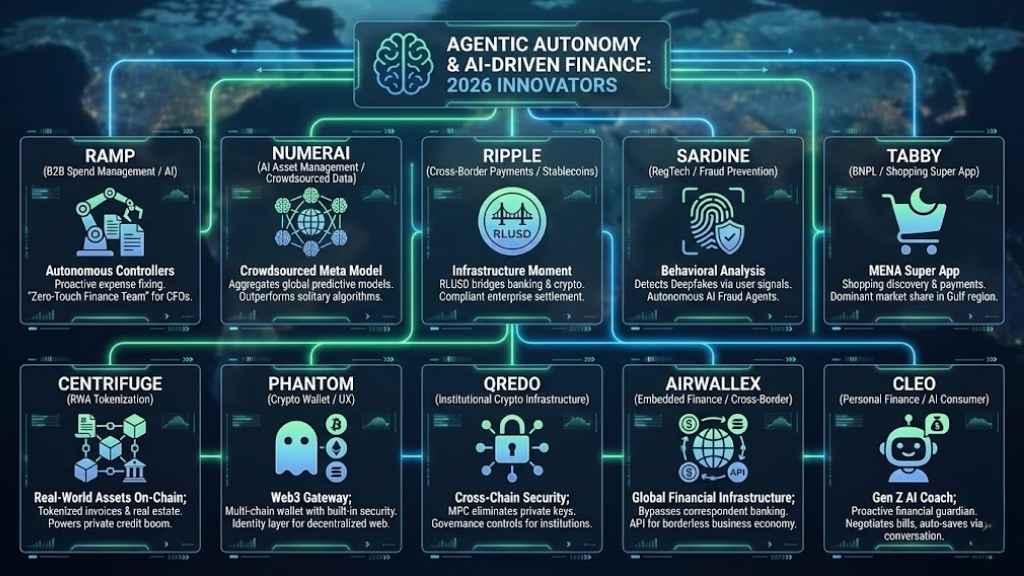

If 2021 was the year of “irrational exuberance” and 2024 was the year of “correction,” 2026 is the year of Autonomous Finance. The era of merely “digitizing” paper processes is over. The standout fintech startups of 2026 aren’t just offering you a banking app with a nicer dashboard; they are building Agentic AI that manages wealth without human input and Real-World Asset (RWA) protocols that are finally bringing the $28 trillion treasury market onto the blockchain.

Below, we analyze the 10 most innovative fintech startups defining this shift. These organizations have survived the high-interest-rate winter and are now scaling infrastructure that will power the next decade of global finance.

| Company | Core Innovation | Key 2026 Milestone |

| 1. Ramp | Agentic AI for Finance | $32B Valuation; AI “Agents for AP” launch |

| 2. Ripple | Stablecoin Settlement | RLUSD hits $1.2B supply on Ethereum |

| 3. Numerai | AI Hedge Fund | $500M Valuation; “Meta Model” outperforming macro funds |

| 4. Sardine | Behavioral Biometrics | Raised $70M to build “Fraud Fighting Agents” |

| 5. Centrifuge | RWA Tokenization | Leader in on-chain private credit & invoices |

| 6. Tabby | BNPL Super App | Dominating the $20B+ Middle East BNPL market |

| 7. Phantom | DeFi “Browser” | The standard gateway for Solana & multi-chain users |

| 8. Qredo | Decentralized Custody | Solving the institutional “key management” crisis |

| 9. Airwallex | Embedded Global Pay | Powering cross-border SaaS platforms |

| 10. Cleo | Gen Z AI Coach | From chatbot to autonomous financial guardian |

The Innovation Criteria: What Matters in 2026?

Before diving into the companies, it is crucial for investors and tech leaders to understand the thematic drivers behind these choices. In 2026, “innovation” is defined by three specific pillars:

1. Agentic AI (The “Doer” Models)

In 2024, AI could summarize a PDF. In 2026, Agentic AI executes complex workflows. The companies listed below (like Ramp and Sardine) use AI agents that autonomously negotiate bills, reconcile million-dollar accounts, and block fraud in real-time without human intervention.

