You may find it hard to pick decentralized finance apps that earn real passive income. Decentralized finance, or DeFi, uses smart contracts and liquidity pools on blockchains to work without banks.

This guide lists ten platforms like Uniswap, Aave, and Curve Finance, and shows how QuickNode can track your funds. Read on.

Key Takeaways

- Top DeFi platforms include Uniswap, Aave, Compound, SushiSwap, Curve, Balancer, PancakeSwap, Yearn, Synthetix, and MakerDAO. These apps use smart contracts and liquidity pools. You can earn by staking, lending, and yield farming.

- Yield rates vary from 4% APY in Yearn vaults to 80% in Beefy vaults. Convex Finance raises Curve yields to 25%, and Pendle Finance trades future yields near 15%. Lido held over $30 billion in TVL by mid-2025.

- Use audited smart contracts and cold wallets to protect funds. Spread assets across chains like Ethereum, BNB Chain, and Solana. Track TVL and APY in real time with QuickNode (99.9% uptime).

- Liquid staking rises with Lido, EigenLayer, and Jito for stETH and restaked ETH. Institutional vaults plan to stake 640 000 SOL (≈ $100 million) in 2025. Regulators set clear rules to aid DeFi growth and bank partnerships.

What Makes Uniswap a Good Choice for Beginners?

Uniswap runs on Ethereum. It works as a decentralized exchange with an Automated Market Maker model. It offers deep liquidity and low slippage. New users trade with a digital wallet.

They keep full control over private keys, so no central custody. The platform needs only internet access.

Liquidity providers earn trading fees and token rewards. They deposit assets into liquidity pools and start earning passive income. Uniswap DAO guides governance and drives upgrades.

The site stays open day and night, so users can manage positions anytime.

How Does Aave Ensure Secure Lending and Borrowing?

Aave uses smart contract automation to protect your crypto assets. Protocol audits check every code line for bugs. Each loan needs collateral, so counterparty risk stays low. All deposits flow into liquidity pools, letting lenders earn interest payments.

Aave DAO runs governance with community votes on risk parameters. Algorithms adjust interest rates in real time, based on supply and demand. Flash loans and rate switching add flexibility, so you can tweak your strategy on the go.

The platform runs on blockchain networks, joining decentralized finance (defi) markets 24/7, across borders.

Why Is Compound Popular for Earning Passive Income?

This platform automates interest rates with smart contracts. It taps liquidity pools to deliver passive income. Users can lend or borrow multiple cryptocurrencies like DAI, USDC, and ETH.

Returns often beat traditional savings account yields. Blockchain technology logs every transaction on Etherscan for full transparency.

Governance token COMP lets holders shape protocol upgrades. MetaMask wallets link smoothly for deposits and withdrawals. Compound Labs pushes frequent updates to refine the platform.

Yield farmers flock here for yield farming and liquidity mining with minimal hassle. Decentralized finance fans praise its high tvl, security, and automated mechanics.

What Are the Yield Farming Options on SushiSwap?

Liquidity miners can stake single tokens for SUSHI rewards. They can also add token pairs to liquidity pools on this decentralized exchange, powering yield farming in decentralized finance.

Automated smart contracts handle fee splits and send staking rewards. Sushi Labs governs protocol changes and voting.

Cross-chain yield farming spans Ethereum, Polygon, Avalanche networks. Pools offer high APYs in liquidity mining, so you boost passive income. Each deposit earns token rewards in SUSHI tokens.

Farmers should monitor impermanent loss and TVL for safer yields.

Why Is Curve Finance Ideal for Stablecoin Yield Farming?

Curve Finance stands out in decentralized finance. It shines for stablecoin swapping. The DEX keeps fees low and slippage minimal on pools for the Dai stablecoin, USDC, and USDT. Curve DAO controls these stablecoin liquidity pools.

Investors lock assets and smart contracts handle trades and yield farming.

Smart contracts connect Curve with Convex Finance for higher token rewards. They ensure efficient, secure yield farming. CRV tokens boost yields and grant governance rights on the DAO.

Regular audits and full transparency cut risks, including impermanent loss. Passive income grows as TVL climbs and staking rewards rack up.

How Can Investors Use Customizable Liquidity Pools on Balancer?

Investors use smart contracts to run liquidity pools in decentralized finance. They add three or more tokens at any ratio. Custom weightings let them shift risk. Liquidity providers see fees flow in as traders swap.

Automated portfolio management rebalances each trade. Pool utilization drives fee earnings. Liquidity mining makes token rewards extra sweet.

