Apple has announced a significant new investment of $100 billion to expand its U.S. manufacturing and supply chain capabilities. This follows an earlier commitment made by the company to invest $500 billion in the United States, bringing its total U.S. investment plans to $600 billion.

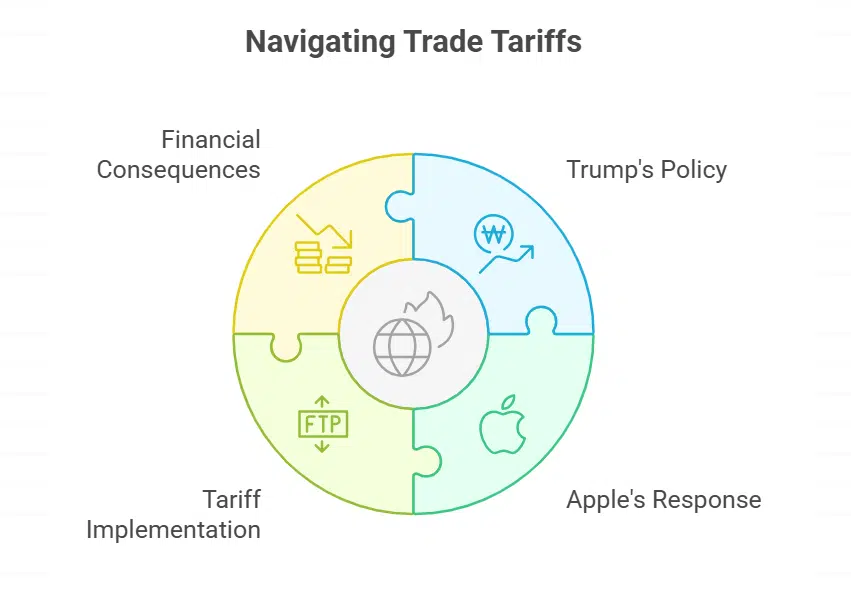

The new investment comes at a critical time. President Donald Trump has escalated his trade agenda by threatening to impose 100% import tariffs on semiconductors and chips manufactured overseas. These levies are aimed at incentivizing companies to relocate manufacturing operations to the United States. However, the administration has stated that firms that are already producing—or have made formal commitments to produce—technology goods within the U.S. may be exempt from these tariffs.

Apple’s announcement appears to strategically position the company to remain in compliance with Trump’s expectations while also maintaining operational flexibility. By expanding its domestic presence and aligning with several U.S.-based suppliers, Apple is demonstrating its commitment to domestic manufacturing while potentially shielding itself from the financial burden of additional tariffs.

Launch of the American Manufacturing Program

At the center of Apple’s new investment is the rollout of a new initiative called the American Manufacturing Program (AMP). The program is designed to shift a larger portion of Apple’s supply chain to the U.S. through partnerships with key American component manufacturers.

Apple has announced collaborations with a wide range of technology and materials companies, including Corning, Coherent, GlobalWafers America, Applied Materials, Texas Instruments, Samsung, Amkor, Broadcom, MP Materials, and others. These companies will contribute to building an end-to-end U.S.-based supply chain that supports everything from chip design to final component packaging.

Domestic Semiconductor Production Targets

Under the AMP, Apple aims to support the production of over 19 billion chips in the United States by the end of 2025. This output will span across 24 manufacturing sites in 12 states, encompassing various stages of chip development such as design, wafer production, photonics, testing, and advanced packaging.

The company’s vision includes transforming the U.S. into a strategic base for its silicon manufacturing needs, reducing reliance on supply chains in Asia. This effort is especially critical given the geopolitical tensions and supply disruptions that have impacted global technology production over the past few years.

Deepening Supplier Partnerships

Apple’s new investment also includes major expansions of existing supplier relationships within the U.S.:

-

Corning, based in Kentucky, will play a central role in producing the cover glass for every iPhone and Apple Watch sold worldwide. The Kentucky facility will serve as the global source of Apple’s durable glass technology.

-

Coherent, a laser manufacturer, supplies the technology used in Apple’s Face ID system. Apple plans to significantly increase its reliance on Coherent’s components, which are critical for facial recognition and other biometric features.

-

GlobalWafers America and Applied Materials will support the supply of raw wafers and chip production equipment within the U.S., enhancing Apple’s efforts to localize the silicon ecosystem.

-

Texas Instruments, Samsung, and Amkor will contribute to chip assembly, testing, and advanced packaging in states like Texas, Arizona, and Oregon.

-

Broadcom and MP Materials will provide RF components and rare earth elements, respectively—both of which are essential in mobile and computing devices.

These supplier investments not only help Apple meet the administration’s push for domestic production but also ensure greater supply chain stability and resilience for the company’s core product lines.

