You might feel lost with decentralized finance terms like smart contracts and liquidity pools. It now locks over $60 billion on the Ethereum blockchain. This post breaks down five beginner-friendly tools like Uniswap and Aave to trade on decentralized exchanges and lend crypto.

Read on.

Key Takeaways

- Uniswap: launched by Hayden Adams in Nov 2018 on Ethereum. It uses a constant-product AMM (x·y=k) and rolled out v3 in May 2021 with concentrated liquidity. The UNI token launched in Sep 2020 for governance. Swaps cost a 0.3% fee and run via MetaMask.

- Aave: launched in Jan 2020 on Ethereum and Polygon. It offers simple lending, borrowing, and flash loans that require no collateral if repaid in one transaction. The dashboard shows real-time health factors to help avoid liquidations.

- Compound: supply tokens like DAI or USDC on Ethereum via MetaMask. Smart contracts mint cTokens that earn 1%–8% APY each block. You also earn COMP governance tokens as extra yield. You keep custody of your keys with noncustodial contracts.

- MetaMask: a browser wallet by ConsenSys since 2016 with over 10 million monthly users. You set up a wallet, write down a secret backup phrase offline, and add ETH or BNB for gas. You connect to DEXs like Uniswap or PancakeSwap in one click.

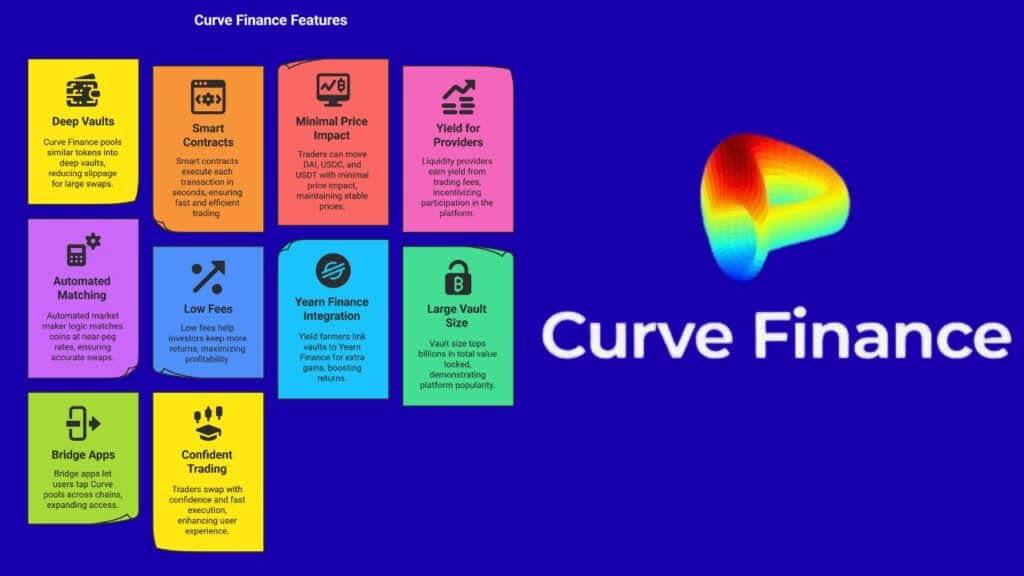

- Curve Finance: pools similar stablecoins (DAI, USDC, USDT) to cut slippage on large swaps. Fees cap at 0.04% versus 0.3% on typical DEXs. It runs on Ethereum and Binance Smart Chain, with vaults holding billions in total value locked. Yield farmers link Curve to Yearn Finance for extra gains.

What is Uniswap and how do I trade on it?

Uniswap works as a decentralized exchange. It runs on an automated market maker model.

- Uniswap origin: Hayden Adams created it on Ethereum in Nov 2018 to trade ERC-20 assets without order books. Version three launched in May 2021, adding concentrated liquidity to pools.

- AMM model: The protocol uses a constant product formula, keeping x times y equal to k in liquidity pools, to auto set prices each trade.

- Governance token: The UNI token launched in Sept 2020, letting holders vote on protocol upgrades and fee structures.

- Connect wallet: Link MetaMask or WalletConnect in seconds so smart contracts can access your funds on Ethereum.

- Pick trading pair: Select any two ERC-20 tokens, check pool size and price impact, then enter the amount you wish to swap.

- Approve token: Send an approval transaction on Ethereum to let the Uniswap smart contract spend your chosen token.

- Execute swap: Hit the swap button, confirm the gas fee in your wallet, and monitor the transaction on Etherscan.

- Monitor slippage and fees: Set your slippage tolerance to avoid costly price jumps and note the 0.3% fee that rewards liquidity providers.

How does Aave make lending and borrowing easy for beginners?

Aave launched in January 2020. The platform joined decentralized finance, powered by blockchain technology. It runs on Ethereum and Polygon. The interface shows clear menus for lending and borrowing.

Users supply assets to earn interest rates. Smart contracts secure deposits in liquidity pools.

Flash loans make the process even more fun. They let users borrow without collateral, as long as they return funds in the same transaction. Many beginners test DeFi strategies with these loans.

