The financial landscape in 2026 has shifted dramatically with the integration of AI-driven credit scoring and real-time transaction monitoring. While credit cards remain essential tools for building wealth and earning rewards, a single misstep can now have immediate consequences on your financial health. As banks move toward continuous risk assessment, maintaining perfect credit hygiene is no longer just about paying on time but about managing your digital financial footprint with precision.

Navigating the modern credit market requires a proactive approach to security and debt management. This guide identifies the ten most critical mistakes you must avoid this year to keep your credit score high and your interest costs at zero.

How We Chose Our Top 10 List?

Our selection process for the 2026 mistakes list is based on analyzing shifts in consumer credit behavior and the latest banking algorithms. We prioritized traps that have become more prevalent due to new technologies like UPI-linked credit and AI-automated limit adjustments.

We applied the following weightings to our research and comparison efforts to identify the most impactful mistakes:

| Criteria | Weighting | Focus Area |

| Financial Cost | 40% | Direct impact on interest charges, fees, and lost rewards |

| Credit Score Impact | 30% | Long-term damage to AI-driven scoring and loan eligibility |

| Security Risk | 30% | Vulnerability to modern fraud and account takeovers |

The Top 10 Most Common Credit Card Mistakes to Avoid 2026

The following mistakes represent the most significant threats to your financial stability in the current year. Avoiding these pitfalls will ensure you maximize the benefits of your cards while minimizing the risks of high-interest debt.

1. Carrying a Monthly Balance

Many users still believe the myth that carrying a small balance helps their credit score. In 2026, with interest rates on many cards exceeding 25%, this is purely a high-cost error. Carrying even a small balance triggers interest on your entire statement, effectively negating any rewards you earned during that period.

Special Features:

-

Instant interest accrual on all new purchases once a balance is carried.

-

Loss of the “interest-free grace period” for the following billing cycle.

-

Potential to trigger AI-driven interest rate hikes due to perceived risk.

Things to Consider:

-

Always set up an “Auto-Pay” for the full statement balance to avoid human error.

-

If you cannot pay the full amount, pay as much as possible to reduce daily interest.

-

Use a low-interest personal loan to consolidate if you have a recurring balance.

Best for: Individuals looking to avoid wealth erosion through high-interest payments.

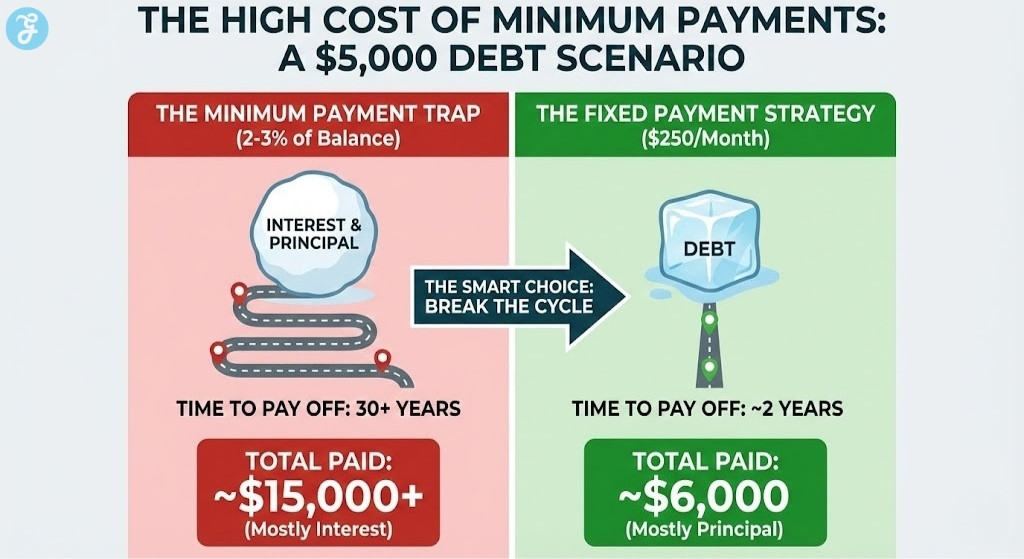

2. Making Only the Minimum Payment

The “Minimum Due” is a psychological trap designed to keep you in a cycle of debt for decades. Paying only the minimum amount barely covers the monthly interest and a tiny fraction of the principal. In the 2026 economy, banks use “minimum payment behavior” as a signal of financial distress, which can lead to lower credit limits.

Special Features:

-

Prolongs debt duration by years or even decades if not increased.

-

Triggers “High Risk” flags in modern AI credit monitoring systems.

-

Maximizes the total profit for the bank at your direct expense.

Things to Consider:

-

The minimum payment is usually just 2% to 5% of your total balance.

-

Use a “Debt Snowball” or “Debt Avalanche” method if you have multiple cards.

-

Check your monthly statement for the “Minimum Payment Warning” table required by law.

Best for: Budget-conscious users who want to stay out of long-term debt traps.