Balancer Labs launched the protocol in 2020. The BAL governance token lets users vote on fees and protocol tweaks. You can adjust pool settings via an on-chain governance tool. This process gives control to the community.

The setup fits both crypto novices and vet whales.

How Does PancakeSwap Provide High Accessibility on the BNB Chain?

This decentralized exchange (dex) runs on BNB Chain, so users pay low fees and avoid Ethereum gas spikes. Transactions clear in seconds, thanks to a proof-of-stake blockchain network.

MetaMask and Trust Wallet link seamlessly, letting traders tap into liquidity pools and yield farming with no fuss. Bridges move tokens from other chains, fueling multi-chain growth.

Smart contracts handle swaps, NFT marketplace deals, and liquidity mining in a few clicks.

Stakers earn CAKE tokens for liquidity provision and yield farming tasks. A built-in NFT marketplace adds extra rewards for token holders. Flexible staking plans let users lock assets from one day to four months and chase high APYs.

The CAKE development team manages updates and governance votes. The user interface delivers clear steps, guiding both rookies and pros.

What Is Automated Yield Aggregation on Yearn Finance?

Yearn Finance uses smart contracts to hunt down top yield farming chances across decentralized finance platforms. It pumps funds into liquidity pools on Curve Finance, Aave, and Compound.

Vaults wrap those strategies. They work with ETH, DAI, USDC and other tokens. Investors lock assets, sit back, and watch compound interest roll in. The automation cuts manual steps and shrugs off timing mistakes.

Vaults show real-time data on yield and performance dashboards. They list expected returns from 4% up to 30%, based on asset and strategy. YFI holders steer updates via decentralized governance.

The Yearn community writes and audits all code. It turns yield farming into a hands-off ride on the blockchain rollercoaster.

How Can You Earn Passive Income Through Synthetic Assets on Synthetix?

Synthetix issues synthetic assets that mirror stocks, commodities, and crypto indices. Smart contracts manage minting and trading on Ethereum. Stakers lock SNX tokens as collateralized debt positions.

Users can gain exposure to gold, Apple shares, and Bitcoin without leaving the blockchain.

Locking SNX in a staking pool earns token rewards and staking rewards each week. Chainlink oracles feed price data for derivative contracts. SNX holders govern protocol upgrades through a voting system.

Traders use on-chain tools to hedge risk or speculate worldwide.

How Does MakerDAO Help You Earn with Decentralized Stablecoins?

MakerDAO runs the protocol behind the DAI stablecoin. It uses over collateralized debt positions on the Ethereum network. Users lock crypto assets as collateral in smart contracts, then mint DAI tokens.

The system uses blockchain technology to show collateral reserves on chain.

Holders can deploy DAI in DeFi platforms for yield farming or liquidity pools. The MKR token drives governance votes on risk settings and protocol upgrades. A decentralized autonomous organization manages changes, and security comes from smart contract audits and on chain governance.

This setup helps earn passive income with decentralized finance.

Key Features to Look for in DeFi Platforms

Check for rock-solid smart contracts, clear on-chain voting paths, and liquid asset pools that handle stake bonuses and locked funds well. Spotting fair coin incentives and smooth user flows can mean the difference between a wallet that sings and one that cries.

What Are the Most Important Features in DeFi Platforms?

Features like robust audits show smart contract expertise. Projects with five years of blockchain experience prove a secure track record. Liquidity pools should run on multiple chains like Binance Smart Chain and Ethereum.

Real-time TVL data and token rewards rates keep users aware of shifts. Automated yield farming tools cut manual steps, limit impermanent loss, and boost passive income.

Decentralized governance via community DAOs gives stakeholders voting rights. End-to-end support teams and regular software updates boost confidence. Competitive APYs on flexible and fixed staking draw both retail and institutional investors.

Transparent communication of fee structures and interest rates builds trust in defi platforms.