Aave tracks collateralized debt positions in real time. The dashboard shows health factors, so users avoid liquidations. You connect with tools like MetaMask in a few clicks.

How can new users earn interest with Compound?

New users add crypto assets to Compound via a web wallet, often MetaMask, on the Ethereum blockchain. They select a token like the Dai stablecoin or USDC and hit supply. Smart contracts lock the tokens in a liquidity pool, then mint cTokens.

These cTokens grow in value thanks to algorithmic interest rates, which adjust on every block using on-chain price oracles. Annual yields float, often ranging from 1% up to 8%, depending on asset demand.

It feels like a savings account on steroids. Lenders also earn COMP governance tokens as extra yield farming perks. Protocol rules send COMP based on how much and how long you supply.

Claim rewards from the interface and send them to your wallet. You keep custody of your private keys the whole time, thanks to noncustodial smart contracts. When you withdraw, Compound burns the cTokens and returns your original crypto plus interest payments.

What is MetaMask and how do beginners use it for DeFi?

MetaMask acts as a digital wallet in your browser. It links your funds to decentralized finance apps on blockchain networks.

- Install the MetaMask extension, first released in 2016 by ConsenSys, from the official Chrome or Firefox add-on store. It hosts over 10 million monthly active users.

- Create a new wallet and write down your secret backup phrase on paper, then store it offline. This set of keys keeps hackers at bay.

- Add ETH or BNB to your address by sending coins from an exchange like Coinbase or Binance. This step gives you gas to call smart contracts on Ethereum or the BNB chain.

- Link your wallet to a decentralized exchange such as Uniswap or PancakeSwap by clicking Connect Wallet. Approve the prompt in MetaMask to unlock liquidity pools.

- Swap tokens, lend assets in a liquidity pool, or stake in a yield farm for passive income. Each trade rides on smart contracts and blockchain technology.

How does Curve Finance simplify stablecoin trading?

Curve Finance pools similar tokens into deep vaults. This setup cuts slippage for large swaps. Smart contracts run each transaction in seconds. Ethereum and Binance Smart Chain host these vaults.

Traders move DAI stablecoin, USDC, USDT with minimal price impact. Liquidity providers earn yield from trading fees. Automated market maker logic matches coins at near‐peg rates.

Low fees help investors keep more returns. Traditional decentralized exchanges charge up to 0.3 percent per swap. Curve caps fees at 0.04 percent. Yield farmers link vaults to Yearn Finance for extra gains.

Vault size tops billions in total value locked. Bridge apps let users tap Curve pools across chains. Traders swap with confidence and fast execution.

How can I safely explore DeFi projects?

Stay safe while you explore DeFi platforms. Always apply risk management for better ROI.

- Verify audits: Check Certik, which audited 900+ projects by 2022, or OpenZeppelin, to spot code flaws in smart contracts.

- Use hardware wallets: Store DAI stablecoin and ETH on cold storage devices to block online hacks.

- Test small deposits: Send $20 of a stablecoin to a fresh platform on Ethereum or Binance Smart Chain (BSC) to gauge liquidity pools.

- Split funds across lending platforms like Aave or borrow on Compound to limit exposure to flash loans.

- Seek community feedback on forums and social media to uncover hidden costs or scam signals.

- Track on-chain data via Etherscan on public blockchains to monitor transactions and spot yield farming or liquidity mining bots.

- Use a DEX aggregator such as 1inch to lock slippage and secure better prices on decentralized exchanges (DEXs).

Takeaways

Your first DeFi steps can feel like dancing to a new beat. Uniswap, a swap site, taps into liquidity pools so you swap tokens fast. Aave and Compound let you earn interest or borrow crypto with simple smart contracts.

MetaMask, a browser wallet, holds your keys, while Curve Finance trades stablecoins with low fees. Your crypto path now has rocket fuel for growth.

FAQs

1. What are 5 beginner-friendly DeFi projects?

You can start on a decentralized exchange to swap tokens. You can use a lending platform to give or take loans. A lending protocol pays you interest. A stablecoin pool lets you earn small yields. A yield aggregator reinvests your rewards.

2. How does a decentralized exchange work?

A decentralized exchange runs on smart contracts. It sits on blockchain technology. It uses automated market makers and liquidity pools. You swap tokens fast, without any bank.

3. What is yield farming on a yield aggregator?

Yield farming means you move tokens to chase high rates. A yield aggregator pools your tokens, chases top yields, then reinvests your rewards. Some yield aggregators also let you farm synthetic assets that track real goods. It feels like chasing the best deal every day.

4. How do lending and borrowing work?

A lending platform lets you lock tokens as security. You can lend or borrow with smart contracts. The protocol sets an interest rate by algorithm. You earn interest or pay a rate in real time.

5. What is a stablecoin pool?

A stablecoin pool groups stablecoins that each peg to the dollar. You add your coins, then share swap fees. It has low price swings, since coins stay close to one dollar. You earn passive income with less risk.

6. Are there risks in DeFi?

Yes, there are risks. Flash loans let attackers test code in one block. Smart contract bugs can lead to loss. Liquidity pools can drop in value if markets crash. Your return on investment can jump or dive. Always read docs, use small funds only.