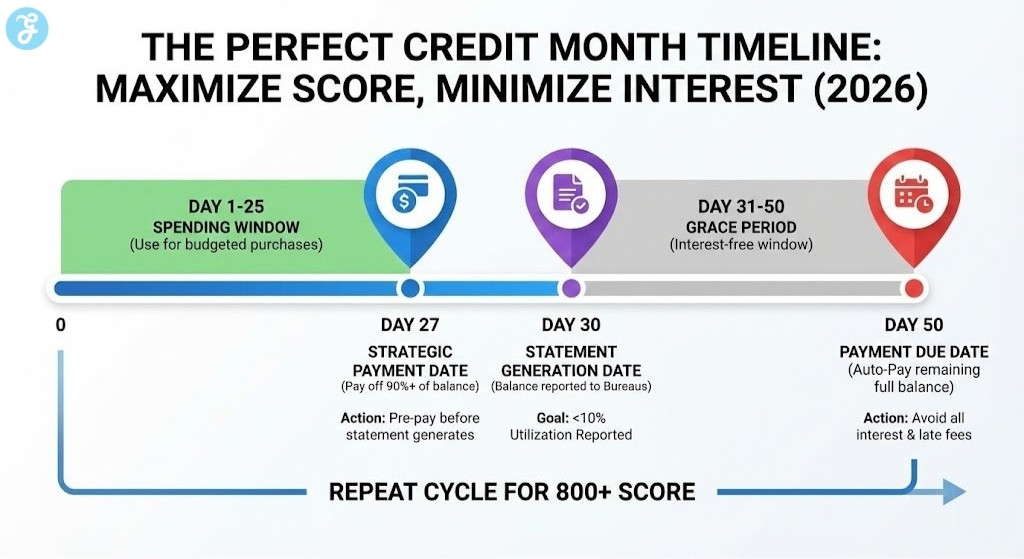

3. Ignoring Statement Generation Dates

A common mistake in 2026 is focusing only on the “Due Date” while ignoring the “Statement Date.” Your credit utilization is reported to bureaus on the statement date, not the day you pay your bill. If you have a high balance on that specific day, your score will drop even if you pay the full amount 24 hours later.

Special Features:

-

Directly impacts your Credit Utilization Ratio (CUR) for the month.

-

Affects real-time AI credit scores used by neobanks for instant loans.

-

Allows for “Balance Shifting” strategies to artificially boost scores.

Things to Consider:

-

Aim to pay off big purchases 2 to 3 days before your statement is generated.

-

Set a calendar alert for your statement date, not just your payment due date.

-

Keeping your reported balance under 30% is the gold standard for high scores.

Best for: Users actively trying to optimize their credit score for an upcoming mortgage or car loan.

4. Overusing UPI-Linked Credit for Daily Essentials

With the 2026 surge in RuPay and other UPI-linked credit cards, it has become too easy to scan and pay for every small item. While convenient, using credit for groceries, coffee, and fuel can lead to “lifestyle creep” where you lose track of your total monthly spend. This behavior often results in a shock when the monthly statement arrives.

Special Features:

-

Frictionless payments through smartphone QR codes.

-

Real-time tracking within banking apps but often lacks category limits.

-

High potential for small, frequent transactions to mask a large total debt.

Things to Consider:

-

Limit UPI credit usage to planned, larger purchases rather than daily snacks.

-

Use a dedicated budgeting app that syncs with your UPI transactions.

-

Monitor your “unbilled transactions” weekly to avoid end-of-month surprises.

Best for: Digital-first spenders who want to maintain discipline in a frictionless economy.

5. Letting Reward Points and Cashback Expire

Billions of dollars in reward points go unredeemed every year, which is essentially free money left on the table. In 2026, many banks have shortened the expiration windows for points to 12 or 24 months. Ignoring your rewards balance is a missed opportunity to offset your annual fees or travel costs.

Special Features:

-

Points can often be redeemed for statement credit, gift cards, or travel.

-

Some cards offer “points boosters” for specific seasonal categories.

-

Reward devaluations happen frequently, so holding points long-term is risky.

Things to Consider:

-

Set a quarterly reminder to check and redeem your rewards balance.

-

Prioritize cards that offer “Cashback” over “Points” for simpler value tracking.

-

Check if your card has a minimum redemption threshold before you can use points.

Best for: Value-focused consumers who want to maximize the ROI of their spending.

6. Missing Fraud and Anomaly Alerts

Fraud tactics in 2026 have evolved to include sophisticated “micro-transactions” that stay under your radar. Many users make the mistake of disabling app notifications or ignoring small $1 to $5 charges. These are often “tester” transactions used by hackers to see if a stolen card is active before making a large purchase.

Special Features:

-

Real-time push notifications for every transaction.

-

AI-driven anomaly detection that flags spending in unusual locations.

-

Virtual card numbers for safer online shopping on unfamiliar websites.

Things to Consider:

-

Enable “Transaction Alerts” for every dollar spent, no matter how small.

-

Use the “Lock Card” feature in your app if you misplace your card temporarily.

