The UK has long been a hotspot for real estate investment, attracting domestic and international investors seeking high returns and stability. From London’s bustling property market to emerging opportunities in smaller cities, the UK offers diverse options for those looking to maximize their investment portfolios.

But what makes the UK so attractive, and which cities should top your list? This comprehensive guide explores the 12 best cities for real estate investment in the UK, breaking down their unique advantages and growth potential.

Real estate investment isn’t just about buying property; it’s about understanding market dynamics, demographic trends, and economic factors. By focusing on the best cities for real estate investment in the UK, you can unlock opportunities for long-term financial growth.

Why the UK is a Hotspot for Real Estate Investment?

The UK’s economy is one of the most robust in the world, offering investors confidence in property value appreciation. Key sectors like finance, technology, and education drive consistent demand for housing and commercial spaces, making it one of the best places to invest in real estate.

High Rental Demand

With a growing population and an influx of international students and professionals, rental properties are in high demand across major cities. This ensures steady cash flow for investors, particularly in the best cities for real estate investment in the UK.

Infrastructure and Connectivity

Ongoing infrastructure projects, such as the High Speed 2 (HS2) rail line, are enhancing connectivity between cities, boosting their attractiveness for businesses and residents alike. These developments often increase the value of properties, especially in the best cities for real estate investment in the UK.

Key Factors to Consider When Investing in Real Estate

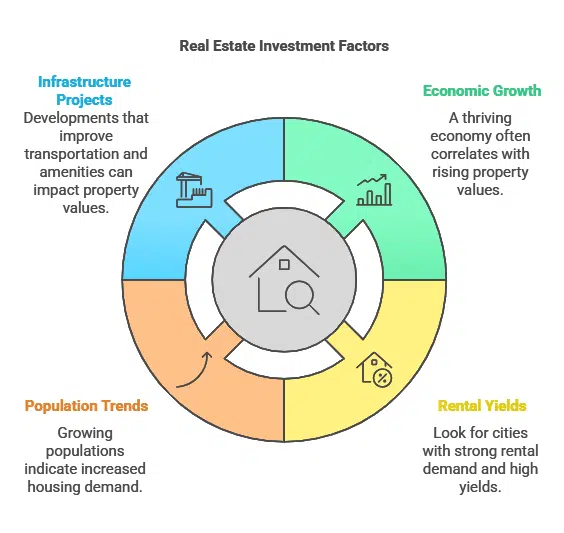

Before diving into the 12 best cities for real estate investment in the UK, it’s essential to understand the factors that drive a city’s investment potential:

- Economic Growth: A thriving economy often correlates with rising property values.

- Rental Yields: Look for cities with strong rental demand and high yields.

- Population Trends: Growing populations indicate increased housing demand.

- Infrastructure Projects: Developments that improve transportation and amenities can significantly impact property values in the best cities for real estate investment in the UK.

Top 12 Cities for Real Estate Investment in the UK

Let’s get straight into it!

1. London

Why Invest in London?

London remains a top choice for real estate investment due to its status as a global financial hub. The city attracts professionals from around the world, ensuring a consistent demand for residential and commercial properties. It is home to world-class educational institutions, robust infrastructure, and a thriving cultural scene, all of which enhance its property market’s value.

Key Investment Opportunities

- Prime Residential Areas: Kensington, Chelsea, and Mayfair offer high-end investment opportunities.

- Commercial Properties: Business districts like Canary Wharf and the City of London are lucrative for commercial real estate.

| Key Metrics for London | Value |

| Average Property Price | £500,000 |

| Rental Yield | 3.5% |

| Population Growth | 5% |

Real-Life Insight

A recent example includes a luxury apartment complex in Chelsea that saw a 12% appreciation within three years due to its proximity to major business hubs and transport links. It’s no surprise London is considered one of the best cities for real estate investment in the UK.

2. Manchester

Why Invest in Manchester?

Known as the UK’s “second city,” Manchester boasts strong economic growth, driven by its thriving media and technology sectors. With a reputation for being one of the fastest-growing cities in the UK, its vibrant nightlife, extensive cultural attractions, and significant student population make it a rental hotspot.

Hot Neighborhoods

- Salford Quays: Home to MediaCityUK, this area is ideal for investors targeting young professionals.

