Hey there, are you a small business owner in South Africa struggling to find the right bank? Maybe you’re tired of high monthly fees, or you can’t seem to get the support you need for cash flow management.

It’s like trying to find a needle in a haystack, isn’t it?

Here’s a quick fact to chew on. South Africa’s banking world, regulated by the South African Reserve Bank, offers a mix of traditional and digital-first options for SMEs like yours.

So, how do you pick the best one? Well, this blog will break it down for you with a list of the 8 best banks for small businesses. We’ll cover everything from online banking perks to business loans and low transaction fees.

Stick around!

Key Takeaways

- FNB First Business Zero Account offers zero monthly fees and eBucks rewards for transactions.

- Absa Business Evolve Lite Account has flexible solutions and easy digital banking tools.

- Standard Bank MyMoBiz Account provides low fees and extensive support for small businesses.

- Nedbank Business PAYU Account charges between R65 and R75 monthly with a pay-as-you-use model.

- Capitec Business Account keeps costs low with a R50 monthly fee and R1.20 per R100 deposit fee.

FNB First Business Zero Account

Hey there, wanna know a cool option for your small biz in South Africa? Check out the FNB First Business Zero Account, it’s got some sweet perks waiting for you!

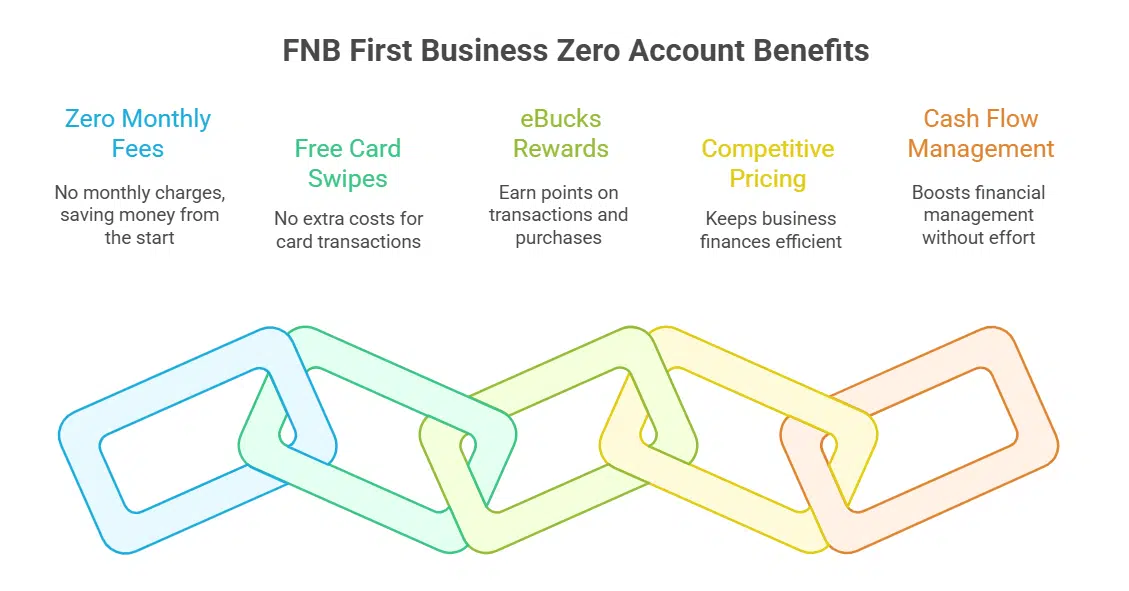

Key Benefits: Affordable fees and eBucks rewards

Let’s chat about why the FNB First Business Zero Account rocks for small businesses in South Africa. First off, it comes with zero monthly fees, which is a total game-changer. You’re saving cash right from the start, and who doesn’t love that? Plus, free card swipes mean no extra costs when you’re ringing up sales.

It’s like getting a high-five from your bank every time you do business.

Now, here’s the cherry on top, folks. With eBucks rewards, you earn points on transactions, card swipes, and even fuel purchases. Imagine turning everyday expenses into sweet perks! This mobile banking gem keeps your business finances humming with competitive pricing.

