Investing in gold and silver can be smart. But, finding a good company is hard. Some people worry about the Augusta Precious Metals lawsuit. It’s important to know if it’s safe to trust them with your money.

The good news is there are no ongoing legal battles for Augusta Precious Metals right now. They focus on teaching their customers and providing great service to keep their reputation strong.

This blog will show you what’s happening with the lawsuit situation and why people still like this company. Keep reading to learn more!

Is There an Augusta Precious Metals Lawsuit?

Augusta Precious Metals has no legal issues now. All past legal problems were solved or thrown out by June 11, 2024. People can check this on UniCourt and Justia. These sites share court records and legal info for free.

No one has sued Augusta Precious Metals recently. This info comes from reliable law resources like UniCourt and Justia, showing the company’s clean record.

Current Status of the Augusta Precious Metals Lawsuit

As of June 11, 2024, there are no lawsuits against Augusta Precious Metals. This information comes from searches on UniCourt and Justia. These platforms show court records and legal documents.

They help us know if a company has legal problems. In the past, any legal issues that came up were either fixed or thrown out by the court.

Customers interested in gold IRAs and secure financial futures want to trust companies they work with. The next section will look at what customers say about their experiences with Augusta Precious Metals.

What Customers Are Saying About Augusta Precious Metals

Customers share their experiences with Augusta Precious Metals, noting both the good and the not so good. This feedback helps new clients know what to expect. Keep reading to learn more about these opinions.

Positive Feedback

People really like Augusta Precious Metals. They have more than 1,000 five-star reviews. This shows they make customers happy. Awards from Money magazine and Investopedia say they are good at what they do.

Their pricing is clear, so you know what you pay for.

Trustpilot and the Better Business Bureau give them high ratings too. This means many people trust them with their money and retirement savings, like gold IRAs. Now let’s see what some customers had concerns about.

Complaints and Concerns

While many customers have good things to say, some have shared concerns. These worries often involve fees, agreements, or how long it takes to get their metals. A big issue for a few is the need to invest at least $50,000 to start a gold IRA.

These issues are small and haven’t led Augusta Precious Metals into big court fights. Yet they matter to those involved. Keeping customer satisfaction high is key for business. This means solving any problems fast and well.

How Does Augusta Precious Metals Handle Complaints?

Augusta Precious Metals takes customer complaints very seriously. They use a special system to keep track of all issues. This helps them fix problems fast. Their team talks to customers right away if there’s a problem.

They always try to solve it quickly and fairly.

Next, they ask for feedback to make sure the customer is happy with the solution. This shows they care about their service quality. Now let’s see how trust levels are among customers after handling complaints this way.

Has the Lawsuit Affected Customer Trust?

Despite the lawsuit, customer trust in Augusta Precious Metals remains strong. This is clear from their high ratings on BBB (A+) and Trustpilot. They also have a AAA rating from the Business Consumer Alliance.

With over 1,000 five-star reviews, it’s obvious that many people still trust them. Plus, they’ve won awards from Money magazine and got recognized by Investopedia.

Customers like their lifetime support and educational resources. These services help people feel more secure with their investments. Even with legal issues, these facts show that Augusta Precious Metals keeps its customers happy and trusts high.

Why Augusta Precious Metals Still Receives Strong Reviews

Augusta Precious Metals gets good reviews for many reasons. They have a team that knows a lot about metals. This team helps customers understand their choices. Their prices are clear, with no extra costs hidden from the customer.

They also offer safe places to keep metals through big-name depositories. People like this because it makes them feel their investments are safe.

They give long-term help, too. This means they keep giving advice and education over time. Customers trust them because of this ongoing support. Plus, they’re known for great service every step of the way, from choosing an investment to storing it safely.

