Canada’s real estate market has long been an attractive investment destination for domestic and international investors.

Known for its economic stability, robust housing demand, and diverse opportunities, Canada offers some of the most promising markets for real estate investments in 2025.

With urban centers thriving and infrastructure projects accelerating, savvy investors have multiple reasons to explore the best cities for real estate investment in Canada.

This article delves into seven top cities, showcasing why they stand out and how you can maximize returns while minimizing risks.

If you’re looking for insights into the best cities for real estate investment in Canada, you’re in the right place.

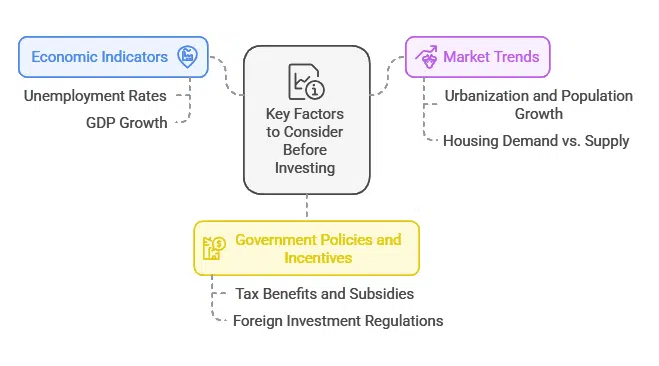

Key Factors to Consider Before Investing

Economic Indicators

Investing in real estate is a significant financial decision, and understanding the economic landscape is crucial.

Here are some vital indicators to evaluate while targeting the best cities for real estate investment in Canada:

- Unemployment Rates: A stable job market often correlates with increased housing demand. Cities with low unemployment rates are typically better for real estate investment.

- GDP Growth: A growing economy indicates rising incomes and a stronger ability to invest in housing. This makes certain cities more appealing to investors.

Market Trends

Understanding market trends ensures that your investments align with future growth.

Paying attention to these trends will help pinpoint the best cities for real estate investment in Canada:

- Urbanization and Population Growth: Cities experiencing rapid urbanization often have higher real estate demand, driving up property values.

- Housing Demand vs. Supply: Monitoring the balance between housing availability and demand can help identify opportunities for growth and appreciation.

Government Policies and Incentives

Government regulations and incentives can significantly impact real estate investments in the best cities for real estate investment in Canada.

- Tax Benefits and Subsidies: Some cities offer tax advantages to attract investors, including rebates and incentives for new developments.

- Foreign Investment Regulations: It’s essential to understand any restrictions or incentives related to foreign property buyers.

7 Best Cities for Real Estate Investment in Canada

Let’s take a closer look at some of the top cities where investing in real estate can yield significant returns.

These cities offer strong market growth, high demand, and solid potential for future appreciation.

1. Toronto, Ontario

Toronto is Canada’s economic and cultural hub, making it a top choice for real estate investors. Known for its dynamic economy and multicultural appeal, Toronto consistently ranks as one of the world’s most livable cities.

With robust population growth driven by immigration and career opportunities, demand for housing remains high in one of the best cities for real estate investment in Canada.

Key Highlights

- Toronto boasts a diverse economy with strengths in finance, technology, and entertainment.

- Major infrastructure projects, including the Eglinton Crosstown LRT and waterfront revitalization, are reshaping the city.

- The city’s multicultural population ensures a dynamic rental market catering to diverse needs.

Investment Opportunities

- High-rise condos in downtown Toronto cater to professionals and students.

- Detached homes in suburban areas like Mississauga and Vaughan offer long-term appreciation potential.

Average Real Estate Metrics in Toronto

| Metric | Value (2025) |

| Average Condo Price | $800,000 |

| Rental Vacancy Rate | 1.8% |

| Population Growth Rate | 2.3% annually |

Pros and Cons

- Pros: Toronto’s strong rental market ensures consistent income. Property values have shown steady appreciation over the years.

- Cons: High property prices and intense market competition can be barriers for some investors.

2. Vancouver, British Columbia

Vancouver is renowned for its stunning landscapes, high quality of life, and vibrant economy.

As a global city, it attracts investors seeking both luxury properties and sustainable housing developments. Vancouver remains one of the best cities for real estate investment in Canada due to its strong demand and limited supply.

Key Highlights

- Vancouver’s economy benefits from its position as a gateway to the Pacific, attracting global businesses and investors.

- Sustainable housing projects are gaining traction, aligning with global green trends.

- Immigration continues to boost demand for housing.

Investment Opportunities

- Luxury housing developments in areas like West Vancouver and Coal Harbour.

- Growing demand for rental apartments, driven by immigration and population growth.

Average Property Prices in Vancouver Neighborhoods

| Neighborhood | Average Price (2025) |

| West Vancouver | $2,500,000 |

| Downtown Vancouver | $1,200,000 |

| East Vancouver | $850,000 |

Pros and Cons

- Pros: Strong appreciation rates, appealing lifestyle, and high rental demand.

- Cons: High entry costs and foreign buyer taxes.

3. Calgary, Alberta

Calgary’s affordability and economic diversification make it an emerging hub for real estate investment.

The city’s growth beyond oil and gas, into tech and clean energy sectors, positions it as a forward-looking market.