Stick with this account, and watch your cash flow management get a boost without breaking a sweat.

Absa Business Evolve Lite Account

Hey there, Absa’s Business Evolve Lite Account offers awesome digital banking tools and flexible options for small businesses in South Africa. Curious about how it can help your cash flow management? Stick around to find out more!

Highlights: Flexible solutions and digital banking tools

Dig into the Absa Business Evolve Lite Account, folks, and you’ll find a real gem for small businesses in South Africa. It offers flexible solutions that bend to fit your needs, whether you’re a sole proprietor or running a medium-sized outfit.

Plus, with no hidden fees thanks to tiered pricing, you know exactly what you’re paying for. Their digital banking tools are a breeze, letting you handle cash flow management right from your mobile app.

Got a busy day? No sweat, Absa’s online banking and comprehensive digital platform make transactions, like bank transfers or even international transactions, super easy. You can also tap into business loans or trade finance if you’re looking to grow.

It’s like having a financial buddy in your pocket, ready to help with a user-friendly setup that saves you time.

Standard Bank MyMoBiz Account

Hey there, let’s chat about the Standard Bank MyMoBiz Account, a real game-changer for small businesses in South Africa. With low fees and awesome support, it’s like having a trusty sidekick for your cash flow management!

Features: Low-cost account with extensive support services

Standard Bank’s MyMoBiz Account is a real game-changer for small businesses in South Africa. It offers low monthly fees, which is a big win if you’re watching every penny. Plus, their tiered pricing based on transaction volumes means you only pay for what you use.

Imagine keeping more cash in your pocket while still getting top-notch business banking!

On top of that, their extensive support services are like having a buddy in your corner. With comprehensive digital banking, you can handle everything from a smartphone or laptop. Need help with cash flow management? They’ve got tools and even business credit cards plus overdraft facilities to keep things rolling.

Standard Bank makes sure you’re never stuck, no matter the challenge.

Nedbank Business PAYU Account

Hey there, let’s chat about the Nedbank Business PAYU Account, a real game-changer for small businesses in South Africa. It’s built on a pay-as-you-use model, so you only shell out for what you need, keeping your cash flow in check.

Key Offering: Pay-as-you-use model tailored for SMEs

Let’s chat about a cool banking option for small businesses in South Africa. Nedbank’s Business PAYU Account brings a pay-as-you-use model that fits SMEs like a glove. It keeps costs low, with monthly fees between R65 and R75, so you’re not shelling out big bucks just to keep an account open.

This setup is all about flexibility for your business banking needs. You only pay for what you use, and guess what? You get free electronic transactions on select accounts too. Plus, Nedbank offers handy extras like business finance and insurance products to help with cash flow management.

It’s like having a financial buddy right by your side!

Capitec Business Account

Hey there, small business owners, ever thought banking could be a breeze? With the Capitec Business Account, you get sweet, competitive rates and a super simple way to handle your cash flow.

Curious about how it can help your venture grow? Stick around to find out more!

Benefits: Competitive rates and simplified banking

Capitec Business Account stands out for small businesses in South Africa with its sharp focus on competitive rates. You won’t get hit with high costs here, folks. With a low monthly fee of just R50, it’s like finding a bargain at a flea market.

Plus, the transaction fees are easy on the wallet, at only R1.20 per R100 cash deposit. This means more money stays in your pocket for growing your dream.

Saving cash is great, but simple banking seals the deal. Capitec offers free online banking, so you can manage your cash flow without breaking a sweat. Need to check your balance or pay a bill? Just hop onto their mobile apps or online platform.

It’s as easy as pie, letting sole proprietors and medium-sized businesses focus on what matters most, not on tricky bank stuff.

Investec Business Account

Hey there, if you’re running a growing business in South Africa, Investec’s Business Account might just be your ace in the hole. Curious about premium banking with top-notch support for international transactions and credit facilities? Keep reading to find out more!

Focus: Premium banking for growing enterprises

Let’s chat about premium banking for growing enterprises, especially with Investec Business Account in South Africa. This service targets established businesses like yours, offering top-notch support to help you scale.

Think of it as a trusty sidekick, always there with cash flow tools to keep your operations smooth.

