Play-to-Own (P2O) is the evolved economic model of blockchain gaming that prioritizes asset custody, utility, and market-driven value over guaranteed token yield. Unlike its predecessor, which promised a “wage” for clicking buttons, P2O focuses on granting players true property rights over the digital items they earn—swords, skins, land, and crafting stations—allowing them to trade, sell, or leverage these assets across an open economy without the expectation of a fixed daily income.

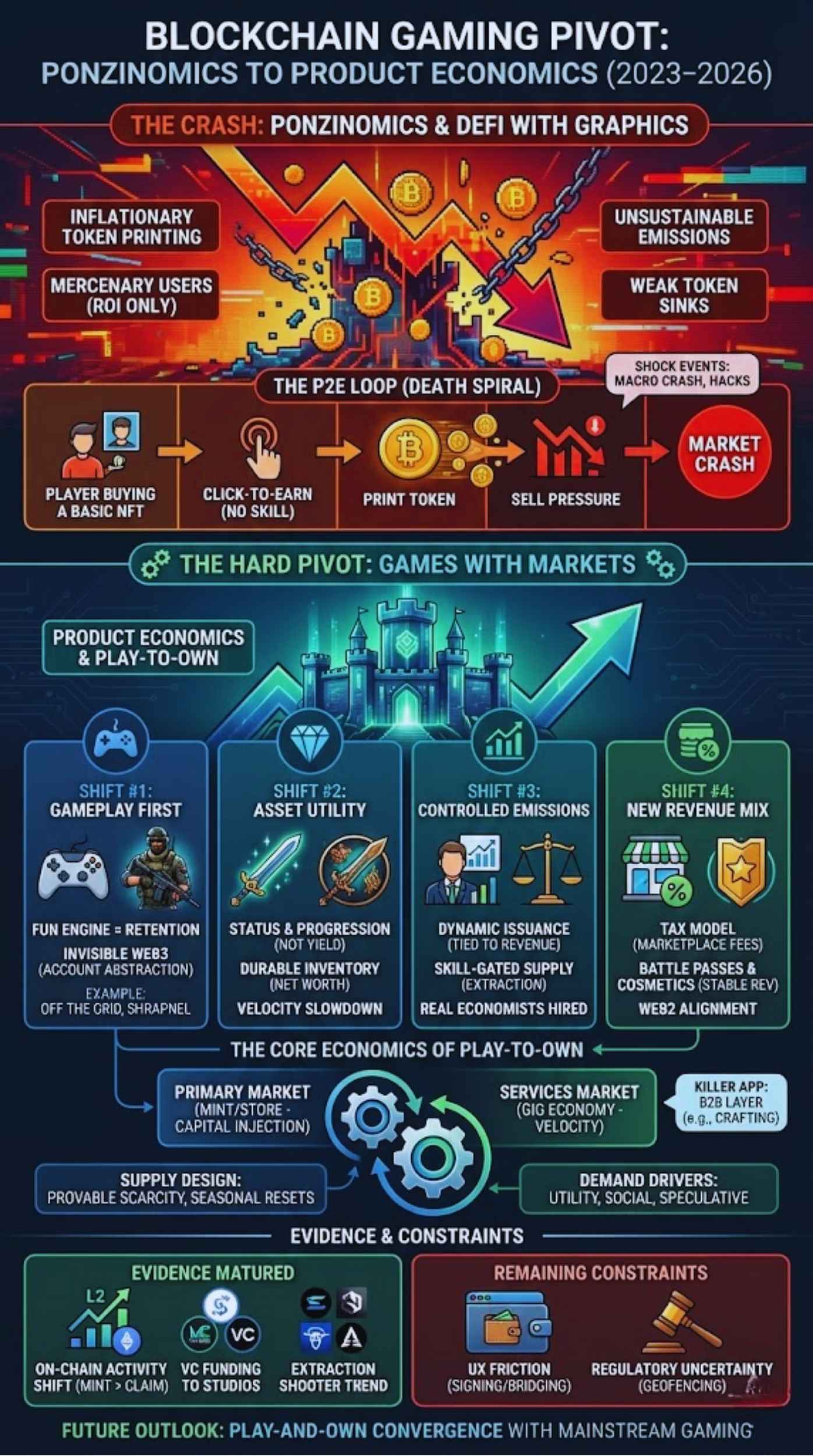

The crash of the earlier Play-to-Earn (P2E) model was an economic inevitability, not just a bursting hype bubble. It failed because of hyper-inflationary tokenomics where supply (rewards issued) perpetually outpaced demand (sinks and utility). Games like Axie Infinity in 2021 functioned on a reflexivity loop: players bought assets solely to farm tokens to sell to new players. When user growth slowed, the demand for “entry assets” collapsed, causing a death spiral in token prices and rendering the “wage” worthless.

