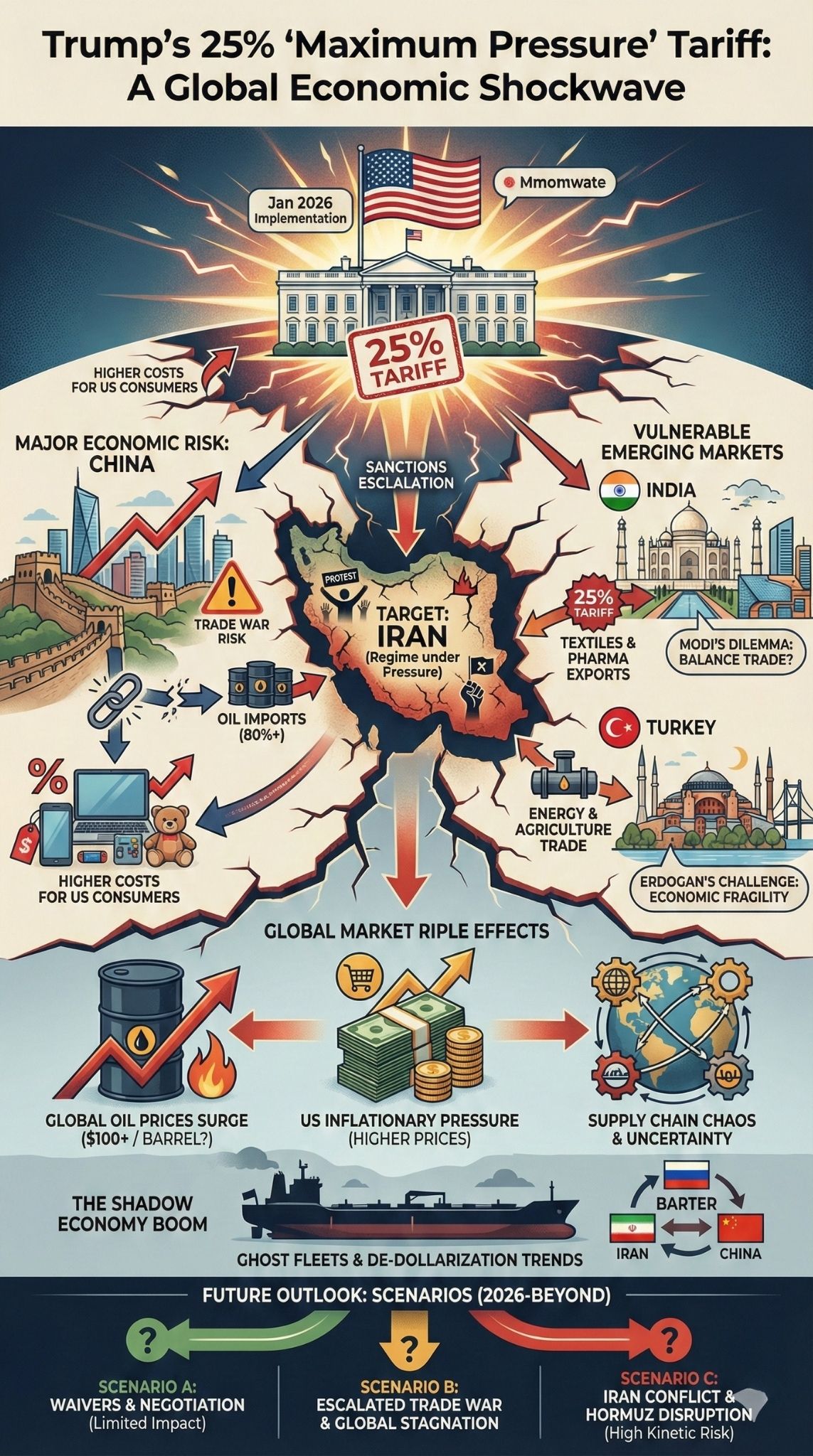

Why This Matters Now In a dramatic escalation of his “Maximum Pressure” 2.0 strategy, President Donald Trump has effectively weaponized the U.S. economy against dozens of nations simultaneously.