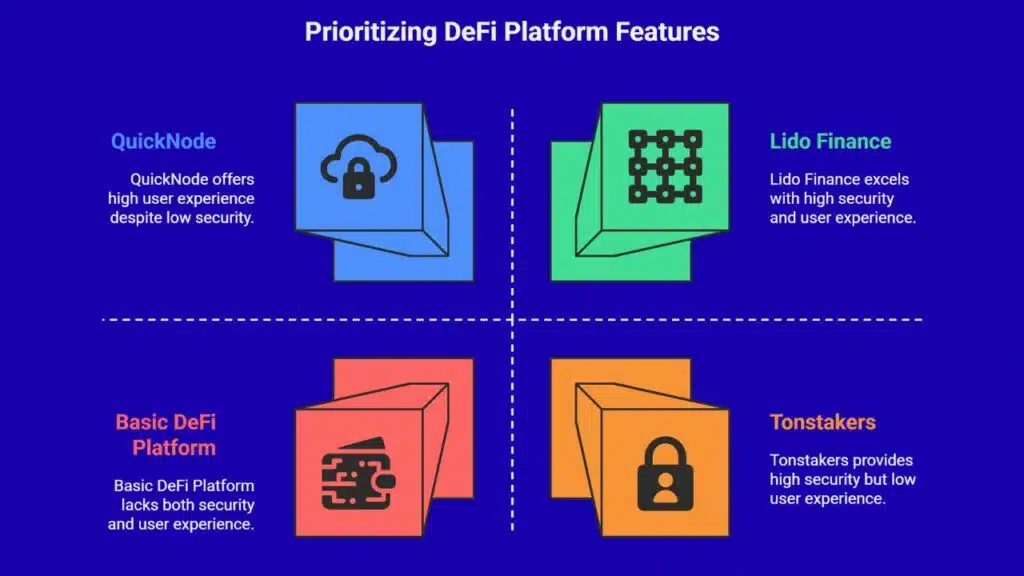

How Does Security Impact DeFi Platform Selection?

Security drives platform choice in decentralized finance. Platforms with on-chain governance and regular audits win user trust. Smart contract audits catch bugs before they cost users.

Lido Finance passed audits and holds over $30 billion in TVL by mid 2025. Protocols with penalty protection tools like Tonstakers cut staking risks. Node service QuickNode uses high availability and full data backfill, so decentralized exchanges run without hitches.

Real-time auditing and fraud shields help reduce hacks. Protocols set up institutional-grade firewalls for proof-of-stake pools. Clear rules from regulators shrink legal risks and curb impermanent loss fears.

Guarded code agreements protect liquidity pools from exploits. Platforms that lock in token rewards draw more yield farming fans. This choice links to better passive income and portfolio diversification.

What Role Does User Experience Play in Choosing a Platform?

Clear visuals and simple menus help users spot yield farming data fast. Margex logs show 85% of newbies pick it for its clean design. Uniswap links wallets directly, so traders keep full control over tokens.

OKX and Jito let you stake or unstake with no wait times, so you can chase the best TVL in liquidity pools. Tonstakers trims withdrawal times to 1 minute, versus 18 hours at many venues.

Live analytics and reporting tools assist your choice.

Multilingual support helps traders from Brazil to Japan tap into DeFi with ease. PancakeSwap adds NFT drops and yield farming in one seamless trade. Lido Finance and Jito let you use liquid staking tokens, so you can earn staking rewards without locking up assets.

Risk Management Tips for DeFi Investments

You can protect your crypto stash by vetting smart contracts, spreading funds across stablecoins, and checking dashboards like MetaMask or Etherscan—read on for more tips.

How Can You Minimize Risks in DeFi Investments?

DeFi still holds risks around hacks and errors. Proper planning cuts hazards.

- Audit protocols using a block explorer and public security reports to verify smart contracts.

- Distribute holdings among multiple chains, liquidity pools, and farming schemes to limit losses.

- Pick platforms that show on-chain governance votes and clear token roadmaps.

- Reject deals with sky-high APYs that lack history or show low TVL, they mask liquidity traps.

- Insure positions with penalty protection or insurance services such as Tonstakers.

- Secure keys in cold-storage devices or trusted Web3 wallets to block seed-phrase theft.

- Monitor key metrics in real time with a portfolio tracker to catch protocol shifts.

- Research team profiles, check GitHub commits and white papers to avoid anonymous projects.

- Avoid pools combining volatile coins that expose you to large impermanent losses.

What Are Common Security Practices for DeFi Users?

Most DeFi hacks start with a weak wallet. Simple habits can keep your tokens safe.

- Store tokens, like DAI stablecoin and other cryptos, in cold wallets or a trusted hot wallet rather than on exchanges.

- Activate two-factor authentication on every exchange account, for example OKX, to add a security layer.

- Move yield farming or staking rewards back to your personal wallet after you earn them on DeFi platforms.

- Pick platforms that show public security audits, smart contract reviews, and active bug bounty programs.

- Skip clicking links in random emails or chats, and never connect your wallet to unknown decentralized apps.

- Update your wallet software on the blockchain network often, and revoke any unused permissions.

