Many readers jump into the crypto market and hit a wall. You see jargon, endless ai crypto coins, and feel stuck. You just want clear picks, not more noise.

CoinMarketCap lists over 18.84 million crypto assets right now. This post will list 10 AI-Powered Crypto Projects To Watch and explain each with simple notes on machine learning, record chain ledgers, and digital contracts.

This guide will cut through the hype and help you spot top ai tokens. Stay tuned.

Key Takeaways

- The crypto market has 18.84 million assets on 835 exchanges and a $3.87 trillion market cap.

- SingularityNET (AGIX) and Ocean Protocol (OCEAN) let users buy and sell AI models built in TensorFlow or PyTorch, share data safely with Ethereum smart contracts, IPFS, and off-chain compute.

- Numerai (NMR) runs an AI hedge fund where data scientists stake NMR tokens on Python models and earn more tokens for accurate stock price forecasts.

- VeChain (VET), Cortex (CTXC), and DeepBrain Chain (DBC) add AI to blockchains for supply chain tracking, on-chain model deployment, and low-cost GPU power on networks like Internet Computer and Near Protocol.

- Artificial Liquid Intelligence (ALI) uses generative AI to mint NFTs on a layer-1 network, locks metadata on chain, and gives token holders voting rights on project updates.

SingularityNET (AGIX): Decentralized AI Marketplace

Developers use AGIX tokens to buy and sell AI services. The marketplace runs on Ethereum smart contracts and showcases blockchain technology. It lets token holders shape artificial intelligence modules.

Anyone can upload machine learning models built in TensorFlow or PyTorch. It taps into collective intelligence across decentralized applications.

It stands out in a crypto market with 18.84 million digital assets on 835 exchanges and a $3.87 trillion market capitalization. It tackles data analytics needs with GPU processing and amazon web services rivals.

The code stays open-source and avoids proof of stake pitfalls. Teams dodge phishing attacks and ponzi schemes by storing AI metadata on IPFS. SingularityNET cuts security risk and boosts market liquidity for ai crypto coins.

Ocean Protocol (OCEAN): Secure Data Sharing and Monetization

Ocean Protocol uses blockchain technology to let people share data without risk. It grants digital assets more security and privacy with programmable agreements. A data provider can publish digital assets on a data store and get paid in OCEAN tokens.

Data seekers buy a token to get access. Apps can build decentralised applications on top of those tokens. This model cuts out middlemen and stops data monopolies.

A pool of algorithms can run secure jobs close to the data. Compute on data happens off the chain to keep private info safe, blockchain only logs the record. A user can stake OCEAN tokens for governance rights on these networks.

This helps drive fair rules for all crypto projects. Stakeholders earn rewards and help guard against fraudulent uploads.

Numerai (NMR): AI-Powered Hedge Fund Platform

Numerai trades stocks using artificial intelligence on blockchain technology. Data scientists submit models in Python code to forecast prices. They stake NMR crypto tokens on predictions, and they earn more tokens for accuracy.

Participants use NMR tokens for governance rights in the network. Investors carry digital assets that mirror stock moves. The fund uses predictive analytics to adjust trades fast.

VeChain (VET): Blockchain Solutions Enhanced with AI

VeChain uses a public ledger to track goods as they move from factories to stores. This setup taps AI algorithms to spot anomalies in real time. It links IoT sensors and smart contracts to record each step.

Oracles feed data from the web into the chain. Smart contracts then trigger events once certain conditions meet. Companies can log batch details, shipping dates, and quality scores on a tamper-proof record.

AI tokens assist in analyzing those records to flag faulty batches. Users tap this data via a crypto wallet and unlock clear insights.

AI helps VeChain scale its blockchain networks without bulky servers. It scans millions of transactions for fraud, supply chain glitches, and network slowness. Chains on VeChain run in sync with other blockchain technology like Near Protocol, Internet Computer, or Akash Network.

VeChain grants governance rights to token holders, so they vote on upgrades and fees. Investors weigh market capitalization and tokenomics before staking VET. Cryptocurrency wallets hold VET, letting holders earn dividends from transaction fees.

Some partners build data markets on VeChain to share digital assets securely. Teams watch for risks in smart contract code and tweak AI models to boost performance.

