Achieving financial freedom is often a goal that seems elusive to many. Whether you’re trapped in credit card debt or struggling to save for retirement, the path to financial security can feel overwhelming.

The good news is that you don’t have to navigate this journey alone. One of the best ways to gain the knowledge and confidence needed to take control of your financial situation is by reading books that offer proven strategies, tips, and actionable steps.

In this article, we’ll explore the 6 best books on debt reduction and financial freedom—each offering unique perspectives on how to manage debt, build wealth, and achieve long-term financial success.

These books are more than just theoretical advice; they are filled with practical tools and wisdom that can help you make meaningful changes in your financial life. By the end of this guide, you’ll be equipped to take actionable steps toward financial freedom, armed with the knowledge from some of the most trusted voices in personal finance.

Top 6 Books on Debt Reduction and Financial Freedom

Let’s take a look.

1. The Total Money Makeover by Dave Ramsey

Dave Ramsey’s The Total Money Makeover is widely regarded as one of the most effective and popular books for anyone looking to reduce debt and achieve financial freedom. With a no-nonsense approach, Ramsey offers a step-by-step system designed to help readers take control of their finances, get out of debt, and build wealth over time. This book is ideal for those who feel overwhelmed by debt and need clear, actionable steps to start turning their financial lives around.

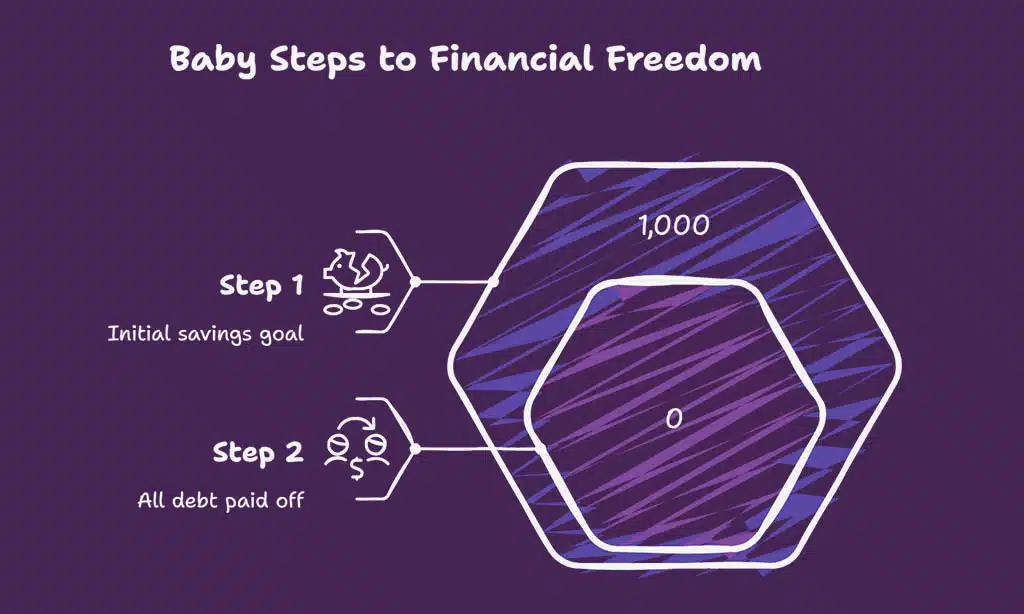

The Baby Steps

The core of Ramsey’s system is his famous “Baby Steps” program. These are simple, actionable steps that guide readers through paying off debt, saving for emergencies, and building long-term wealth. The Baby Steps are designed to help people make progress in a systematic way, without feeling overwhelmed by the process.

| Baby Step | Action |

| Step 1 | Save $1,000 for an emergency fund. |

| Step 2 | Pay off all debt (except the mortgage) using the debt snowball method. |

| Step 3 | Save 3-6 months of expenses in a fully funded emergency fund. |

| Step 4 | Invest 15% of household income into retirement accounts. |

| Step 5 | Save for your children’s college education. |

| Step 6 | Pay off your home early. |

| Step 7 | Build wealth and give generously. |

Why It’s Essential for Those Starting Their Financial Journey

If you’re overwhelmed with debt or unsure where to begin, The Total Money Makeover provides a solid framework for those just starting. Ramsey’s practical advice allows anyone to take the first steps toward debt freedom, no matter where they are on their financial journey.