By announcing a blanket 25% tariff on any country trading with Iran as of January 2026, Washington is no longer just sanctioning Tehran—it is issuing a “with us or against us” ultimatum to the global economy. This move threatens to shatter the fragile U.S.-China trade truce, disrupt global oil markets, and force major emerging economies like India and Turkey into an impossible diplomatic corner during a time of heightened global volatility.

How We Got Here: The Context of Escalation

The path to this moment has been paved by a confluence of internal Iranian turmoil and renewed American hawkishness.4 Throughout late 2025, Iran witnessed its most significant anti-government protests in decades, triggered by economic collapse and hyperinflation.5 The Trump administration, sensing an opportunity to deliver a knockout blow to the clerical establishment in Tehran, has moved beyond standard sanctions.

Historically, U.S. sanctions targeted Iranian entities directly (primary sanctions) or foreign companies dealing with them (secondary sanctions). However, a blanket tariff on all goods from a trading partner—regardless of whether those specific goods are related to Iran—is an unprecedented expansion of economic statecraft.6 It signifies a shift from targeted scalpel strikes to a blunt force instrument, leveraging the immense size of the U.S. consumer market to strong-arm neutral nations.7 This comes just months after a tentative stabilization in U.S.-China relations, putting recent diplomatic gains at severe risk.

The Geopolitical Fallout and the “China Test”

The most immediate and dangerous friction point is Beijing. China remains Iran’s economic lifeline, purchasing over 80% of its oil exports.9 For years, Beijing has circumvented sanctions through “teapot” refineries and the “shadow fleet.” Trump’s new order removes the nuance: if China buys Iranian oil, all Chinese exports to the U.S. face a 25% hike.

This is a direct challenge to Chinese sovereignty and economic stability. It forces President Xi Jinping into a dilemma: abandon a strategic partner (Iran) and look weak domestically, or retaliate and spark a trade war that could derail China’s fragile economic recovery. Analysts suggest Beijing is unlikely to capitulate, potentially leading to a titanic clash that could bifurcate the global economy into distinct U.S. and anti-U.S. trading blocs.

Emerging Markets in the Crossfire (India & Turkey)

While China has the weight to fight back, emerging markets like India and Turkey are far more vulnerable.10

- India: New Delhi has historically balanced ties between Washington and Tehran. While it ceased oil imports to comply with previous sanctions, it maintains trade in tea, rice, and pharmaceuticals. A 25% tariff on Indian tech and textiles entering the U.S. would be catastrophic for Prime Minister Modi’s “Make in India” export goals.

- Turkey: Sharing a land border with Iran, Turkey relies on regional trade for energy and agriculture.11 Ankara’s economy, already battling inflation, cannot afford a 25% penalty on its exports to the U.S. This could push Turkey further away from NATO and towards the Eurasian sphere.

Energy Markets and Inflationary Blowback

The tariff threat is technically a “supply shock” for the global energy market. If the tariffs succeed in cutting off Iran’s remaining oil exports (roughly 1.5 million barrels per day, mostly to China), oil prices could surge past $100/barrel.12

Crucially, the tariffs themselves act as a tax on American consumers.13 If implemented against major partners like the EU, India, or Vietnam (who may have minor trade links with Iran), the cost of imported goods in the U.S.—from electronics to clothing—will rise. This creates a domestic political risk for Trump: fighting inflation was a key campaign promise, yet this policy is inherently inflationary.14

The Legal and Institutional Battle

Legal scholars question the authority Trump is using to enact such sweeping measures. Likely citing the International Emergency Economic Powers Act (IEEPA), the administration is stretching the definition of a “national emergency” to punish third-party nations.15 This sets the stage for a showdown at the Supreme Court, which is already reviewing the constitutionality of previous executive tariff actions.16 If the courts uphold this move, it grants the U.S. President nearly unchecked power to regulate global trade based on foreign policy grievances.

Data & Visualization: Assessing the Impact

The following tables breakdown the stakes for key players and the potential economic shifts.

