Ever feel like predicting the economy is a bit like trying to read tea leaves in a hurricane? You are not the only one. With interest rates shifting and new financial tools popping up every day, knowing exactly how to get the most out of your digital bank can feel overwhelming. But here is the good news: you do not need a PhD in economics to make smart moves in 2026.

I have spent years watching these trends, and I have found that a few strategic tweaks can turn a stagnant account into a serious wealth builder. Whether you are running a fintech startup or just managing your own savings, the rules of the game are changing in your favor if you know where to look.

Digital banking is currently exploding, with over half of all new accounts in the U.S. now opened online. This shift means more competition, which often leads to better deals for you if you are paying attention. Let’s walk through the exact steps on how to maximize yields in a digital bank this year.

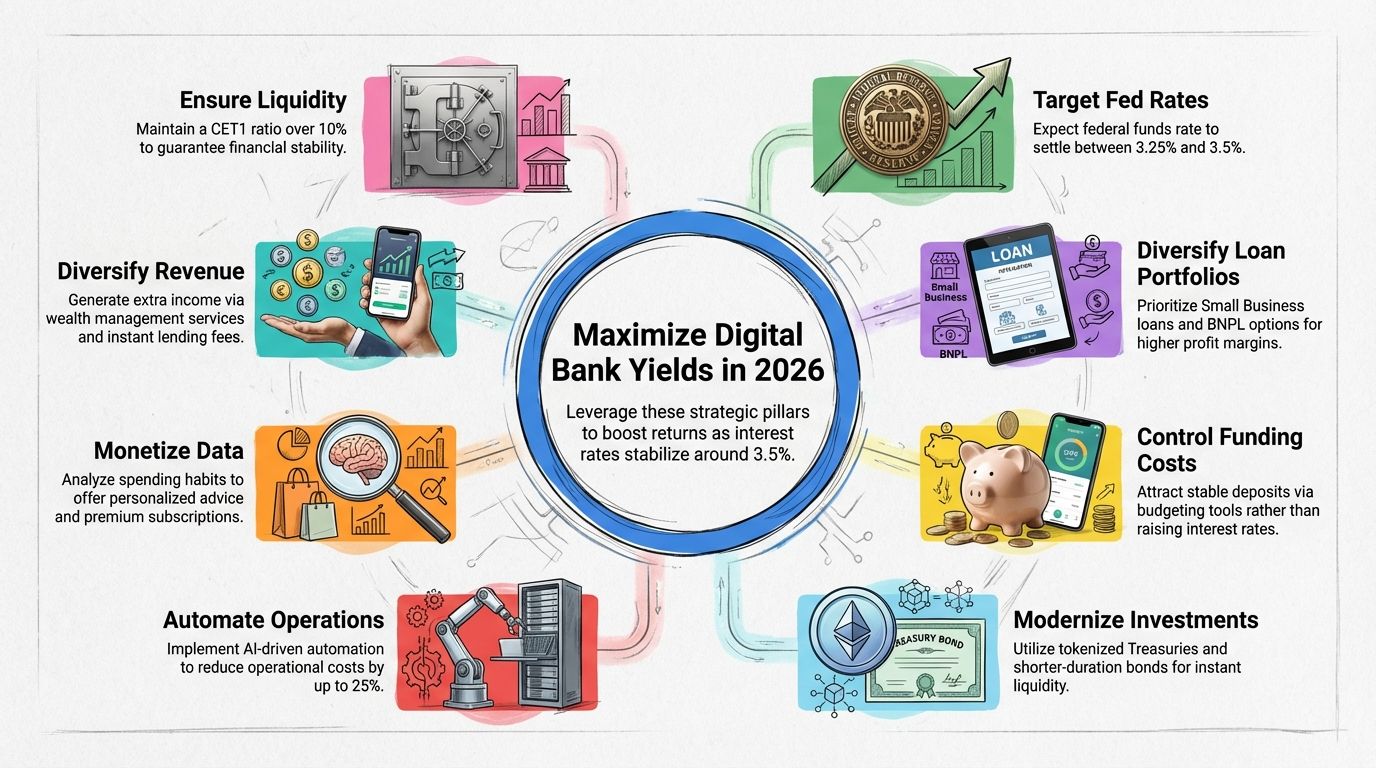

Understanding Interest Rates in 2026

Interest rates move like a pendulum, and catching the swing at the right moment determines whether you make a little money or a lot. For digital banks and their customers, spotting these shifts early is the secret sauce to staying ahead.

Trends in Global Interest Rates

We have been on quite a ride since 2022. After the U.S. Federal Reserve pushed rates to over 5% to cool down inflation, things are finally starting to find a new rhythm. The big question on everyone’s mind is: where do we land in 2026?