Practical Tips from the Book to Reduce Debt and Create Wealth

- Start by creating a zero-based budget that accounts for every dollar you earn.

- Use the debt snowball method, which involves paying off your smallest debts first to gain momentum.

- Avoid the temptation to rely on credit and take the time to create an emergency fund to cover unexpected costs.

2. You Are a Badass at Making Money by Jen Sincero

Jen Sincero’s You Are a Badass at Making Money is a perfect blend of motivational self-help and financial wisdom. While many finance books focus solely on practical tips, Sincero’s book emphasizes the mental and emotional aspects of achieving financial success. She argues that one’s mindset is just as important as practical knowledge when it comes to creating wealth and financial freedom.

Sincero teaches readers to shift their mindset from limiting beliefs and scarcity to a mindset of abundance and possibility. Her engaging writing style combines humor with actionable advice, making this book an enjoyable and empowering read for anyone ready to transform their financial life.

How the Book Blends Personal Growth with Financial Wisdom

Sincero weaves her personal experiences with financial lessons and insights, demonstrating how adopting a new mindset can lead to real financial results. By focusing on the connection between your self-worth and your net worth, she provides readers with the tools to shift their attitudes about money.

| Mindset Shift | Practical Action |

| Believe you are worthy of wealth | Identify and eliminate money blocks or limiting beliefs. |

| Focus on abundance, not scarcity | Create financial affirmations and visualize your financial goals. |

| Confidence is key | Take bold actions toward your financial goals, even if they feel uncomfortable. |

Engaging Readers with Actionable Steps Toward Debt Freedom

Sincero breaks down the steps required to align your thoughts and actions with financial success, providing readers with practical advice for growing their wealth:

- Focus on what you want, not on what you lack.

- Challenge your existing money beliefs.

- Invest in yourself through personal development and learning.

Key Takeaways: Confidence and Wealth-Building Mindset

The ultimate lesson from You Are a Badass at Making Money is that achieving financial freedom starts with a mindset shift. Confidence, positive thinking, and a belief in your own abilities are crucial steps in building wealth and reducing debt.

3. Rich Dad Poor Dad by Robert Kiyosaki

In Rich Dad Poor Dad, Robert Kiyosaki contrasts the teachings of his “rich dad” (his best friend’s father) with the lessons of his “poor dad” (his biological father). The key difference between these two approaches lies in their views on money, wealth, and assets. Kiyosaki emphasizes the importance of building assets—things that put money in your pocket—rather than accumulating liabilities, which take money out of your pocket.

This fundamental concept challenges the traditional mindset that emphasizes earning a salary and saving money in a bank account. Kiyosaki advocates for a mindset shift where investing and acquiring assets is the true key to financial freedom.

| Concept | Rich Dad’s Approach | Poor Dad’s Approach |

| Income Source | Build passive income through assets (e.g., real estate). | Work hard for a paycheck (traditional employment). |

| Wealth Accumulation | Invest in assets that appreciate over time. | Save and avoid debt. |

| Financial Education | Continuous learning about money and investing. | Rely on traditional education and job stability. |

Lessons on Entrepreneurship, Investing, and Managing Debt

The book is a perfect introduction to the world of entrepreneurship, real estate investing, and financial independence. It teaches readers the importance of managing debt wisely and using leverage to build wealth. Kiyosaki provides numerous examples of individuals who have built wealth by focusing on creating income-producing assets.

How Kiyosaki’s Lessons Can Influence Your Path to Financial Freedom

Rich Dad Poor Dad encourages readers to rethink the traditional path of working for money and instead focus on making money work for them. By building assets like real estate, stocks, and businesses, you can achieve financial independence far earlier than most people realize.

Key Ideas for Overcoming Financial Struggles and Becoming Wealthy

Kiyosaki’s message is clear: wealth isn’t about how much you earn, but how much you keep, and more importantly, how you make your money work for you. This shift in thinking is key for anyone looking to reduce debt and build a sustainable wealth-building strategy.