The industry’s pivot to P2O represents a fundamental shift from extraction to retention. In 2024–2026, successful studios like Gunzilla Games (Off The Grid) and Big Time Studios transformed the landscape by treating blockchain as an invisible backend for inventory management rather than a speculative casino. This “ownership-first” approach emphasizes fun gameplay as the primary demand driver, enforces strict emissions discipline to prevent inflation, and builds “service economies” where players earn by providing value (crafting, curing, renting) to other players, rather than extracting value from a developer’s reward pool.

What “Play-to-Own” Actually Means

To understand the future of gaming economies, we must first decouple the concept of “ownership” from “income.” The nuance lies in the asset’s role within the ecosystem.

Ownership vs. Rewards

In the P2E era, the primary asset was the yield-bearing token (e.g., SLP). In P2O, the primary asset is the durable good (e.g., a Level 50 Sword).

- Asset Custody and Transferability: P2O means the database of items is decentralized. If you grind for 100 hours to earn a rare sniper rifle in an extraction shooter like Shrapnel, that rifle sits in your wallet, not on a company server. You can sell it on a secondary marketplace, lend it to a friend, or use it as collateral in DeFi protocols, independent of the developer’s permission.

- NFTs as Durable Inventory, Not Paychecks: In P2O, NFTs are treated like physical inventory. A carpenter owns their tools and the chairs they build; they do not get paid merely for existing in the workshop. Similarly, P2O players own their digital inventory. Its value is determined by market demand for that specific item’s utility, not by a protocol emitting a daily salary.

- Why “Owning” is Not “Earning”: Owning a rare Magic: The Gathering card is “Play-to-Own.” You have an asset that might appreciate, but you don’t receive a weekly dividend check from Wizards of the Coast for holding it. P2O replicates this: it offers the option of liquidity, not the promise of cash flow.

The P2O Promise

The core promise of Play-to-Own is alignment.

- Long-Lived Assets: Items are designed to have multi-season or even multi-game utility.

- Optional Monetization: Players who just want fun can ignore the economy; “mercenary” players can focus on trading. The two groups coexist without the former resenting the latter.

- Less Reflexive Sell Pressure: Because rewards are often non-fungible (unique items) rather than fungible (liquid tokens), there is no single “sell button” that crashes the entire economy. A price drop in “Common Swords” does not necessarily crash the price of “Rare Shields.”

The Play-to-Earn Crash Through An Economics Lens

The 2021-2022 collapse of P2E was a classic case of hyperinflationary monetary failure. To prevent history from repeating, we must diagnose the specific economic mechanics that broke.

Inflation and Sell Pressure

In early P2E games, the core loop was: Buy Asset → Play → Print Token.

The “Play” part often required zero skill, meaning the token was essentially a participation trophy.

- Emissions as “Printing”: Every time a player won a match and earned tokens, the game was effectively “printing money.” Without a corresponding increase in GDP (real value created in the game ecosystem), this increased the money supply.

- The Wage-Like Dynamic: Because the marketing pitch was “earn a living,” players treated the game as a job. A worker doesn’t reinvest their salary into their company; they cash it out to buy groceries. This created massive, structural sell pressure. Every day, millions of dollars in tokens were dumped on the market, requiring millions of dollars of new player capital to absorb it. When new players stopped joining, the bid side of the order book vanished.

Weak or Missing Token Sinks

A “sink” is a mechanism that removes tokens from circulation.

- Sinks Must Scale: In many P2E games, the sinks (e.g., breeding fees) were linear, but the emissions were exponential (as the player base grew).

- The Breeding Fallacy: The primary sink in games like Axie Infinity was “breeding” new characters. This burned tokens, which looked good on paper. However, it created more assets (Axies) that then needed to be played to earn more tokens. It was a sink that created future inflation liabilities. When the market for new characters cooled, the sink turned off completely, but the emissions (from existing characters) continued, accelerating the crash.

Mercenary Users and Reflexive Economies

P2E attracted “mercenaries”—users present solely for ROI.

- Low “Fun Retention”: If the yield dropped below a certain threshold (e.g., minimum wage in the Philippines), mercenaries left instantly.

- The Death Spiral: As mercenaries sold assets to exit, asset prices dropped. This lowered the potential ROI for remaining players, causing them to sell, creating a reflexive loop. A sustainable economy needs “tourists” (spenders) and “citizens” (believers), not just day-traders.

Shock Events That Accelerated The Unwind

The structural weakness was exposed by macro shocks:

- The Crypto Macro Crash: As Bitcoin and Ethereum fell in 2022, liquidity dried up across the board.

