Worried about your credit score dropping without warning, or worse, identity theft sneaking up on you? Credit monitoring can track your credit reports and alert you to odd changes fast.

In this post, we’ll break down the 10 Best Credit Monitoring Services for 2025, tested and ranked to keep your finances safe. Stick around, let’s find your fit!

Key Takeaways

- Experian stands out as the leading credit monitoring service in 2025 with a 4.8 rating, covering all three bureaus and offering plans ranging from free to $34.99 monthly.

- Credit Karma shines as the premier free choice with a 3.9 rating, delivering daily updates from Equifax and TransUnion, along with user-friendly apps rated 4.7 on Google Play.

- Aura is exceptional for families in 2025 with a 4.7 rating, providing $5 million in identity theft insurance and plans priced between $15 and $50 a month.

- myFICO is the go-to option for accessing FICO scores, rated 4.2, with plans from free to $39.95 monthly and monthly updates from all three bureaus.

- LifeLock Ultimate Plus brings cutting-edge features in 2025, including three-bureau monitoring and $1 million in identity theft insurance for individuals and families.

Experian: Best Overall Credit Monitoring Service

Experian shines as the top pick for credit monitoring in 2025, and it’s easy to see why. With a stellar 4.8 rating, it covers all three major bureaus: Equifax, Experian, and TransUnion.

You get a solid mix of features, from tracking your credit score to spotting fraud alerts. Their plans range from free to $34.99 per month, fitting various budgets. Plus, the free plan tosses in a FICO 8 score, an Experian credit report, real-time alerts, and even dark web monitoring.

Got a family to protect? Check out their IdentityWorks Family plan at $34.99 monthly. It guards two adults and up to ten kids against identity theft, backed by $1 million in identity theft insurance.

Whether you’re dodging credit card fraud or sneaky data breaches, Experian keeps your credit history safe. It’s like having a watchdog for your financial life, barking at any sign of trouble.

Stick with this service, and sleep a bit easier knowing your personal data has a tough shield.

Credit Karma: Best Free Option

Hey there, let’s chat about Credit Karma, the top pick for free credit monitoring in 2025. This service shines with a solid 3.9 rating, and guess what? It costs you nothing, zero, zilch.

You get daily updated reports and access to your VantageScore, straight from Equifax and TransUnion, two major credit bureaus. That means you’re always in the loop about your credit score changes.

Now, here’s the cherry on top, Credit Karma’s mobile apps are a breeze to use. They’ve got awesome ratings, 4.7 on Google Play and 4.8 on the App Store. Want to keep tabs on credit report errors or watch for identity theft? This tool has your back with easy alerts.

Plus, it helps you understand your credit history, so you can make smart financial decisions for loans or credit cards. Stick with this free option, and you’ll feel like a pro in no time.

myFICO: Best for FICO Score Access

Dig into myFICO if you want the real deal on your FICO score. This service, rated at 4.2, shines for giving you direct access to those vital numbers from Equifax, Experian, and TransUnion, the big three credit reporting agencies.

Whether you’re eyeing a mortgage or just checking your credit history, myFICO offers plans from $0 to $39.95 per month, with three options to fit your wallet.

Now, let’s talk perks, shall we? Their Premier plan at $39.95 a month gets you monthly updates from all bureaus, plus advanced scores and industry-specific data. You even get a credit score simulator to play around with financial decisions.

It’s like having a crystal ball for your credit reports, helping you spot errors or dodge identity theft before it stings!

Aura: Best for Families and ID Theft Insurance

Aura stands out as the top pick for families needing solid credit monitoring and identity theft protection. With a stellar 4.7 rating, it covers all three big bureaus, Equifax, Experian, and TransUnion.

Plus, it offers a hefty $5 million in identity theft insurance for family plans. That’s a big safety net if something goes wrong!

On top of that, Aura packs extras like a VPN, antivirus protection, and a password manager. Plans range from $15 to $50 a month, or $144 to $384 a year. Just watch out, the price might jump after the first year.

If you’ve got kids or loved ones to shield from fraud alerts and data breaches, this service feels like a cozy blanket on a cold night.

IDShield: Best for Comprehensive Identity Protection

IDShield stands out as a top pick for guarding your identity. It offers solid identity theft protection with a stellar 4.7 rating. You get coverage across Equifax, Experian, and TransUnion, the big three in credit bureaus.

Plus, they throw in a whopping $3 million in identity theft insurance. If fraud strikes, private detectives jump in to help, and you’ve got 24/7 assistance ready to go.

Got a family to protect? IDShield has plans just for that. Pick the $29.95 per month option for single-bureau monitoring, or step up to $34.95 monthly for full three-bureau credit monitoring.

They watch for sneaky stuff like fraudulent activity and social security number misuse. With dark web scanning and customized alerts, it’s like having a watchdog for your personal info.

Stick with this service to keep identity thieves at bay.

