, as well as large insurance companies, sell policies via these insurance agents and brokers. Keep in mind that insurance agents and brokers work on commission, so there are good chances that they can offer you the best customer service or even direct you to more affordable car insurance policies. No doubt, you may need to use insurance agents and brokers if you want to have transparency. This is because you can know how much they will be making from your business.

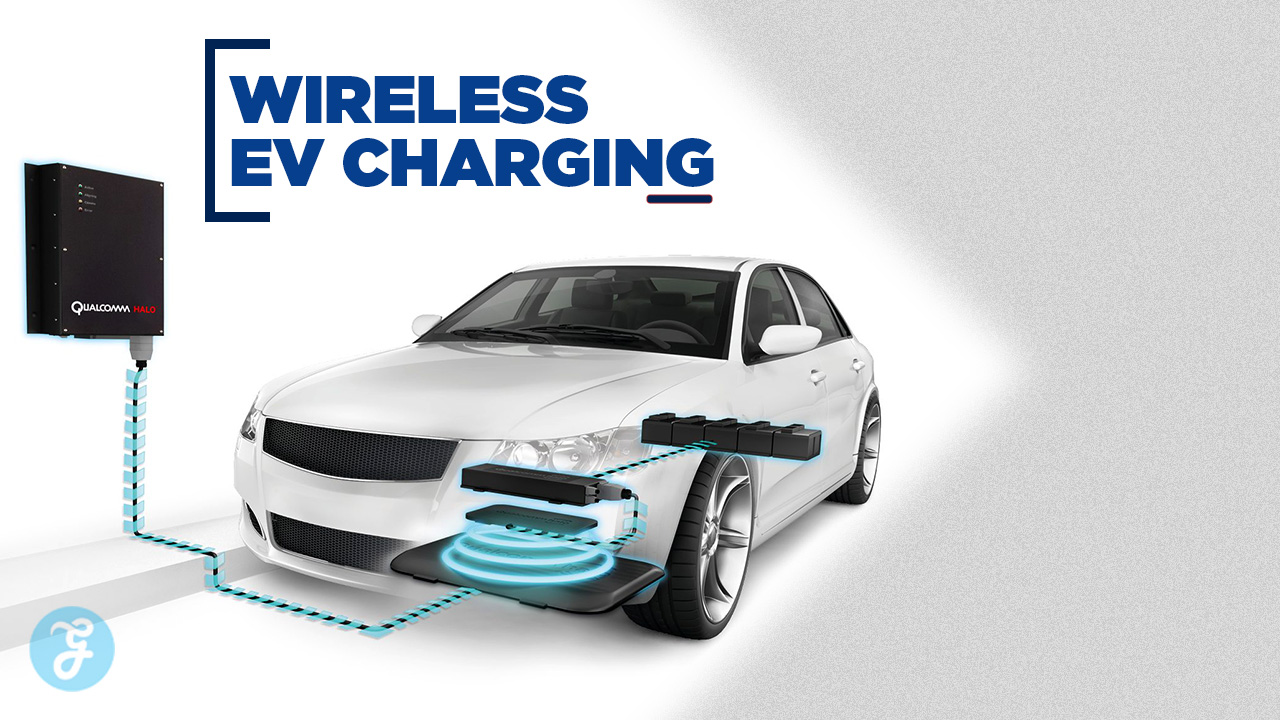

Car Insurance for EV Vehicles : is Battery Protect addon a must for EV cars in India?

Yes, the Battery protect add-on is a must for EV vehicles and other vehicles. The protection covers the whole battery pack from day one of coverage. The battery protect add-on is specifically designed for Electric or Hybrid vehicles or Petrol + Electric models.A good insurance broker who understands the importance of insurance for EVs and follows industry trends can suggest suitable options. They recommend comprehensive coverage that includes battery protection and other essential features. In India, Qian Insurance Broker Firm can suggest a good insurance policy from a list of providers like ICICI, HDFC Ergo, etc. It’s recommended to get insurance cross-checked by a third-party insurance broker to verify the coverage details, including premium rates and repair costs associated with electric vehicles