The fintech industry is booming, offering lucrative opportunities for tech-savvy students who want to combine their passion for finance and technology. With innovations such as blockchain, AI-driven banking, and digital payments reshaping the financial sector, fintech has become one of the most dynamic career fields today. The industry’s rapid growth means there is an increasing demand for skilled professionals, making it an exciting career path for college students looking for future-proof jobs.

Many students aspire to enter fintech but are unsure where to start. Between studying for exams, managing internships, and finding time to write my term paper by PaperWriter, students often struggle to explore their career options. However, breaking into fintech does not require an advanced finance degree or years of experience—many entry-level roles emphasize skills over credentials. With the right knowledge, networking, and practical experience, students can secure a promising fintech career even before graduation.

Why Fintech is a Great Career Choice for College Students

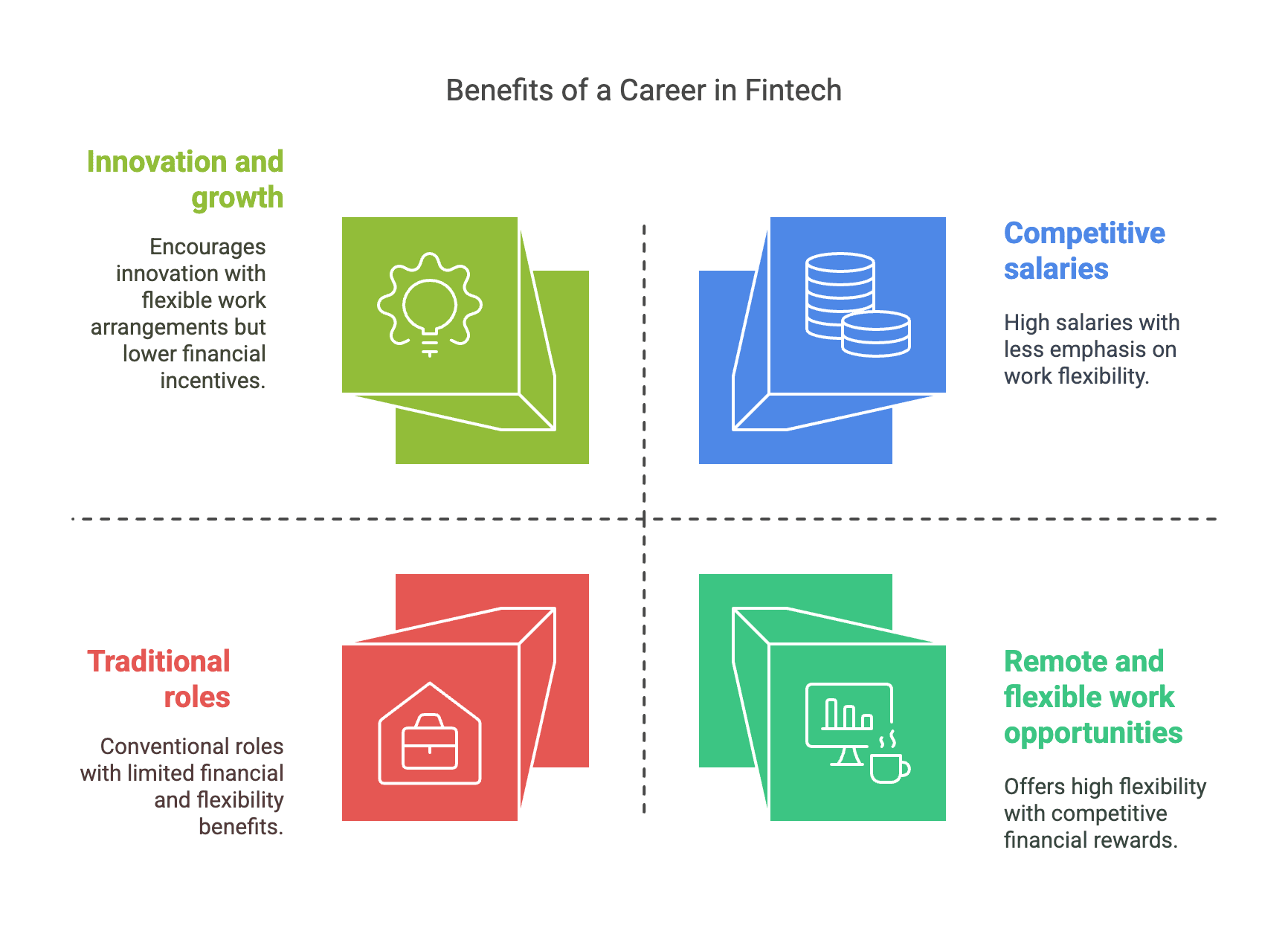

The fintech industry offers several advantages that make it an attractive field for young professionals:

- High demand for talent. The fintech sector is growing rapidly, with startups and established financial firms alike seeking skilled candidates.

- Competitive salaries. Entry-level fintech jobs often pay more than traditional finance or tech roles due to high demand.

- Innovation and fast-paced growth. Fintech is constantly evolving, providing opportunities to work with cutting-edge technology.