Key Highlights

- Calgary has a growing tech sector and remains a center for Canada’s energy industry.

- Affordable property prices compared to other major cities.

- Infrastructure developments, such as the Green Line LRT, are enhancing connectivity.

Investment Opportunities

- Commercial spaces catering to the energy and tech sectors.

- Affordable housing developments in growing suburban areas.

Real Estate Snapshot for Calgary

| Metric | Value (2025) |

| Average Home Price | $500,000 |

| Rental Yield | 5.5% |

| Vacancy Rate | 3.2% |

Pros and Cons

- Pros: High rental yields, affordability, and economic growth.

- Cons: Slower appreciation in some areas.

4. Montreal, Quebec

Montreal combines cultural richness with economic opportunity, offering diverse real estate options. The city’s bilingual nature and vibrant neighborhoods make it a magnet for students, professionals, and families alike.

Key Highlights

- The city’s strong rental market is fueled by a large student population and young professionals.

- Infrastructure upgrades, including the REM light rail network, are driving interest in key areas.

Investment Opportunities

- Duplex and triplex properties in trendy areas like Plateau Mont-Royal.

- Student housing developments near McGill University and Concordia University.

Key Metrics for Montreal Properties

| Metric | Value (2025) |

| Average Duplex Price | $650,000 |

| Rental Yield | 4.7% |

| Student Population | 200,000+ |

Pros and Cons

- Pros: Affordable entry prices, strong rental market.

- Cons: Language requirements may deter some investors.

5. Ottawa, Ontario

Ottawa, Canada’s capital city, is a stable and steadily growing market for real estate investment.

Known for its strong employment rate fueled by the federal government and its burgeoning tech sector, Ottawa remains a top pick for investors seeking consistent returns.

Key Highlights

- Ottawa’s job market is anchored by federal employment, offering economic stability.

- The growing tech sector in areas like Kanata attracts young professionals and drives demand for rental properties.

- Proximity to Montreal and Toronto makes Ottawa an appealing alternative for those seeking lower property costs.

Investment Opportunities

- Modern condos in downtown Ottawa targeting professionals and government employees.

- Family-friendly suburban developments in neighborhoods like Barrhaven and Orleans.

Real Estate Snapshot for Ottawa

| Metric | Value (2025) |

| Average Home Price | $550,000 |

| Rental Vacancy Rate | 2.5% |

| Population Growth Rate | 1.9% annually |

Pros and Cons

- Pros: Stable economy, affordable property prices compared to larger markets.

- Cons: Slower appreciation and limited large-scale development projects.

6. Halifax, Nova Scotia

Halifax is an up-and-coming city for real estate investment, known for its affordability, vibrant waterfront, and growing economy.

The city’s interprovincial migration and high quality of life make it an attractive location for property investors.

Key Highlights

- Halifax’s economy is supported by shipping, education, and healthcare sectors.

- Immigration and interprovincial migration contribute to rising housing demand.

- Urban revitalization projects are making Halifax’s downtown core increasingly desirable.

Investment Opportunities

- Waterfront properties with strong rental potential.

- Multi-unit residential buildings catering to students and young professionals near Dalhousie University.

Halifax Real Estate Metrics

| Metric | Value (2025) |

| Average Home Price | $450,000 |

| Rental Yield | 5.2% |

| Vacancy Rate | 2.1% |

Pros and Cons

- Pros: Affordable housing market, steady rental demand.

- Cons: Smaller population compared to larger cities limits scalability.

7. Winnipeg, Manitoba

Winnipeg is a budget-friendly option for investors seeking strong rental yields and affordability.

Its diverse economy, which includes manufacturing, agriculture, and education, keeps housing demand steady.

Key Highlights

- Winnipeg’s cost of living is among the lowest in Canada, attracting families and first-time homebuyers.

- Growth in its downtown area has spurred demand for both residential and commercial spaces.

- High rental yields make Winnipeg one of the most affordable best cities for real estate investment in Canada.

Investment Opportunities

- Multi-family properties in areas like Osborne Village and St. Boniface.

- Commercial properties in the expanding downtown core.

Winnipeg Real Estate Metrics

| Metric | Value (2025) |

| Average Home Price | $350,000 |

| Rental Yield | 6.0% |

| Population Growth Rate | 1.5% annually |

Pros and Cons

- Pros: Affordable entry prices, high rental returns.

- Cons: Slower appreciation compared to more dynamic markets.

Tips for Successful Real Estate Investment in Canada

Diversify Your Portfolio

Spread investments across multiple cities to reduce risk and maximize returns.

Conduct Market Research

Analyze trends and government policies for specific cities before investing.

Work With Local Experts

Partnering with real estate agents and property managers ensures informed decisions.

Wrap Up

Investing in Canada’s real estate market provides access to diverse opportunities and stable growth.

By exploring the best cities for real estate investment in Canada, such as Toronto, Vancouver, Calgary, Montreal, Ottawa, Halifax, and Winnipeg, investors can find markets suited to their goals.

Whether focusing on high-growth cities or affordable housing, these urban centers offer promising avenues for consistent returns.

Start your journey into Canadian real estate today to take advantage of these thriving markets.