As an educator, you dedicate your time and expertise to shaping young minds. But did you know there are ways to reduce your taxable income legally and maximize your savings? Understanding tax deductions and leveraging smart financial strategies can help you keep more of your hard-earned money.

This comprehensive guide explores 8 Tax-Saving Tips for Teachers in Australia, covering work-related expenses, education costs, and salary sacrificing opportunities to help you optimize your tax return.

We will also provide real-life examples, practical tips, and tables to help you navigate your tax-saving options efficiently.

Understanding Tax Deductions for Teachers in Australia

Tax deductions allow teachers to claim expenses incurred in their profession, reducing their taxable income. By understanding eligible deductions and ATO guidelines, you can legally maximize savings while staying compliant.

Why Tax Deductions Matter for Teachers

- Reduces taxable income, leading to a lower tax bill.

- Ensures fair reimbursement for work-related expenses.

- Helps teachers reinvest savings into professional development.

- Encourages financial planning and future savings.

What Expenses Can Teachers Claim?

Teachers can claim a variety of expenses, provided they are directly related to their job and not reimbursed by their employer. Understanding these categories can ensure that teachers maximize their claims effectively.

Work-Related Expenses

| Expense Type | Examples | Claimable Amount |

| Teaching Materials | Books, stationary, posters | 100% if used for work |

| Work-Related Travel | Fuel, public transport fares | Proportionate to work use |

| Professional Memberships | Union fees, teacher associations | Fully deductible |

| Work-Related Technology | Laptops, software, internet costs | Percentage of work use |

Education and Professional Development Costs

| Eligible Course Type | Examples | Claimable? |

| Postgraduate Education | Masters in Education | Yes |

| Professional Workshops | Classroom management training | Yes |

| Certification Courses | Special education programs | Yes |

| General Courses | Non-work related courses | No |

Teaching Materials and Equipment

- Whiteboard markers, posters, and learning aids.

- Software and educational apps.

- Work-related electronics like tablets and e-readers.

8 Tax-Saving Tips for Teachers in Australia

Maximizing tax deductions is essential for teachers looking to reduce their taxable income and increase savings. From work-related expenses to salary sacrificing, there are various ways educators can take advantage of available tax benefits.

By staying informed and organized, teachers in Australia can ensure they are making the most of their deductions while remaining compliant with ATO guidelines.

Tip 1: Claim Work-Related Expenses Efficiently

Keeping track of work-related expenses ensures you claim all allowable deductions. Many teachers spend hundreds of dollars annually on classroom supplies, technology, and memberships that they can claim but often forget.

Proper documentation and knowledge of claimable expenses can significantly impact the amount of tax refund received. Teachers should also be aware of specific ATO guidelines regarding work-related expenses, ensuring compliance while maximizing benefits. Leveraging digital tools and systematic record-keeping can simplify the process and help avoid missed deductions.

Eligible Deductions for Teaching Professionals

| Expense | Example | Claimable? |

| Uniforms | School-logo attire | Yes |

| Teaching Supplies | Markers, books, subscriptions | Yes |

| Work-Related Internet | Portion used for lesson planning | Yes |

Best Practices for Keeping Expense Records

- Maintain receipts for all purchases.

- Use a dedicated work-related bank account.

- Leverage expense-tracking apps like Expensify or ATO myDeductions.

- Regularly review deductible expenses to avoid missing claims.

Tip 2: Maximize Self-Education Tax Deductions

Pursuing further education enhances career growth and provides tax advantages. Many teachers invest in professional development but may not realize they can claim these expenses on their tax return. Eligible expenses include tuition fees, course materials, and even travel costs for attending relevant training sessions.

By taking advantage of these deductions, educators can improve their qualifications while reducing their taxable income. It is essential to maintain proper documentation, including receipts and proof of course completion, to ensure compliance with ATO guidelines and maximize potential savings.

