Artificial intelligence has already moved from buzzword to basic plumbing in the markets. By 2026, most active US traders will not ask whether to use AI-powered trading tools. The real question will be which tools sit at the center of their workflow.

From charting and stock picking to options structures, portfolio management, and news analysis, AI now quietly powers many of the interfaces traders touch every day. Some tools run in the background as scoring engines or signal filters. Others show up as chat-style copilots, ready to answer questions, test ideas, or even route orders.

Importantly, AI-powered trading tools do not eliminate risk. They can surface patterns faster than humans and compress hours of analysis into seconds. They do not remove the need for judgment, position sizing, or discipline. Think of them as leveraged research assistants: powerful, but still under your control.

Why AI-Powered Trading Tools Matter for US Traders in 2026

AI-powered trading tools are becoming part of the basic toolkit, not a niche add-on. For US traders in 2026, the difference will lie in how well these tools turn noisy market data into clear, actionable choices without slowing down decision-making.

From data overload to decision support

Modern markets generate an almost absurd amount of information. A single trading day can involve thousands of price moves, cross-asset correlations, options flow, corporate filings, central-bank commentary, and social-media noise. Even full-time traders cannot read everything that might matter.

AI-powered trading tools thrive in this environment. Machine learning models can scan vast data streams, detect relationships, spot outliers, and compress narratives into a few usable signals. Language models take long reports, earnings calls, and news feeds and turn them into summaries or structured data. That shift from raw data to decision support is where AI earns its keep.

Where AI fits into a typical US trading workflow

For most US traders, AI will not appear as a single “all-in-one” black box in 2026. Instead, it slots into each step of a normal workflow:

-

Idea generation: scanners flag unusual activity or patterns.

-

Research: copilots summarise filings, transcripts, and macro context.

-

Structuring: options tools, test payoff diagrams, and probability ranges.

-

Execution: automation tools help apply rules as alerts or bots.

-

Risk and review: portfolio engines monitor exposures and performance drivers.

The tools below map onto those stages. Some focus tightly on one layer. Others try to manage most of the process. The mix a trader chooses will depend more on strategy than on technology.

AI Charting, Scanning, and Idea Generation Platforms

The first touchpoint for many traders is the chart. AI-powered trading tools that scan, label, and rank setups are reshaping this front line, helping US traders move from manual chart-watching toward systematic idea generation and faster shortlists.

1. TrendSpider: pattern recognition without hand-drawing charts

TrendSpider is built around a simple promise: spend less time drawing lines and more time thinking about trades. Its algorithms automatically draw trendlines, highlight chart patterns, and scan for setups across watchlists.

For US traders active in stocks and ETFs, this matters in two ways. First, it reduces the subjectivity of “eyeballing” charts. The same rules apply across hundreds of tickers. Second, the platform connects these visuals to backtesting and alerts. When a breakout, retest, or Fibonacci level appears, a rule-based system can highlight it without the trader living inside one chart all day.

In 2026, it is easy to imagine TrendSpider acting as a first pass on technicals: a filter that tells you where to look, even if you still make the final call on entries and exits.

2. Trade Ideas: Holly AI and intraday strategy engines

Trade Ideas is an early example of AI in retail trading. Its “Holly” engine uses statistical modeling on historical data and current conditions to generate intraday strategies, then tracks how those strategies perform in real time.

Rather than simply throwing a list of “hot stocks” at users, the platform frames each idea within a strategy: entry rules, stops, profit targets, and historical performance. For active US day traders, that means a feed of system-defined opportunities instead of raw symbol lists.

By 2026, as more intraday volume competes on speed and automation, tools like Trade Ideas will likely remain attractive to traders who want a semi-systematic edge without building a full quant stack from scratch.

3. TradingView: community charts with AI-enhanced edges

TradingView is already the de facto charting and idea-sharing platform for many US traders. Its Pine scripting language powers a huge library of indicators and strategies, and third-party developers increasingly layer AI models on top of TradingView data.

The AI angle is subtle. Traders can use scripts that incorporate machine learning logic or connect to external AI services, then visualise outputs directly on charts. As the platform adds more AI-assisted pattern recognition and natural-language search, it becomes an even more central “front end” for traders whose actual models sit somewhere in the background.

In practice, TradingView may not call itself an “AI tool” loudly. But for the typical US trader in 2026, many of the most useful indicators and alerts inside it will be powered by AI under the hood.

4. Tickeron: AI screeners and model portfolios

Tickeron approaches AI-powered trading tools with a broad toolkit. It offers:

-

AI stock screeners based on patterns and factors.

-

A trend-prediction engine that scores likely price paths.

