The telephone rang in New Delhi on February 2, 2026, and for a brief moment, the global economy held its breath. On the line were two leaders who have spent the last decade redefining the art of the deal: President Donald Trump and Prime Minister Narendra Modi. When they hung up, the markets rallied, the rupee stabilized, and the headlines screamed of a “historic truce.”

What followed would be branded the Trump-Modi Trade Truce 2026, a phrase polished for headlines but light on substance. But let’s be clear about what actually happened. This wasn’t a trade deal. It was a mutual agreement to hallucinate.

By accepting a “handshake” seemingly worth a mythical $500 billion instead of a binding treaty, Washington and New Delhi haven’t solved their trade war; they’ve just privatized the chaos. We have entered the era of Strategic Ambiguity, where the “deal” is whatever the loudest man in the room says it is, and the details are someone else’s problem. This isn’t diplomacy; it’s day-trading with the livelihoods of a billion people.

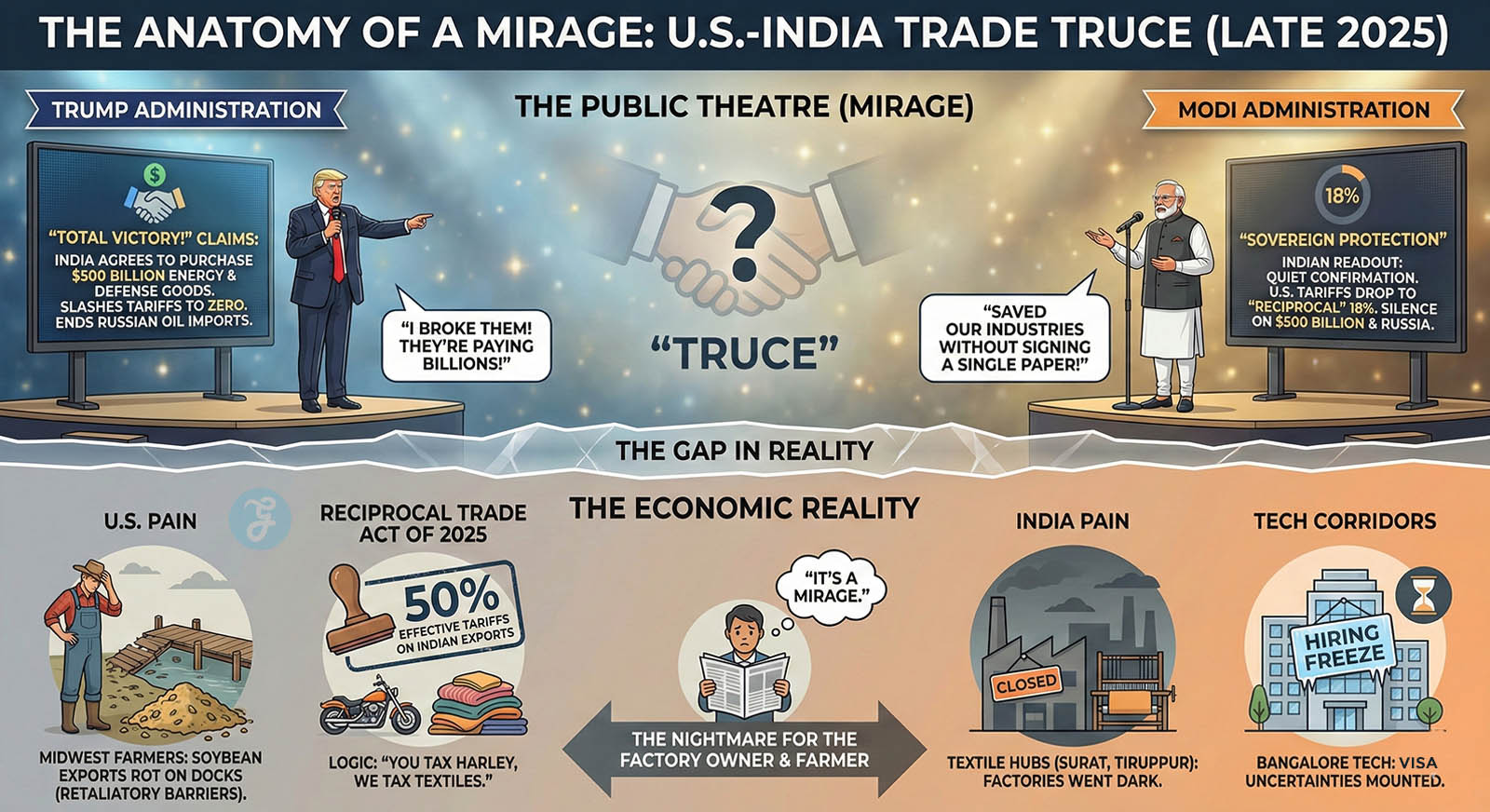

Trump-Modi Trade Truce 2026: The Anatomy of a Mirage

