Picking the right health insurance often feels like a big puzzle, doesn’t it? You might worry about finding a plan that truly covers your needs, or how to get the best deal without breaking the bank.

With so many choices, it is easy to feel lost when looking at Health Insurance Providers In Australia.

Good news, though! This article simplifies your search for 2025. We lay out the details for the top seven health funds, showing you what each offers. Get ready to make a smart choice.

Medibank: Comprehensive Review

Medibank stands tall as a major force in Australian health insurance. We lay bare its strengths and weaknesses, helping you decide.

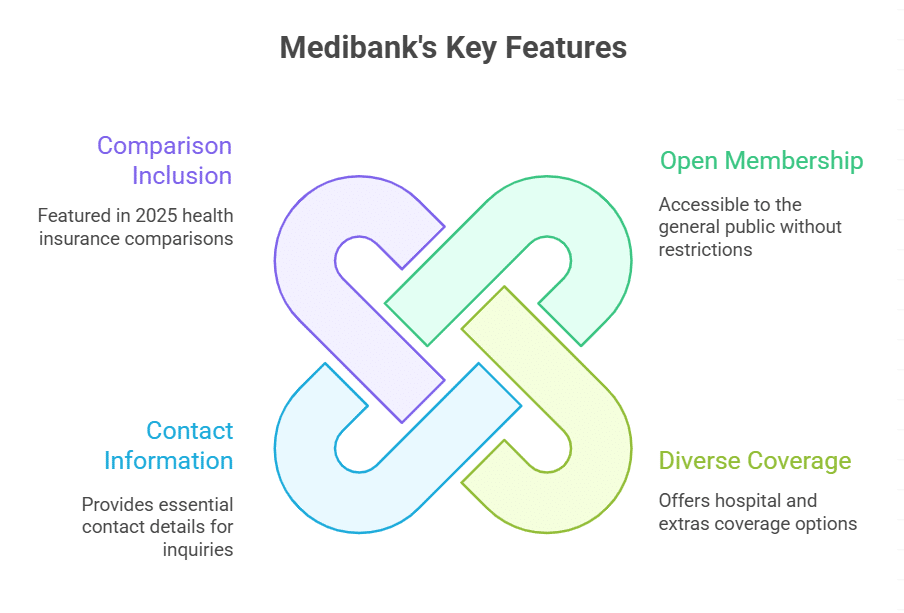

Features of Medibank

Australians often weigh health insurance options carefully. Medibank holds a significant position among private health funds.

- Medibank Private Limited functions as an open health fund. This important distinction means its membership accessibility extends to the general public. It is one of the 25 open health funds available across Australia.

- Membership remains widely accessible, open to all. People do not face specific eligibility restrictions to become members. This broad accessibility simplifies the process for many.

- A diverse range of health insurance services is available. Their coverage options include both hospital and extras, meeting varied requirements. Members may select plans that suit their individual circumstances.

- Essential contact details are made available. This helps individuals connect with the fund for inquiries. Prospective members find these details useful for initial steps.

- The current 2025 comparison of health insurance providers features Medibank. This inclusion allows readers to weigh its offerings against others. Such a review assists in making informed choices.

Advantages and Disadvantages (Medibank)

Before you sign on the dotted line, let’s peek at Medibank’s bright spots and a few bumps in the road.

| Advantages | Disadvantages |

|---|---|

| Wide network access often helps members find care easily. | Premiums can sometimes run higher. |

| Many policy choices exist, suiting diverse needs. | Service might feel less personal to some. |

| Digital tools simplify claims and policy management. | Dealing with large systems can involve more steps. |

| Established providers typically offer financial stability. | Limited provider options may appear in certain rural zones. |

| Customer support lines are usually available. | Annual premium adjustments are a common occurrence. |

| Some plans include wellness incentives for members. | Policy documents sometimes present complex details. |

Bupa: Detailed Analysis

Bupa holds a big slice of the Australian health insurance pie. Does their broad coverage fit your specific needs, or is there a catch?

