The world of investing has been revolutionized by financial technology, or fintech. With the rise of AI-driven insights, commission-free trades, and mobile-first investment solutions, fintech apps are making investing more accessible and efficient than ever.

Whether you’re a beginner looking to start small or an experienced investor seeking sophisticated trading tools, the best fintech apps for investing in 2025 offer something for everyone.

In this guide, we’ll explore the best fintech apps for investing that are shaping the future of finance. We’ll dive into their features, pros and cons, and how they can help you maximize your returns.

Why Fintech Apps Are Revolutionizing Investing in 2025

AI and machine learning are transforming how we invest. The best fintech apps for investing leverage AI to provide predictive analytics, automated portfolio management, and personalized insights that help investors make smarter decisions. In 2025, AI-powered trading bots and robo-advisors are becoming mainstream, helping both retail and institutional investors minimize risk and maximize gains.

Personalized Portfolios and Smart Analytics

Gone are the days of one-size-fits-all investing. The best fintech apps for investing now use AI-powered smart analytics to tailor portfolios to individual financial goals and risk tolerance. These insights help investors make informed decisions and adjust their strategies dynamically based on market trends and behavioral data.

Accessibility and Low-Cost Investing for Everyone

Investing is no longer limited to Wall Street. Thanks to fintech, anyone with a smartphone can start investing with as little as $1. These apps eliminate high fees, making investing more inclusive. In addition, fractional shares allow users to own portions of high-priced stocks, making diversification possible even with a small budget.

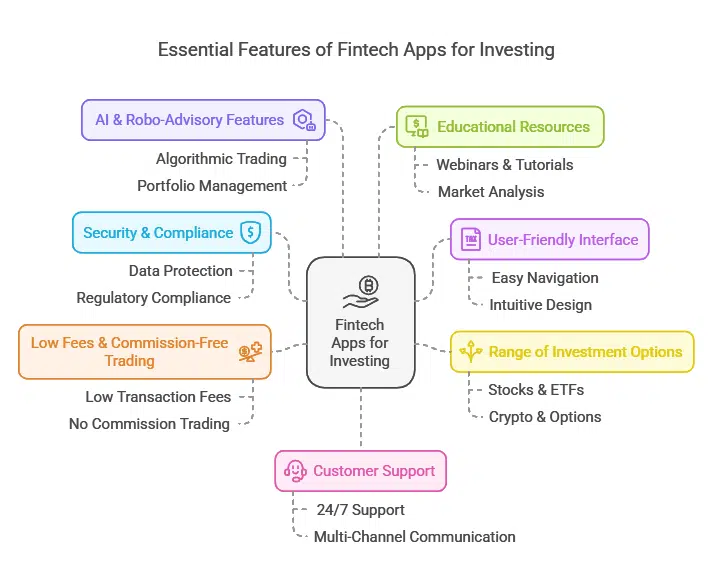

Key Features to Look for in the Best Fintech Apps for Investing

| Feature | Importance |

| Security & Compliance | Ensures your funds and data are protected. |

| User-Friendly Interface | Makes investing easy for beginners. |

| Range of Investment Options | Stocks, ETFs, crypto, options, and more. |

| Low Fees & Commission-Free Trading | Reduces the cost of investing. |

| AI & Robo-Advisory Features | Helps automate investment strategies. |

| Educational Resources | Empowers users with knowledge for informed investing. |

| Customer Support | Ensures assistance when needed. |

When choosing the best fintech apps for investing, make sure they offer these essential features.

10 Best Fintech Apps for Investing in 2025

With fintech reshaping the way people invest, a wide range of apps are making it easier than ever to take control of your financial future. Whether you’re a seasoned investor looking for advanced tools or a beginner exploring your first investment options, these apps offer cutting-edge technology and cost-effective solutions to suit your needs.

Below, we’ve compiled the top fintech apps that stand out in 2025 for their features, ease of use, and value.