To understand the sheer absurdity of this week, you have to look at the scoreboard before the call. Late 2025 was a bloodbath for US-India relations. The Trump administration, armed with the newly minted “Reciprocal Trade Act of 2025,” had slapped effective tariffs of nearly 50% on Indian exports. The logic was blunt: “You tax our Harley Davidsons, we tax your textiles.”

The pain was visceral. In the textile hubs of Surat and Tiruppur, factories went dark. In the tech corridors of Bangalore, hiring froze as visa uncertainties mounted. On the American side, farmers in the Midwest watched their soybean exports to India rot on the docks, victims of retaliatory barriers.

Then came the “Truce.”

In his public statement, President Trump claimed India had agreed to purchase $500 billion in American energy and defense goods, slash tariffs to zero, and end Russian oil imports.

The Indian readout? Silence on the $500 billion. Silence on Russia. Just a quiet, relieved confirmation that US tariffs will drop to a “reciprocal” 18%.

We are staring at a massive, deliberate gap in reality. This gap isn’t a mistake; it’s the strategy. Trump gets to sell a “total victory” to his base: “Look, I broke them! They’re paying billions!”… while Modi gets to sell “sovereign protection” to his: Look, I saved our industries without signing a single piece of paper!”

It’s brilliant political theatre. But for the factory owner in Gujarat or the soybean farmer in Iowa, it is a nightmare.