Features of Bupa

Choosing health insurance feels like a big decision. Let’s look closely at what Bupa offers.

- This fund insurer, Bupa HI Pty Ltd, operates as an open fund. It means anyone eligible can join, a real open door.

- Membership has no restrictions at all. You do not need to work in a specific field. It’s not a secret club.

- Accessibility stands as a core strength for policyholders. It truly sets itself apart from restricted membership insurers.

- Coverage options are straightforward to understand. They define “Partner” as a spouse or de facto partner. A “Dependant” refers to your child under set conditions.

- Contact details are readily available for user inquiries. Their customer support is there to help, a friendly voice on the line.

- Open enrollment periods simplify the joining process. New policyholders can sign up with ease. It’s smooth sailing.

- They offer a wide array of insurance benefits. These benefits aim to cover various health needs, giving peace of mind.

Advantages and Disadvantages (Bupa)

After exploring the various facets of Bupa’s offerings, let’s now consider the bright and cloudy sides of their health insurance plans, helping you weigh your options.

| Advantages | Disadvantages |

|---|---|

| Their broad network of providers can mean easier access to care. | Policy costs could be higher than some smaller insurers. |

| Many plan choices exist, catering to diverse family situations. | Certain plans may carry specific claim caps. |

| The fund’s established reputation often offers peace of mind. | Not every medical procedure might receive payment. |

| Digital platforms frequently streamline account handling. | Understanding all policy terms sometimes takes effort. |

| Programs for well-being sometimes come with membership. | New members often face initial waiting periods. |

HCF: In-Depth Overview

HCF, a true stalwart, garners praise for its member-centric approach. Curious what makes them a go-to for many Australian families seeking health coverage?

Features of HCF

HCF stands as a well-known name in Australian health insurance. People often consider its offerings for their healthcare needs.

- This insurer provides various hospital coverage options. Plans range from basic to extensive, fitting different budgets. You can select levels for private hospital care.

- Access to a wide array of extra services is a key benefit. These include dental care, optical needs, and physiotherapy. Many members value these additional coverages.

- The company offers member programs. These might include health and wellness initiatives. Some plans give discounts on certain services.

- Customers often report good service experiences. Claiming benefits is generally straightforward. Help desks stand ready to assist.

- Policyholders gain choice over their healthcare providers. Policyholders often pick their own doctor or hospital. This freedom gives peace of mind.

- As a not-for-profit entity, it focuses on members. Profits return to benefit policyholders. This structure may appeal to many.

- Digital tools simplify policy management. An app helps track claims and benefits. Online portals make administration easy.

Next, we will explore Nib Health Insurance: Essential Insights.

Advantages and Disadvantages (HCF)

Every health insurer, including HCF, presents its own set of strengths and areas for improvement, and knowing these helps you pick a plan that fits your life like a glove.

| Advantages | Disadvantages |

|---|---|

| A broad network often means more choice. | Premiums might seem high for some budgets. |

| Diverse plans cater to different needs. | Choice of providers can be limited in smaller towns. |

| Many providers offer solid member support. | Waiting periods apply to many services. |

| Value can come from comprehensive coverage. | Annual limits affect certain treatments. |

| Some insurers focus on community well-being. | Policies often carry specific exclusions. |

| Simple claim systems ease the process. | Contacting support may involve a wait. |

Nib Health Insurance: Essential Insights

What about Nib Health Insurance, you ask? Discover how they approach health coverage for Australians.

Features of Nib Health Insurance

NIB Health Insurance stands as a significant player in Australia’s health coverage landscape. They offer various policies designed for individuals seeking protection.

- NIB Health Funds Ltd operates as an open membership insurer. This means many individuals can join their plans. Access to their services is broad for the general public.

- This provider extends its services across numerous Australian states and territories. You can find NIB in ACT, New South Wales, Queensland, South Australia, Tasmania, Victoria, Western Australia, and the Northern Territory. Their presence covers a wide geographic area.