Courses and Training That Qualify for Deductions

| Course Type | Example | Claimable? |

| Accredited Degree | Master of Education | Yes |

| Online Certification | Teaching with Technology | Yes |

| Language Course | French for Teachers | No |

How to Claim Education Expenses Properly

- Keep tuition receipts and study material invoices.

- Ensure the course directly relates to your job.

- Deduct travel costs for attending training sessions.

- Maintain proof of course completion in case of an audit.

Tip 3: Deduct Work-Related Travel Costs

Many teachers travel for work, whether for professional development, conferences, or school-related duties. These trips often involve expenses such as transportation, accommodation, and meals, many of which can be tax-deductible if they meet ATO guidelines.

Knowing what qualifies for deductions can help maximize your tax savings and prevent missed opportunities. Teachers should keep a detailed log of their work-related travel, including receipts and purpose documentation, to ensure they claim all eligible expenses accurately.

When Can Teachers Claim Travel Expenses?

- Attending professional development workshops.

- Traveling between schools or teaching locations.

- Work-related field trips (if not reimbursed).

| Travel Type | Example | Claimable? |

| Daily Commute | Home to school | No |

| School Visits | Between two schools | Yes |

| Conference Attendance | Out-of-town education seminar | Yes |

Understanding ATO Rules on Work Travel

- Daily commutes between home and work are not deductible.

- Keep a travel log for mileage-based claims.

- Store fuel receipts and transport fare records.

Tip 4: Claim Teaching Materials and Resources

Many teachers pay out-of-pocket for classroom supplies and teaching resources. These expenses can add up quickly, making it essential to track every purchase meticulously. Eligible deductions include stationery, textbooks, software subscriptions, and online educational tools, all of which contribute to classroom efficiency.

Keeping a detailed log and storing receipts ensures that teachers claim the maximum allowable amount, reducing overall taxable income and maximizing financial benefits.

| Item | Example | Claimable? |

| Stationery | Pens, notebooks | Yes |

| Digital Tools | Educational apps, subscriptions | Yes |

| Furniture | Desk, chair for classroom | No |

Tip 5: Leverage Home Office Deductions

Many teachers work from home to prepare lesson plans, grade assignments, and conduct online classes. These work-from-home activities can lead to significant expenses, including electricity, internet, and office supplies. Home office expenses can be claimed as deductions, but they must meet ATO guidelines, which require that these costs are directly related to income-generating work.

Teachers should keep detailed records, including receipts and a log of work hours, to substantiate their claims. Additionally, choosing the right deduction method—fixed rate or actual cost—can significantly impact the amount saved on taxes.

Eligible Home Office Expenses

| Expense | Example | Claimable? |

| Electricity | Power usage for work hours | Yes |

| Internet | Work-related portion of the bill | Yes |

| Office Supplies | Paper, printer ink, software | Yes |

| Furniture | Desk, ergonomic chair | No |

Best Practices for Claiming Home Office Expenses

- Keep detailed records of work-from-home hours.

- Use ATO’s fixed-rate method or actual expense method.

- Ensure receipts and logs are well-maintained for audits.

Tip 6: Utilize Tax Benefits for Work-Related Technology

Technology is vital for modern teaching, enabling educators to create interactive lessons, manage online classrooms, and enhance student engagement. Many tech-related expenses qualify for tax deductions, including the cost of purchasing and maintaining laptops, tablets, and specialized software for lesson planning. Teachers can also claim internet expenses proportional to their work-related use, ensuring that they maximize deductions while staying compliant with ATO guidelines. Staying updated with the latest educational technology trends can also help in choosing tools that are both effective for teaching and eligible for tax benefits.

Common Tech Deductions

| Item | Example | Claimable? |

| Laptop | Used for lesson planning | Yes |

| Software | Educational subscriptions | Yes |

| Internet Plan | Work-related portion | Yes |

How to Maximize Tech Deductions

- Ensure work-related tech usage is documented.

- Claim depreciation for expensive purchases over $300.

- Check ATO rules for instant asset write-offs.