- Favor sites with real-time attack monitoring, rapid response teams, and clear bug bounty protocols.

- Study common scams and phishing tactics so you can spot funky token rewards or fake liquidity pools.

How Should You Diversify to Manage DeFi Risks?

Diversification cuts DeFi risk. It protects your crypto income.

- Set clear caps across lending, liquidity mining, yield farming, and staking. This splits funds to limit losses in any single smart contract.

- Use stablecoin holdings like USDC or DAI for 40 percent of assets. Non-stable token positions then add growth potential with balanced risk.

- Choose protocols on Ethereum, BNB Chain, and Solana. Cross-chain exposure reduces network congestion and gas fee risks.

- Pick institutional-grade platforms such as Aave and Compound for large sums. They run audits and keep high TVL to back staking rewards.

- Split staking between liquid staking on OKX and fixed terms on Margex. This mix adapts to market moves and shifting interest rates.

- Track governance tokens and protocol upgrades. Shifts in voting power can alter smart contract safety and token rewards.

- Spread assets across multiple liquidity pools and vaults. This tactic lowers impermanent loss when one pool faces volatility.

- Rebalance your portfolio monthly in line with changing APYs and TVL. This practice locks in gains and boosts passive income.

Best Practices for Maximizing Returns

Rebalance your crypto portfolio often to dodge temporary dips like a ninja and snag fresh token rewards. Use yield farming tactics and automation bots like Yearn or Lido to boost your gains.

What Strategies Help Maximize Passive Income in DeFi?

Crypto fans chase passive income in DeFi. Smart tactics can boost your returns.

- Stake tokens in high-APY liquidity pools on dexs such as Uniswap or SushiSwap to earn token rewards, interests, and gains from liquidity mining.

- Use vault tools on Beefy or Yearn. They track data and move tokens for top yields.

- Monitor market volatility and move funds when demand or supply shifts to find fresh TVL chances.

- Combine liquid staking on Lido or Jito with yield farming for proof-of-stake gains and wider returns.

- Lend assets on Curve for dai stablecoin yield farming. You face less impermanent loss and earn steady interests.

- Spread funds over multiple chains and platforms to lower smart contract risk and guard your capital.

- Track TVL and APYs daily. This helps you spot pools with new token rewards.

- Lock tokens in flexible or fixed staking vaults. You can grab up to 80% APY on select Beefy vaults.

- Mint synthetic assets on Synthetix. You earn fees from decentralized derivatives and diversify income.

How Does Timing Affect Your DeFi Earnings?

Early entry into new high-yield products can capture higher APYs. Ethena’s offering fell from sixty percent to below five percent in 2025. A fresh smart contract launch in a liquidity pool can yield big token rewards at first.

Liquidity mining campaigns on a decentralized exchange boost initial returns. TVL on liquid staking may top thirty billion dollars on Lido Finance. That trend may signal a yield shift.

Timely withdrawal during market volatility protects your passive income. A pool upgrade on Yearn Finance can alter harvest windows. Protocol upgrades under decentralized governance may steer yield changes.

Shifting out of a fixed staking program limits impermanent loss. The U.S. SEC said in 2025 that proof-of-stake rewards on a blockchain network do not count as securities. Watch lock-up terms and withdrawal windows on a DEX to avoid missed chances.

Track APY trends on stablecoin pools and on non-stablecoin products in your crypto portfolio.

What Tools Can Optimize Your DeFi Investments?

Smart solutions save time and boost gains. They tap RPC, archive and WebSocket nodes, track gas efficiency and monitor liquidity flows.

- QuickNode offers 99.9% uptime on RPC, archive and WebSocket endpoints. It delivers real-time on-chain data for analytics and gas tracking.

- Dune Analytics lets you craft custom Stream Templates with live TVL and transaction metrics. It uses SQL on blockchain data for clear yield farming insights.

- Gas Station Network shows live gas prices across chains. It optimizes smart contract calls to cut transaction costs.

- Yearn Finance vaults auto-shift your tokens among Aave, Curve and Compound. It pools yield farming strategies to chase top APYs.

- Beefy Finance runs on Binance Smart Chain. It auto-compounds staking rewards and amplifies token gains.

- Convex Finance aggregates Curve Finance liquidity pools. It displays transparent staking metrics and token rewards.

- Snapshot governance portal tracks proposal votes on decentralized finance platforms. It lets you join governance with simple dashboards.

- APY Watcher highlights risk metrics and annualized yield rates. It helps you balance impermanent loss while earning passive income.