-

AI model portfolios and AI-managed “active portfolios” that rebalance automatically.

A US trader can use Tickeron in several ways: as a scanner, as a model-portfolio catalogue, or as a sandbox for AI-generated strategies. The platform also provides transparency around how its AI portfolios behave over time, which helps traders judge whether those models fit their own risk tolerance.

5. BlackBoxStocks: real-time options flow with AI filters

For many short-term US traders, options flow is the early-warning radar of the market. BlackBoxStocks sits squarely in that space. It streams options order flow and stock activity, then uses algorithms to highlight unusual trades, sweeps, and volume clusters.

The AI component is less about prediction and more about prioritisation. Instead of staring at an unfiltered firehose, traders see curated alerts that flag where “something different” might be happening. For options and momentum traders, that kind of intelligent triage will remain invaluable in 2026 as options volume stays elevated.

AI Research, Stock Pickers and Copilots

Once an idea lands on the radar, research begins. AI stock pickers and research copilots sit in this middle layer, sifting through fundamentals, technicals, and sentiment so US traders can focus on interpreting the story rather than gathering every data point by hand.

6. Danelfin: AI Scores for stock ideas

Danelfin boils the complexity of machine learning down to an “AI Score” for each stock. Behind that single number sit factors such as fundamentals, technicals, and sentiment. The idea is simple: higher scores suggest a more favorable statistical backdrop.

For US traders, this type of tool can serve as a screening overlay. You might start with your normal filters—market cap, liquidity, sector—and then use the AI Score as one more criterion. It will not replace due diligence, but it can nudge attention toward names where patterns look historically favorable.

7. Kavout: K Score and factor-driven ranking

Kavout’s K Score works along similar lines, ranking equities based on a blend of signals. The platform markets itself as a bridge between traditional factor investing and machine learning. For traders and investors who already think in factors—value, momentum, quality—this framing can feel more familiar than black-box predictions.

By 2026, tools like Kavout may sit behind the scenes of more broker platforms, even when retail traders do not see the brand. For those who do use it directly, the main value lies in consistent, data-driven ranking of large stock universes.

8. Fiscal.ai: a copilot built on institutional-quality data

Fiscal.ai marries a chat-style interface with institutional-grade data. Instead of combing through filings, conference-call transcripts, and KPI tables, a trader can ask targeted questions and receive synthesized responses, with the ability to drill into underlying numbers.

For US traders who run concentrated portfolios or follow complex sectors, this copilot approach can compress hours of reading into a few well-posed prompts. The risk, as always, is over-reliance. But used as a starting point rather than an oracle, Fiscal.ai can help retail traders work more like analysts without hiring a team.

9. Magnifi: chat-first investing assistant plus brokerage

Magnifi positions itself as an investing assistant that also routes trades. Users interact in natural language—asking for dividend ideas, sector exposures, or risk comparisons—and the system responds with suggestions and data.

For US traders who prefer a single app experience, that combination of conversational research and execution will likely become more common in 2026. The trade-off is convenience versus flexibility: you gain speed and guidance but rely on one platform’s data and decision rules.