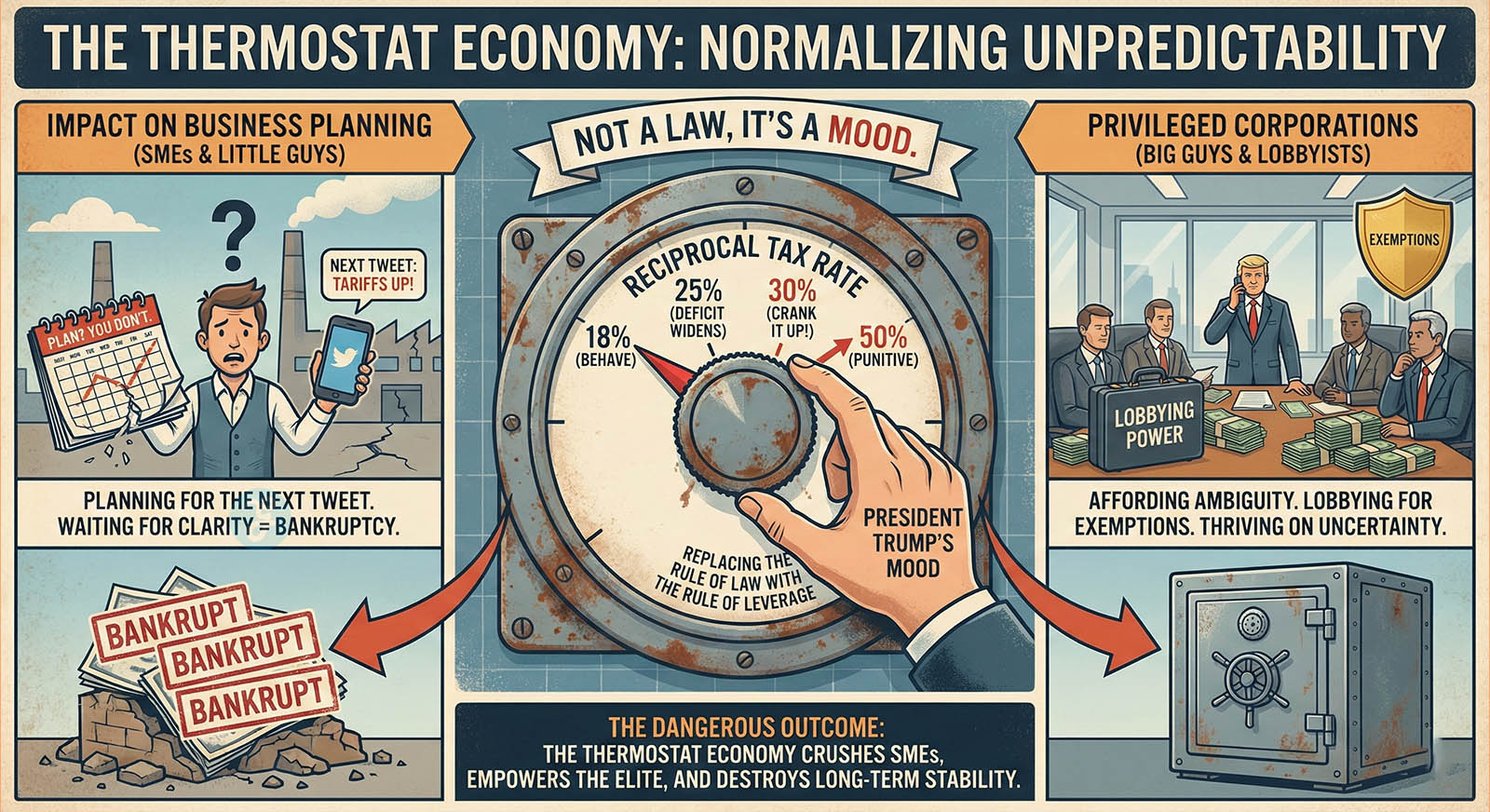

The “Thermostat” Economy

The most dangerous outcome of this truce is the normalization of the “Reciprocal Tax.” Unlike a standard tariff, which is fixed by treaty and predictable, this new 18% rate is a thermostat. It’s not a law; it’s a mood.

President Trump has made it clear: if India “behaves,” the rate stays at 18%. If the trade deficit widens, he cranks the dial back up to 25% or 30%.

Think about what that does to human behaviour. If you are a business owner, how do you plan for the next five years? You don’t. You plan for the next tweet.

We have replaced the rule of law with the rule of leverage. This “thermostat” approach privileges massive corporations that have the lobbying power to get exemptions, while crushing the Small and Medium Enterprises (SMEs) that drive the actual economy. The big guys can afford the ambiguity; the little guys go bankrupt waiting for clarity.

The Winners and Losers of Ambiguity

Let’s break down who actually benefits when two world leaders decide to handshake on a lie rather than sign a law.

The Asymmetry of the Truce

| Metric | The “Big Deal” Winner | The “Real Economy” Loser |

| Certainty & Planning | Political Incumbents: Both leaders get an immediate “win” cycle without the messy scrutiny of legislative ratification. | SMEs & Exporters: Facing “Policy Whiplash.” A Surat textile mill cannot invest in new machinery if tariffs might jump back to 50% next quarter based on a diplomatic mood swing. |

| Market Access | Energy Giants (US/India): The ambiguity favours massive, state-directed deals (LNG, Defense) negotiated privately by envoys. | Digital & Service Workers: The freelance coder in Bangalore or the remote consultant in Ohio gets zero protection. There is no framework for digital tax or visa security in a “handshake.” |

| Pricing Power | US Consumers (Short Term): Prices on Indian generics and apparel stabilize temporarily as the 50% tariff vanishes. | Indian Middle Class: The implicit promise to buy American oil means India is swapping cheap Russian crude for expensive US LNG, likely driving up domestic inflation. |

| Legal Recourse | Lobbyists: Disputes will be settled via back-channel calls between the White House and the PMO, bypassing the WTO. | Labor Unions/Farmers: If the US reimposes tariffs, Indian unions have no legal text to appeal to. If India dumps steel, US workers have no enforcement mechanism, only executive whim. |