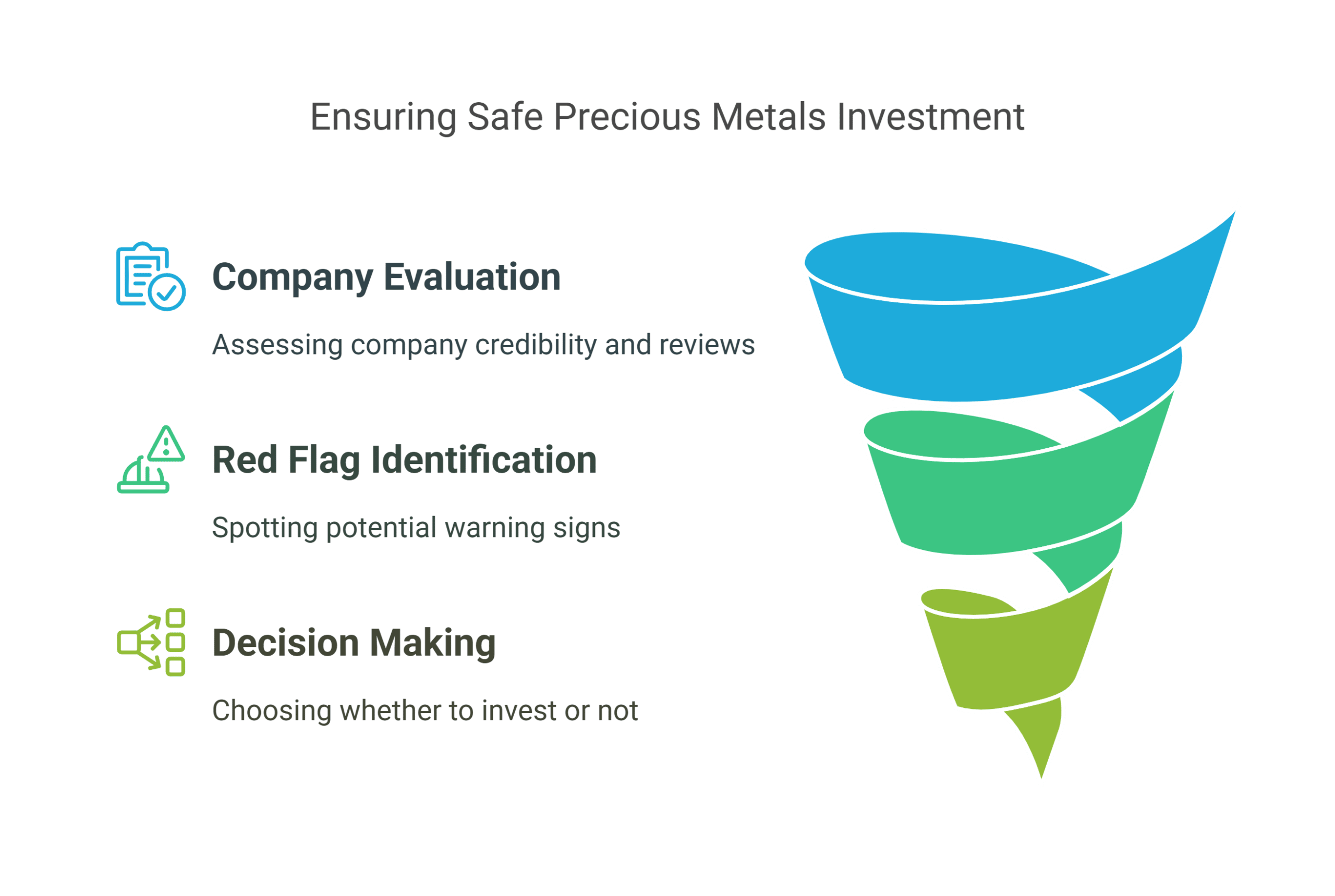

How to Avoid Issues When Investing in Precious Metals

To keep safe when putting money into gold or silver, do your homework on the company. It’s like making sure you know who you’re dealing with before you trust them with your cash. For more tips, keep reading!

Research the Company Thoroughly

Checking a company well is key before you put your money in precious metals. You want to find a trusted firm. Sites like WireDaily can help since they rank and review gold IRA companies.

This makes it easier to see which are good and avoid scams spotted in 2024. It’s also smart to stay away from places promising too much.

Look for signs of honest business, such as lifetime customer support and clear info about fees. Good firms will have high scores from the Better Business Bureau (BBB). They also respect laws that protect you, like consumer protection laws.

Now, spotting red flags is the next step.

Identify Red Flags in Precious Metals Investments

High-pressure sales are a big red flag. If someone tries to hurry you into buying, think twice. Honest companies give you time to decide. Look out for unclear pricing too. Trustworthy firms are open about costs without hidden fees.

Another warning sign is misleading statements about risk and return. Investing always involves some risk, especially with precious metals like gold and silver.

Contracts should be clear and easy to understand. If they’re not, ask questions or look elsewhere for your investment needs. Good research methods can help spot these issues early on, saving you trouble later on.

Now, let’s move on to the final verdict on the Augusta Precious Metals lawsuit situation.

The Final Verdict on the Augusta Precious Metals Lawsuit

Augusta Precious Metals faced few legal issues. They solved them fast. People trust this company a lot. It offers good gold IRAs and helps with silver too. Customers like their service and feel safe investing in metals with them.

This shows Augusta cares about clients a lot.

Takeaways

We learned that the Augusta Precious Metals lawsuit issues are not current worries. This shows the firm handles problems well and keeps clients happy. Speaking to their handling, positive reviews often highlight strong service and education on gold IRAs.

Tips shared here make investing in metals simpler, urging a careful check on firms before diving in. Feel motivated to explore more about safe investments, and keep your assets guarded against inflation with smart choices—like maybe starting a gold IRA.