Hey there, are you worried about your online transactions being tracked? It’s a real hassle when every move you make on the internet feels like it’s under a spotlight, right?

Here’s a cool fact, privacy coins work like cash in the real world; they make it tough to trace who’s sending or receiving money. That’s where our blog, “7 Privacy Coins Leading The Way In Web3 Anonymity,” comes in to save the day.

We’re gonna break down the top players like Monero and Zcash, show you how they use tricks like ring signatures and zero-knowledge proofs to keep things hush-hush, and help you understand why financial privacy matters.

Stick with me, okay? Let’s explore!

Key Takeaways

- Monero (XMR) leads with a market cap of $2.8 to $2.9 billion in April to May 2023, using ring signatures for private transactions.

- Zcash (ZEC) offers privacy and transparency options with zk-SNARKs, holding a market cap of $550 to $700 million in April to May 2023.

- Dash (DASH) ensures fast transactions in 1 to 2 seconds via InstantSend, with a market cap of $500 to $670 million in April to May 2023.

- Secret Network (SCRT) protects smart contracts, reaching a market cap of $120 million in April to May 2023.

- Oasis Network (ROSE) combines scalability and privacy, with a market cap of $310 to $460 million in April to May 2023.

Monero (XMR): The Gold Standard of Privacy Coins

Monero (XMR) stands tall as the top choice for privacy coins in the Web3 space. It’s like a secret vault for your digital cash, keeping your transactions hidden from prying eyes.

With a market cap of about $2.8 to $2.9 billion in April to May 2023, it’s clear folks trust this coin. Monero uses cool tricks like ring signatures, stealth addresses, and RingCT to mask who’s sending what to whom.

Every single deal stays private by default, no exceptions.

Think of Monero as the quiet hero of financial privacy. It has handled around 32 million transactions total, with a huge spike to 8.8 million back in 2021. That’s a lot of anonymous transactions flying under the radar.

If you’re into keeping your cryptocurrency moves on the down-low, this coin sets the bar high with its strong cryptographic techniques. Stick with us to see how it compares to others!

Zcash (ZEC): Combining Privacy with Transparency Options

Zcash, or ZEC, shines among privacy coins. It offers a great option to either conceal your transactions or keep them visible. Using an innovative feature called zk-SNARKs, Zcash provides protected transactions that safeguard your information.

Pretty impressive, right? This allows you to transfer funds without anyone seeing your details.

Now, check this out, Zcash also gives you the choice of transparency if you prefer it. Selective disclosure is their approach, so you control what to reveal. With a market cap ranging between $550 and $700 million from April to May 2023, it’s a significant contender.

Be aware, though, while it’s permitted in the U.S., countries like Japan prohibited it in 2018, and South Korea, Australia, as well as Dubai did the same in 2023. Strict regulations, huh? Stay with Zcash if financial privacy on public blockchains is your priority.

Dash (DASH): Fast and Private Transactions

Hey there, folks, let’s talk about Dash, a standout in the privacy coin arena. Dash, or DASH, shines with its emphasis on fast and discreet transactions. Think of sending money instantly, like shooting a quick message to a friend.

That’s Dash with its InstantSend feature, wrapping up transactions in just 1 to 2 seconds. Pretty impressive, huh?

Now, Dash also delivers with PrivateSend, a smart method for blending coins. This ensures your cryptocurrency transactions stay private, shielded from unwanted attention. Even after facing a challenge, being removed from Bittrex in 2021, Dash remains resilient.

With a market cap ranging from $500 to $670 million between April and May 2023, this digital currency shows it’s got staying power in the sphere of financial privacy.

Secret Network (SCRT): Privacy for Smart Contracts

Secret Network, or SCRT, stands out as a key player in guarding your data privacy. It uses strong encryption to protect smart contracts, keeping sensitive information safe in decentralized applications, often called dApps.

