Fraud has been a persistent issue in the financial technology (Fintech) industry, with cybercriminals constantly devising new ways to exploit vulnerabilities. As digital transactions increase, so does the sophistication of fraud tactics, making traditional fraud detection methods insufficient.

This is where artificial intelligence (AI) steps in, revolutionizing fraud prevention and detection. AI-driven fraud detection systems analyze vast amounts of data in real-time, identifying anomalies, reducing false positives, and enhancing security.

This article explores how AI improves fraud detection in the Fintech world, discussing its applications, benefits, challenges, and future potential. We will also examine real-world examples of AI in action, emerging trends, and regulatory considerations shaping AI-driven fraud prevention.

Understanding Fraud Detection in Fintech

Fraudsters use various techniques to exploit financial institutions and consumers. The most common types of fraud in Fintech include:

| Fraud Type | Description | Example |

| Identity Theft | Using stolen personal information to open accounts or conduct fraudulent transactions. | Fraudsters use stolen SSNs to take out loans. |

| Payment Fraud | Unauthorized transactions using stolen credit/debit card details or digital payment credentials. | Fraudulent online purchases using leaked card details. |

| Account Takeover | Cybercriminals hijack user accounts by bypassing security measures. | Hackers gain access to bank accounts and transfer funds. |

| Money Laundering | Concealing illicit funds through a series of transactions to make them appear legitimate. | Shell companies used to move illegal funds through multiple accounts. |

Fraud in Fintech is continuously evolving, requiring innovative solutions like AI to stay ahead of malicious actors.

Traditional Fraud Detection vs. AI-Powered Systems

| Traditional Fraud Detection | AI-Powered Fraud Detection |

| Rule-based, requiring manual updates | Self-learning and adaptive |

| High false positives | Reduces false positives with precise anomaly detection |

| Slow response to new fraud tactics | Real-time threat detection and mitigation |

| Struggles with large-scale data | Analyzes vast data sets in milliseconds |

Traditional fraud detection methods rely on predefined rules, making them ineffective against evolving threats. AI-powered fraud detection, on the other hand, continuously learns from data patterns and adapts to new fraud techniques, providing a more dynamic and effective defense.

How AI Improves Fraud Detection in the Fintech World?

Machine learning (ML), a subset of AI, plays a crucial role in fraud detection by identifying patterns and predicting fraudulent activities. Key aspects include:

| ML Technique | Function in Fraud Detection |

| Supervised Learning | AI models trained with labeled data detect fraud based on historical cases. |

| Unsupervised Learning | Identifies new fraud patterns without prior labeled data. |

| Reinforcement Learning | Continuously improves fraud detection based on feedback loops. |

Role of Natural Language Processing (NLP) in Fraud Detection

Natural language processing (NLP) helps analyze text-based data, such as:

- Analyzing Customer Support Chats: Detects suspicious inquiries related to account access.

- Sentiment Analysis: Identifies fraudulent intent in emails, messages, or transaction descriptions.

- KYC Document Verification: Ensures legitimacy by scanning and validating submitted documents.

| NLP Use Case | How It Enhances Fraud Detection |

| Email Scanning | Detects phishing attempts and suspicious requests. |

| Text Mining | Identifies fraud patterns in financial transactions. |

| Voice Recognition | Enhances biometric security and fraud detection. |

Behavioral Analytics and Real-Time Fraud Detection

AI-driven behavioral analytics track user actions to detect anomalies. Key techniques include:

- User Activity Monitoring: Tracks login locations, transaction habits, and device usage.

- Keystroke Dynamics: Identifies users based on typing patterns.

- Mouse Movement Tracking: Detects robotic or unusual activity.

