Pocketpair Aetheria chatter matters right now because it tests a post-breakout rule: can a studio that “wins” early access attention convert it into a second hit while lawsuits, platform economics, and player fatigue tighten the funnel in 2026?

Why A Second “Big Swing” Matters More Than The Rumor Itself?

If you are seeing headlines and social posts framing “Pocketpair’s next open-world survival RPG” as Pocketpair Aetheria, it is worth starting with a hard reality: as of January 9, 2026, Pocketpair’s own public news releases emphasize Palworld’s 1.0 plan for 2026, ongoing content work, and business expansion, but they do not publicly confirm a new flagship RPG called “Aetheria.” That gap is not a footnote. It is the point.

In today’s game economy, “the next game” often becomes a narrative proxy for everything people want to believe about a studio: that it is scaling up, that it has solved retention, that it can diversify risk, or that it is cashing out attention before it fades. For a breakout team like Pocketpair, speculation about a new project spreads because the incentives align. Fans want proof the studio can build a universe, competitors want signals about what to copy or counterprogram, and platforms want the next tentpole that can pull players into ecosystems.

The deeper significance is structural. Breakout successes in survival and crafting have become less about launch-day spikes and more about whether a studio can keep a game “sticky” while shipping real updates, surviving market noise, and building an IP layer on top. Pocketpair has already taken steps in that direction through its licensing joint venture and publishing expansion. That makes any “Aetheria” narrative, real or rumored, a useful lens for a larger question: what does a second act look like for a studio that already captured lightning once?

Here is the context that frames everything: Palworld is moving toward a 1.0 release in 2026, and Pocketpair has explicitly said it made gameplay compromises during litigation to keep development and distribution moving. That combination of ambition plus constraint is exactly the environment where studios either professionalize into durable IP companies or burn out under their own success.

| Pocketpair Milestones And What They Signal | Date | Why It Matters For “What Comes Next” |

| Palworld surpasses 25 million players within one month | Feb 23, 2024 | A breakout scale event turns a studio into an IP target and a platform asset |

| Palworld Entertainment joint venture with Sony Music (Japan) and Aniplex | Jul 10, 2024 | Signals a pivot from “game studio” to “franchise business” |

| Patent lawsuit details published by Pocketpair, including damages sought and patent dates | Nov 8, 2024 | Adds legal drag, feature risk, and long-term design constraints |

| Pocketpair acknowledges lawsuit-driven mechanic changes and more planned compromises | May 8, 2025 | Shows how litigation can reshape game design and roadmaps |

| Pocketpair Publishing launched | Jan 23, 2025 | Diversifies revenue and influence beyond one game |

| Palworld 1.0 confirmed for 2026 | Sep 16, 2025 | Locks in a major delivery milestone while attention remains competitive |

Survival Games In 2026 Are A Retention War, Not A Launch Race

The survival genre rewards virality, but it punishes complacency. A game can spike to massive concurrency, then settle into a much smaller “working population” that determines community health, creator coverage, modding energy, and long-term revenue. What matters is not the peak. It is the shape of the curve after the peak and how predictable the studio becomes at delivering reasons to return.

Palworld’s public player data illustrates both the opportunity and the challenge. Even two years after early access launch, it still posts meaningful monthly averages relative to many peers, but its peak was historically extreme. That means any “is it dead” discourse is often mathematically misleading: a tiny fraction of an enormous peak can still be a very large community by normal standards.

Compare Palworld’s recent monthly averages to other major survival titles. This does not measure sales or total players. It measures how crowded the servers feel, how alive the world feels, and how much daily attention the game can reliably command.

| Survival Game Engagement Snapshot | Last 30 Days Avg Players | All-Time Peak Players | Avg As % Of Peak |

| Palworld | 42,407 | 2,101,535 | 2.0% |

| Rust | 118,509 | 259,646 | 45.6% |

| Valheim | 20,092 | 498,478 | 4.0% |

| ARK: Survival Evolved | 20,464 | 247,292 | 8.3% |

| Enshrouded | 18,821 | 160,361 | 11.7% |

Two interpretations can be true at once. Palworld’s retention ratio looks small because its peak was a once-in-a-decade anomaly. At the same time, its current average players still represent a serious live game footprint, and recent months show rebound patterns that tend to follow major updates, content beats, or renewed creator attention.

This is where a hypothetical “Aetheria” matters. If Pocketpair truly wants a second open-world survival RPG, it cannot rely on novelty alone. The genre has matured into a high-frequency competition for time, not just money. Players are choosing fewer games to “live in,” and that pressures studios to build deeper loops, better onboarding, stronger social scaffolding, and a clearer endgame without turning the experience into a grind.