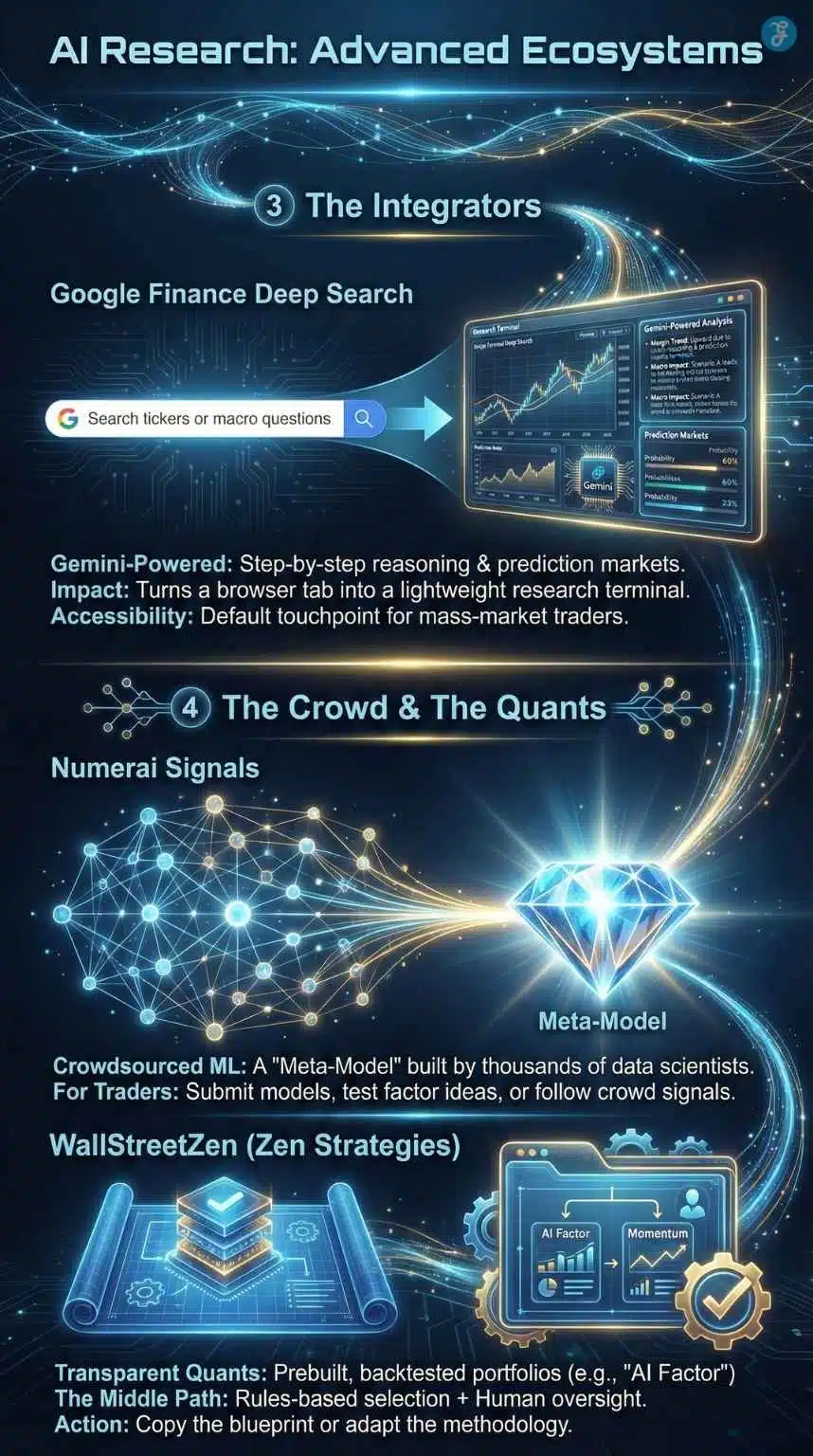

10. Google Finance Deep Search: AI that sits inside a familiar portal

Many US traders already search tickers or macro questions directly in Google. With Deep Search inside Google Finance, those queries now hit Gemini-powered analysis, with step-by-step reasoning and integrated prediction-market probabilities.

In practical terms, this turns a browser tab into a lightweight research terminal. Traders can ask, for example, how a company’s margins have trended, or how certain macro scenarios might affect a sector, and receive structured answers. As Google continues to integrate this into the broader search experience, it will become a default research touchpoint even for traders who never sign up for niche platforms.

11. Numerai Signals: crowdsourced machine learning

Numerai Signals represents a different flavor of AI-powered trading tools. Instead of one company building a single model, Numerai invites thousands of data scientists to submit their own stock-prediction models. Those predictions are combined into a “meta-model” that helps drive a professional hedge fund’s trades.

Retail traders can access parts of this ecosystem in a few ways: by contributing models, by using the Signals platform to test their own factor ideas, or by watching which kinds of signals the crowd seems to favor. It is not as plug-and-play as a smartphone app, but for more quant-minded US traders, this kind of collaborative AI will likely grow in influence by 2026.

12. WallStreetZen Zen Strategies: AI-backed quant portfolios

Zen Strategies are prebuilt, backtested portfolios such as “AI Factor” or “Momentum,” created using data-driven selection rules rather than gut feeling. While not marketed as a robo-advisor, the service leans heavily on statistical modeling and backtests.

For US investors who want rules but not full automation, these strategies can act as blueprints. You can copy them outright or adapt the methodology to your own portfolio. By 2026, this blend of transparent quant rules and human oversight may represent a middle path between fully active and fully automated investing.

AI Portfolio and Wealth Platforms Built for Retail Investors

Beyond single trades, investors need a view of the whole picture. New portfolio and wealth platforms use AI to connect positions, goals, and risk in one place, giving US traders tools that look closer to institutional dashboards than traditional retail brokerage screens.

13. Range: AI plus human planners for complex finances

Range targets households that need more than a trading app. Its platform uses an internal model, branded Rai, to run portfolio analysis, tax projections, and retirement modeling, while human advisors provide oversight and context.