- The Ronin Bridge Hack: The $600M hack of the Axie network destroyed confidence, proving that even “blue chip” P2E ecosystems had catastrophic tail risks.

How Blockchain Gaming Pivoted: From Ponzinomics To Product Economics

Post-crash, the survivors and new entrants (2023–2026) initiated a hard pivot. The industry stopped trying to be “DeFi with graphics” and started building “Games with markets.”

Shift #1: Gameplay First, Economy Second

This is the most cited yet most critical shift. Games like Off The Grid (Gunzilla Games) and Shrapnel focused on building AAA-quality shooters first.

- Fun as the Engine: Retention must come from dopamine, not dollars. If a player stays for the gameplay, they become a net spender (buying skins, battle passes), which funds the economy for the earners.

- Invisible Web3: The most successful P2O games now hide the blockchain. Wallets are created automatically in the background (using account abstraction); players might not even know they are using NFTs until they decide to sell an item.

Shift #2: Asset Utility Over Token Yield

The focus moved from earning tokens ($) to earning stuff (Swords/Skins).

- Status and Progression: Items are tied to status (skins) or power (weapons). A player grinds to get the “Gold Sniper” because it looks cool or shoots better, not because it pays 50 cents a day.

- Durable Inventory: Instead of a daily paycheck, players build a “net worth” of inventory. This slows down the velocity of money; players are happier holding a cool sword for 3 months than holding a volatile token for 3 days.

Shift #3: Controlled Emissions and Better Monetary Policy

Studios now hire actual economists (often from traditional finance or MMO backgrounds like EVE Online).

- Dynamic Issuance: Rewards are now often tied to the revenue of the game. If the game makes $1M in fees this month, the reward pool is $500k. If revenue drops, rewards drop. This prevents the “printing money from thin air” problem.

- Skill-Gated Supply: In extraction shooters, you only keep the loot if you survive. This acts as a natural sink—bad players lose assets, reducing the total supply and maintaining scarcity for good players.

Shift #4: New Revenue Mix

Sustainable P2O economics look remarkably like Web2 economics, but with a twist.

- The “Tax” Model: Instead of selling $100M of NFTs upfront (a cash grab), studios monetize via marketplace fees. They take a 5% cut of every trade between players. This aligns incentives: the studio only makes money if the players are actively trading and enjoying the economy.

- Battle Passes & Cosmetics: Primary sales of non-power items (skins) provide stable revenue to fund server costs and development, reducing the need to sell power-imbalancing items.

The Core Economics Of Play-to-Own

A healthy P2O economy functions like a small nation-state. It comprises three distinct market layers.

The Three Markets in P2O

| Market Layer | Description | Economic Function |

| Primary Market | The “Mint” or Store. Players buy assets from the developer. | Capital Injection: This is how new money enters the ecosystem (GDP growth). |

| Secondary Market | The P2P Bazaar. Players trade used items with each other. | Price Discovery & Liquidity: Allows players to exit or specialize. Studios earn royalties here. |

| Services Market | The “Gig Economy.” Players pay other players for actions. | Velocity of Money: E.g., A player with a “Blacksmith” NFT charges a fee to repair another player’s sword. |

Note: The Services Market is the “killer app” of P2O. In Big Time, for example, players own “Space” and “Forges.” They don’t just find items; they refine raw materials for other players. This creates a B2B (Business to Business) layer inside the game, where “suppliers” and “fighters” trade value.

Supply Design

- Scarcity Models: P2O games use “Provable Scarcity.” There might only be 1,000 “Genesis Swords.” Once they are minted, no more can be created. This creates a collector’s market.

- Seasonal Supply: To prevent old items from becoming useless (power creep) or too dominant, games use seasonal resets or “durability” mechanics where items break over time, necessitating constant crafting (demand for resources).

Demand Drivers

Why do people buy P2O assets?

- Utility Demand (Gameplay): “I need this gun to win.” (The healthiest form of demand).

- Social Demand (Status): “I want this skin to flex.” (High margin, zero inflation risk).

- Speculative Demand: “I think this will be worth more later.” (Dangerous if it’s the only driver, but helpful for liquidity).

Liquidity and Price Discovery

- Thin Liquidity Risks: In traditional markets, market makers ensure you can always sell. In NFT markets, liquidity is “thin.” If you have a rare item, you might not find a buyer for weeks.

- Reducing Death Spirals: Studios now use “Soft Currencies” (off-chain gold) for low-value trades to keep liquidity high, reserving the blockchain for high-value transactions. This prevents the “gas fee” friction from killing the economy.

Player Value, Not Player Extraction

The ethos has shifted from “How much can we extract from this user?” to “How much value can this user build?”

- Retention Loops: The economy is designed to keep you in the ecosystem. Selling an asset should be a difficult choice because the utility of holding it is high.