- NIB Health holds a strong reputation. They are recognized as one of Australia’s top health insurance providers. This standing reflects their service quality and policy offerings.

- Reaching NIB is straightforward for any questions about policies or services. You can call them directly at 13 16 42 for general inquiries. For calls from overseas, the number is +61 2 9692 4300.

- Detailed information about NIB’s health insurance policies and benefits is available online. Their official website, http://www.nib.com.au, provides comprehensive details. This platform helps members and prospective members find what they need.

- NIB’s main registered address is located at Level 5, 22 Honeysuckle Drive, Newcastle, NSW 2300. This central location supports their operations across the country.

Advantages and Disadvantages (Nib Health Insurance)

Nib Health Insurance offers several notable points for those seeking medical insurance. Their digital tools often simplify the claims process, making it less of a chore. Policy options provide various levels of health coverage, allowing some flexibility for different needs. Many find their customer service quite helpful when questions arise about benefits. This focus on user experience can make managing your medical insurance straightforward.

Yet, a few considerations arise regarding their offerings. Premiums for some plans might feel a bit steep, depending on the level of coverage chosen. Certain policy exclusions could surprise you, so reading the fine print is always smart. While they have a wide network, specific providers might not always be included, potentially leading to higher out-of-pocket expenses if you choose an out-of-network doctor. It is wise to check their list of network providers before committing.

HBF: Critical Evaluation

Many Australians consider HBF when shopping for health coverage, and for good reason. We pull apart their plans, giving you a straightforward look at what they offer, warts and all.

Features of HBF

HBF stands as a top health insurance provider in Australia for 2025. It offers a straightforward approach to coverage for its members.

- Open Membership: HBF operates as an open fund. This means any person can join its membership. There are no restrictions on who can become a member. This contrasts with restricted funds, which have specific eligibility rules. HBF is one of 25 open health insurers across Australia.

- Universal Access: This provider offers wide access to its health insurance plans. Eligibility criteria do not limit who can join. You do not need a special job or group affiliation. This broad accessibility makes HBF a popular choice for many individuals.

- Varied Communication Methods: HBF provides several easy ways to connect. You can reach them by telephone for direct help. Sending an email is another simple option for inquiries. Their website offers extensive information and contact forms. A friendly voice is always just a call away.

Now, let’s explore the advantages and disadvantages of choosing HBF.

Advantages and Disadvantages (HBF)

HBF, a prominent health insurer, presents several appealing aspects. Many members commend its strong community focus. They often feel a sense of belonging with this fund. The company generally offers a range of health plans. These options aim to suit diverse needs. Customer service often receives positive feedback. People appreciate the direct support provided. This commitment to members forms a key strength. The insurer’s long history also provides a sense of stability.

Every insurer has areas for improvement. Some members report that HBF premiums can be higher. This might affect budget-conscious individuals. Their network of preferred providers might be less extensive in some regions. This could limit choices for some policyholders. Digital tools and online features sometimes lag behind competitors. Members might desire more advanced self-service options. Certain plans may also have specific exclusions. These limitations warrant careful review. These considerations help in making an informed choice.

Australian Unity: Thorough Examination

Australian Unity presents a compelling option, often a dark horse in the health fund race. We scrutinize its offerings, peeling back layers to reveal what truly lies beneath the surface for your peace of mind.

Features of Australian Unity

Finding the right health insurance provider matters greatly. Australian Unity Health Limited stands as a key player in this field.

- This health insurer offers open membership. This means there are no particular eligibility requirements for joining. It serves a broad range of people seeking health insurance coverage.

- It operates across many regions. This includes the ACT, NSW, QLD, SA, TAS, VIC, WA, and NT. Its wide regional operations provide access to benefits for many Australians.

- Detailed information on its policy offerings is available. You can find data on performance and various plans. This helps consumers make informed decisions about premiums and benefits.

