Bitcoin has hit a historic milestone, surpassing $120,000 for the first time in history. Early Monday morning trading showed the world’s largest cryptocurrency valued at approximately $121,207, signaling a powerful rally that has more than doubled Bitcoin’s value over the past year. This unprecedented surge is being closely linked to President Donald Trump’s renewed support for cryptocurrency regulation and digital assets in his second term.

Key Drivers Behind Bitcoin’s Record-Breaking Rally

Bitcoin’s rise above $120,000 is not happening in a vacuum. Several significant factors are fueling this explosive growth:

Clear Signals from the U.S. Government on Crypto Legislation

The United States government, under Trump’s leadership, is taking proactive steps toward regulating the cryptocurrency industry. The U.S. House of Representatives is preparing to debate and vote on multiple crypto-focused bills this week, collectively referred to as “Crypto Week” on Capitol Hill. These bills aim to provide a comprehensive legal and regulatory framework for the crypto industry.

One of the most anticipated bills is the GENIUS Act, which seeks to establish clear federal regulations for stablecoins—a type of cryptocurrency tied to traditional assets like the U.S. dollar. This bill would require full asset backing, regular audits, and enhanced transparency measures for stablecoin issuers.

Additionally, two other major legislative proposals are on the table:

-

The Digital Asset Market Structure Bill, which will define whether cryptocurrencies fall under the jurisdiction of the SEC or CFTC by distinguishing between securities and commodities.

-

The Anti-CBDC Surveillance State Act, aimed at banning a government-issued digital currency (CBDC), amid concerns about privacy and overreach by central authorities.

If passed, these laws are expected to reduce legal uncertainty, attract institutional capital, and help push crypto further into the mainstream financial ecosystem.

Trump’s “Crypto President” Strategy and Personal Involvement

President Trump has made no secret of his enthusiasm for the cryptocurrency industry. He has repeatedly referred to himself as the “crypto president,” emphasizing that the U.S. must lead the digital currency revolution. His administration has placed strong emphasis on encouraging innovation in blockchain, digital payments, and decentralized finance (DeFi).

Trump is not just pushing policy—he and his family are personally invested in the crypto economy. His sons Eric Trump and Donald Trump Jr. are involved in World Liberty Financial, a digital finance platform that promotes a stablecoin called USD1. This initiative aims to offer stable, dollar-pegged crypto tokens that are accessible globally and can be used for everyday payments, especially in emerging markets.

While some critics have raised ethical concerns about potential conflicts of interest, the Trump administration argues that its policies will help the United States become the global hub for financial innovation.

Altcoins Ride the Bitcoin Momentum

Bitcoin’s competitors—often referred to as altcoins—have also seen major price gains in recent weeks. Coins like Ethereum (ETH), Solana (SOL), and Avalanche (AVAX) have risen between 10% to 20% in the past two weeks. Market analysts attribute this to investor optimism that regulatory clarity in the U.S. will benefit the entire crypto ecosystem—not just Bitcoin.

As a result, the total crypto market cap has now reached $3.8 trillion, according to data from CoinMarketCap, with Bitcoin alone accounting for more than 50% of that value.

New Financial Products and ETF Inflows Boost Demand

Another major contributor to Bitcoin’s record valuation is the introduction of new financial products on Wall Street, particularly the rise of spot Bitcoin ETFs (exchange-traded funds). Since their approval earlier this year, these ETFs have made it much easier for institutional and retail investors to gain exposure to Bitcoin without needing to directly buy or hold the asset.

The result has been billions in capital inflows into crypto funds, with U.S. Bitcoin ETFs seeing record-high daily volumes. Some of the largest funds, including those by BlackRock and Fidelity, now hold hundreds of thousands of Bitcoin on behalf of investors.

Stock Market Rally and the “TACO Trade”

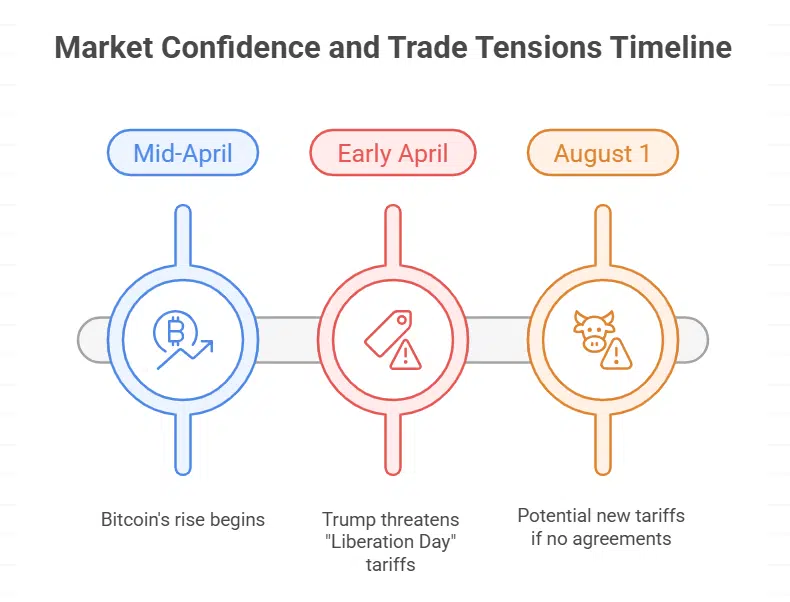

Bitcoin’s meteoric rise is also part of a broader market rally that has taken hold since mid-April. U.S. stock indexes like the S&P 500 and Nasdaq have hit record levels, supported by investor optimism about the U.S. economy, steady interest rates, and hopes of a stable regulatory climate.

Analysts have coined the term “TACO trade”—short for “Trump Always Chickens Out”—to describe the market movement that followed Trump’s delay in implementing sweeping tariffs on major trading partners.

Earlier this year, Trump had threatened to impose “Liberation Day” tariffs on countries like Canada, Japan, South Korea, and the European Union by early April. But he postponed the enforcement of those tariffs to August 1, in an effort to negotiate better trade deals.

This delay sparked renewed confidence among global investors, leading to inflows into both equities and digital assets. However, Trump has made it clear that if no satisfactory agreements are reached, new tariffs will take effect on August 1—a move that could trigger volatility in both the stock and crypto markets.

Market Risks Still Remain

Despite the euphoria around Bitcoin’s new high, experts caution that volatility remains a constant threat. Cryptocurrency markets are historically prone to rapid corrections, especially when sentiment shifts or regulatory uncertainty resurfaces.

Should the proposed bills fail to pass in Congress—or if Trump follows through on his tariff threats—both Wall Street and crypto markets could face renewed selling pressure.

Additionally, while the U.S. is moving forward with regulation, many other major economies have yet to introduce consistent rules. This global inconsistency continues to hold back broader adoption and leaves room for regulatory arbitrage and illicit activity in certain regions.

A Historic Moment for Bitcoin and the Crypto Industry

Bitcoin crossing $120,000 is a historic and symbolic achievement for the digital asset space. Backed by political support, regulatory developments, and institutional investment, the cryptocurrency is increasingly being seen not just as a speculative asset—but as a legitimate part of the global financial system.

As Congress debates key legislation during “Crypto Week,” all eyes will be on Washington to determine whether the U.S. truly steps up to become a global leader in crypto policy—or whether political divides could slow down the momentum.

For now, the markets are celebrating—but caution is still warranted.