Long-term growth is mostly about staying diversified, keeping costs low, and staying invested when markets get noisy. The right ETFs make that easier by giving you broad exposure (U.S. + international), with optional “tilts” (growth, quality, small-cap, dividend growth) to match how aggressive you want to be.

How We Picked Our 15 Best ETFs for Long-Term Growth

What we prioritized:

-

Broad diversification (core building blocks first, “tilts” second)

-

Low ongoing costs (expense ratios matter over decades)

-

Index-based approach for consistent exposure and transparency

-

Liquidity and fund scale (generally easier trading, tighter spreads)

What we avoided:

-

Ultra-narrow thematic ETFs that can boom/bust

-

Leveraged/inverse products (not built for long-term holding)

Comparison Table

| ETF (Ticker) | Category | Best For | Core Exposure | Key Risk |

|---|---|---|---|---|

| VTI / SCHB / ITOT | U.S. Total Market | One-fund U.S. core | U.S. large+mid+small | U.S.-only concentration |

| VOO / IVV | S&P 500 | Simple U.S. large-cap core | 500 large U.S. stocks | Less small/mid exposure |

| VT | Global All-World | One-fund global | U.S. + international | Global equity drawdowns |

| VXUS / VEA / VWO | International | Diversify beyond U.S. | Developed + emerging options | FX + country risk |

| VUG / SCHG / QQQM / IWF | Growth tilt | More growth-style exposure | Large-cap growth focus | Tech concentration/volatility |

| QUAL | Quality tilt | “Higher quality” U.S. mix | Profitability/low leverage tilt | Still equity drawdowns |

| IJR | Small-cap | Small-cap long horizon | U.S. small-cap index | Higher volatility |

| VIG / DGRO | Dividend growth | Quality + growth blend | Dividend growers | Can lag in high-growth rallies |

Portfolio Blueprints Using These ETFs

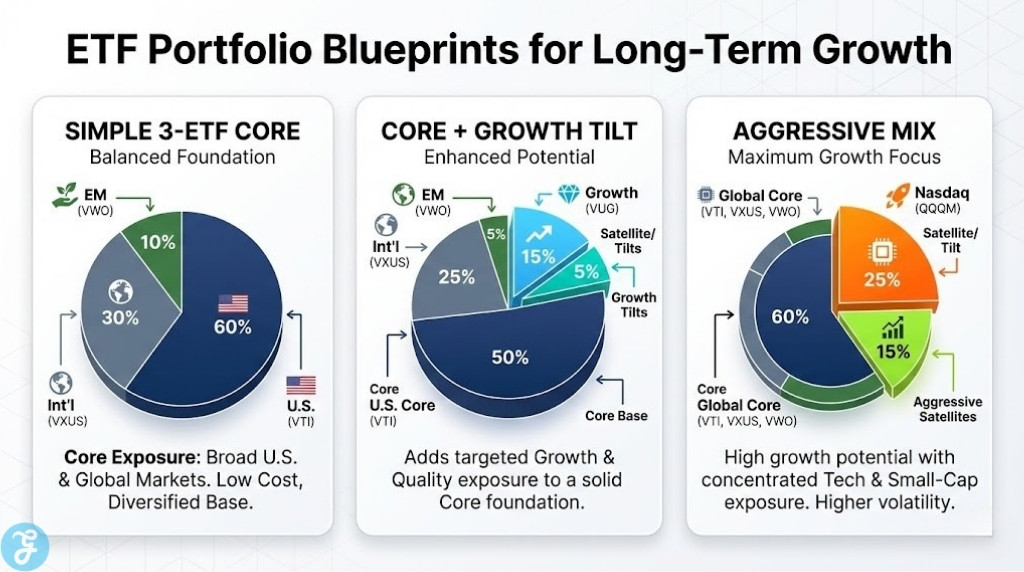

Simple 3-ETF Core:

| Goal | Example Allocation | ETFs |

|---|---|---|

| Balanced long-term | 60% U.S. / 30% international / 10% EM | VTI + VXUS + VWO |

Core + Growth Tilt (5 ETFs)

-

50% U.S. total market (VTI)

-

25% International (VXUS)

-

15% U.S. growth (VUG or SCHG)

-

5% Emerging markets (VWO)

-

5% Quality (QUAL)

Aggressive Growth Mix (7 ETFs)

Add small-cap and a Nasdaq tilt (IJR + QQQM), but keep an eye on overlap.

15 Best ETFs (Exchange-Traded Funds) for Long-Term Growth

Here are the 15 Best ETFs for Long-Term Growth picks to build a diversified, long-term portfolio.

1) Vanguard Total Stock Market ETF (VTI)

A classic “own the whole U.S. market” ETF, covering large-, mid-, small-, and micro-cap stocks in one fund. It’s a clean core holding if you want broad U.S. growth with very low ongoing costs.