- Zapper dashboard links to multiple decentralized exchanges. It tracks your liquidity pools, token swaps and portfolio value in real time.

- Forta network scans smart contracts for exploits. It sends instant security alerts to protect your capital.

Future Trends in DeFi and Passive Income Opportunities

New code agreements will power upgraded blockchain networks to expand fund reserves and boost rewards. Fluid staking services will pool tokens into yield vaults to drive steady earnings.

What Emerging Trends Will Shape DeFi’s Future?

Institutional vaults plan to stake over 640,000 SOL in 2025, worth about $100 million. Regulators carve clearer rules across major markets, cutting guesswork for platforms and users.

Banks team up with DeFi platforms to fuse smart contracts with legacy rails. Derivatives venues like dYdX and GMX drive new traction, as traders chase token rewards and passive income.

Governance models shift toward greater protocol autonomy, cutting manual risk steps. Developers roll out fresh yield farming bundles that mix liquidity pools with stablecoin vaults.

Lido Finance and other staking platforms expand liquid staking, boosting TVL across chains. Investors tap collateralized debt positions and flexible staking options to hedge market volatility.

How Will Passive Income Opportunities Evolve in DeFi?

Protocols will pack new yield farming options. Liquid staking tools like Lido Finance, EigenLayer and Jito let you earn on stETH and restaked ETH, with APY above 10%. Convex Finance boosts Curve DAO token farming up to 25% APY, while Pendle Finance trades future reward claims for yields near 15%.

Beefy Finance vaults chase high returns, some near 80%, though risk climbs too.

Yearn vaults target four to thirty percent returns by shifting funds across lending protocols. Stablecoin staking with DAI or USDC can hit ten percent annual yield. Tonstakers enables one minute withdrawals, so you can redeploy capital fast.

Hard audits and stronger smart contract protocols keep token rewards safer and guard against impermanent loss.

What Technologies Are Driving DeFi Innovation?

Decentralized finance taps blockchain networks and smart contracts. They automate trades, lock assets in liquidity pools, and boost efficiency and transparency. You can stake assets in liquid staking networks like Lido and EigenLayer to earn rewards.

A node service like QuickNode offers analytics, real-time auditing, and hack protection. Multi-chain support across Ethereum, Binance Smart Chain, and Solana grows TVL and widens passive income paths with yield farming.

Automated vault managers such as Balancer optimize asset weights to lower impermanent loss. Synthetic asset platforms like Synthetix enable on-chain trading, hedging, and decentralized derivatives.

Decentralized exchanges such as Uniswap, dYdX, and GMX power liquidity mining and complex strategies.

Common Mistakes to Avoid in DeFi Yield Farming

Novice users often stake coins in liquidity pools without smart contract checks or impermanent loss hedges, then cry over spilled milk—read on to avoid these pitfalls.

What Are Frequent Errors New Users Make in Yield Farming?

New users often pull the yield farming lever without checking the trapdoor. They plunge into asset pools chasing big APYs, and end up pinching pennies.

- Research lapses on protocol audits expose funds to automated script bugs.

- Overconcentration in a single asset pool spikes temporary loss.

- Chasing sky-high APYs backfires, as seen with Ethena’s plunge from 50,000% to single digits.

- Ignoring gas fees chips away at stake bonuses, wiping out small gains.

- Skipping real-time tracking leaves you blind to yield drops or protocol shifts.

- Neglecting diversification across DeFi platforms deepens wallet wounds.

- Forgetting to withdraw or rebalance locks yields in a sinking ship.

- Plunging into low-volume pools invites slippage and front-running bots.

- Underestimating network congestion pushes transaction costs through the roof.

- Backing unvetted automated scripts risks hacks and exploits.

How Can You Protect Yourself from Scams and Hacks?

Hackers seek weak links in DeFi platforms. Smart habits can fend off scams and hacks.

- Choose audited platforms such as Lido or Tonstakers for their regular security audits.

- Skip obscure decentralized exchanges or liquidity pools with no public team or clear docs.

- Keep private keys and seed phrases offline at all times.

- Review wallet permissions daily and revoke access to unused DApps.

- Enable multi factor auth and use hardware wallets for all DeFi actions.

- Study common phishing tactics before approving malicious smart contracts.

- Participate in bug bounty programs and track response teams for quick fixes.

- Use QuickNode analytics and monitoring to spot odd moves in yield farming pools.

What Should You Avoid to Preserve Your Earnings?

Risky moves can kill your passive income. Smart moves can keep your crypto stash safe.