In an environment where many “AI investing apps” promise easy answers, Range is a reminder that real-world wealth management still involves messy constraints: taxes, estate planning, insurance, and income needs. For higher-net-worth US traders who also hold private business interests or multiple accounts, this hybrid approach is likely to remain attractive in 2026.

14. Public.com’s agentic brokerage: AI woven into a full-stack broker

Public.com evolved from a commission-free stock app into a multi-asset broker. The newer layer is AI. Its Alpha assistant helps users research companies in plain language, and its “Generated Assets” feature lets investors build custom indexes. The company has also announced an upcoming AI wealth manager capable of taking routine actions on accounts.

For US traders, this model is important because it points to where mainstream brokers are heading. By 2026, the idea of a “dumb” brokerage account that simply holds positions may feel dated. Instead, AI-powered trading tools will live directly inside your broker, guiding order entry, rebalancing, and even cash management—subject, of course, to regulatory scrutiny.

AI News, Sentiment, and Macro Intelligence

Markets still move on stories, and those stories now spread at machine speed. AI-driven news and sentiment platforms track narratives across media and social channels, helping US traders spot shifts in mood, risk, and opportunity long before they show up in price alone.

15. TradeEasy.ai: turning headlines into structured signals

News moves markets, but traders cannot read everything. TradeEasy.ai filters the firehose of financial news, clusters stories by theme and asset, tags sentiment, and highlights sectors that appear bullish, neutral, or bearish.

For US traders with limited time, this transforms the daily news ritual. Instead of flicking through dozens of sites and social feeds, they can scan a dashboard that already encodes “what changed” and “where attention is building.” Used alongside technical and fundamental tools, AI-driven narrative analysis helps avoid tunnel vision on charts alone.

16. Sentifi: alternative data and crowd sentiment

Sentifi focuses on alternative data—social media, blogs, niche news outlets—and uses AI to quantify how the crowd feels about stocks, currencies, and commodities. It also flags emerging risks and unusual spikes in attention.

In 2026, as more flows come from retail communities and online discussions, ignoring crowd sentiment becomes risky. Tools like Sentifi do not tell you what to believe, but they show you how loudly the market is talking about a name, and whether that mood is euphoric, calm, or fearful. For US traders who remember how quickly meme-stock episodes unfolded, that information is not trivial.

Automation, Bots, and Options Optimizers

Execution is where good ideas succeed or fail. Automation platforms, trading bots, and options optimizers turn written rules into live orders, allowing US traders to express structured views with greater consistency while keeping a closer eye on risk and trade quality.

17. Capitalise.ai: speaking your strategy out loud

Capitalise.ai sits in the growing niche of “no-code automation.” Traders describe a strategy in natural language—conditions, triggers, time frames—and the platform translates that into executable rules linked to supported brokers and exchanges.

For example, a US trader could instruct the system to buy a stock if it breaks above a moving average and volume crosses a threshold, then sell if profit or loss bounds are hit. Capitalise.ai watches the market and sends alerts or executes trades accordingly.

By 2026, this style of rule-building will likely be far more common. The key advantage is that traders capture their logic explicitly instead of half-remembered heuristics. The risk is that a poorly phrased rule can misfire at speed, so testing and conservative sizing remain essential.

18. Cryptohopper: AI crypto bots for multi-exchange trading

Cryptohopper provides bots that connect to multiple crypto exchanges, running strategies around trend following, dollar-cost averaging, arbitrage, and more. Its Algorithmic Intelligence feature helps users test and optimise strategies on historical data, while AI trading modes adapt to conditions.

For US traders who treat crypto as part of a broader portfolio, this kind of tool can take over the high-frequency monitoring that 24/7 markets demand. The usual caveats apply: exchanges carry their own risks, and no bot can guarantee profits. But as digital assets remain in the mix, AI-powered automation will continue to appeal to traders who cannot—or do not want to—watch charts round the clock.

19. Coinrule: template-driven automation for crypto and beyond

Coinrule offers template strategies and a visual “if-this-then-that” builder so traders can design rules without coding. It supports numerous crypto exchanges and has been expanding toward other brokers.

For US traders who dislike scripting but want more than manual clicking, Coinrule fills a gap. It is easy to imagine 2026 seeing more retail investors run small, rule-based allocations on autopilot alongside their discretionary accounts, particularly in volatile, around-the-clock markets.

20. Options AI: simplifying options structures with smarter visuals

Options AI focuses on options specifically. Instead of starting with an options chain, it starts with payoff diagrams and risk ranges. The platform helps traders visualise how different strategies—spreads, condors, covered plays—change potential outcomes, then routes orders accordingly.