Top Iranian Trading Partners & Potential Tariff Exposure (2025 Data) Data estimates based on World Bank and Kpler analytics.

| Country | Primary Imports from Iran | Est. Annual Trade Vol. (USD) | Key Exports to US at Risk | Geopolitical Stance |

| China | Crude Oil, Petrochemicals | $22.0 Billion+ | Electronics, Machinery, Toys | High Risk: Likely to retaliate; views tariffs as “long-arm jurisdiction.” |

| UAE | Re-exports, Agricultural Goods | $18.0 Billion | Aluminum, Logistics Services | Moderate: Strong US ally; may seek waivers or covertly reduce Iran trade. |

| Turkey | Natural Gas, Plastics | $6.0 Billion | Steel, Textiles, Auto Parts | High Risk: Economic fragility makes US tariffs devastating. |

| India | Chemicals, Dry Fruits | $1.5 – $2.0 Billion | Pharma, IT Services, Textiles | Moderate: Likely to negotiate; historically complies with US pressure. |

Winners vs. Losers Analysis

| Group | Impact Status | Analysis |

| US Domestic Producers | Short-Term Winner | May see reduced competition from cheap imports (e.g., Indian textiles). |

| US Consumers | Loser | Will face higher prices for goods from targeted nations (25% tax is passed on). |

| Iran | Loser | Further economic isolation; currency (Rial) likely to collapse further. |

| Global Supply Chains | Loser | Chaos in shipping; companies must audit deeper tiers of suppliers to avoid “contamination.” |

| Russia | Winner | May step in to trade with Iran using non-dollar systems, immune to US financial pressure. |

Timeline of Escalation (2025-2026)

- June 2025: Israel and US forces conduct limited strikes on Iranian nuclear facilities.17

- Sept 2025: UN “Snapback” sanctions are reimposed on Iran.18

- Dec 2025: Mass anti-government protests erupt across 20+ Iranian cities.19

- Jan 12, 2026: Trump announces 25% tariff on all nations trading with Iran.20

- Jan 13, 2026: China calls the move “illicit”; Global markets react with volatility.21

Expert Perspectives

To understand the nuance, we must look at differing expert views on the efficacy of this policy:

The Skeptic: Brad Setser, Council on Foreign Relations: “This is economic carpet bombing. By targeting allies and rivals alike, the U.S. risks isolating itself more than Iran. The sheer complexity of untangling global supply chains means American businesses will pay a steep price before Tehran feels the pinch.”

The Hawk: Defense & Security Forum Analysts: “The regime in Tehran is on the ropes. Traditional sanctions have too many loopholes. This ‘scorched earth’ tariff policy forces the world to choose: the $28 trillion U.S. market or the $400 billion Iranian market.22 It’s a math problem that solves itself in America’s favor.”

The Market Watcher: Nigel Green, Financial Analyst: “Markets hate uncertainty. This doesn’t just affect oil; it affects the cost of a laptop from China or a shirt from India. We are pricing in a ‘geopolitical risk premium’ that will keep inflation sticky through 2026.”

Future Outlook: What Comes Next?

As we look toward the remainder of 2026, three scenarios are likely to emerge:

- The Waiver Game: The Trump administration may quietly issue “national security waivers” to close allies like the UK, Germany, or India, transforming the blanket tariff into a targeted weapon primarily against China.

- The Shadow Economy Boom: Trade with Iran will not stop; it will go dark. We will see a rise in “ghost ships,” dark fleet tankers, and barter trade (e.g., tea for oil) that bypasses the US dollar entirely, accelerating the trend of de-dollarization in the Global South.

- Tehran’s Collapse or Conflict: If the economic stranglehold works, the Iranian regime faces an existential crisis. History suggests they may lash out externally—potentially closing the Strait of Hormuz—to force the West to the negotiating table, converting an economic war into a kinetic one.

Final Words

Trump’s 25% tariff announcement is not just a trade policy; it is a rewriting of the rules of global engagement.23 While the intended target is Tehran, the collateral damage will be felt in Beijing, New Delhi, and American living rooms.24 The era of free trade is officially over; the era of economic coercion has begun in earnest.