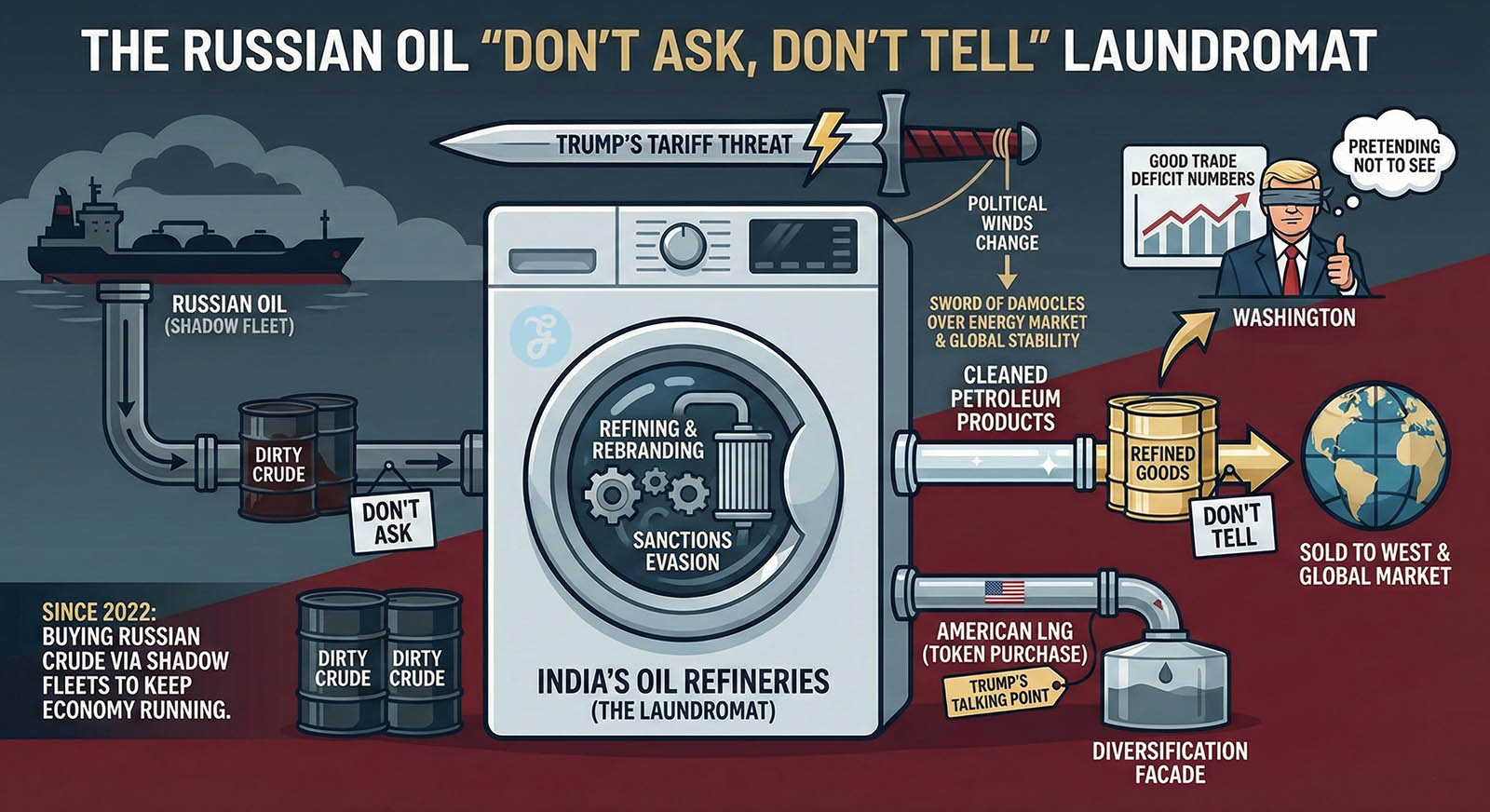

The Russian Oil “Don’t Ask, Don’t Tell”

The most cynical component of this arrangement is the energy question. Trump claims India is “defunding Russia.” This is verifiable nonsense, and everyone in Washington knows it.

Since 2022, India has been the laundromat for Russian oil, refining it and selling it to the West. This kept global oil prices stable (preventing a US recession) while technically adhering to sanctions.

The new “agreement” doesn’t stop this; it just rebrands it. Indian officials are privately instructing refiners to “diversify”, meaning, buy just enough American LNG to give Trump a talking point, while continuing to buy Russian crude through shadow fleets to keep the domestic economy running.

It is a policy of “Don’t Ask, Don’t Tell.” As long as the US trade deficit numbers look good, Washington will pretend not to see the tankers docking in Jamnagar. But if the political winds change, Trump can suddenly “discover” this violation and slam the tariffs back on. It is a sword of Damocles hanging over the entire energy market.

The Counter-Punch: “Isn’t Any Deal Better Than War?”

