The financial technology (fintech) revolution has reshaped the way people access loans, making borrowing more accessible, efficient, and transparent. Traditional lending institutions often involve lengthy approval processes, excessive paperwork, and stringent eligibility requirements.

However, fintech platforms have emerged as game-changers, streamlining loan applications and offering borrowers more flexible, cost-effective options.

In this article, we’ll explore the 7 Benefits of Using Fintech Platforms for Loans, helping you understand why these digital solutions are increasingly preferred over traditional banks.

What Are Fintech Platforms for Loans?

Fintech platforms for loans are digital lending solutions that leverage technology to provide seamless borrowing experiences. These platforms use artificial intelligence (AI), blockchain, big data analytics, and machine learning to evaluate creditworthiness and process loan applications faster than traditional lenders.

Key Features of Fintech Loan Platforms:

- AI-Powered Credit Assessment – Uses alternative data sources to evaluate loan eligibility.

- Minimal Paperwork – Digital documentation replaces lengthy manual processes.

- Instant Fund Transfers – Borrowers receive money quickly after approval.

- 24/7 Accessibility – Applications can be submitted anytime, from anywhere.

- Flexible Loan Terms – Borrowers can choose customized repayment schedules.

With these benefits, fintech lending platforms are rapidly gaining traction as an alternative to traditional banks.

7 Benefits of Using Fintech Platforms for Loans

Fintech platforms have significantly changed the landscape of borrowing, providing more efficient and accessible loan options compared to traditional financial institutions. These digital solutions leverage cutting-edge technology to streamline the lending process, offering borrowers numerous advantages, from faster approvals to lower interest rates.

1. Faster Loan Approvals and Disbursements

One of the most significant benefits of using fintech platforms for loans is the speed of processing. Traditional banks often take days or even weeks to approve loans, but fintech platforms use AI-driven algorithms to make decisions within minutes. This means borrowers can access funds quickly for emergencies, business expansions, or personal financial needs.

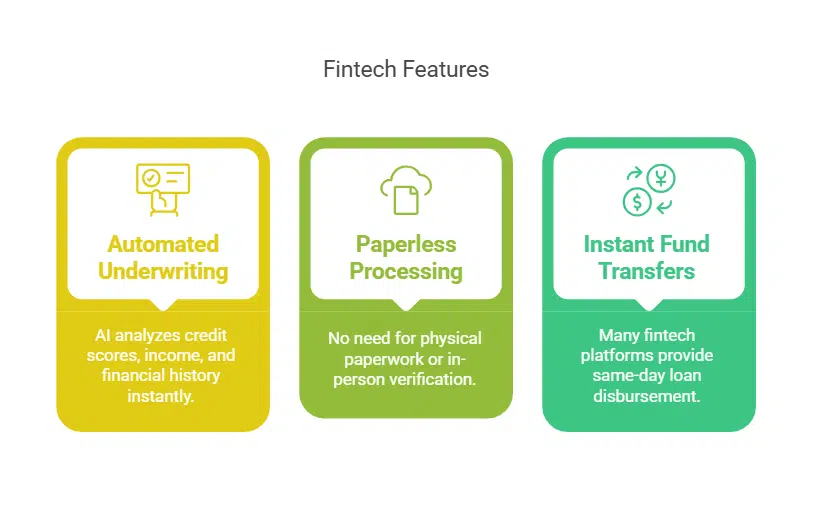

How Fintech Platforms Accelerate Loan Approvals:

- Automated Underwriting – AI analyzes credit scores, income, and financial history instantly.

- Paperless Processing – No need for physical paperwork or in-person verification.

- Instant Fund Transfers – Many fintech platforms provide same-day loan disbursement.

Example: A recent study found that 65% of fintech loans are approved within 24 hours, compared to traditional banks that take an average of 7-10 business days.

2. Lower Interest Rates and Fees

Another key benefit of using fintech platforms for loans is the potential for lower interest rates and fewer fees. Since fintech companies operate digitally and don’t require physical branches, they save on overhead costs and pass the savings on to customers.

Why Fintech Loans Are More Affordable:

- Reduced Operational Costs – No expensive physical branches mean lower service fees.