Credit Sesame: Best Low-Cost Option for 3-Bureau Monitoring

Hey folks, let’s chat about Credit Sesame, a top pick for affordable three-bureau credit monitoring. It snags a solid 4.1 rating, and for just $9.99 a month, you get coverage from Equifax, Experian, and TransUnion.

That’s a steal for keeping tabs on your credit reports across all major bureaus, right?

On top of that, Credit Sesame offers free tools to track your credit score, plus a hefty $1 million in identity theft insurance. If you want more, their Sesame+ Complete plan at $19.99 monthly gives detailed reports and scores.

It’s like having a watchful buddy for your credit history, guarding against fraud alerts and sneaky errors!

Identity Guard: Best for AI-Powered Monitoring

Identity Guard stands out in 2025 for its sharp AI-powered monitoring. This tool keeps a close watch on your credit and personal info, spotting threats fast. It offers plans for singles, couples, and families, fitting all kinds of needs.

Plus, with dark web monitoring and social media alerts, it guards against identity theft like a hawk.

On top of that, you get monthly VantageScore 3.0 updates to track your credit score changes. Identity Guard also packs up to $1 million in identity theft insurance, along with help from private detectives if things go south.

With fees between $16.67 and $25 a month, it’s a solid pick for strong protection without breaking the bank.

LifeLock Ultimate Plus: Best for Advanced Features

Hey folks, let’s chat about LifeLock Ultimate Plus, the top pick for advanced features in credit monitoring services for 2025. This service packs a punch with three-bureau credit monitoring, keeping tabs on your credit reports across all major agencies.

You’ll also get credit score tracking and quick fraud alerts if something fishy pops up with identity theft.

On top of that, LifeLock offers identity theft insurance with coverage up to $1 million, which is a big safety net. They throw in extra tools like a VPN, antivirus software, and a password manager to guard your online life.

Pricing might jump after the first year, and there’s no credit score simulator, but they do have plans for individuals and families. Plus, family options come with parental controls and safe gaming features for kids.

How cool is that?

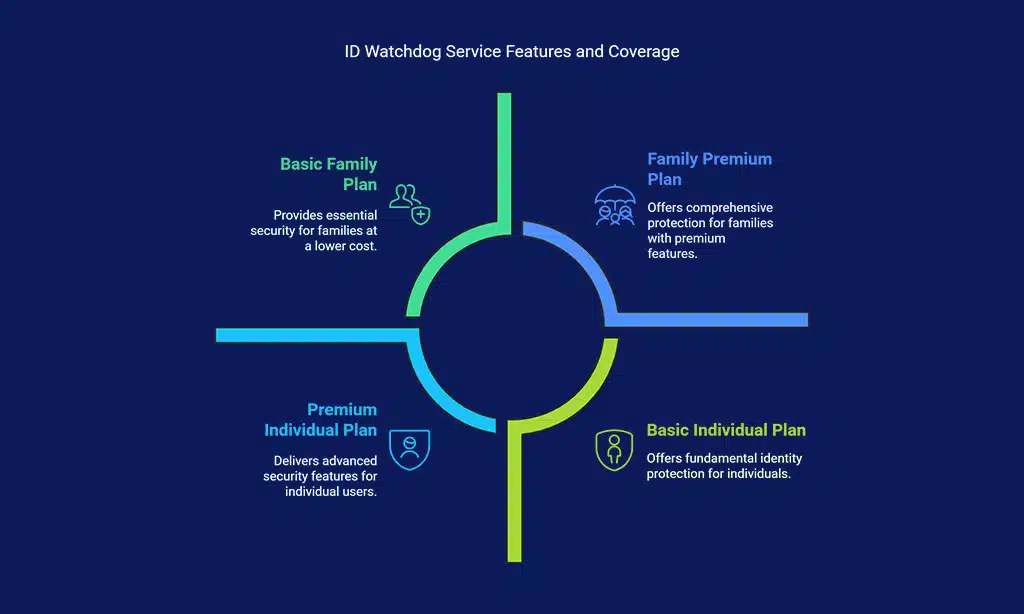

ID Watchdog: Best for Security Features

ID Watchdog stands out with a solid 4.2 rating for its top-notch security features. If you’re worried about identity theft or data breaches, this service has your back. It offers dark web monitoring to catch any funny business with your info.

Plus, it provides social security number monitoring to keep your personal details safe from credit card fraud.

On top of that, ID Watchdog gives you daily updates, credit locks, and a hefty $1M in identity theft insurance. Plans range from $14.95 to $34.95 a month, or $150 to $350 a year, covering Equifax, Experian, and TransUnion in premium options.

Got a family? Their Family Premium Plan at $34.95 a month protects up to 4 kids, keeping everyone secure from cyber threats.

Equifax Complete Premier: Best for VantageScore Monitoring

Equifax Complete Premier stands out for tracking your VantageScores with ease. For just $19.95 a month, you get solid three-bureau credit monitoring across Equifax, Experian, and TransUnion.

That means you’re covered from all angles, no gaps in sight.