According to the Federal Reserve’s recent “dot plot” projections, officials expect the federal funds rate to settle somewhere between 3.25% and 3.5% in 2026. This is a “Goldilocks” zone, not too hot, not too cold, which stabilizes borrowing costs while still offering decent returns for savers.

This stability is a game-changer. It means digital banking strategies can finally shift from emergency defense to long-term growth. While Europe and emerging markets like Brazil adjust their own dials to fight local inflation, the U.S. market is signaling a period of steady opportunities.

As financial analyst Lisa Chang from FinTrend Advisors puts it, “Monetary policy shapes profits just as surely as the sun rises.” The key now is understanding why these numbers are moving.

Key Factors Driving Rate Changes

You might wonder what actually pushes these rates up or down. It usually comes down to three things: inflation data, job numbers, and global events.

- Inflation Control: The Fed aims for a Personal Consumption Expenditures (PCE) inflation rate of around 2%. Current forecasts for 2026 hover near 2.4%, meaning rates will likely stay steady to keep prices in check.

- Labor Market Heat: When more people have jobs and spend money, rates often stay higher to prevent the economy from overheating.

- Tech Competition: This is the wild card. Big tech firms launching online banking solutions are forcing traditional banks to offer better rates just to keep their customers.

Digital banks watch these signals like hawks. When the government tweaks a trade law or a tariff, loan prices can swing overnight. Staying agile is the only way to survive the rollercoaster.

Importance of Maximizing Yields in Digital Banking

In the world of digital banking, efficiency is king. Because online banks do not have to pay for thousands of brick-and-mortar branches, they operate with a massive advantage. Leveraging this difference is how you squeeze more value out of every dollar.

Impact on Profitability

Did you know that a digital bank’s cost base is often 60% to 70% lower than a traditional bank’s? This efficiency ratio is your best friend. It allows digital platforms to pass those savings on to you in the form of higher yields on savings and lower rates on loans.

But there is a catch. If funding costs (the interest paid to depositors) rise faster than the income from loans, profit margins get squeezed. Successful banks in 2026 are using this “digital dividend” to buffer against market swings, ensuring they remain profitable even if the Fed cuts rates slightly.

Enhancing Customer Value

People today have zero patience for slow service or hidden fees. Speed is the new currency. For example, opening a checking account at a top-tier digital bank now takes about 36 clicks, compared to an average of 85 clicks at a traditional bank.

Better service means happier people, says Tim Riley, a fintech expert.

Banks are also using tools like Salesforce Financial Services Cloud to personalize advice. Imagine an app that notices you have extra cash sitting idle and suggests moving it to a high-yield account automatically. That is not just helpful; it builds the kind of loyalty that keeps customers around for the long haul.

Strategies to Optimize Yields in a Digital Bank

Boosting returns is not about luck; it is about mix and management. You need the right combination of products and a hawk-eyed focus on costs.

Optimize Loan Mix for Higher Returns

Relying on just one type of loan is risky. The smartest digital banks diversify their portfolios to balance risk and reward.

| Loan Type | Yield Potential | Why It Works in 2026 |

| Small Business (SMB) Loans | High | Offers higher margins than consumer loans; vital for economic recovery. |

| Buy Now, Pay Later (BNPL) | Very High | Short duration means money turns over fast, compounding returns quickly. |

| Residential Mortgages | Moderate/Stable | Provides steady, long-term income flow to balance riskier bets. |

In 2023, banks that leaned into small business lending saw a significant yield jump. For 2026, the smart money is on adjustable-rate products that can adapt if the Fed changes course unexpectedly.

Aggressively Manage Funding Costs

Paying too much for deposits is the fastest way to kill profitability. The goal is to keep “deposit beta”, the percentage of rate hikes passed to customers, manageable.

Instead of just raising rates on savings accounts to attract money, top banks are offering tools like real-time budgeting apps or “early direct deposit” features. These perks attract “sticky” money that stays in the account regardless of rate fluctuations. Small shifts, like moving from expensive brokered CDs to reliable customer deposits, can save millions.

Strategic Investment Portfolio Allocation

Do not put all your eggs in one basket. Digital banks are now exploring modern assets like tokenized U.S. Treasuries on the blockchain, which offer instant settlement and high liquidity.

With global interest rates expected to stay higher than in the pre-2022 era, shorter-duration bonds are a smart play. They react less violently to rate changes, protecting the portfolio’s value. The key is using real-time data to rebalance often, rather than setting it and forgetting it.

Leveraging Technology for Yield Maximization

This is where the magic happens. Technology is the lever that turns small operational improvements into massive financial gains.

Automate Core Operations to Reduce Costs

Manual work is the enemy of yield. Leading digital banks utilize platforms like nCino for loan origination, which can cut the time to fund a loan from weeks to days. Automation handles the boring stuff, data entry, document verification, and compliance checks.