- Northern Quarter: Popular for its vibrant cultural scene and trendy apartments.

| Key Metrics for Manchester | Value |

| Average Property Price | £200,000 |

| Rental Yield | 6.0% |

| Population Growth | 8% |

Practical Tip

Consider properties near tram lines, as Manchester’s Metrolink expansion is increasing connectivity and driving demand in suburban areas. This positions Manchester as one of the best cities for real estate investment in the UK.

3. Birmingham

Why Invest in Birmingham?

As the UK’s second-largest city, Birmingham is undergoing a transformation with major infrastructure projects like HS2. Its growing population and job opportunities make it a prime location for investment. Birmingham’s thriving retail, tech, and manufacturing sectors are driving demand for both residential and commercial properties.

Property Hotspots

- Jewellery Quarter: Known for its unique charm and growing demand among young professionals.

- Digbeth: A creative hub attracting renters and buyers alike.

| Key Metrics for Birmingham | Value |

| Average Property Price | £220,000 |

| Rental Yield | 5.5% |

| Population Growth | 7% |

Case Study

A regeneration project in Digbeth led to a 15% increase in property values over five years, highlighting the impact of urban renewal on real estate. This makes Birmingham one of the best cities for real estate investment in the UK.

4. Liverpool

Why Invest in Liverpool?

Liverpool offers some of the most affordable property prices among major UK cities, combined with high rental yields. Its thriving tourism, port industry, and student markets add to its appeal. The city’s regeneration projects, such as the Liverpool Waters development, are set to enhance its real estate value further.

Promising Areas

- Baltic Triangle: A hotspot for regeneration projects and modern apartments.

- Ropewalks: Known for its nightlife and proximity to universities.

| Key Metrics for Liverpool | Value |

| Average Property Price | £170,000 |

| Rental Yield | 7.0% |

| Population Growth | 6% |

Current Data

Liverpool Waters, a £5 billion development, aims to transform the city’s northern docks into a commercial and residential hub, creating significant opportunities for investors. Liverpool is a prime example of the best cities for real estate investment in the UK.

5. Leeds

Why Invest in Leeds?

Leeds is a rapidly growing city with a booming financial and digital sector. Its high rental yields and affordable property prices make it an attractive option for investors. The city’s redevelopment projects and strong economy further add to its investment potential.

Key Areas to Explore

- City Centre: Ideal for luxury apartments and rental properties.

- Headingley: Popular among students and young families.

| Key Metrics for Leeds | Value |

| Average Property Price | £190,000 |

| Rental Yield | 5.8% |

| Population Growth | 7% |

Practical Insight

Leeds’s South Bank regeneration project is one of Europe’s largest city centre redevelopment plans, poised to double the size of Leeds city centre. This ensures its place among the best cities for real estate investment in the UK.

6. Glasgow

Why Invest in Glasgow?

As Scotland’s largest city, Glasgow combines cultural vibrancy with economic growth, making it a promising choice for real estate investment. The city boasts affordable housing prices and high rental demand, especially from its large student population and expanding tech sector.

Promising Areas

- West End: Known for its historic architecture and lively social scene.

- Merchant City: A modern hub for professionals with upscale apartments.

| Key Metrics for Glasgow | Value |

| Average Property Price | £165,000 |

| Rental Yield | 6.5% |

| Population Growth | 5% |

Practical Example

A recent investment in the West End saw rental yields exceed 7%, driven by proximity to the University of Glasgow and vibrant local amenities. It’s clear Glasgow is one of the best cities for real estate investment in the UK.

7. Edinburgh

Why Invest in Edinburgh?

As Scotland’s capital, Edinburgh offers a stable and lucrative market. The city is known for its robust economy, significant tourism sector, and a strong student presence, all contributing to sustained property demand.

Investment Hotspots

- Old Town: A UNESCO World Heritage site with high demand for unique properties.

- New Town: Renowned for its Georgian architecture and luxury investments.

| Key Metrics for Edinburgh | Value |

| Average Property Price | £280,000 |

| Rental Yield | 5.0% |

| Population Growth | 4% |

Current Trends

Short-term rental properties in Edinburgh are thriving due to the city’s appeal as a year-round tourist destination, with notable spikes during events like the Edinburgh Festival Fringe. It’s no surprise Edinburgh ranks among the best cities for real estate investment in the UK.