- Fairness: P2O games must fight “Pay-to-Win” accusations. The best implementations use “Pay-to-Progress” (save time) or “Pay-to-Look-Cool,” ensuring that skill remains the deciding factor in competitive play.

Evidence The Market Matured (And What Still Hasn’t Been Solved)

The 2024–2026 period has provided concrete data that the pivot is working for select projects.

Adoption Signals

- On-Chain Activity: We are seeing a divergence. While “wallet count” on old P2E chains stagnated, activity on gaming-specific L2s (like Ronin, Immutable zkEVM, and Avalanche Subnets) has hit new highs. However, the type of transaction has changed: fewer “claim token” transactions, more “mint/craft item” transactions.

- The “Extraction Shooter” Trend: Games like Off The Grid and Shrapnel have utilized the “extraction” genre perfectly for P2O. The high-stakes nature of “die and lose your loot” makes asset ownership emotionally resonant. Off The Grid garnered significant mainstream attention (including streamer partnerships) by pitching the gameplay intensity rather than the token price.

Funding and Studio Behavior

- Capital Allocation: VCs (like a16z crypto, Griffin Gaming Partners) shifted funding in 2024/2025 away from “GameFi” protocols toward “studio-grade” teams with veterans from Ubisoft, EA, and Activision.

- Studio Reports: Reports from 2025 highlight that studios are voluntarily locking tokens for longer periods (3-5 years) to signal long-term commitment, a stark contrast to the “pump and dump” vesting schedules of 2021.

Remaining Constraints

- UX Friction: Despite account abstraction, “signing” a transaction can still be buggy. Bridging assets between chains (e.g., Ethereum to a Layer 2) remains a terrifying experience for a non-crypto native.

- Regulatory Uncertainty: In the US and EU, the line between a “gaming item” and a “security” remains blurry. This forces many games to geofence features, excluding huge markets like the US from the “earning” aspects of the economy to avoid SEC wrath.

What A “Sustainable” P2O Economy Looks Like: A Checklist

If you are evaluating a P2O game or building one, this checklist separates the Ponzis from the Products.

The Sustainability Checklist

- Emissions Discipline: Does the game emit tokens based on a fixed schedule (bad) or based on actual revenue/player activity (good)?

- Sinks Proportional to Growth: Do the sinks (repair costs, crafting fees) scale up as the player base gets stronger/richer?

- Utility-Driven Demand: Can you play the game without caring about the token price? (If the answer is no, it’s a financial product, not a game).

- Anti-Bot Measures: Is there a “Proof of Humanity” or skill-gate? (Bots extract value without adding fun; they must be ruthlessly eliminated).

- Services Economy: Can players earn by helping other players (curing, crafting, transporting)? This creates internal GDP.

- Healthy Marketplace Design: Does the studio take a fee? (This aligns them with volume). Are there royalties for creators?

- Clear Risk Disclosures: Does the game admit that assets can go to zero?

- Separation of Church and State: Is the “Governance Token” (equity) separate from the “In-Game Currency” (utility)? Merging them usually leads to volatility.

Future Outlook: Where Play-to-Own Goes Next

“Play-and-Own” vs. “Play-to-Own”

Semantics matter. The industry is increasingly adopting the term “Play-and-Own” to subtly deemphasize the intent of playing. “Play-to-Own” implies a job; “Play-and-Own” implies a perk. This psychological shift is crucial for onboarding the 3 billion traditional gamers who despise the idea of the “financialization of fun.”

Convergence with Mainstream Monetization

We are heading toward a hybrid model.

- Free-to-Play (F2P) frontend: Anyone can download and play for free, using “soulbound” (untradeable) items.

- P2O backend: Once a player reaches a high level or buys a “Pro Pass,” their assets are “minted” onto the blockchain and become tradeable.

- The “Steam Market” on Steroids: The endgame is an open, interoperable version of the Steam Community Market, where your Counter-Strike skin isn’t locked to Valve’s platform but is yours to sell on eBay, swap for a Sword in another game, or lend out for yield.

Final Thoughts

The crash of Play-to-Earn was a painful but necessary forest fire that cleared out the brush of unsustainable “Ponzinomics.” What has emerged from the ashes in the Play-to-Own era is a more robust, honest, and complex economic model. It is no longer about “easy money”; it is about digital sovereignty.

By shifting focus from yield to utility, and from extraction to ownership, blockchain gaming has finally found a product-market fit that can survive a bear market. The games of 2026 won’t ask you to quit your job to play them. Instead, they will offer you a simple, powerful proposition: If you spend 1,000 hours in our world, you get to keep what you find. That is a value proposition that doesn’t need a bull market to sell.