1. Robinhood – Best for Commission-Free Trading

Robinhood is a pioneer in commission-free trading, offering easy access to stocks, ETFs, options, and cryptocurrencies. It provides an intuitive mobile experience that caters to both beginners and active traders. While it lacks advanced research tools, it remains a top choice for users looking for no-cost investing.

| Feature | Details |

| Trading Fees | $0 commission on stocks, ETFs, options, and crypto |

| Account Minimum | None |

| Best For | Beginner and cost-conscious investors |

| Platform | Mobile and web |

2. SoFi Invest – Best for Beginner Investors

SoFi Invest provides a hybrid approach to investing, offering both self-directed trading and automated robo-advisory services. It also provides financial planning services at no extra cost, making it ideal for beginners looking for professional guidance. SoFi members benefit from career coaching and educational workshops.

| Feature | Details |

| Trading Fees | $0 for stocks and ETFs |

| Account Minimum | None |

| Best For | Beginners and financial planning seekers |

| Platform | Mobile and web |

3. Betterment – Best for Automated Investing

Betterment is a robo-advisor that creates and manages portfolios based on your financial goals and risk tolerance. It utilizes tax-loss harvesting and auto-rebalancing to optimize returns. It’s best suited for hands-off investors who want a professionally managed experience.

| Feature | Details |

| Trading Fees | 0.25% management fee per year |

| Account Minimum | None for basic plan |

| Best For | Hands-off investors |

| Platform | Mobile and web |

4. Acorns – Best for Micro-Investing

Acorns helps users grow their wealth by automatically investing spare change from everyday purchases. It offers pre-designed diversified portfolios, making investing effortless. Acorns also includes a checking account with cashback rewards.

| Feature | Details |

| Trading Fees | $3-$5 monthly subscription |

| Account Minimum | None |

| Best For | New investors and micro-investors |

| Platform | Mobile and web |

5. Fidelity Investments – Best for Comprehensive Services

Fidelity offers an all-in-one investment platform with no commission fees, advanced research tools, and multiple account types. It’s best for those who want access to a broad range of investment opportunities, including mutual funds and retirement accounts.

| Feature | Details |

| Trading Fees | $0 for stocks, ETFs |

| Account Minimum | None |

| Best For | Long-term investors and retirement planners |

| Platform | Mobile, web, and desktop |

6. Webull – Best for Active Traders

Webull offers a feature-rich platform designed for traders who rely on technical analysis and real-time data. It provides commission-free trading and advanced charting tools, making it a strong choice for active investors looking to maximize their strategies.

| Feature | Details |

| Trading Fees | $0 commission on stocks, ETFs, and options |

| Account Minimum | None |

| Best For | Active traders and technical analysts |

| Platform | Mobile and web |

7. E*TRADE – Best for Options Trading

E*TRADE is well known for its extensive range of investment products and robust options trading tools. It offers commission-free stock trading, a vast library of educational resources, and dedicated platforms for both casual and advanced traders.

| Feature | Details |

| Trading Fees | $0 commission on stocks and ETFs |

| Account Minimum | None |

| Best For | Options traders and educational resources |

| Platform | Mobile, web, and desktop |

8. Charles Schwab – Best for Research and Tools

Charles Schwab is ideal for investors who value extensive research and powerful trading tools. With its no-commission trading model and a robust set of analytics tools, it appeals to both long-term investors and traders.

| Feature | Details |

| Trading Fees | $0 commission on stocks and ETFs |

| Account Minimum | None |

| Best For | Investors who value in-depth research |

| Platform | Mobile, web, and desktop |

9. Ally Invest – Best for Banking and Investing Integration

Ally Invest seamlessly integrates with Ally Bank, providing a one-stop-shop for banking and investing. It offers commission-free trading, a solid range of investment options, and an easy-to-use platform.

| Feature | Details |

| Trading Fees | $0 commission on stocks and ETFs |

| Account Minimum | None |

| Best For | Investors looking for banking and investing integration |

| Platform | Mobile and web |

10. Public – Best for Social Investing

Public is designed for investors who want a social experience while managing their portfolios. It enables users to follow other investors, learn from their strategies, and engage in discussions, making it an interactive way to invest.

| Feature | Details |

| Trading Fees | $0 commission on stocks and ETFs |

| Account Minimum | None |

| Best For | Social investors and beginners |

| Platform | Mobile and web |

Future Trends in Fintech Investing Apps

Decentralized finance (DeFi) platforms are reducing reliance on traditional financial institutions. Investors are increasingly shifting towards blockchain-based solutions that offer transparency and security.

1. AI-Powered Predictions and Automated Trading

AI-driven analytics are improving market predictions, enabling traders to make data-driven decisions faster and more efficiently.

2. Personalized Investing Through Data Analytics

With the integration of big data, fintech apps are personalizing investment strategies based on spending habits, income levels, and financial goals.

Final Thoughts on the Best Fintech Apps for Investing in 2025

The best fintech apps for investing in 2025 make wealth-building easier than ever. Whether you’re a beginner or an experienced trader, there’s a fintech solution that fits your needs. Explore these apps, find the right one for you, and start investing in your financial future today!