-

Review your transaction history at least once a week for unfamiliar names.

Best for: Security-conscious users who want to catch fraud before it escalates.

7. Opening Multiple Cards for Sign-Up Bonuses Simultaneously

The “churning” trend remains popular in 2026, but doing it too aggressively is a major mistake. Every application triggers a “Hard Inquiry” on your report. Multiple inquiries in a short window tell AI scoring models that you are “credit hungry” or under financial stress, which can lead to immediate score drops.

Special Features:

-

Hard inquiries typically stay on your credit report for two years.

-

“Welcome Bonuses” often require high spending targets within 90 days.

-

Average age of accounts decreases with every new card opened.

Things to Consider:

-

Space out new card applications by at least 3 to 6 months.

-

Ensure you can meet the “Minimum Spend” without overspending your budget.

-

Research the “Approval Odds” before applying to avoid a wasted inquiry.

Best for: Reward hunters who want to build a portfolio of cards without damaging their score.

8. Taking Cash Advances for Non-Emergencies

Using your credit card at an ATM is one of the most expensive financial mistakes you can make in 2026. Cash advances usually have no grace period, meaning interest starts accruing the second the cash leaves the machine. Additionally, banks often charge a flat fee or a high percentage of the withdrawal amount.

Special Features:

-

Instant interest charges at a higher rate than regular purchases.

-

Upfront fees ranging from 3% to 5% of the total cash amount.

-

Not eligible for reward points or cashback in almost all cases.

Things to Consider:

-

Keep a small “Emergency Fund” in a high-yield savings account for cash needs.

-

Use your debit card for ATM withdrawals to avoid high-cost credit interest.

-

A personal loan or “Credit Line” is almost always cheaper than a cash advance.

Best for: Anyone looking to avoid emergency fees and sky-high interest rates.

9. Closing Your Oldest Credit Card Accounts

When people pay off a card, their first instinct is often to close the account to “clean up” their finances. This is a mistake because the “Length of Credit History” is a major factor in your score. Closing an old account reduces your average account age and lowers your total available credit, which can cause your score to tank.

Special Features:

-

Contributes significantly to the “Age of Credit” scoring category.

-

Increases your “Total Credit Limit,” which helps lower your utilization ratio.

-

Demonstrates long-term stability and reliability to potential lenders.

Things to Consider:

-

If the card has an annual fee, ask the bank for a “Product Change” to a no-fee version.

-

Put one small recurring subscription (like Netflix) on the old card to keep it active.

-

Only close an account if it is truly tempting you to overspend or has a high fee.

Best for: Long-term planners focused on maintaining a high 800+ credit score.

10. Ignoring Changes to Terms and Conditions

In 2026, banks are constantly “revising” their reward structures, lounge access rules, and fee schedules. A common mistake is assuming your card benefits are static. Failing to read the mandatory update emails can result in paying a new “hidden” fee or missing out on a reward category change.

Special Features:

-

Seasonal category rotations for 5% cashback cards.

-

New “Inactivity Fees” or “Paper Statement Fees” added to older accounts.

-

Devaluation of travel miles or changes to airline partner lists.

Things to Consider:

-

Scan the “Summary of Changes” section in your monthly statement email.

-

Check your card issuer’s app once a month for new “Offers” or “Rules.”

-

Be prepared to switch cards if your current one no longer fits your lifestyle.

Best for: Detail-oriented users who want to stay ahead of bank-led devaluations.

Credit Card Market Overview 2026

The 2026 market is defined by “Hyper-Personalization,” where your interest rate and reward structure can change monthly based on your spending patterns. Banks are increasingly using alternative data such as utility payment consistency and digital wallet behavior to supplement traditional scores.

| Trend | 2026 Shift | Impact on Users |

| AI Scoring | Real-time behavior analysis | Small habits affect scores instantly |

| UPI Integration | Credit linked to QR scans | Higher risk of overspending on daily items |

| Reward Caps | Lower limits on high-value categories | Harder to “game” the system for points |

| Security | Biometric and virtual card defaults | Fewer physical card thefts but more digital fraud |

How To Avoid Some Common Mistakes:

Avoiding credit card mistakes is about aligning your payment habits with your financial goals:

-

For the Score Optimizer: Focus on Mistake #3 and Mistake #9 to build a rock-solid profile for major loans.

-

For the Debt Crusader: Prioritize Mistake #1 and Mistake #2 to eliminate high-interest leaks in your budget.

-

For the Security Seeker: Address Mistake #6 to protect your identity in an increasingly digital world.

-

For the Maximizer: Ensure you are not falling for Mistake #5 and Mistake #10 to get every cent of value from your spend.

Wrap-Up

Avoiding these common credit card mistakes to avoid 2026 is the key to turning your plastic from a liability into a wealth-building asset. In an era of AI-driven finance, your spending discipline is monitored more closely than ever, making perfect credit hygiene a mandatory skill. By paying in full, tracking your statement dates, and staying alert to fraud, you ensure that you are the one profiting from your credit cards, not the banks.