4. The Simple Path to Wealth by JL Collins

JL Collins’ The Simple Path to Wealth simplifies the complex world of investing, making it accessible to anyone, regardless of their financial background. Collins advocates for a minimalist approach to managing finances, focusing on low-cost index fund investing to build wealth over time. His straightforward advice makes it easier for people to reduce debt, save for retirement, and ultimately gain financial independence.

| Key Concepts | Simple Strategies |

| Investment Strategy | Invest in low-cost index funds for long-term wealth. |

| Debt Reduction | Avoid debt by living within your means and eliminating unnecessary expenses. |

| Financial Independence | Save and invest aggressively for the future. |

The Role of Index Funds in Debt Reduction and Financial Growth

Collins advocates for investing in index funds, which are a low-cost, low-maintenance option for growing wealth over time. The simplicity of index funds makes them an excellent tool for those who want to reduce their debt and achieve long-term financial independence.

How Simplicity Can Lead to Financial Independence

By focusing on low-fee, diversified investments and avoiding complex financial products, Collins shows readers that it is possible to build wealth without overcomplicating the process. His advice is particularly useful for those looking to reduce debt and focus on the basics of investing.

Tips on Cutting Debt and Achieving Long-Term Wealth

- Automate your savings and investment contributions.

- Avoid high-interest debt and prioritize paying it off quickly.

- Live below your means and save aggressively.

5. Financial Freedom by Grant Sabatier

Grant Sabatier’s Financial Freedom dives deep into the FIRE (Financial Independence, Retire Early) movement. Sabatier’s story of going from broke to financially independent in just five years serves as an inspiring example of what’s possible when you take control of your finances and aggressively pursue financial freedom.

Actionable Steps to Increase Income and Eliminate Debt

Sabatier focuses on increasing income as one of the fastest ways to accelerate the path to financial freedom. He emphasizes taking on side jobs, investing in high-return opportunities, and cutting unnecessary expenses. His actionable advice is practical and helps readers see the power of their earning potential.

| Key Strategies | Actionable Steps |

| Increase Income | Seek out side gigs, freelance opportunities, or other income streams. |

| Cut Expenses | Reduce unnecessary spending by tracking every dollar. |

| Invest Early | Start investing in high-return opportunities as early as possible. |

Why This Book Is Perfect for Those Seeking to Accelerate Their Path to Financial Freedom

Sabatier’s approach to financial independence offers a blueprint for anyone looking to build wealth quickly. His book is packed with case studies, examples, and a clear path for accelerating debt reduction and wealth creation.

6. The Millionaire Next Door by Thomas J. Stanley and William D. Danko

In The Millionaire Next Door, Stanley and Danko share the findings from their decades-long study of self-made millionaires. Their research shows that most millionaires don’t live extravagantly. Instead, they live frugally, save consistently, and invest wisely, allowing them to accumulate wealth over time without the trappings of flashy spending.

The Importance of Living Frugally and Investing Wisely

The book stresses the importance of managing money responsibly and avoiding debt. Many of the millionaires profiled in the book attribute their success to living below their means and prioritizing smart investments.

| Millionaire Traits | Practical Application |

| Frugality | Focus on saving a significant portion of income while maintaining a modest lifestyle. |

| Investing | Invest consistently in long-term, low-risk investments. |

| Wealth Accumulation | Build wealth slowly over time by prioritizing long-term goals over short-term luxuries. |

How to Make Smart Choices That Reduce Debt and Build Wealth

Stanley and Danko show readers that financial freedom is less about high income and more about consistent saving, investing, and living frugally. By making small, disciplined financial decisions each day, you can build wealth in a sustainable and realistic way.

Key Takeaways: Building Wealth Through Disciplined Living

The book encourages readers to take a disciplined approach to money management. By living below your means, making smart investments, and avoiding unnecessary debt, you too can build wealth and achieve financial independence.

Wrap Up: Empowering Your Financial Future

The best books on debt reduction and financial freedom provide invaluable insights into how you can take control of your financial life.

From understanding the psychology behind money to mastering budgeting, investing, and wealth-building strategies, these books offer tools that can help anyone—no matter their financial background—start their journey to financial independence.

By reading these books and applying their principles, you can begin the process of eliminating debt, building wealth, and securing a brighter financial future. Start today by picking up one of these books and committing to your financial transformation.