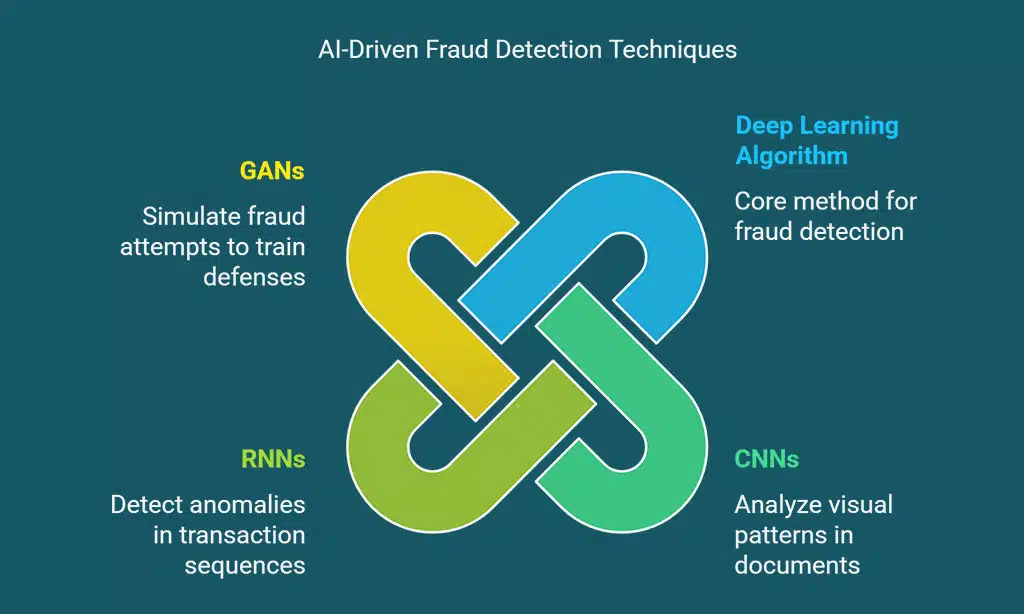

Deep Learning and AI Algorithms for Fraud Detection

Deep learning utilizes neural networks to detect sophisticated fraud techniques. AI-driven fraud prevention includes:

| Deep Learning Algorithm | Application in Fraud Detection |

| CNNs (Convolutional Neural Networks) | Analyze visual patterns in fraudulent documents. |

| RNNs (Recurrent Neural Networks) | Detect anomalies in transaction sequences. |

| GANs (Generative Adversarial Networks) | Simulate fraud attempts to train AI defenses. |

Key Benefits of AI in Fintech Fraud Detection

The integration of AI in fraud detection has transformed the Fintech industry by offering innovative solutions that enhance security, efficiency, and customer trust. AI-powered fraud detection systems not only detect fraudulent activities more accurately but also adapt to evolving threats. From reducing false positives to enabling real-time fraud prevention, AI is becoming an indispensable tool for financial institutions. Below, we explore the key benefits of how AI improves fraud detection in the Fintech world.

Enhanced Accuracy and Speed

- AI can analyze millions of transactions per second to detect fraud in real time.

- Reduces false positives, ensuring genuine users are not flagged incorrectly.

Cost-Effectiveness and Efficiency

- AI automates fraud detection, reducing manual review costs.

- Minimizes financial losses caused by fraudulent transactions.

Adaptability and Continuous Learning

- AI evolves to counter new fraud tactics without manual updates.

- Self-learning models improve fraud detection over time.

Challenges and Ethical Considerations in AI-Based Fraud Detection

As AI continues to revolutionize fraud detection in the Fintech industry, it also presents new challenges and ethical dilemmas. While AI-powered systems enhance security and efficiency, concerns surrounding data privacy, biases, and regulatory compliance cannot be overlooked. Understanding these issues is crucial for financial institutions looking to implement AI-driven fraud detection solutions responsibly.

Data Privacy and Security Concerns

The implementation of AI in fraud detection requires access to vast datasets to improve its accuracy and efficiency. However, this dependency raises serious concerns about user privacy, as financial institutions collect and analyze sensitive information, such as transaction histories, personal details, and behavioral data.

Unauthorized access or breaches of such data can lead to identity theft, financial loss, and reputational damage.

Additionally, AI systems must comply with data protection regulations such as the General Data Protection Regulation (GDPR) in Europe and the California Consumer Privacy Act (CCPA) in the United States. Failure to meet these regulatory standards can result in hefty fines and loss of customer trust.

To mitigate these risks, Fintech companies must implement robust encryption, anonymization techniques, and strict access controls. Additionally, businesses should educate customers about data usage policies and offer transparency regarding how their information is stored and processed.

| Privacy Concern | Impact on Fraud Detection | Mitigation Strategy |

| Data Collection | Large datasets increase risk of breaches. | Encryption, anonymization, access control. |

| Compliance Regulations | Non-compliance leads to legal consequences. | Regular audits, adherence to GDPR, CCPA. |

| Customer Trust | Privacy concerns may deter AI adoption. | Transparent policies, user consent. |

AI Bias and Model Interpretability

AI fraud detection models are only as good as the data they are trained on. If the dataset contains historical biases—such as profiling certain demographics as higher risk—AI may perpetuate unfair discrimination. For example, if past fraud cases disproportionately flagged transactions from certain regions or economic backgrounds, the AI model could wrongly associate legitimate transactions from these areas as fraudulent, leading to financial exclusion.