Industry-wide engagement data supports this shift. Across PC and console, playtime is rising, but it is being concentrated into fewer titles. The implication for any new survival RPG is blunt: a “good” game may not be enough. It has to be a lifestyle fit.

| Attention Economy Signals That Shape New Survival RPGs | Metric | Latest Reported Value | What It Implies |

| Growth in playtime | YoY 2024 | +6% | Players have time, but spend it selectively |

| Share of 2024 playtime from new games | 2024 | 12% | New launches struggle to take time from incumbents |

| Steam players engaging with 3 or fewer games annually | 2024 | 34% (up from 22% in 2021) | The “default library” is shrinking, switching costs are rising |

| Portion of Steam traffic coming from off-platform sources | 2025 | 46% | Creator and community distribution is now core marketing |

So if “Pocketpair Aetheria” is real, the strategic bar is higher than “Palworld but fantasy.” It would need to solve at least one major problem better than the market: sustained co-op progression without burnout, meaningful building without save-wiping tech debt, and a content pipeline that does not collapse under studio size limits.

Technology And Design Constraints Are Now Part Of The Business Model

Survival games are systems-heavy. They are physics-heavy, simulation-heavy, and content-heavy. That creates a specific risk that players notice only after they care: foundational engine choices can limit what the community demands later. When a developer explains that a popular request would require a year of work and wipe existing save files, it is not just a design detail. It is a reminder that early technical decisions become product governance decisions.

This matters because “second games” are often shaped by first-game scars. A follow-up project can be a creative evolution, but it can also be a technical reset where a studio designs around everything it learned the hard way. In a world where base-building communities invest hundreds of hours into worlds, the cost of breaking saves becomes reputational as well as technical. That is one reason sequels or spin-offs can look attractive: they provide permission to rebuild systems without betraying existing players.

At the same time, a second open-world survival RPG introduces scope dangers. The genre tempts studios to promise everything: deeper story, bigger map, more biomes, more AI, more crafting, more multiplayer stability, more endgame, more mod support. Those promises are not additive, they are multiplicative. Each system increases the number of interactions that can break.

This is also where industry layoffs and funding patterns matter. The modern development environment is tighter and more risk-averse than the pandemic boom. Data from major developer surveys suggests layoffs hit broadly, many teams self-fund, and live-service opinions are divided, even as AAA continues to chase it. For a studio like Pocketpair, that can cut two ways. Success provides capital and leverage, but it also raises expectations about hiring, release cadence, and quality control.

If “Aetheria” exists as a project concept, it would likely be shaped by three technical lessons that define survival games in 2026:

- Persistence is the product. Players are not buying content drops, they are buying continuity and trust that the world will still matter next month.

- Tooling beats heroics. The studios that survive are the ones that automate pipelines for biomes, assets, quests, and events so updates do not depend on crunch.

- Network stability is content. In co-op survival, performance and server reliability create more retention than any single feature.

That third point is especially relevant because survival communities punish instability. When players lose progress or feel that systems are unpredictable, they churn. A studio considering a second flagship survival RPG is implicitly signing up to build not just a game, but an operations machine.

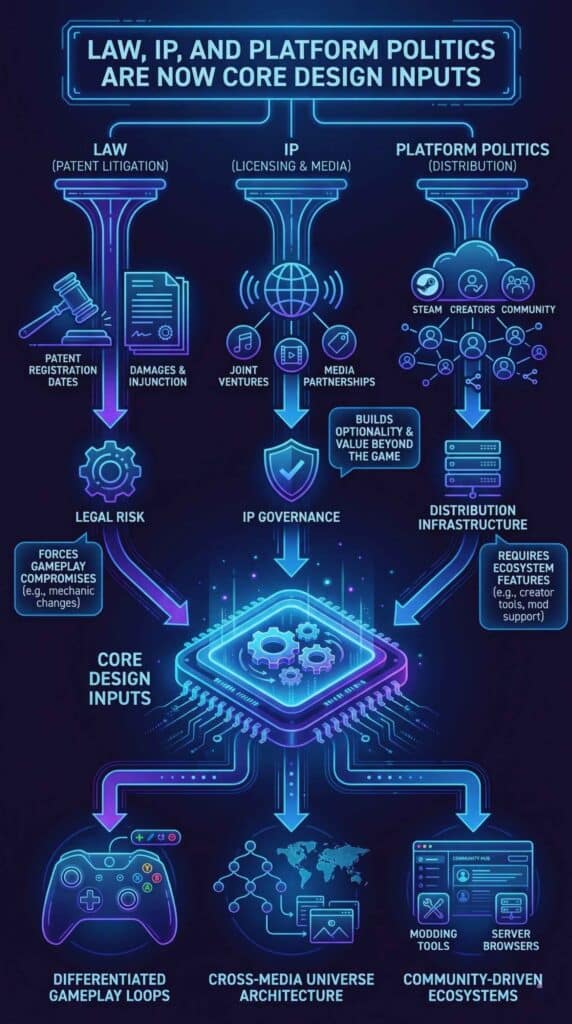

Law, IP, And Platform Politics Are Now Core Design Inputs

Palworld is not just a game story, it is an IP governance story. Pocketpair publicly detailed the patents at issue in litigation, including the patent registration dates and the requested damages and injunction. Later, Pocketpair acknowledged specific gameplay changes made under litigation pressure, including changes to capture and gliding mechanics. This is one of the clearest recent examples of how legal risk can move from the courtroom into the patch notes.