With a market cap of about $120 million as of April-May 2023, this network shows its growing impact. Isn’t it neat how it hides your details while still letting apps work smoothly?

Part of the vast Cosmos ecosystem, SCRT boosts privacy across blockchain networks. It shields your transactions and data, making sure no one peeks at your business. Think of it like a secret vault for your digital deals.

How cool is that for keeping things under wraps in the wild world of decentralized finance?

Oasis Network (ROSE): Scalable and Secure Privacy Solutions

Oasis Network (ROSE) emerges as a transformative force in the sphere of privacy coins. It prioritizes integrating data protection with exceptional scalability. Envision a blockchain that safeguards your information while operating seamlessly, even under heavy user demand.

With a market cap ranging from $310 to $460 million between April and May 2023, Oasis demonstrates significant support. This network employs innovative mechanisms like homomorphic encryption and secure enclaves to protect your data.

Picture it as a digital stronghold, securing your private details while maintaining swift system performance.

Explore how Oasis addresses major hurdles in Web3. Its privacy-centric design ensures that confidential transactions remain protected. Moreover, it’s engineered to support decentralized applications (dApps) without any loss in efficiency.

The goal? To harmonize privacy with speed, delivering secure blockchain technology that keeps up. Whether for decentralized finance (DeFi) or other initiatives, Oasis provides a dependable foundation.

Choose this coin if you’re looking for encrypted data solutions that grow with demand!

Horizen (ZEN): Privacy and Interoperability Combined

Hey there, folks, let’s chat about Horizen, also known as ZEN, a cool player in the privacy coins game. This project stands out by mixing personal privacy with interoperability, letting blockchains talk to each other seamlessly.

With a market cap hovering between $120 and $150 million around April to May 2023, Horizen shows it’s got some serious backing. Plus, it uses zk-SNARKs, a fancy cryptographic method, to keep transactions hidden and secure.

Now, imagine your data as a secret recipe, shared only with trusted friends across different kitchens. That’s how Horizen rolls, supporting safe and private data sharing across various blockchains.

It’s like a bridge in the Web3 world, connecting isolated islands. Curious about the tech behind all this privacy magic? Let’s move on to explore the key technologies powering privacy coins.

Decred (DCR): Community-Driven Privacy Enhancements

Let’s chat about Decred, or DCR, a coin that puts community power first. It’s not just about hiding your transactions; it’s about giving you a say. With a market cap hovering between $260 and $320 million in April to May 2023, Decred stands strong.

This governance-focused cryptocurrency lets users vote on changes, making sure everyone’s voice matters in its growth. How cool is that?

Think of Decred as a team huddle where you’re the star player. It uses neat tricks like CoinShuffle++ and CoinJoin to keep your deals private on the blockchain. Plus, its focus on decentralized governance means the community drives privacy updates.

Stick with DCR, and you’re part of a squad that shapes financial privacy for the future of Web 3.0.

Key Technologies Powering Privacy Coins

Hey there, ever wonder what makes privacy coins tick, even under the toughest scrutiny? Let’s peek behind the curtain at the clever tricks, like advanced cryptography and sneaky digital signatures, that keep your transactions under wraps!