2. Real-World Assets (RWA) & Backend DeFi

Decentralized Finance (DeFi) has matured. It is no longer about yield farming with meme tokens. It is about tokenizing U.S. Treasuries, private credit, and invoices. The “rails” of finance are moving on-chain, but the interface remains simple for the user.

3. Borderless Compliance

As companies go global from Day 1, they need financial infrastructure that handles tax, payroll, and compliance across 50+ jurisdictions instantly.

Top 10 Innovative Fintech Startups to Watch in 2026

The global financial landscape has shifted from simple digital apps to a regime of “Agentic Autonomy,” where capital is increasingly self-allocating and programmable. In this era, Innovative Fintech Startups are no longer just digitizing old bank forms; they are deploying autonomous AI agents and tokenizing trillions in real-world assets. From decentralized credit protocols to AI-driven wealth guardians, these ten companies represent the cutting edge of financial technology. Staying ahead of the curve means tracking these Innovative Fintech Startups as they redefine how we trade, save, and secure our digital identities.

1. Ramp (The Autonomous Finance Department)

- HQ: New York, USA

- Sector: B2B Spend Management / AI

- Status: Late-Stage Venture ($32B Valuation)

The Innovation

Ramp has successfully transitioned from a corporate card company to a full-stack financial automation platform. In late 2025, they launched “Agents for Controllers,” an AI system that doesn’t just flag expenses but proactively fixes them.

Why They Win in 2026

Ramp’s AI now makes over 26 million decisions per month. It automatically matches receipts, categorizes spend, and even flags “out-of-policy” SaaS subscriptions before they renew. While competitors are still building better dashboards, Ramp is building the “Zero-Touch Finance Team,” where the software handles 90% of the CFO’s grunt work.

2. Numerai (The AI Hedge Fund)

- HQ: San Francisco, USA

- Sector: AI Asset Management / Crowdsourced Data

- Status: Series C ($500M Valuation)

The Innovation

Numerai is the “anti-hedge fund.” Instead of hiring analysts, they host a global tournament where data scientists download encrypted financial data and upload predictive models. Numerai aggregates these thousands of models into a single “Meta Model” to trade the stock market.

Why They Win in 2026

With their recent $30M Series C (backed by university endowments), Numerai proved that crowdsourced AI outperforms solitary algorithms. As of early 2026, their model is managing nearly $1B in assets. In a world where AI is commoditized, Numerai’s proprietary dataset and incentive network (paid in NMR tokens) create a moat that traditional funds like Bridgewater cannot easily replicate.

3. Ripple (The Settlement Layer)

- HQ: San Francisco, USA

- Sector: Cross-Border Payments / Stablecoins

- Status: Enterprise / Late Stage

The Innovation

Ripple has long been a giant, but 2026 marks its true “infrastructure” moment. The launch and rapid adoption of RLUSD (Ripple USD stablecoin) has bridged the gap between traditional banking and crypto.

Why They Win in 2026

RLUSD recently hit $1.2 billion in supply on Ethereum alone. By focusing on compliance first (holding a New York Trust Charter), Ripple has become the safe harbor for institutions. Banks are finally using Ripple’s rails not just for “tests,” but for actual commercial settlement to avoid the slow, expensive SWIFT network. They are effectively becoming the “HTTP of Money.”

4. Sardine (Fraud Fighting with Behavior)

- HQ: San Francisco, USA

- Sector: RegTech / Fraud Prevention

- Status: Series C (Raised $70M in Feb 2025)

The Innovation

In an era of Deepfakes and AI-generated identity theft, traditional KYC (Know Your Customer) is broken. Sardine moves beyond checking IDs; they check behavior. Their SDK analyzes how a user holds their phone, their typing cadence, and thousands of other signals to detect if a user is a human or a bot (or a human under duress).

