In recent years, cryptocurrency has transformed from a niche financial asset into a mainstream payment method. With more businesses and individuals embracing digital currencies, people are discovering how convenient, secure, and cost-effective they can be for daily transactions.

Unlike traditional banking systems, which rely on third-party institutions, cryptocurrencies operate on decentralized networks powered by blockchain technology. This innovation ensures transparency, security, and efficiency. But what exactly makes cryptocurrencies ideal for everyday use?

This article explores the seven key benefits of using cryptocurrency for everyday transactions, highlighting why digital currencies like Bitcoin, Ethereum, and stablecoins are gaining traction as viable payment solutions.

1. Fast and Secure Transactions

One of the most significant advantages of cryptocurrency is the speed and security it offers. Unlike traditional payment systems that rely on banks and third-party intermediaries, cryptocurrencies operate on decentralized networks that facilitate near-instant transactions.

Why Are Crypto Transactions Faster and More Secure?

| Feature | Cryptocurrency Transactions | Traditional Banking Transactions |

| Processing Speed | Almost instant (seconds to minutes) | 1–5 business days (especially for international transfers) |

| Security Level | High (blockchain encryption) | Medium (bank-dependent security) |

| Third-Party Involvement | None (peer-to-peer) | Banks, payment processors |

| Availability | 24/7, worldwide | Limited by banking hours and holidays |

- Speed: Cryptocurrency payments bypass intermediaries, reducing delays.

- Security: Blockchain technology encrypts transactions, making them highly resistant to fraud and hacking.

- Global Reach: You can send and receive payments from anywhere in the world without restrictions.

How Blockchain Enhances Security

Cryptocurrency transactions are recorded on a decentralized ledger called the blockchain. This means that each transaction is verified by multiple nodes (computers) before being confirmed, making it nearly impossible to alter past transactions fraudulently. Additionally, cryptographic encryption ensures that only the sender and recipient can access transaction details.

Real-World Example

El Salvador, the first country to adopt Bitcoin as legal tender, has integrated Bitcoin payments into daily commerce, allowing citizens to complete transactions instantly without banking fees. Businesses across the country now accept Bitcoin, enabling seamless, fast, and borderless payments.

2. Lower Transaction Fees

Traditional banking and payment systems often charge high fees, especially for international transactions. Cryptocurrencies, on the other hand, significantly reduce these costs.

Comparing Transaction Fees

| Payment Method | Transaction Fee (Approximate) |

| Credit/Debit Card | 1.5% – 3% per transaction |

| PayPal/Stripe | 2.9% + additional fees |

| International Bank Transfer | $10 – $50 per transaction |

| Cryptocurrency | Less than $1 (depends on the blockchain) |

- Lower Costs: Many cryptocurrencies, such as Litecoin and Solana, offer minimal transaction fees compared to credit card or wire transfer costs.

- No Hidden Charges: Unlike banks, which often charge hidden fees, crypto transactions are transparent.

- Perfect for International Payments: Businesses and freelancers benefit from cost-effective cross-border payments.

Why Are Crypto Fees Lower?

Unlike traditional banking, which involves multiple intermediaries (banks, credit card processors, and payment gateways), cryptocurrency transactions occur directly between sender and receiver. This eliminates middlemen and reduces operational costs.

Real-World Example

Freelancers working for international clients can receive payments in stablecoins like USDT or USDC with minimal fees compared to PayPal or bank wire transfers. Businesses that operate globally can save thousands of dollars annually by switching to crypto payments.

3. Financial Inclusion and Accessibility

Approximately 1.4 billion people worldwide remain unbanked, meaning they lack access to traditional banking services. Cryptocurrencies provide an alternative financial solution for these individuals.

How Crypto Improves Financial Inclusion

| Barrier to Banking | How Cryptocurrency Helps |

| Lack of ID Documents | No need for formal identification in many crypto platforms |

| No Access to Banks | Only requires an internet connection |

| High Banking Fees | Crypto transactions are more affordable |

| Geographical Limitations | Can be used globally without restrictions |

- Empowering the Unbanked: People in developing countries can store value and make transactions using mobile crypto wallets.

- No Need for a Bank Account: A smartphone and internet access are enough to use cryptocurrency.

- Financial Freedom: Users have full control over their funds without reliance on banks.

How Crypto Wallets Work

A cryptocurrency wallet is a digital tool that allows users to send, receive, and store digital assets. Popular mobile wallets like Trust Wallet, MetaMask, and Binance Pay provide seamless access to financial services without requiring a bank account.

Real-World Example

In Africa, mobile-based cryptocurrency platforms like Binance Pay and BitPesa help users make transactions without needing a traditional bank account. This allows farmers, small business owners, and individuals in rural areas to participate in the global economy.