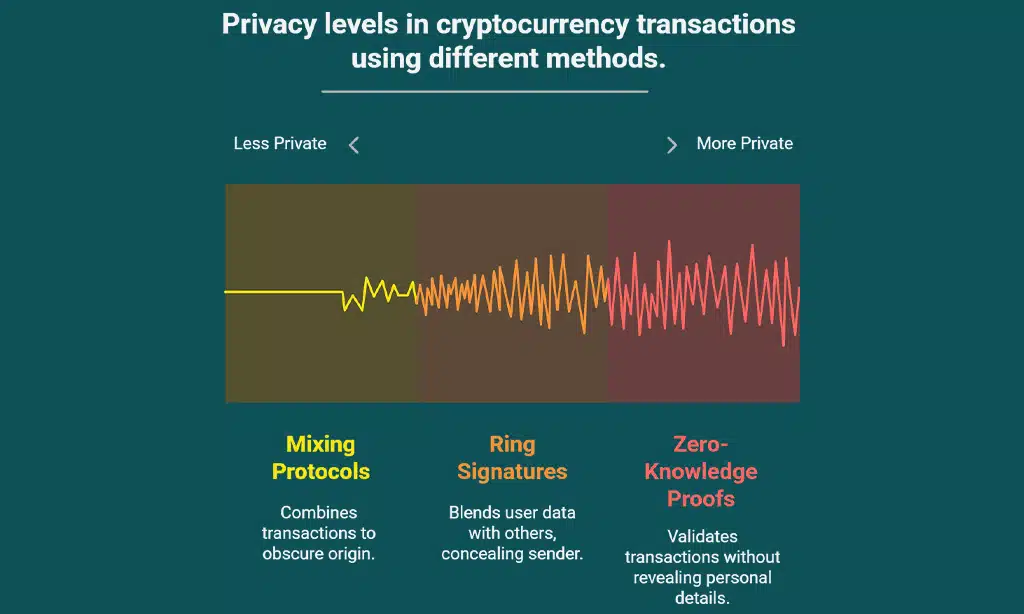

Ring Signatures

Let’s talk about ring signatures, a fascinating technique in the sphere of privacy coins. They help shield your identity when you send crypto. Picture a group of friends signing a note, yet no one can pinpoint who actually penned it.

That’s the essence of ring signatures, blending users together to conceal the true sender. Employed by coins like Monero and Bytecoin, this approach is essential for anonymous transactions.

Think of it as a covert club signal. Ring signatures blend your data with others, making it challenging to link it back to you. They’re a significant factor in financial privacy, aiding in the creation of transactions that can’t be tracked.

So, when you use a coin like Monero (XMR), this technology ensures your actions remain hidden on the blockchain.

Zero-Knowledge Proofs (ZKPs)

Moving from the clever disguise of ring signatures, let’s chat about another cool trick in the privacy coin world, Zero-Knowledge Proofs, or ZKPs for short. Think of ZKPs as a magic act where you prove something is true without showing the secret.

They let you validate a transaction on the blockchain without spilling any personal details, keeping your info safe and sound.

ZKPs power some big names like Zcash with a special tool called zk-SNARKs, which stands for Zero-Knowledge Succinct Non-Interactive Arguments of Knowledge. This tech enables shielded transactions, hiding who sent what to whom.

It’s like mailing a locked box; the recipient knows it arrived, but no one else sees what’s inside. How neat is that for financial privacy in decentralized finance?

Mixing Protocols

Mixing protocols are a neat trick for keeping your crypto deals under wraps. They blend your transactions with others, making it tough to trace who sent what to whom. Think of it as shuffling a deck of cards; good luck figuring out which card came from where! Dash and Decred use this magic with tools like PrivateSend and CoinJoin.

These methods boost privacy by hiding your transaction history in a crowd.

Isn’t it cool how coin mixing works? It combines lots of transactions into one big jumble, so your anonymous transactions stay, well, anonymous. By using these mixing protocols, financial privacy gets a solid lift.

Just imagine tossing your money into a big hat with everyone else’s; try picking out yours now! This clever step helps dodge prying eyes on the public ledger.

Challenges Facing Privacy Coins in Web3

Facing privacy coins in Web3, we see some tough hurdles ahead, folks. These coins, like Monero (XMR) and Zcash (ZEC), often get a bad rap for possibly aiding illicit stuff, such as money laundering.

Critics point fingers, saying these anonymous transactions might hide shady dealings on darknet markets. It’s a real thorn in the side, making many wary of using or supporting them.

Add to that, their liquidity and adoption lag far behind giants like Bitcoin (BTC). So, getting widespread use feels like chasing a wild goose sometimes.