Why They Win in 2026

Sardine is the “immune system” for the fintech economy. Their new AI Fraud Agents interact autonomously with other systems to freeze funds or challenge transactions. As faster payments (FedNow, RTP) become the norm, fraud moves instantly—Sardine is the only player fast enough to stop it.

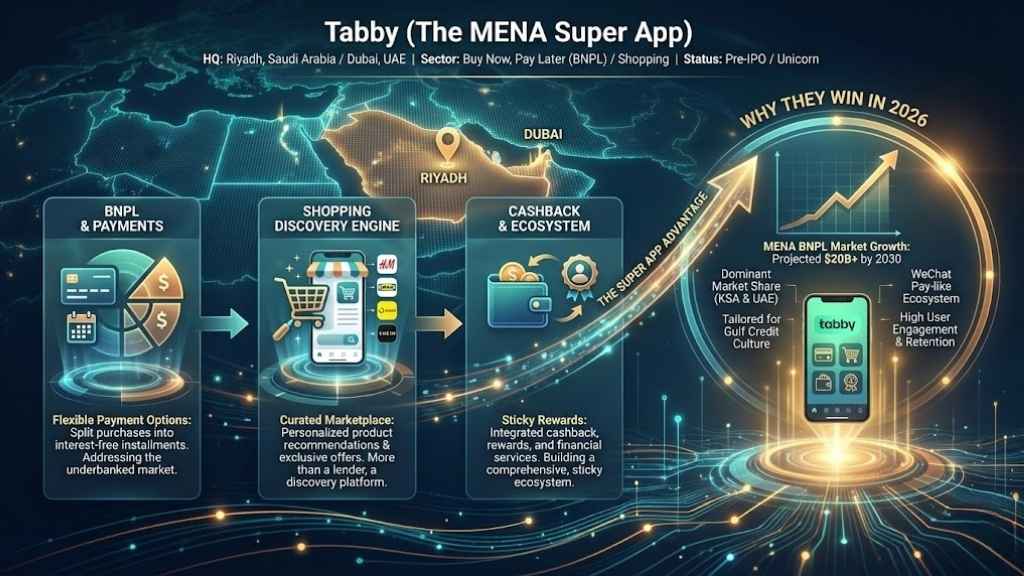

5. Tabby (The MENA Super App)

- HQ: Riyadh, Saudi Arabia / Dubai, UAE

- Sector: Buy Now, Pay Later (BNPL) / Shopping

- Status: Pre-IPO / Unicorn

The Innovation

While Western BNPL firms (like Affirm and Klarna) face saturation, Tabby is capitalizing on the massive, underbanked growth in the Middle East. They aren’t just a lender; they are a shopping discovery engine.

Why They Win in 2026

The Middle East BNPL market is projected to hit $20B+ by 2030. Tabby has secured a dominant market share in Saudi Arabia and the UAE. By integrating payments, shopping, and cashback into one “Super App,” they have built a sticky ecosystem that mimics the success of WeChat Pay in China, but tailored for the Gulf region’s unique credit culture.

6. Centrifuge (Real-World Assets)

- HQ: Zug, Switzerland (DeFi Native)

- Sector: RWA Tokenization

- Status: Growth Stage Protocol

The Innovation

Centrifuge is the bridge bringing the “real world” on-chain. They allow businesses to tokenize invoices, real estate, and revenue-based royalties, using them as collateral to borrow stablecoins from DeFi liquidity pools.

Why They Win in 2026

The “Tokenized Treasury” market exploded to $25B+ in 2025. Centrifuge is the protocol powering the private credit side of this boom. With major partnerships (like those with BlockTower Capital and MakerDAO), they are the infrastructure layer allowing a small business in Kenya or a fintech in Berlin to access global liquidity instantly, 24/7.