Avoiding Tariffs with Strategic Commitment

President Trump has intensified his trade enforcement by warning of impending 100% tariffs on all foreign-made semiconductors and chips. However, he has clarified that companies that have demonstrated a clear and verifiable commitment to U.S. production would be exempt from these charges.

Apple’s announcement appears to be timed with this policy shift. By heavily investing in the U.S. supply chain, the company is taking clear steps to remain outside the scope of future semiconductor tariffs, which could otherwise impact the pricing and profitability of its iPhones, iPads, and Macs.

Although the White House has not issued a specific date for the implementation of the new chip tariffs, the administration has made it clear that the policy is forthcoming. Companies that have not moved production stateside are expected to face financial consequences once the tariffs are enacted.

Limitations to Full iPhone Assembly in the U.S.

While Apple is expanding its U.S. footprint significantly, company executives have acknowledged that final iPhone assembly in the United States remains out of reach in the near term.

This limitation is due to several structural challenges. The U.S. currently lacks the highly specialized labor force needed to assemble devices at the scale and speed required for global distribution. Additionally, assembling iPhones in the U.S. would dramatically increase production costs due to higher labor expenses and a fragmented domestic supplier network.

Apple has therefore focused on producing as many key components as possible—such as chips, glass, and Face ID modules—in the U.S. while continuing to assemble the final products in countries like India and China.

Tariffs on India and Smartphone Exemptions

Apple’s announcement also comes shortly after the U.S. imposed 25% tariffs on imports from India, citing geopolitical concerns such as India’s continued purchase of Russian oil. India is a major iPhone production hub for Apple, particularly for models sold in the U.S.

Interestingly, smartphones themselves have been exempt from Trump’s reciprocal tariffs, giving Apple breathing room to continue overseas assembly while scaling U.S. component production. Despite this, the administration has made it clear that it expects Apple to eventually move closer to domestic assembly—at least partially.

The company’s leadership has previously raised concerns about these tariffs. Internal sources indicate that CEO Tim Cook has held several private meetings with the White House to outline the company’s investment roadmap and highlight the challenges of relocating iPhone manufacturing to the U.S.

Other Major Tech Investments in the U.S.

Apple is not alone in its shift toward U.S.-based manufacturing. Several other tech companies have announced large-scale investments in recent months:

-

Texas Instruments pledged $60 billion to build semiconductor facilities across Texas, focusing on analog chip production.

-

TSMC, the world’s leading chip manufacturer based in Taiwan, has committed $100 billion to develop advanced fabrication plants in Arizona, which will supply U.S.-based tech firms including Apple.

-

Nvidia announced plans to build AI supercomputers and high-performance computing systems entirely within the U.S., with operations starting later this year.

These parallel developments indicate a broader trend in the tech industry toward reshoring manufacturing and building strategic redundancy in critical components such as semiconductors.

Apple’s Detroit Academy and Rare Earth Sourcing

In addition to its supplier-focused initiatives, Apple plans to launch a Manufacturing Academy in Detroit, aimed at training American workers in advanced manufacturing skills. The program is designed to build a future talent pipeline capable of supporting high-precision industries like chipmaking and hardware assembly.

Apple is also sourcing rare earth materials from MP Materials, a U.S.-based mining and processing company. Rare earths are critical for the internal components of smartphones, computers, and other consumer electronics.

By securing local sources of rare earths, Apple is reducing its reliance on overseas suppliers—particularly in China, which has historically dominated the rare earth supply chain.

AI Delays and Tariff-Driven Cost Concerns

Apple’s new investment announcement comes during a challenging period for the company. In addition to the tariff-related pressure, Apple is dealing with delays to its planned Siri overhaul, a key product upgrade intended to keep pace with competitors like OpenAI and Google in the artificial intelligence space.

Furthermore, Apple has stated that it expects to incur at least $1.1 billion in additional expenses during the September quarter due to tariffs already imposed by the Trump administration. This includes costs from materials, shipping, and alternative supply routes. While the company has not specified whether it will raise product prices, analysts believe Apple may be forced to make operational changes if tariffs continue to escalate.

Strategic Alignment with Domestic Priorities

Apple’s decision to pour another $100 billion into its U.S. operations is a calculated move to align with national industrial priorities, manage long-term tariff exposure, and create a more resilient supply chain. Though full iPhone assembly in the U.S. remains a distant goal, the company is clearly laying the groundwork for deeper domestic integration.

In the context of broader global trade shifts and political uncertainty, Apple’s strategy of reinforcing its American manufacturing base reflects both economic pragmatism and political foresight. The investment will not only enhance the company’s operational flexibility but also set the stage for the next era of tech manufacturing in the United States.