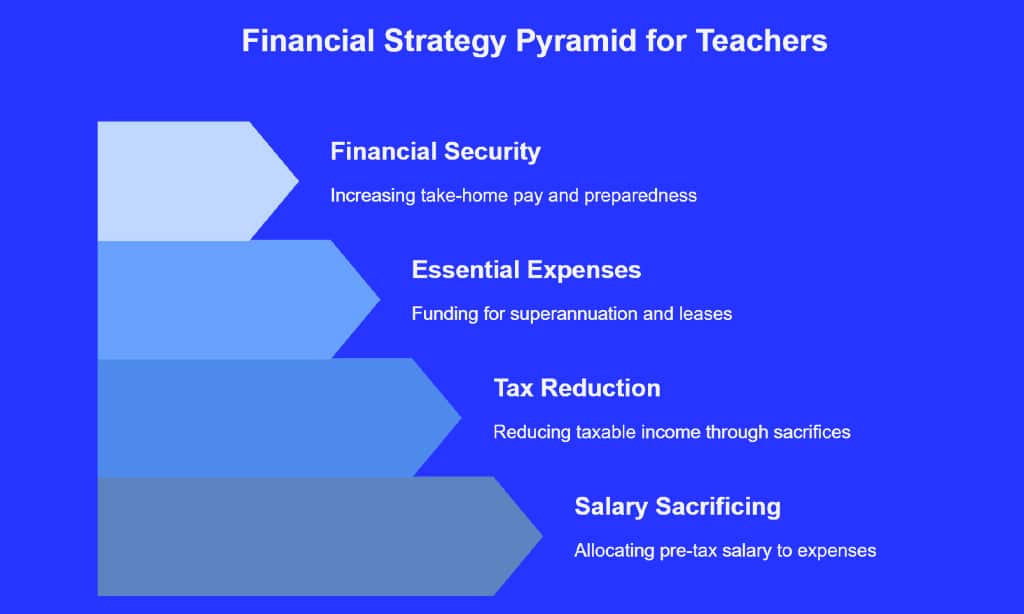

Tip 7: Salary Sacrificing for Teachers – A Smart Move

Salary sacrificing allows teachers to allocate part of their pre-tax salary into specific expenses, reducing taxable income. This strategy enables educators to set aside funds for essential expenses like superannuation, car leases, or work-related professional fees before tax is applied, ultimately lowering their overall tax liability.

By doing so, teachers can increase their take-home pay while ensuring they are financially prepared for future needs. Understanding how to structure a salary sacrifice arrangement with their employer can help teachers maximize their benefits and long-term financial security.

Benefits of Salary Sacrificing

- Reduces taxable income.

- Increases take-home pay.

- Enhances superannuation benefits.

Common Salary Sacrifice Options

| Expense Type | Example | Benefit |

| Superannuation | Extra contributions | Tax savings |

| Car Leasing | Work vehicle | Lower tax rate |

| Professional Fees | Union memberships, courses | Deductible |

Tip 8: Stay Updated on ATO Tax Guidelines for Teachers

Tax regulations change often, making it crucial to stay informed. Teachers who stay updated on tax law changes can maximize their deductions and avoid penalties. The Australian Taxation Office (ATO) frequently updates policies related to work-related expenses, salary sacrificing, and deductions for professional development.

Keeping track of these changes ensures that teachers take full advantage of allowable deductions while maintaining compliance with tax laws.

How to Stay Compliant

- Regularly check ATO website updates and subscribe to their newsletter.

- Attend professional finance workshops or online webinars tailored for educators.

- Consult a tax professional for tailored advice to ensure accurate and optimized filings.

- Join teacher associations that provide updates on tax-related matters.

- Keep thorough documentation of all deductions to support claims in case of an audit.

Takeaways

By implementing these 8 tax-saving tips for teachers in Australia, educators can legally reduce their taxable income while maximizing financial benefits. Understanding allowable deductions, maintaining accurate records, and leveraging salary sacrifice opportunities ensure a stress-free tax season.

Start planning today, and make the most of your tax-saving opportunities!