- Competitive Pricing – AI-driven risk assessment allows better interest rate offers.

- Transparent Fee Structure – No hidden costs or surprise charges.

| Loan Type | Fintech Loan Avg. Interest Rate | Traditional Bank Loan Avg. Interest Rate |

| Personal Loan | 5% – 15% | 8% – 20% |

| Business Loan | 6% – 12% | 10% – 18% |

Fintech loans tend to have more transparent fee structures and reduced processing costs, making them a better option for cost-conscious borrowers.

3. Improved Accessibility and Convenience

Fintech platforms eliminate many barriers associated with traditional lending. Anyone with an internet connection can apply for a loan, making financial services more inclusive. This has been especially beneficial for underserved populations who lack access to traditional banking infrastructure.

Features That Enhance Accessibility:

- Mobile-Friendly Applications – Borrowers can apply via apps without visiting a branch.

- 24/7 Availability – No need to wait for banking hours.

- Inclusive Lending – Individuals with limited credit history can still qualify using alternative data.

Case Study: A survey by the World Bank found that fintech lending has provided access to credit for over 1.7 billion unbanked individuals worldwide.

4. Personalized Loan Offers and Flexible Terms

Traditional banks often offer one-size-fits-all loan products, but fintech platforms use AI-driven customization to tailor loan terms to individual needs. Borrowers can choose repayment schedules that align with their income cycles.

Advantages of Personalized Fintech Loans:

- Custom Loan Amounts – Borrowers get offers based on their specific financial situations.

- Flexible Repayment Plans – Adjustments for monthly payments based on income levels.

- Dynamic Interest Rates – Risk-based pricing for better affordability.

Example: Fintech lenders like Upstart and SoFi analyze employment data and spending habits to offer loans at more personalized rates than traditional banks.

5. Better Credit Evaluation for Borrowers

Unlike traditional banks that rely solely on credit scores, fintech platforms use alternative data sources to evaluate a borrower’s creditworthiness.

How Fintech Evaluates Creditworthiness:

- AI-Based Credit Scoring – Includes transaction history, spending habits, and employment status.

- Open Banking Data – Uses real-time financial insights to assess risk.

- No Discrimination Against New Borrowers – Beneficial for first-time loan applicants with no credit history.

| Credit Evaluation Method | Fintech Platforms | Traditional Banks |

| AI & Alternative Data | Yes | No |

| Open Banking Integration | Yes | No |

| Manual Credit Score Reliance | No | Yes |

6. Enhanced Security and Fraud Protection

Security is a major concern in online financial transactions, but fintech platforms integrate advanced technologies to ensure safe and secure lending experiences.

Security Features of Fintech Lending Platforms:

- Blockchain Technology – Ensures transparency and data security.

- End-to-End Encryption – Protects sensitive borrower information.

- AI-Based Fraud Detection – Identifies suspicious activities and prevents cyber threats.

Example: Companies like Plaid use encrypted API connections to safeguard financial data, reducing fraud risks by 45% compared to traditional banking methods.

7. Greater Transparency and User Experience

Fintech lending platforms prioritize user satisfaction by offering clear loan terms and intuitive digital experiences.

How Fintech Improves Transparency:

- No Hidden Fees – All charges are disclosed upfront.

- User-Friendly Interfaces – Easy-to-navigate loan application and management dashboards.

- Customer Support Accessibility – Live chat and AI chatbots for instant assistance.

Survey Insight: 82% of fintech borrowers report a smoother, more transparent experience compared to traditional banks.

Takeaways

The rise of fintech platforms has revolutionized lending, making loans more accessible, affordable, and efficient. The 7 benefits of using fintech platforms for loans—from faster approvals and lower fees to enhanced security and transparency—demonstrate why these digital solutions are the future of borrowing.

As more individuals and businesses embrace fintech loans, traditional lending institutions will need to adapt or risk being left behind. Whether you need quick funding, flexible repayment options, or a seamless digital experience, fintech platforms provide an innovative and user-friendly approach to modern borrowing.

Are you ready to explore the benefits of using fintech platforms for loans? Compare your options today and take advantage of digital lending solutions that put borrowers first.