Health insurance is a cornerstone of financial and medical security, but sometimes, a basic policy isn’t enough. With rising healthcare costs and evolving health needs, customizing your health insurance with add-ons has become a necessity in 2025.

These optional features, also known as riders, help fill gaps in standard policies, offering more comprehensive coverage and peace of mind. If you’re looking to enhance your plan, exploring add-ons for health insurance is a great way to secure additional benefits and safeguard your future.

In this article, we’ll dive into five essential add-ons for your health insurance policy in 2025, detailing their benefits, who should consider them, and why they’re more relevant than ever. Whether you’re a seasoned insurance policyholder or a first-time buyer, this guide will help you make informed decisions for your health and financial well-being.

Why You Should Consider Add-Ons for Health Insurance in 2025

Health insurance riders provide additional coverage tailored to specific needs, ensuring you’re better prepared for unforeseen medical events. As medical advancements and specialized treatments grow, so do healthcare expenses. Here are some key reasons add-ons for health insurance matter:

- Cost Management: Add-ons cover specialized treatments and expenses that basic policies exclude, reducing out-of-pocket costs.

- Flexibility: You can customize your plan to suit your unique health and lifestyle needs.

- Enhanced Security: Riders offer protection against specific risks, like critical illnesses or accidents, ensuring financial stability during emergencies.

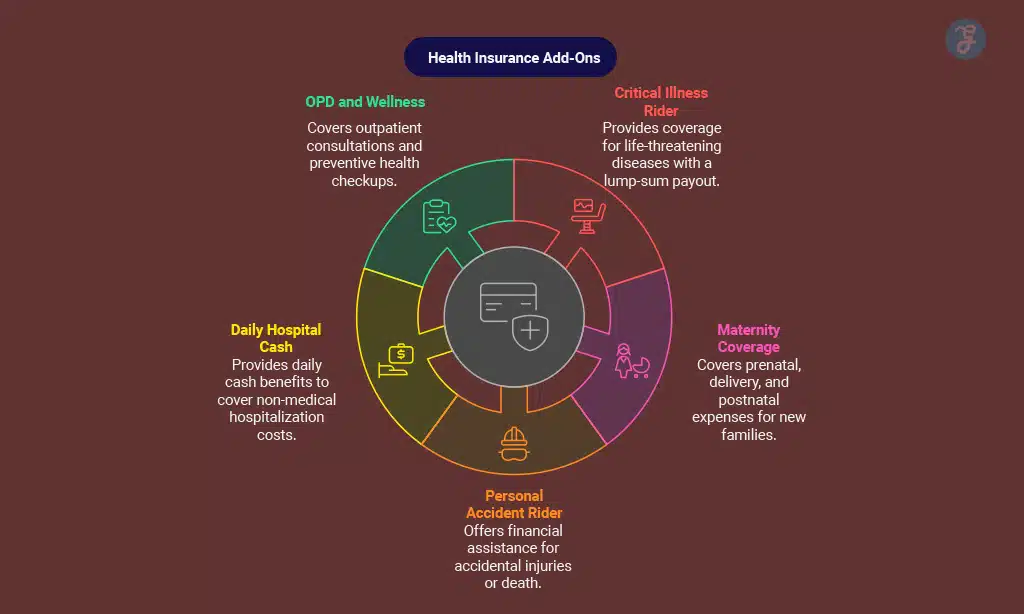

Overview of the Top 5 Health Insurance Add-Ons

Let’s explore the five most essential add-ons for health insurance you should consider in 2025.

1. Critical Illness Rider

A critical illness rider provides coverage for life-threatening diseases such as cancer, heart attack, kidney failure, and stroke. Upon diagnosis, you receive a lump-sum payout to cover medical expenses, treatment costs, and even lifestyle adjustments like home modifications.

Why It’s Essential:

- Covers high-cost treatments.

- Offers financial support during recovery, when you might be unable to work.

- Particularly useful if you have a family history of critical illnesses.

Ideal For:

- Individuals with high-risk jobs or lifestyles.

- People with a family history of serious illnesses.