What makes this plan shine is the extras. Think $1 million in identity theft insurance, protecting up to five family members. Worried about data breaches or credit card fraud? This service offers dark web monitoring and quick fraud alerts.

Stick with this for peace of mind on your credit reports and scores.

CreditWise by Capital One: Best for Simplicity and Accessibility

Hey there, let’s chat about CreditWise by Capital One, a super easy tool for keeping tabs on your credit. This free credit monitoring service is a gem for anyone who wants simplicity.

You don’t need to be a Capital One customer to use it, which is pretty cool. It checks your credit reports weekly, pulling data to spot any odd changes or sneaky credit inquiries. Think of it as a watchful buddy, always looking out for you.

Got a busy life? No sweat, CreditWise makes things hassle-free with clear alerts for potential credit card fraud or identity theft. It’s tied into free fraud alerts, notifying all three credit bureaus if something looks fishy.

Plus, you can pair it with weekly checks at Annualcreditreport.com to stay on top of your credit history. Stick with this for an easy way to guard your financial peace of mind.

Chase Credit Journey: Best for Budget-Conscious Users

Chase Credit Journey stands out for folks watching their wallets. This free credit monitoring tool, offered by Chase, gives you a clear peek at your credit score and report. No fees, no hidden costs, just straight-up access to keep tabs on your financial health.

You can check for credit report errors or odd changes, all without spending a dime.

Pop in weekly to see updates, and pair it with free tools like Annualcreditreport.com for deeper insights. It’s a breeze to use, even if you’re new to credit monitoring services.

Plus, you get fraud alerts to catch identity theft early. For budget-conscious users, this service is a real gem to guard your credit history!

Important Factors to Consider When Choosing a Credit Monitoring Service

Picking the right credit monitoring service can feel like finding a needle in a haystack, but don’t worry, I’ve got your back. Let’s break it down with some key things to weigh.

First, look at the features, which carry a big 44.60% in our evaluation. Does the service offer three-bureau credit monitoring or dark web scanning? How about fraud alerts or identity theft protection? These tools help spot issues like credit card fraud or data breaches fast, even though they can’t stop them from happening.

Next up, think about costs, making up 25.18% of our focus. Individual plans might hit $360 a year, while family plans can range from $300 to $500 yearly. Also, check customer support and reputation, each at 15.11% of importance.

Can you reach help quickly if there’s a glitch in your credit reports? And don’t forget, fraud alerts are free across all three bureaus like Equifax, Inc., lasting one year or seven for identity theft victims.

Ponder these bits to guard your credit score and keep peace of mind!

Takeaways

Hey there, picking the right credit monitoring service can feel like finding a needle in a haystack, but I’ve got your back. Stick with options like Credit Karma for free tools or Aura for family safety, and you’re on solid ground.

Isn’t it a relief to know your credit score and identity theft worries can be watched over? Drop a comment if you’ve tried any of these services, I’d love to hear your story.

Let’s keep those finances safe together!

FAQs

1. What are credit monitoring services, and why should I care about them?

Hey, think of credit monitoring services as your financial watchdog, always sniffing out trouble like identity theft or credit card fraud. They keep tabs on your credit reports, alert you to weird stuff like credit inquiries or report changes, and often toss in perks like dark web monitoring. If you wanna dodge a fiscal fiasco, these tools are your first line of defense.

2. How do credit monitoring services help with identity theft protection?

Listen up, pal, these services are like a shield against identity theft, spotting shady moves on your credit history before you’re knee-deep in debt. They offer fraud alerts, social security number monitoring, and even identity theft insurance to cover losses from data breaches or phishing emails. It’s like having a bouncer for your personal privacy.

3. What’s the difference between free credit monitoring and paid credit monitoring?

Free credit monitoring, like what Credit Karma offers, gives you basic peeks at your credit score and some alerts for credit report errors. Paid credit monitoring, though, steps it up with three-bureau credit monitoring, dark web scanning, and sometimes family plans for broader identity protection. You get what you pay for, so weigh your risks before picking.

4. Can credit monitoring services fix my FICO scores?

Nope, they can’t directly boost your FICO credit scores or wipe out bankruptcies from your credit histories. But, they do help by flagging issues like credit report errors or odd credit inquiries, so you can tackle them fast and make smarter financial decisions.

5. What features should I look for in the best credit monitoring services for 2025?

When hunting for top-notch services, eyeball stuff like customized alerts, social media monitoring, and a credit score simulator to map out your financial future. Also, check for cybersecurity features to guard against ransomware and junk mail scams, plus a solid terms of service from financial institutions or an insurance company for identity theft coverage. It’s like picking a trusty sidekick, so choose wisely to protect your debit card and personal data.

6. How does a credit freeze work with these services, and is it worth it?

A credit freeze locks down your credit reports tighter than a drum, stopping crooks from opening accounts in your name during data breaches. Many credit monitoring services help you set it up or lift it when needed, often alongside perks like personal privacy scans. If identity theft or dark web threats keep you up at night, this feature’s a no-brainer to safeguard your inbox and peace of mind.