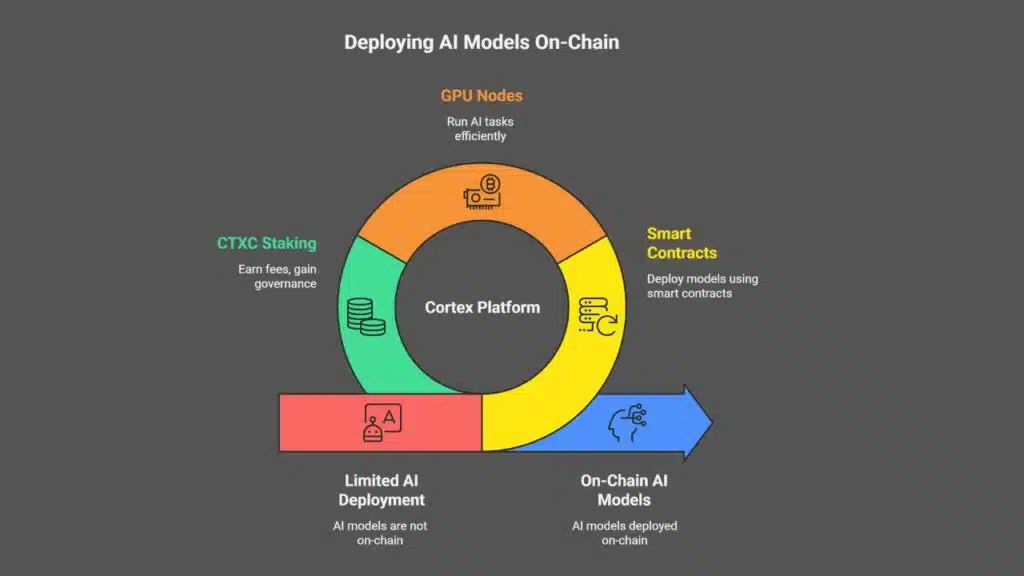

Cortex (CTXC): On-Chain AI Model Deployment

Cortex lets developers launch artificial intelligence (ai) models on chain, using smart contracts and the Ethereum Virtual Machine. It feels like a public AI lab in the crypto market, complete with GPU nodes that run TensorFlow or PyTorch tasks, then write proofs to the ledger.

Node operators stake CTXC and earn fees, granting governance rights and testing decentralisation in real time.

Apps tap data from social media feeds, price oracles or digital assets, then call on the on-chain AI for tasks like price predictions or image tagging. It rivals Internet Computer, Near Protocol, Akash Network and Virtuals Protocol, yet focuses on AI.

CTXC ranks among ai crypto coins, its market capitalization climbing as more projects deploy models, boosting scalability and options in the blockchain technology space.

DeepBrain Chain (DBC): AI Computing Power for Blockchain Projects

DeepBrain Chain offers cheap GPU credits on a blockchain network. It taps idle GPU clusters to power AI training tasks. This concept lowers costs for digital assets projects. It runs on smart contracts on the Internet Computer and Near Protocol.

Users pay with DBC tokens, a type of ai crypto coin. Governance rights let participants vote on system upgrades via a simple DAO. Teams can link their neural network models to DBC’s cloud computing nodes.

This tool rivals Akash Network but focuses on artificial intelligence (ai). It speeds up model testing and cuts energy waste. Developers can spin up virtual protocol nodes in minutes, no magic wand needed.

The service aims to shrink barriers around blockchain technology and ai tokens. It appeals to crypto market spectators and machine learning shops.

Artificial Liquid Intelligence (ALI): AI-Driven NFT Creation and Management

Artificial Liquid Intelligence (ALI) uses generative neural network models to craft NFTs in moments. Developers tap ALI’s engine for AI crypto coins that define rare tokens with vivid imagery.

This platform links blockchain technology, a self-executing script, and image synthesis in one flow. Collectors can mint tokens on a distributed storage network, locking metadata and ownership on chain.

Artists watch ALI boost creativity, offering fresh designs with every run. A layer-1 network like internet computer may host these creations with low fees. Rising demand can push market capitalization sky high.

Users link some AI tokens to governance rights, shaping project updates and tokenomics. Gamers trade these digital assets in marketplaces built on virtuals protocol stacks.

Takeaways

These tokens show how AI, smart contracts, and deep learning rewrite finance codes. Developers use a digital wallet and a programming library to test dapps. Traders track market cap shifts on a data platform and adjust tokenomics plans.

The next wave in data crowdsourcing and cryptography looks bright and bold.

FAQs

1. What are AI-Powered Crypto Projects?

They are crypto projects that mix artificial intelligence (ai) and digital assets. They use ai tokens and ai crypto coins to fuel smart tools. They rest on blockchain technology. They live in the crypto market.

2. How do I spot ai crypto coins with high market capitalization?

Open a crypto market tracker, sort by market capitalization, filter for coins with ai features. Read their white papers or website. Pick the biggest names, they are like big fish in a pond.

3. Why track Near Protocol, a fast chain, in this list?

Near Protocol is a mainnet that runs fast and charges low fees. It lets developers add ai models with little fuss. I once built a bot there, and it ran like a rocket.

4. What makes Internet Computer stand out among blockchain technology?

Internet Computer, a world cloud, blends server power and a ledger. It runs code with low lag and holds data close to the net. You can host apps without renting outside servers. It feels like magic on chain.

5. How do Virtuals Protocol, a new ledger, and Akash Network, a cloud grid, give governance rights?

They issue tokens that let you vote on upgrades and fees. You hold a token, you join the rule-making crowd. It’s like a club meeting where every voice counts.