The “Realists” are already making their voices heard. “Get off your high horse,” they argue. “The alternative was a 50% tariff war that would have caused a recession in both countries. Ambiguity is the grease of diplomacy. This truce bought stability. It stopped the bleeding. Isn’t that enough?”

Pragmatism deserves respect. In the short term, a bandage is indeed better than an open wound. For an Indian exporter facing bankruptcy last week, today is a day for cheering.

But the Realist argument fails in 2026 for one primary reason: Ambiguity is not stability. It is deferred volatility.

By refusing to sign a binding text, the two nations haven’t created peace; they’ve created a hostage situation. Every month, India must “prove” its loyalty to keep the tariffs at 18%. Every month, the US must “threaten” nicely to keep the orders flowing.

This is unsustainable. A 21st-century supply chain cannot be built on the foundation of a 19th-century feudal oath. The moment the “trust” erodes, perhaps over a visa dispute, a geopolitical vote at the UN, or a tweet, the economic fallout will be faster and more severe than if both sides had simply stuck to standard WTO rules.

The world is trading a recession today for a depression tomorrow.

The Cost of Living in the Grey Zone

If we continue down this path, where “deals” are just press releases, the cost will be measured not just in dollars, but in institutional decay.

The High Cost of the “Handshake Era” (2026-2030)

| Area of Impact | Scenario A: The Current “Ambiguity” Path | Scenario B: The “Binding Treaty” Alternative |

| Investment Flows | Volatile Hot Money: Investors will favour short-term, liquid assets. No one builds a Gigafactory in a country whose market access depends on a phone call. | Deep Capital Expenditure: Companies commit to 20-year infrastructure projects, knowing dispute resolution mechanisms exist independent of the President. |

| Geopolitical Alignment | Transactional Loyalty: India remains a “swing state,” siding with the US only when the tariff gun is to its head, and pivoting to BRICS whenever the pressure eases. | Strategic Integration: A formal FTA would lock India’s economy into the West’s legal architecture, making a pivot to China/Russia legally and structurally impossible. |

| Inflation Impact | Structural Inflation: Supply chains remain inefficient and redundant as companies “hedge” against tariff spikes, passing those costs to consumers. | Efficiency Deflation: Streamlined supply chains and predictable duties lower the cost of goods for working-class families in both nations. |

| Moral Hazard | High: Other nations (Japan, UK) see that “flattery and fake promises” work better than following rules, leading to a breakdown of the global trading order. | Low: Reaffirms that verifiable commitments are the price of entry to the US market, strengthening the rule of law globally. |

The Roadmap: From Handshake to Ink

We cannot stay here. The sugar high of the February 2nd announcement will fade. When the Q2 trade data comes out and the deficit hasn’t moved, the anger will return.

Here is what needs to happen to turn this fragile truce into a durable peace:

- Codify the Tariff Floor: The US Congress and Indian Parliament must ratify the 18% rate. Take the thermostat out of the President’s hands. Make it law.

- The “Energy Verification” Compact: Instead of vague bans, set a hard cap on Russian energy imports (e.g., <20% of total basket) and create a joint US-India monitoring body. Transparency kills the leverage game.

- The Services Trade-Off: The US wants market access for goods; India wants protection for its workers. A formal deal should swap lower agricultural tariffs (US win) for a guaranteed H-1B/L-1 visa quota (India win). This aligns the actual economic strengths of both nations.

Fact Sheet: The 2026 Reality Check

- The “Reciprocal” Rate: 18% (The new effective tariff on Indian goods entering the US, down from the punitive 50%).

- The “Phantom” Number: $500 Billion (The claimed value of US exports India will buy; current actual US exports to India are <$100 Billion).

- The Oil Spread: India currently imports ~40% of its crude from Russia. Trump demands 0%. The likely reality: ~30%.

- The Legislative Tool: The “Reciprocal Trade Act of 2025” allows the US President to adjust tariffs without Congressional approval, the core enabler of this ambiguity.

The Final Calculation

We are witnessing a grand experiment. Can two of the world’s largest democracies run their relationship on “vibes”?

My prediction: No. The “Handshake Economy” works until the first crisis. When the next recession hits, or the next geopolitical flare-up occurs, we will look for the contract, and we will find only a blank page.

President Trump and Prime Minister Modi have bought themselves time. But time is a loan, not a gift. And the interest rate on ambiguity is always higher than you think.

The question isn’t whether this deal will break. Who will be left holding the bag when it does?