Another significant challenge is AI’s lack of interpretability. Many AI models, particularly deep learning algorithms, function as “black boxes,” making it difficult to understand why a particular transaction was flagged as fraudulent. This lack of transparency can create regulatory compliance challenges and erode user trust. Regulators, financial institutions, and customers increasingly demand explainable AI (XAI) that provides insights into decision-making processes.

To address bias, Fintech firms should adopt diverse training datasets, implement regular bias audits, and ensure AI-driven decisions are reviewed by human analysts. Developing interpretable AI models, such as decision trees and rule-based algorithms, can also enhance transparency.

| AI Challenge | Potential Risk | Solution |

| Data Bias | Discriminatory fraud detection | Diverse training datasets, bias audits. |

| Lack of Transparency | Difficult to explain AI decisions | Explainable AI models, human oversight. |

| Regulatory Scrutiny | AI may not meet legal standards | Compliance audits, ethical AI frameworks. |

Future of AI in Fintech Fraud Prevention

The rapid advancements in artificial intelligence are shaping the future of fraud detection in the Fintech industry. AI-driven fraud prevention is no longer just a reactive tool but a proactive force that predicts, detects, and mitigates fraudulent activities before they cause harm. With increasing digital transactions and sophisticated cyber threats, AI will play a central role in safeguarding financial systems. By leveraging next-generation technologies, Fintech companies can strengthen fraud detection mechanisms, enhance security, and maintain regulatory compliance.

Emerging AI Technologies for Fraud Detection

The future of fraud detection in Fintech is being shaped by cutting-edge AI innovations that promise greater accuracy, speed, and security. Some of the most promising technologies include:

- Blockchain Integration: Combining AI with blockchain technology enhances fraud prevention by creating immutable, transparent transaction records. AI can analyze blockchain transactions to detect suspicious activities, preventing fraud in real time.

- Quantum Computing: As quantum computing develops, it will revolutionize fraud detection by enabling faster, more complex data analysis. This advancement will allow AI models to detect intricate fraud patterns that current computing power struggles to process.

- Federated Learning: This AI approach allows multiple institutions to train fraud detection models without sharing raw data, addressing privacy concerns while enhancing collaborative fraud prevention efforts.

| Technology | Benefit in Fraud Detection |

| Blockchain | Immutable transaction records, real-time fraud prevention. |

| Quantum Computing | Faster fraud detection through complex data processing. |

| Federated Learning | Collaborative fraud detection while preserving data privacy. |

Evolving Threats and AI’s Role in Combating Future Fraud

As AI advances in fraud prevention, cybercriminals are also leveraging AI to develop more sophisticated fraud techniques. AI-powered fraud attacks, such as deepfake identity fraud and AI-generated phishing scams, are becoming increasingly difficult to detect using traditional security measures. This evolution creates an AI vs. AI battleground, where Fintech firms must continuously update their fraud detection models to outpace cybercriminals.

Additionally, predictive analytics will play a vital role in future fraud prevention strategies. By analyzing past fraud trends, AI can anticipate potential threats before they occur, allowing financial institutions to implement proactive security measures rather than just reactive ones.

To stay ahead, Fintech companies should invest in AI-powered cybersecurity defenses, implement multi-layered authentication protocols, and integrate AI with real-time risk assessment tools to combat emerging threats effectively.

| Evolving Threat | Impact on Fintech | Countermeasure |

| AI-Powered Fraud | Cybercriminals use AI to bypass security. | Advanced AI-driven fraud detection. |

| Deepfake Identity Theft | Fraudsters create synthetic identities. | Biometric verification, multi-factor authentication. |

| AI-Generated Phishing Scams | More realistic and convincing scams. | AI-based email and message scanning tools. |

Takeaways

As financial fraud evolves, AI remains the most powerful tool for Fintech companies to detect and prevent fraud in real time. How AI improves fraud detection in the Fintech world is evident through its ability to analyze massive datasets, detect complex fraud patterns, and adapt to emerging threats.

Despite challenges like data privacy and AI bias, the future of AI in Fintech security looks promising, ensuring safer transactions and improved financial security.

Fintech companies must invest in AI-driven fraud detection to stay ahead of cybercriminals and protect their customers. AI’s transformative power in fraud prevention is not just an advantage—it’s a necessity for the future of secure digital finance.