7. Phantom (The Web3 Gateway)

- HQ: Remote / Distributed

- Sector: Crypto Wallet / UX

- Status: Growth Stage

The Innovation

Phantom solved the biggest problem in crypto: Usability. Originally built for Solana, they have expanded to become the premier multi-chain wallet (Bitcoin, Ethereum, Solana).

Why They Win in 2026

In 2026, the “wallet” is the new “browser.” Phantom’s built-in security features (simulating transactions before you click “approve”) have saved users millions in potential scams. As DeFi becomes the backend for more consumer apps, Phantom is positioning itself as the identity layer for the decentralized web—the “Sign in with Google” for Web3.

8. Qredo (Cross-Chain Security)

- HQ: London, UK

- Sector: Institutional Crypto Infrastructure

- Status: Growth Stage

The Innovation

Qredo (now evolving into open custodial networks) uses Multi-Party Computation (MPC) to eliminate “private keys.” This means institutions can trade and hold crypto without the risk of a single employee losing a laptop or stealing a key.

Why They Win in 2026

Interoperability is the theme of 2026. Qredo’s network allows assets to move between blockchains (e.g., from Bitcoin to Ethereum) securely. For hedge funds and banks entering the space, Qredo offers the governance controls (like multi-person approval workflows) that are mandatory for compliance.

9. Airwallex (Global Financial Infrastructure)

- HQ: Melbourne, Australia / Global

- Sector: Embedded Finance / Cross-Border

- Status: Late-Stage / Pre-IPO

The Innovation

Airwallex built a proprietary global banking network that bypasses the correspondent banking system. They allow software companies (like Shopify or generic SaaS platforms) to become banks, offering accounts and cards to their own users.

Why They Win in 2026

Globalization hasn’t stopped; it has just gone digital. Airwallex’s API allows a US company to instantly issue virtual Visa cards to employees in Hong Kong or collect payments in Brazilian Reals. In 2026, they are the backbone of the “borderless business” economy.

10. Cleo (Gen Z’s AI Financial Coach)

- HQ: London, UK

- Sector: Personal Finance / AI Consumer

- Status: Series C+

The Innovation

Cleo started as a “roasting” chatbot that shamed you for spending too much on coffee. In 2026, it has evolved into a proactive financial guardian. It uses Agentic AI to negotiate better rates on bills, cancel unused subscriptions, and auto-save for goals.

Why They Win in 2026

Gen Z and Gen Alpha do not want to log into a bank app. They want a conversation. Cleo’s high engagement rates (far surpassing traditional banking apps) prove that personality + AI is the winning formula for the next generation of wealth management.

Key Trends Driving Investment in 2026

Investors looking for the “next big thing” should focus less on individual stock picks and more on these three macro-trends:

Trend 1: The “Death” of the App Interface

Notice how Ramp and Cleo are succeeding? They are moving away from “apps you visit” to “agents that work for you.” The most valuable fintechs of 2026 are invisible. They live in your browser, your Slack, or your background processes, solving problems before you even notice them.

Trend 2: Stablecoins as B2B Rails

With Ripple’s RLUSD and other regulated stablecoins reaching billions in circulation, the argument about “crypto volatility” is dead for B2B. Companies are now using stablecoins for payroll and supplier payments because they settle in seconds, not days. The infrastructure providers (custody, compliance, issuance) are the picks and shovels here.

Trend 3: Identity is the New Perimeter

As AI gets better at faking being human, “Proof of Personhood” and behavioral biometrics (like Sardine) become the most critical security layer. You cannot have an AI economy without a way to verify who is actually authorizing the money movement.

Final Thoughts

The fintech winners of 2026 are not the companies shouting the loudest about “disruption.” They are the ones quietly rebuilding the plumbing of the global economy. Whether it is Numerai proving that the crowd is smarter than the individual, or Ramp proving that software can replace the accounting department, the common thread is autonomy. The future of finance isn’t about giving you more charts to look at—it’s about giving you your time back.