On top of that mess, regulatory scrutiny is tightening like a vise. Governments and groups, such as the Financial Crimes Enforcement Network, demand compliance with strict KYC and anti-money laundering (AML) rules.

This clash with privacy by default creates a sticky situation for coins aiming to shield user data. Plus, there’s a looming shadow from quantum computing; it could crack the cryptographic techniques, like zero-knowledge proofs, that keep these transactions safe.

Talk about a storm brewing for financial privacy in decentralized finance (DeFi)!

Regulatory Concerns and Global Perspectives

Hey there, let’s chat about the big hurdles privacy coins face around the world. Countries like Japan in 2018, South Korea, Australia, and even Dubai in 2023 have banned these coins outright.

Why? Well, folks in power worry about stuff like money laundering, tax evasion, and even terrorism financing. Privacy coins, with their anonymous transactions, can hide shady dealings, and that’s a red flag for many governments.

It’s like giving someone a mask at a party; you just don’t know who’s behind it.

Now, check this out, major exchanges like Bittrex kicked privacy coins off their platforms back in 2021. Add to that, the Financial Action Task Force, or FATF, dropped guidance in June 2022, pushing nations to tackle risks tied to these coins.

Over in the EU, there’s talk of stopping financial institutions from handling anonymity tools like Monero or Zcash. It’s a tough spot, balancing data privacy with regulatory compliance, and privacy coins are right in the hot seat.

Takeaways

Well, folks, we’ve journeyed through the hidden corners of Web3 anonymity with these seven privacy coins. Each one, from Monero to Decred, fights hard to shield your financial privacy on the blockchain.

Isn’t it wild how tech like ring signatures and zero-knowledge proofs can guard your transactions? Let’s keep chatting about how these tools shape a freer digital world. Drop your thoughts, I’m all ears!

FAQs

1. What are privacy coins, and why do they matter in Web3?

Hey, let’s chat about privacy coins, those digital tokens like Monero (XMR) and Zcash (ZEC) that guard your financial privacy. They use slick tricks like ring signatures and zero-knowledge proofs to keep anonymous transactions under wraps. In a Web3 world full of public ledgers like the Bitcoin blockchain, they’re your secret handshake for data privacy.

2. How does Monero (XMR) keep my transactions hidden?

Monero (XMR) is like a cloak of invisibility for your cryptocurrency transactions. It leans on ring confidential transactions (RingCT) and stealth addresses to mask who’s sending what to whom.

3. What makes Zcash (ZEC) stand out among privacy coins?

Zcash (ZEC) is a bit of a shape-shifter in the decentralized finance (DeFi) space. It offers shielded transactions using zero-knowledge proofs, letting you pick between private or open dealings on its hybrid blockchain. Pretty neat for dodging prying eyes, right?

4. Can privacy coins like Dash (DASH) dodge regulatory challenges?

Well, Dash (DASH) with its X11 hashing algorithm tries to keep things hush-hush for users. But, let’s be real, rules from groups like the Financial Action Task Force (FATF) and South Korea cryptocurrency regulations often clash with privacy by default. Issues like money laundering and tax evasion keep anti-money laundering (AML) folks on high alert.

5. Are there risks with privacy coins on decentralized exchanges?

Oh, you bet there are hiccups with privacy coins on a decentralized exchange. While they’re champs at hiding stuff with cryptographic techniques like homomorphic encryption, some fear they could be tied to terrorist financing or other shady deals. It’s a tightrope walk between financial privacy and regulatory compliance, my friend.

6. How do coins like Decred (DCR) and Beldex (BDX) fit into Web3 anonymity?

Let’s chew the fat about Decred (DCR) and Beldex (BDX), two players in the privacy game. Decred mixes decentralized governance with proof of stake for secure dealings, while Beldex uses private blockchains to bolster anonymity. Both aim to shield your moves in decentralized applications (DApps), kinda like a digital fortress in the wild Web3 landscape.