At a Glance:

| Feature | Details |

| Diseases Covered | Cancer, stroke, heart attack, kidney failure, etc. |

| Benefits | Lump-sum payout upon diagnosis |

| Waiting Period | Typically 90 days |

| Who Needs It? | High-risk individuals, families with medical history |

2. Maternity and Newborn Coverage

Maternity and newborn coverage is a vital add-on for young families or couples planning children. It covers prenatal care, delivery costs, and postnatal expenses, including newborn screenings and vaccinations.

Why It’s Essential:

- Reduces financial stress related to childbirth and newborn care.

- Covers both normal and cesarean deliveries.

Ideal For:

- Young couples.

- Women planning pregnancies.

At a Glance:

| Feature | Details |

| Coverage | Prenatal care, delivery, newborn care |

| Benefits | Reduces out-of-pocket maternity costs |

| Waiting Period | Typically 9-24 months |

| Who Needs It? | Young families, expectant parents |

3. Personal Accident Rider

A personal accident rider provides financial assistance in case of accidental injuries, permanent disability, or death. This rider ensures your loved ones are financially secure, even in unfortunate situations.

Why It’s Essential:

- Covers unforeseen accidents and related costs.

- Provides financial support to families after loss of income.

Ideal For:

- Individuals in high-risk professions (construction, travel).

- Families looking for extra security.

At a Glance:

| Feature | Details |

| Coverage | Accidental death, disability, hospitalization |

| Benefits | Lump-sum or regular payouts |

| Exclusions | Self-inflicted injuries |

| Who Needs It? | High-risk jobholders, families |

4. Daily Hospital Cash Benefit

This add-on provides a fixed daily payout for each day you’re hospitalized. It helps cover non-medical expenses like food, travel, or lodging for accompanying family members.

Why It’s Essential:

- Eases financial burden of non-medical costs during hospitalization.

- Useful for people with regular hospital visits due to chronic conditions.

Ideal For:

- Individuals with chronic illnesses.

- Families supporting elderly members.

At a Glance:

| Feature | Details |

| Benefit Amount | Fixed daily cash payout |

| Coverage Period | Depends on policy terms |

| Suitable For | Chronic illness patients, elderly care |

| Exclusions | Pre-existing conditions may apply |

5. OPD and Wellness Add-On

Outpatient Department (OPD) and wellness add-ons cover expenses for consultations, diagnostic tests, and preventive health checkups. These costs are typically not included in standard health insurance.

Why It’s Essential:

- Promotes preventive care and early diagnosis.

- Saves on regular healthcare costs.

Ideal For:

- Individuals with frequent doctor visits.

- Families prioritizing preventive health.

At a Glance:

| Feature | Details |

| Coverage | OPD consultations, diagnostic tests, wellness programs |

| Benefits | Saves on routine healthcare costs |

| Exclusions | Cosmetic or elective treatments |

| Who Needs It? | Families, individuals with regular medical needs |

Factors to Consider When Choosing Add-Ons for Health Insurance

Selecting the right add-ons depends on your individual and family needs. Consider these factors:

- Health History: Review your medical history and potential risks.

- Budget: Ensure the premium for add-ons is affordable.

- Waiting Periods: Check the waiting period for each add-on.

- Policy Terms: Understand coverage limits and exclusions.

Benefits of Adding These Riders to Your Policy

Investing in these add-ons for health insurance brings several benefits:

- Financial Security: Reduces unexpected out-of-pocket expenses.

- Comprehensive Coverage: Protects against specific risks excluded from basic plans.

- Customized Policies: Tailor your insurance to meet individual needs.

FAQs

What are health insurance add-ons?

Add-ons are optional features that extend the coverage of your basic health insurance policy to address specific needs.

Are health insurance riders expensive?

While riders add to your premium, they offer significant savings during emergencies by covering high-cost treatments or risks.

How do I choose the best health insurance add-on?

Assess your health risks, budget, and lifestyle to select add-ons that complement your basic policy.

Takeaways

Health insurance add-ons are no longer optional luxuries—they are essential tools for comprehensive financial protection. Exploring add-ons for health insurance ensures you’re prepared for critical illnesses, maternity costs, accidents, hospitalization expenses, and outpatient care.

By choosing the right add-ons, you can secure better health coverage and reduce financial stress. Start evaluating your health insurance policy today to discover how add-ons for health insurance can provide the coverage you need for a healthier, more secure future!