That has two immediate implications for any future Pocketpair project, including a rumored “Aetheria.”

First, it raises the value of differentiation. The safest creative strategy is not merely “different art.” It is building core loops that are structurally distinct, with mechanics that are less vulnerable to claims of similarity. In practice, that can push a studio toward clearer genre hybrids, more unique interaction models, or entirely different progression logic.

Second, it strengthens the business case for expanding into licensing and media partnerships. Pocketpair’s joint venture with Sony Music (Japan) and Aniplex to expand Palworld’s licensing business is a classic move for breakout IP. It creates additional revenue streams that are less sensitive to Steam traffic dips, and it anchors the franchise in a broader entertainment ecosystem.

If “Aetheria” is real, one plausible interpretation is that Pocketpair is trying to build optionality: a new world and brand architecture that can stand independently even if Palworld’s design is constrained by legal outcomes. But even if “Aetheria” is not real, the logic still holds. In 2026, IP expansion is not just upside. It is risk management.

There is also platform politics. On Steam, visibility is harder to earn, and the importance of external marketing has risen. If nearly half of traffic comes from off-platform sources, creators and community become distribution infrastructure. That means studios increasingly design for “shareable moments,” modability, and community tools, because those are marketing multipliers.

If Pocketpair launches a new survival RPG, it will likely be judged not only on gameplay, but on whether it arrives with the ecosystem pieces that modern platform economics require:

- Creator-friendly tools and policies.

- Strong community moderation and server tooling.

- Update cadence that creators can plan around.

- Monetization that does not fracture trust.

The uncomfortable truth is that survival games are now evaluated like platforms, even when they are sold as premium products.

What Comes Next In 2026: The Most Likely Paths And The Signals To Watch

Whether “Pocketpair Aetheria” is confirmed or not, the strategic fork in front of Pocketpair is visible. The studio has four broad paths, and the most likely future is some mix of them.

| Strategic Options For Pocketpair In 2026 | What It Looks Like | Upside | Risk | Key Dependency |

| Deliver Palworld 1.0 as a definitive “real launch” | World Tree, polish, systems maturity, retention focus | Converts early access success into long-term franchise stability | Expectations spike, legal constraints may complicate features | Execution quality and legal maneuvering |

| Expand Palworld as a cross-media IP | Licensing, merch, media collaborations, spin-offs | Diversifies revenue beyond live player counts | Brand dilution if quality control slips | Partner alignment and brand governance |

| Launch a distinct new survival RPG (the “Aetheria” idea) | New setting, new core loop, reset tech debt | Builds a second pillar and reduces single-IP risk | Cannibalization, scope creep, community backlash | Clear differentiation and staffing depth |

| Grow Pocketpair Publishing as a portfolio bet | Funding and publishing multiple indie titles | Stabilizes cash flow and influence | Publishing is a different business with reputational risk | Deal selection and support capabilities |

So what should observers watch in 2026 to separate signal from noise?

First, the Palworld 1.0 timeline and what “1.0” actually means. Some studios use 1.0 as a marketing relaunch that includes onboarding, endgame, and stability upgrades. Others use it as a label change. Pocketpair has framed 1.0 as a major step, and that wording sets expectations that it will feel meaningfully different from early access.

Second, how Pocketpair communicates under constraint. The studio has already said it could not be fully transparent during litigation. If 2026 communications become more guarded, that may indicate legal sensitivity. If they become more confident, it may signal reduced uncertainty or a stable path forward.

Third, whether new projects appear as “spin-offs” rather than “sequels.” Pocketpair has a public history of playful spin-off announcements, and the company has already discussed ideas in sequel-like terms. A spin-off format is often a low-conflict way to explore new mechanics without splitting the main team.

Fourth, portfolio moves through Pocketpair Publishing. Publishing announcements can reveal where the studio believes the market is going. If it backs more co-op PvE or survival-adjacent projects, that indicates conviction that the segment still has runway.

A forward-looking prediction, clearly labeled: Analysts would reasonably expect Pocketpair’s near-term priority to remain Palworld 1.0 delivery, with any new flagship project kept quieter until the 1.0 milestone is secured. That is the risk-minimizing play in a market where players stick to fewer games and where operational excellence matters more than surprise reveals.

If the “Aetheria” name turns out to be misinformation or confusion with other projects using the same term, the broader lesson is still important for the industry: the appetite for “the next Palworld” remains intense, but the conditions that created the first Palworld moment have changed. Discoverability is harder, players are more selective, and external distribution is mandatory. The next breakout will not just need a hook. It will need a machine.