-

Best For: A one-fund U.S. core

-

Pros: Extremely diversified; low expense ratio

-

Cons: U.S.-only exposure unless paired with international

2) Schwab U.S. Broad Market ETF (SCHB)

A low-cost, broad U.S. market ETF that plays a similar “core U.S.” role to VTI. Great if you’re building around Schwab’s lineup and want a simple foundation.

-

Best For: Low-cost U.S. core (Schwab ecosystem)

-

Pros: Broad exposure; low net expense ratio

-

Cons: Overlaps heavily with any other U.S. core ETF you own

3) iShares Core S&P Total U.S. Stock Market ETF (ITOT)

Another “buy the entire U.S. market” core option, designed for long-term growth at the center of a portfolio. It’s a strong alternative if you prefer iShares’ lineup.

-

Best For: iShares-style total U.S. market core

-

Pros: Broad U.S. coverage; simple core building block

-

Cons: Similar exposure to VTI/SCHB (choose one core)

4) Vanguard S&P 500 ETF (VOO)

A straightforward way to own large U.S. leaders through the S&P 500, often used as a long-term “set-and-hold” core. It’s less broad than total-market ETFs but extremely simple.

-

Best For: Minimalist U.S. large-cap core

-

Pros: Simple; low-cost and widely used

-

Cons: Less small/mid-cap exposure than total-market funds

5) iShares Core S&P 500 ETF (IVV)

A low-cost S&P 500 core alternative with the same “large-cap U.S. foundation” role as VOO. If you want S&P 500 exposure, this is one of the cleanest long-term options.

-

Best For: S&P 500 core at low cost

-

Pros: Low fee and strong liquidity for many investors

-

Cons: Same S&P 500 limits: less small-cap diversification

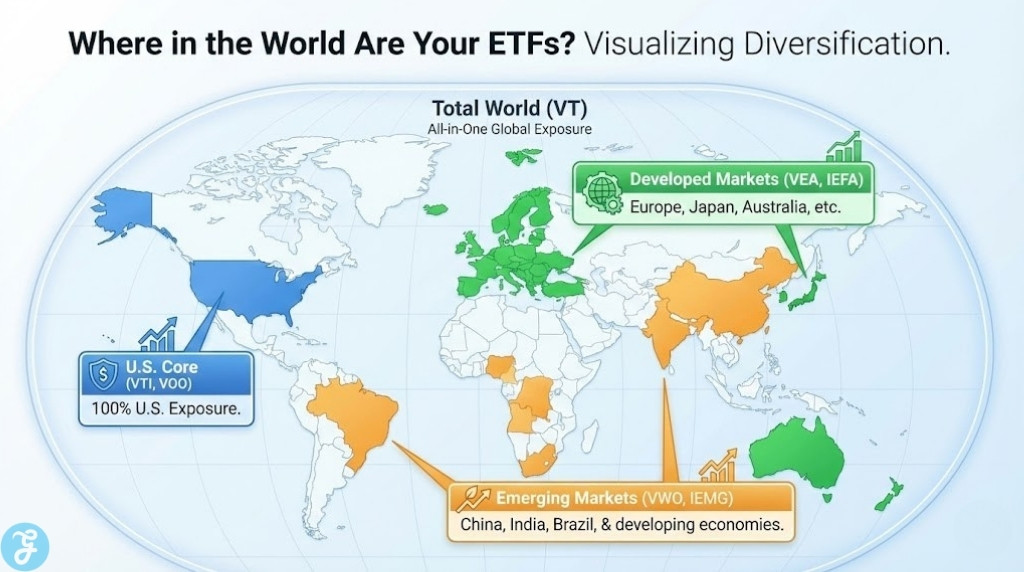

6) Vanguard Total World Stock ETF (VT)

A true one-fund global equity approach, holding both U.S. and international stocks in a single ETF. Great if you want global diversification without managing multiple allocations.

-

Best For: One-fund global “own the world” approach

-

Pros: Global diversification in one holding

-

Cons: You lose control over U.S. vs international weighting

7) Vanguard Total International Stock ETF (VXUS)

A broad international ETF that covers developed and emerging markets outside the U.S., making it a natural partner to a U.S. core ETF. This is the simplest “international sleeve” for long-term diversification.

-

Best For: Adding international diversification to a U.S. core

-

Pros: Broad ex-U.S. coverage

-

Cons: Currency and country risks can raise volatility vs U.S.-only

8) Vanguard FTSE Developed Markets ETF (VEA)

Targets developed markets outside the U.S. (think Europe and parts of Asia-Pacific), often used to diversify without taking as much emerging-market volatility. Useful if you want to separate developed and emerging allocations.