- Flee platforms with sky-high APYs and low tvl. Many show tiny user counts, they can vanish overnight.

- Pass on protocols with rigid lock-up periods. Locked assets block you from acting when market swings hit.

- Steer clear of projects missing clear documentation or open decentralized governance. Vague guides hide code pitfalls.

- Shun ventures that pour all capital into synthetic assets; collateralized debt positions can amplify losses.

- Skip defi platforms that bury you in fees. High charges can wipe out your yield farming gains or token rewards.

- Walk away from dexs in legal gray areas. Regulatory shifts may freeze your dai stablecoin or stall withdrawals.

- Eschew liquidity pools without insurance or penalty cover. Impermanent loss can drain your deposit under market volatility.

- Dodge farms lacking code audits on Etherscan to avoid hidden bugs in smart contracts.

FAQs About DeFi and Earning Passive Income

Got questions on how smart contracts power token rewards or on avoiding impermanent loss in a liquidity pool? We break down key FAQs and show you how to use Etherscan, MetaMask, and a DEX aggregator so you can grow your passive income without sweating the small stuff.

What Is DeFi and How Does It Work?

DeFi uses smart contracts on blockchain networks like Ethereum or Binance Smart Chain. It lets users trade, lend, or stake digital assets without a bank. Apps tap liquidity pools to match lenders and borrowers automatically.

They run non-stop and put you in full control.

You earn passive income via yield farming or staking rewards. DAOs handle governance, so token holders can vote on fees or upgrades. This approach cuts transaction costs, and speeds cross-border transfers.

DeFi paved the way for 24/7 markets and self-custody of assets.

How Can Beginners Start Earning Passive Income with DeFi?

New users pick a decentralized exchange like Uniswap to add liquidity pools, earn token rewards via smart contracts. They stake assets on OKX or Lido Finance using flexible staking and liquid staking, tapping yield farming and staking rewards.

They join Yearn Finance for automated yield aggregation and simple optimization. They rely on blockchain network tools to track TVL and monitor APY.

Stablecoin staking on a dai stablecoin yields up to 10% returns with lower risk. Liquidity mining campaigns on decentralized platforms grant bonus rewards without much fuss. They start with small totals, diversify across chains like Binance Smart Chain, curb impermanent loss, and scale up as they gain confidence.

What Are the Risks Involved in DeFi Investments?

Smart contract bugs can drain your funds in a flash. You might face impermanent loss when you add assets to liquidity pools. A sudden market swing can wipe out token rewards. Ethena’s APY plunged from 60% to below 5% in 2025, proof that yield figures can flip overnight.

Regulatory changes can lock out US users or shut down a blockchain network in certain countries. Centralized exchange failures have stranded deposits without FDIC backup. Tonstakers offers penalty protection or insurance on some vaults, but DeFi offers no safety net from a government sponsor.

You must dig into project audits and watch dashboards every day to spot trouble.

Takeaways

These 10 DeFi platforms let you earn passive income with smart contracts and liquidity pools, while you grab a coffee. You can stake tokens on lending markets, trade on a DEX, or farm crypto with token rewards.

A node provider helps you track TVL, or total value locked, without code headaches. Impermanent loss can sting, but yield farming tweaks can cut risks. Community votes power decentralized governance, so you can shape fees and updates.

Keep a balanced portfolio, watch gas fees, and enjoy your crypto growth ride.

FAQs

1. What are the main ways to earn passive income on DeFi platforms?

You can join liquidity pools, try yield farming, stake coins on a proof-of-stake network, or lend tokens on a decentralized finance app.

2. How do smart contracts work in yield farming?

A smart contract is code on a blockchain network. It holds your crypto, runs without humans, then pays you token rewards for lending funds.

3. Which decentralized exchanges let you farm tokens with liquidity mining?

Many decentralized exchanges let you add funds to a pool, like a curve-based trading platform, on Binance Smart Chain or Ethereum 2.0, then they send you extra coins.

4. What is impermanent loss, and how can I avoid it?

Impermanent loss happens when pool tokens change price, it can cut your gains. Stick to stablecoin pools or smaller pools to lower that risk.

5. How does liquid staking differ from fixed staking?

Liquid staking, via a liquid staking service, gives you a tradable token for each stake, while fixed staking locks your coins for a set time, so you can’t trade them until the end.

6. How do I handle taxes on DeFi dividends and yield?

Track your block rewards and staking rewards. Report gains under capital gains tax rules. If you feel lost, ask a tax pro.