While the underlying pricing engines use familiar option-pricing math rather than magic, the user experience leans on automation and smart defaults. For US traders in 2026, tools like this matter because they lower the friction of trading multi-leg structures while still forcing you to confront risk and reward visually.

21. PowerX Optimizer: AI-backed scanner and trading assistant

PowerX Optimizer combines scanners, trade selection tools, and an AI assistant nicknamed Rocky. The system helps identify stocks and options that match predefined criteria, generates trade plans, and offers checklists that guide traders from idea to execution.

For busy US traders who cannot follow every market move, this type of “guided workflow” software can be more useful than raw signals. Rather than simply saying “buy this,” it walks through why a setup fits the rules, what exits look like, and how it fits into a broader plan. By 2026, expect more trading software to embed this kind of assistant layer.

22. Sterling Stock Picker: an LLM as investing coach

Sterling Stock Picker uses large language models to interpret stock data and present it through a rating system and conversational coach named Finley. Users can ask questions about diversification, individual tickers, or portfolio changes and receive tailored suggestions based on their stated goals and risk tolerance.

This is a clear example of AI-powered trading tools nudging toward advice, not just analysis. For US traders, that raises two responsibilities. First, to understand the limitations and biases of any AI coach. Second, to treat its guidance as input, not as a licensed advisor. Used thoughtfully, it can help investors frame decisions more explicitly. Used blindly, it can encourage overconfidence.

How US Traders Can Evaluate AI-Powered Trading Tools in 2026

With so many AI-powered trading tools competing for attention, selection becomes a strategic decision in its own right. US traders need clear criteria to separate marketing from real edge and to choose a stack that supports, rather than distorts, their existing approach.

Match the tool to your strategy, not the other way round

It is tempting to pick tools first and then hunt for ways to justify them.

A healthier approach starts with strategy:

-

Are you primarily a day trader, a swing trader, or a long-term investor?

-

Do you trade equities, options, futures, crypto, or a mix?

-

Is your edge in fundamentals, technicals, sentiment, or structural flows?

Once the answers are clear, selection becomes easier. A short-term options trader may lean heavily on scanners like Trade Ideas, options-centric platforms such as Options AI, and automation tools like Capitalise.ai or PowerX Optimizer. A long-term equity investor might prioritize copilots such as Fiscal.ai, Danelfin, Kavout, and portfolio engines like Range or Zen Strategies. The key is to avoid bending your process to fit whatever your newest subscription can do.

Ask hard questions about data, risk, and fees

AI language can make any product sound impressive. To cut through the marketing, traders can ask a few simple questions:

-

Data – Which instruments and time frames does the model cover? How often is data refreshed? Are corporate actions and survivorship bias handled correctly?

-

Testing – Does the provider explain how strategies were backtested? Are the results out-of-sample or only in-sample? Are drawdowns shown as clearly as returns?

-

Risk and controls – Can you cap position sizes, daily losses, or leverage at the tool level? Are there clear logs of what the system did and why?

-

Costs – Which fees are fixed subscription, and which come from spreads, commissions, or performance? Are there hidden data or exchange fees?

Expert commentary around AI in investing consistently warns that traders should be wary of tools that promise certainty, skip risk disclosures, or present unrealistically smooth performance. A healthy dose of skepticism is an asset, not a barrier.

Keep humans firmly in the loop

Finally, regulators and practitioners alike stress that AI is not a substitute for fiduciary duty or personal responsibility. AI tools can illuminate patterns, speed up research, and automate routine decisions. They cannot carry legal accountability for your portfolio, tax situation, or financial goals.

For US traders in 2026, a sensible stance looks like this:

-

Use AI to generate questions, not just answers.

-

Treat AI outputs as hypotheses to test, not instructions to obey.

-

Maintain independent risk rules and position limits that no bot can override.

-

Reconcile AI-driven activity with your own records and understanding.

When AI sits in the role of co-pilot—supporting your decisions rather than making them for you—it can genuinely improve the quality and consistency of your trading.

The Bottom Line: AI as Co-Pilot, Not Autopilot

By 2026, AI-powered trading tools will be woven through almost every layer of the US trading ecosystem. Charting platforms will quietly mark up patterns with algorithms. Scanners and sentiment engines will rank opportunities. Copilots will summarise filings and highlight risks. Brokers will offer AI-assisted order routing, custom indexes, and, increasingly, semi-automated portfolio actions.

Yet the core realities of trading will not change. Markets will still punish overconfidence, poor risk management, and blind faith in any tool—human or machine. The traders who benefit most from AI will likely be those who treat these systems as force multipliers, not as oracles.