- Remote and flexible work. Many fintech companies offer remote work and flexible schedules, making them ideal for students and recent graduates.

- Entrepreneurial opportunities. Fintech startups are booming, and many students with innovative ideas launch their own ventures.

With the fintech industry expanding across various domains, students from different backgrounds—finance, computer science, business, and even marketing—can find their niche in this field.

Top Career Paths in Fintech for College Students

There are several career paths available for students who want to break into fintech. Whether you’re interested in data, software development, cybersecurity, or product management, the industry offers a wide range of opportunities.

1. Data Analyst

Data analysts play a crucial role in fintech by helping companies understand market trends, customer behavior, and investment opportunities. They work with large datasets, using statistical tools and programming languages such as Python and SQL to generate insights that drive financial decisions. For students interested in this field, gaining experience with data visualization tools like Tableau and Power BI is essential. Many fintech firms seek candidates with strong analytical thinking and problem-solving skills, making internships and hands-on projects a great way to gain a competitive edge.

2. Blockchain Developer

With the rise of cryptocurrencies and decentralized finance [DeFi], blockchain developers are in high demand. These professionals create and maintain blockchain-based applications, including smart contracts, digital wallets, and cryptocurrency exchanges. Knowledge of programming languages such as Solidity, Rust, and JavaScript is crucial for this role. Students interested in blockchain development should consider participating in blockchain hackathons, contributing to open-source projects, or taking online courses to gain hands-on experience.

3. Product Manager [Fintech Apps]

Fintech product managers oversee the development of digital financial products, including mobile banking apps, payment platforms, and trading applications. They collaborate with engineers, designers, and marketing teams to ensure that the product meets user needs and business goals. This role requires a mix of technical knowledge, business acumen, and leadership skills. Many students enter fintech product management through internships at startups or by gaining experience in business analysis and UX design.

4. Cybersecurity Specialist

As fintech companies handle sensitive financial data, cybersecurity specialists play a crucial role in preventing fraud, hacking, and data breaches. These professionals design and implement security measures, conduct risk assessments, and ensure compliance with financial regulations. To enter this field, students should develop skills in ethical hacking, penetration testing, and network security. Earning cybersecurity certifications such as CEH [Certified Ethical Hacker] or CISSP [Certified Information Systems Security Professional] can significantly boost employability in fintech security roles.

5. Financial Analyst [Fintech Focused]

Financial analysts in fintech assess investment opportunities, analyze risk, and provide financial strategies for startups and established firms. Unlike traditional financial analysts, those in fintech often work with AI-driven investment tools, automated trading platforms, and alternative data sources. Students interested in this path should develop skills in financial modeling, market research, and risk assessment. Taking finance courses, working on investment case studies, and securing internships at fintech firms can provide valuable experience.

6. AI & Machine Learning Engineer

Artificial intelligence is transforming fintech by enabling fraud detection, automated trading, and robo-advisory services. AI and machine learning engineers develop algorithms that analyze financial data and make predictions to optimize decision-making. This role requires strong programming skills in Python, experience with machine learning frameworks such as TensorFlow and PyTorch, and a solid understanding of statistics and probability. Students interested in AI-driven fintech careers should build their skills by working on AI-powered financial projects or participating in machine learning competitions.

7. UX/UI Designer for Fintech Apps

Fintech apps must be user-friendly and intuitive, making UX/UI designers an essential part of the industry. These professionals focus on creating seamless user experiences by designing interfaces that simplify complex financial transactions. Students interested in this career should build a portfolio showcasing their design skills, learn tools such as Adobe XD and Figma, and gain an understanding of user psychology and accessibility principles. Many fintech startups look for designers who can bridge the gap between aesthetics and functionality in financial products.

8. Fintech Marketing Specialist

Marketing specialists in fintech help companies attract and retain users through digital campaigns, SEO strategies, and content marketing. This role involves understanding customer behavior, optimizing conversion rates, and creating engaging content that educates users about financial products. Students interested in fintech marketing should develop skills in social media strategy, data analytics, and branding. Gaining experience through freelance work or marketing internships at fintech startups can provide a strong foundation for a career in this field.

How College Students Can Break Into Fintech

Breaking into fintech requires a mix of technical skills, industry knowledge, and networking. The first step is gaining relevant skills through self-learning, online courses, or formal education. Many fintech roles require proficiency in programming, data analysis, or financial modeling, so students should focus on building expertise in their chosen field. Websites like Coursera, Udemy, and LinkedIn Learning offer specialized courses that can help students gain the necessary knowledge.

Conclusion: The Future is Fintech

The fintech industry is full of exciting opportunities for college students looking to build a career in finance, technology, or digital innovation. With a variety of roles available—from data analysts and blockchain developers to product managers and cybersecurity specialists—students can find a path that matches their skills and interests. By gaining relevant skills, securing internships, and networking with industry professionals, students can successfully enter the fintech industry and secure a promising, future-proof career.

As fintech continues to reshape global finance, now is the perfect time for students to get involved. Whether working at a startup, joining an established firm, or launching an entrepreneurial venture, fintech offers limitless possibilities for ambitious young professionals ready to take on the future.