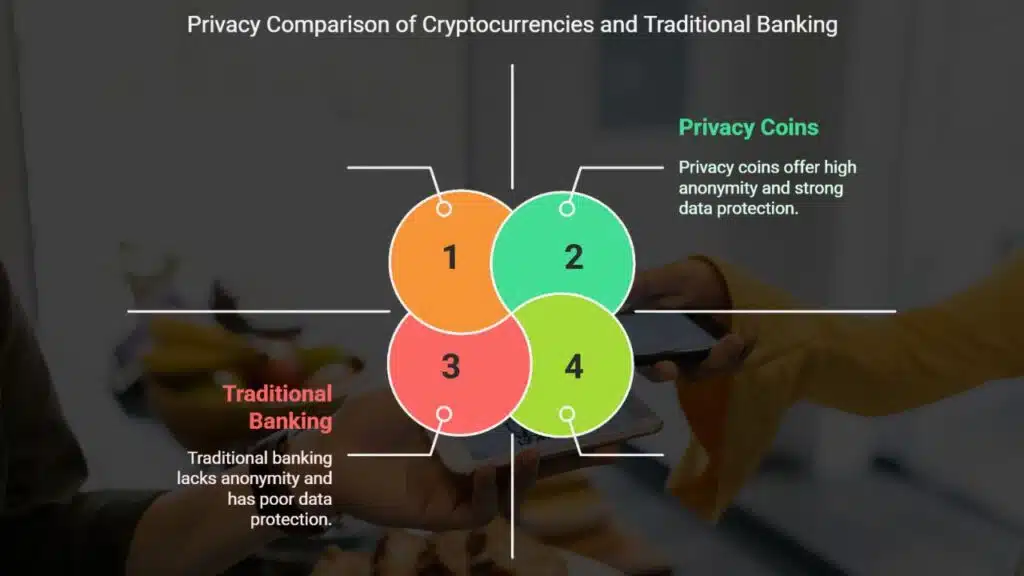

4. Enhanced Privacy and Anonymity

Privacy is a growing concern in digital transactions. Unlike traditional banking, where personal data is required for every transaction, cryptocurrencies allow users to maintain a higher level of anonymity.

Privacy Features of Cryptocurrency

| Feature | Cryptocurrencies | Traditional Banking |

| Transaction Anonymity | High (varies by coin) | Low (banks track all transactions) |

| Data Protection | Secure blockchain ledger | Prone to hacks & leaks |

| Control Over Information | Full user control | Banks/government access |

- No Need for Personal Data: Crypto wallets do not require name, address, or other sensitive information.

- Decentralized Transactions: No central authority monitors your spending habits.

- Privacy Coins: Cryptocurrencies like Monero (XMR) and Zcash (ZEC) provide even greater transaction anonymity.

Why Does Privacy Matter?

In an era where financial transactions are heavily monitored, cryptocurrencies offer individuals the ability to control their own financial data. Unlike bank accounts, which are subject to government surveillance, crypto transactions provide greater personal freedom.

Real-World Example

Many individuals in restrictive regimes or countries with strict financial regulations use privacy-focused cryptocurrencies to protect their assets from government control and economic instability.

5. Protection Against Inflation

Inflation reduces the value of fiat currencies, but many cryptocurrencies have fixed supply limits to prevent depreciation.

Fiat vs. Cryptocurrency: Inflation Protection

| Currency | Supply Limit | Inflation Risk |

| USD, EUR, etc. | Unlimited (central banks print more) | High risk of inflation |

| Bitcoin (BTC) | 21 million cap | Low inflation risk |

| Ethereum (ETH) | No fixed cap but controlled supply | Moderate inflation risk |

Why Crypto Protects Against Inflation:

- Fixed supply prevents excessive printing.

- No government manipulation.

- Investors use Bitcoin as digital gold to hedge against fiat devaluation.

6. Global Transactions Without Borders

Cryptocurrency enables instant cross-border payments without banking delays and currency exchange costs.

Cross-Border Payments: Crypto vs. Banks

| Feature | Bank Transfers | Cryptocurrency |

| Processing Time | 3-7 business days | Minutes to hours |

| Fees | High (foreign exchange fees) | Low (blockchain transaction fees) |

| Accessibility | Bank-dependent | 24/7 global access |

With cryptocurrency, anyone can send money instantly across borders without currency conversion fees.

7. Greater Control Over Your Money

Unlike traditional banking, where third parties can freeze or limit access to funds, cryptocurrencies allow full financial control.

Why Crypto Gives You More Control?

- No banks or governments can freeze or seize funds.

- Users control private keys to their wallets.

- Transactions are censorship-resistant.

| Feature | Banks | Cryptocurrency |

| Fund Control | Bank has authority | User has full control |

| Transaction Limits | Daily limits apply | No restrictions |

| Seizure Risk | Possible in legal disputes | Not possible unless private keys are lost |

With crypto, individuals have complete ownership of their money without interference.

Takeaways

The benefits of using cryptocurrency for everyday transactions are clear: faster payments, lower fees, financial inclusion, better privacy, inflation protection, seamless global transfers, and complete financial control. As crypto adoption grows, digital assets are set to revolutionize the way we handle money.

If you’re new to cryptocurrency, consider exploring Bitcoin, Ethereum, or stablecoins for secure and efficient transactions. The future of finance is digital, and now is the perfect time to be a part of it!