According to reports from McKinsey, AI-driven automation can reduce operational costs by up to 20-25%. That is free money that can be reinvested into better rates for customers or higher profits for the bank.

Monetize Customer Data and Services

Your data tells a story, and smart banks listen. By analyzing spending habits, banks can offer “next best action” recommendations. For example, if an algorithm sees you spending a lot on travel, it might suggest a premium credit card with no foreign transaction fees.

This approach transforms a standard service into a personalized financial assistant. Banks like Revolut have successfully monetized this by offering tiered subscription models (like “Metal” or “Premium” cards) that bundle these insights with exclusive perks.

Implement RegTech for Efficient Compliance

Staying legal used to be expensive and slow. Now, RegTech (Regulatory Technology) handles it in the background. Tools like ComplyAdvantage or Chainalysis use AI to scan transactions for fraud or money laundering in milliseconds.

In 2023, nearly 60% of digital banks used these tools to slash manual compliance work. This does not just save money; it prevents the massive fines that come from missing a red flag. It keeps the bank safe and the regulators happy without slowing down your transactions.

Enhancing Non-Interest Income Streams

Relying solely on interest is so 2020. The most profitable banks today are building diversified revenue streams that pay out rain or shine.

Introduce High-Margin Services

Think beyond the basic checking account. High-margin services are where the real growth lies.

- Wealth Management: Robo-advisors like Betterment have shown that people will pay for automated, low-fee investment management.

- Instant Lending: Offering “spot me” features for a small fee can generate significant revenue from users who need short-term liquidity.

- Interchange Fees: Every time a user swipes their card, the bank earns a fee. Encouraging card usage through rewards programs drives this income up effortlessly.

Transparent and Optimized Fee Structures

Nobody likes “gotcha” fees. The trend for 2026 is radical transparency. A subscription model, where you pay $5 or $10 a month for premium features and no hidden costs, is becoming incredibly popular.

Neobanks like Chime have grown massive user bases by promising “no hidden fees.” This builds immense trust. When customers know exactly what they are paying for, they are far less likely to leave, increasing their lifetime value to the bank.

Preparing for Loan Growth in a High-Rate Environment

Lending money is easy; getting it back is the hard part. As rates stabilize, the focus shifts to finding the highest quality borrowers.

Capital and Liquidity Management

You need a safety net. Regulators are stricter than ever about liquidity, basically, having enough cash on hand if everyone wants their money back at once. Maintaining a Common Equity Tier 1 (CET1) ratio of over 10% is the gold standard for safety.

Liquidity must flow like water. Digital platforms now use AI to stress-test their portfolios daily. They simulate worst-case scenarios, like a sudden recession, to ensure they can survive any storm. This balance protects the bank from collapse while still allowing for aggressive lending.

Underwriting Adjustments for Efficiency

Old credit scores utilize limited data. New AI underwriting models, such as those from Zest AI, look at thousands of data points to find creditworthy borrowers that traditional banks miss.

This creates a win-win: the bank gets more customers with lower default rates, and people with “thin” credit files get access to fair loans. Speed is also critical; being able to approve a loan in seconds rather than days means you capture the customer before they go to a competitor.

Digital Pitfalls: Crucial Factors that Impact Profitability

It is not all smooth sailing. The digital world has its own set of sharks, and ignoring them can be fatal.

The High Cost of Breaches: Cybersecurity is no longer optional. The average cost of a data breach in the financial sector has skyrocketed to approximately $6.08 million globally in recent years. In the U.S., that figure can be even higher.

Credential Stuffing: This is a common attack where hackers use stolen passwords from one site to break into banking accounts. If a bank’s security is weak, one breach can destroy its reputation.

Regulatory Fines: Strict rules like the EU’s GDPR or emerging crypto regulations from the U.S. SEC mean that a single compliance slip-up can lead to heavy fines. Automating compliance isn’t just about efficiency; it’s an insurance policy against disaster.

Key Takeaways and Actionable Insights

Interest rates in 2026 might be settling down, but the opportunities for digital banks are just heating up. By focusing on a diverse loan mix, automating the boring work, and keeping your data secure, you can maximize yields regardless of what the Fed does next. Remember to leverage high-margin services and keep your fee structures simple to build lasting customer loyalty. These small, strategic steps can turn pennies into dollars before you finish your second cup of coffee!

Final Thoughts

As you gear up for 2026, use these digital banking tools to make interest rates work for you, not against you. Mix your loans smartly, lower funding costs when you can, and choose investments that balance safety with growth. Lean into tech to cut daily expenses and boost profits without the headache.

Small steps, like adding a new fee-based service or improving your loan underwriting with AI, can lift your results faster than you might think. For more details on money trends or ways to grow yields, check trusted online financial guides and expert blogs anytime.

Keep an eye on each dollar; it all adds up over time, just like a snowball rolling downhill!