Man, the customer service here feels like a warm hug on a tough day. You get variable fees that adjust to your needs, plus financial tools for business banking and international transactions.

Growing your medium-sized business just got a whole lot easier with this kind of backup.

TymeBank Business Account

Hey there, ready to explore a game-changer for your small business in South Africa? TymeBank Business Account offers zero monthly fees and a slick, digital-first vibe that’s like having a bank in your pocket!

Features: Zero monthly fees and digital-first approach

TymeBank’s Business Account stands out for small businesses in South Africa with its zero monthly fees. You won’t pay a dime to keep your account running, which is a big win for cash flow management.

Plus, they offer free day-to-day transactions, so your regular banking won’t eat into your profits. Imagine saving that extra cash for a rainy day, or maybe a new project!

On top of that, their digital-first approach makes online banking a breeze. Handle bulk payments for up to 30 accounts without stepping into a branch. Their mobile banking app is simple, fast, and packed with financial tools to keep your business humming.

It’s like having a banker in your pocket, ready to help anytime!

Bank Zero for SMEs

Hey, guess what? Bank Zero offers SMEs clear fees and cool digital tools that make banking a breeze. Curious about how they can help your small business shine? Stick around to learn more!

Key Advantage: Transparent fees and innovative tools

Let’s chat about something vital for your small business in South Africa, folks. Transparent fees with Bank Zero mean no sneaky surprises eating into your hard-earned cash. You see every cost upfront, plain as day, so budgeting for your SME becomes a walk in the park.

This clarity helps with cash flow management, letting you plan without guesswork.

Now, toss in their innovative tools, and you’ve got a real game-changer. Their comprehensive online banking and mobile banking platforms are built for busy entrepreneurs like you. Need to handle transactions or check your current account on the fly? No sweat, their digital-first banking has your back, saving you time to grow your business.

Takeaways

Hey there, picking the right bank for your SME in South Africa can feel like finding a needle in a haystack. Don’t worry, though, we’ve got your back with this list of top players like FNB and Standard Bank.

Imagine having tools for cash flow management and mobile banking right at your fingertips. So, dive right in, explore these options, and watch your small business grow!

FAQs on Best Banks in South Africa for SMEs

1. Which banks in South Africa stand out for small businesses and medium-sized businesses?

Hey there, if you’re running a small outfit or a growing venture, banks like Standard Bank and FNB with their First Business Zero Account are fantastic picks for business banking. They offer tailored solutions, from business loans to overdraft facilities, that can keep your cash flow management on point. So, which one fits your vibe, pal?

2. What’s the deal with monthly fees for SMEs at these South African banks?

Listen up, my friend, monthly fees can sneak up on you, but options like Capitec Business Account often keep costs low with competitive pricing. You won’t feel like you’re bleeding cash just to maintain a transactional account.

3. Can I get digital banking perks for my business in South Africa?

Oh, absolutely, digital-first banking is the name of the game with spots like Discovery Bank. They’ve got slick mobile banking and online banking setups, perfect for handling online transactions or even e-commerce needs without breaking a sweat. Plus, two-factor authentication keeps your dough safe, so you can sleep easy.

4. Are there rewards programs for SMEs with these banks?

You bet, buddy, some banks toss in sweet perks like eBucks Rewards with FNB, or even cashback deals. It’s like getting a pat on the back for just doing your regular business with a debit card or point-of-sale transactions.

5. How do interest rates impact business loans for sole proprietors in South Africa?

Well, let’s chew the fat on this, interest rates can make or break your loan applications for business loans or credit facilities. Banks like Standard Bank Group often adjust their interest rate offers, so you gotta shop around for the best deal to avoid getting stuck in a financial pickle. Keep an eye on those numbers, alright?

6. What about international transactions or foreign exchange for my growing biz?

Hey, no sweat, if your company’s reaching beyond borders, many top banks in South Africa handle international transactions and foreign exchange like pros. Standard Bank and others offer tools for money transfer and letters of credit, making sure your global deals don’t hit a snag. Stick with them, and you’ll be navigating the world market smoother than a hot knife through butter.