8. Bristol

Why Invest in Bristol?

Bristol is a thriving hub for technology and creative industries, making it one of the best cities for real estate investment in the UK. Known for its high quality of life, the city attracts professionals and families, driving demand for both rental and residential properties. Bristol’s waterfront developments and strong economy further enhance its appeal to investors.

Top Neighborhoods

- Clifton: Famous for its Georgian architecture and high-end properties.

- Harbourside: A vibrant area popular among young professionals.

| Key Metrics for Bristol | Value |

| Average Property Price | £240,000 |

| Rental Yield | 5.4% |

| Population Growth | 6% |

Insightful Example

Properties near Temple Meads Station have seen consistent appreciation due to excellent connectivity and proximity to the city centre, ensuring Bristol remains a top contender among the best cities for real estate investment in the UK.

9. Sheffield

Why Invest in Sheffield?

Sheffield’s reputation as a city undergoing significant regeneration makes it a prime choice for real estate investment. Affordable property prices combined with a growing student population and industrial resurgence create high-yield opportunities. Sheffield’s strong community vibe and emphasis on sustainability attract a diverse pool of renters and buyers.

Prominent Areas

- Kelham Island: A trendy area with a blend of modern apartments and industrial charm.

- Ecclesall Road: Popular among students and young professionals for its vibrant atmosphere.

| Key Metrics for Sheffield | Value |

| Average Property Price | £175,000 |

| Rental Yield | 6.2% |

| Population Growth | 5% |

Case Study

A redevelopment project in Kelham Island has led to a 10% increase in property values over the past three years, cementing Sheffield’s position as one of the best cities for real estate investment in the UK.

10. Newcastle

Why Invest in Newcastle?

Newcastle offers a mix of affordability, strong rental demand, and vibrant cultural appeal, making it one of the best cities for real estate investment in the UK. The city’s thriving student population and increasing job opportunities drive consistent property demand.

Key Areas

- Jesmond: A family-friendly area with a mix of traditional and modern properties.

- Quayside: Known for its riverside apartments and cultural attractions.

| Key Metrics for Newcastle | Value |

| Average Property Price | £180,000 |

| Rental Yield | 5.7% |

| Population Growth | 4% |

Example Insight

An investor purchasing a buy-to-let property near Newcastle University reported consistent rental income, with yields averaging 6%, thanks to the high demand from students and young professionals.

11. Cardiff

Why Invest in Cardiff?

As Wales’ capital, Cardiff offers a dynamic real estate market driven by growing infrastructure and a thriving economy. The city’s diverse population and vibrant cultural scene attract renters and buyers alike, ensuring its spot among the best cities for real estate investment in the UK.

Promising Locations

- Cardiff Bay: A redeveloped waterfront area with high-end developments.

- Roath: Known for its strong community feel and rental demand.

| Key Metrics for Cardiff | Value |

| Average Property Price | £185,000 |

| Rental Yield | 5.9% |

| Population Growth | 5% |

Practical Tip

Investing in properties near Cardiff Bay can yield high returns, as the area’s popularity among professionals and young families continues to rise.

12. Nottingham

Why Invest in Nottingham?

Nottingham’s affordability and thriving economy make it an attractive destination for real estate investors. With a strong student population and ongoing urban regeneration projects, Nottingham consistently ranks among the best cities for real estate investment in the UK.

Notable Areas

- Lace Market: Known for its historic buildings and trendy loft apartments.

- West Bridgford: A suburban area popular among families for its excellent schools and amenities.

| Key Metrics for Nottingham | Value |

| Average Property Price | £170,000 |

| Rental Yield | 6.1% |

| Population Growth | 6% |

Case Study

A historic warehouse in Lace Market was converted into luxury apartments, attracting buyers and renters, with property values appreciating by 15% over five years.

Takeaways

Investing in the UK’s real estate market can be highly rewarding when approached strategically. By focusing on the best cities for real estate investment in the UK, you can capitalize on growth opportunities and achieve significant returns.

From London’s global appeal to Nottingham’s affordability, each city offers unique benefits for investors.

Conduct thorough research, stay informed about market trends, and consult with local experts to align your investments with your financial goals.

The UK’s diverse and dynamic property market is waiting for you to seize the opportunities it offers in the best cities for real estate investment in the UK.