- The provider is a major open fund. It sits alongside large names like Bupa, Medibank, and HCF. This shows its significant standing in the health insurance market.

- Contact information is readily accessible. Its telephone number and website are also available. This makes consumer information easy to obtain.

- It exemplifies an open fund. Unlike restricted funds, it has no entry criteria. This broad access distinguishes its plans.

Now, let’s consider HBF, another significant provider.

Advantages and Disadvantages (Australian Unity)

Australian Unity presents a mixed bag, like most things in life. One might appreciate their broad range of coverage options, a clear benefit for many. Their customer support often earns praise, making interactions smoother. These aspects are definite pros for members seeking a reliable partner.

Every coin has two sides, though. Some people might find certain plans carry higher costs, a significant drawback. Specific policy exclusions could also present a challenge for those needing particular treatments. These are important considerations for any potential policyholder. This critical evaluation shows the full picture, helping you weigh your options. Next, we turn our attention to Teachers Health.

Teachers Health: Complete Assessment

Teachers Health, a fund built for the education community, understands your specific needs. Discover how this provider gives back to those shaping young minds.

Features of Teachers Health

Choosing health insurance feels like a big puzzle. Teachers Health offers a clear solution for educators.

- The provider operates as a restricted fund. It serves teachers, and related professionals, exclusively. Membership is open only to eligible educators. Such a structure focuses on their specific needs.

- Families can join, too. Dependants under 18 years old qualify. Those under 25 also qualify, if substantially dependent. Such coverage extends to family units.

- The fund provides specific support for educators. It recognizes their professional development needs. The services address their particular health requirements. Such dedication promotes overall wellness among members.

- The provider fosters a strong community spirit. Members experience a sense of belonging. Such collective support enhances their health journey. It builds a supportive network for all.

- Getting help is straightforward. Contact information, like telephone numbers, is readily available. Their websites offer easy access to details. Such accessibility helps members find assistance quickly.

Takeaway

We looked at Australia’s top health insurers for 2025. Picking the right plan becomes much simpler with good information. A good policy protects your money from big medical bills. Check their websites or compare plans online for more details.

Take charge of your health coverage; it truly matters. Peace of mind truly makes life a little easier, doesn’t it?

FAQs on Health Insurance Providers In Australia

1. Why should I consider health insurance in Australia?

Look, Australia has a good public system, Medicare. But it doesn’t cover everything, does it? Private health insurance, it’s like a safety net for those gaps. Think about specialist visits, dental work, or even a private hospital room; Medicare often leaves you holding the bill. Many Australians opt for it, simply for the peace of mind. It helps you avoid long public waiting lists, too. It’s about having choices, really.

2. How do I pick the best health insurance provider from the top 7?

Picking a provider, it’s not a one-size-fits-all situation, you know. First, look at what you actually need. Are you single, or do you have a growing family? Compare the specific benefits each of the top health insurance providers offers. Don’t just stare at the price tag; dig into the details. Read reviews, too. What do other people say about their customer service? It’s like buying a car; you check under the hood, right?

3. What makes a health insurance comparison for 2025 useful?

A 2025 comparison, it’s your future roadmap, plain and simple. Health needs change, and so do the offerings from health insurance providers in Australia. This kind of comparison gives you current, relevant data. It helps you see new plans, altered benefits, and updated pricing. It’s not about guessing; it’s about making an informed choice for the year ahead. You wouldn’t use an old map for a new journey, would you?

4. Are there common pitfalls when choosing a health insurance plan?

Oh, absolutely, plenty of traps for the unwary. The biggest one? Only looking at the premium. Some folks just pick the cheapest plan, but it might not cover what you need. Another pitfall, not understanding waiting periods. You can’t just sign up today and get major surgery tomorrow, usually. Also, ignoring the fine print on exclusions is a classic mistake. Don’t be shy; ask questions. It’s your health, after all.