-

Best For: Developed international exposure (ex-U.S.)

-

Pros: Broad developed-market diversification

-

Cons: No emerging markets unless paired with an EM ETF

9) Vanguard FTSE Emerging Markets ETF (VWO)

An emerging markets ETF meant to add long-term growth potential through faster-growing regions, with higher ups and downs. Best used as a smaller slice alongside developed markets and a U.S. core.

-

Best For: A controlled EM allocation for long horizons

-

Pros: Adds EM diversification and growth exposure

-

Cons: Higher volatility; geopolitical and currency risk

10) iShares Core MSCI EAFE ETF (IEFA)

A developed-markets ex-U.S. ETF (excluding the U.S. and Canada), commonly used as a core international developed holding. It’s a clean way to diversify globally while keeping EM separate.

-

Best For: Developed international core (iShares ecosystem)

-

Pros: Broad developed-market coverage

-

Cons: Needs EM pairing if you want emerging exposure

11) iShares Core MSCI Emerging Markets ETF (IEMG)

A broad emerging markets ETF used to diversify beyond developed markets, with the typical EM risk profile. It pairs naturally with an EAFE-style developed ETF for a two-part international sleeve.

-

Best For: Emerging markets allocation in an iShares lineup

-

Pros: Broad EM coverage

-

Cons: Volatility can be sharp during global risk-off cycles

12) Vanguard Growth ETF (VUG)

A large-cap U.S. growth ETF designed for investors who want a deliberate growth tilt on top of a core market holding. It can boost growth exposure but tends to increase tech and mega-cap concentration.

-

Best For: Growth tilt alongside a broad core

-

Pros: Straightforward large-cap growth exposure

-

Cons: Can overlap heavily with S&P 500 and Nasdaq-heavy ETFs

13) Schwab U.S. Large-Cap Growth ETF (SCHG)

Another large-cap growth tilt option with a low net expense ratio, often used as a “growth satellite” around a total-market core. Strong for long-term holders who want growth style exposure without going fully thematic ETFs.

-

Best For: Low-cost growth tilt (Schwab)

-

Pros: Growth exposure; low net expense ratio

-

Cons: Concentration risk (growth can swing more in rate shocks)

14) Invesco NASDAQ 100 ETF (QQQM)

A Nasdaq-100 ETF often used as a higher-octane growth tilt, typically more concentrated in mega-cap tech and tech-adjacent names. It can work as a smaller satellite position in an aggressive long-term growth mix.

-

Best For: Aggressive growth tilt with a tech-heavy bias

-

Pros: Strong growth-style exposure; clear index design

-

Cons: Higher concentration; can be more volatile than broad market

15) iShares MSCI USA Quality Factor ETF (QUAL)

A “quality” tilt ETF focusing on companies with quality characteristics (commonly profitability and balance-sheet strength), used to improve portfolio resilience without leaving equities. It’s a smart complement if you want a growth portfolio that’s not purely momentum/tech-driven.

-

Best For: Quality tilt to balance a growth-heavy core

-

Pros: Adds a quality screen and can reduce “junk risk”

-

Cons: Still equity exposure; factor tilts can lag in certain cycles

How to Choose the Right Long-Term Growth ETFs

Quick checklist

-

Start with a core: total U.S. (VTI/ITOT/SCHB) or S&P 500 (VOO/IVV)

-

Add international on purpose: VXUS for “all ex-U.S.”, or VEA + VWO to separate developed vs EM

-

Watch overlap: owning VOO + VUG + QQQM can stack the same mega-caps repeatedly

-

Keep tilts smaller: growth/quality/small-cap usually work best as satellites

Small decision table

| If you want… | Consider… |

|---|---|

| One-fund simplicity | VT |

| U.S.-only core | VTI or VOO (pick one style) |

| U.S. + international classic | VTI + VXUS |

| Extra growth tilt | Add SCHG or VUG or QQQM (small slice) |

| More “durability” in equities | Add QUAL |

Risk Notes and Practical Tips

What to expect with growth ETFs:

-

Growth-heavy ETFs can be more sensitive to interest rate changes

-

Concentrated indexes can have bigger drawdowns

-

Diversification across U.S. + international can help smooth the ride

Simple rebalancing habits:

-

Monthly contributions: buy whatever is under target

-

Quarterly check: rebalance if allocations drift a lot

-

Yearly reset: keep it boring and consistent

Ending Thoughts

The “best” long-term growth ETFs are the ones you can hold through boring months and brutal drawdowns without constantly changing the plan. Build a sturdy core first, add international exposure so your future isn’t tied to one country, and only then add small tilts like growth or quality if they match your temperament. Over decades, consistency and cost control tend to matter more than chasing whatever is hottest this year.