Hey there, are you curious about making some extra cash with your crypto, but feeling unsure amid all the choices? You’re not alone, my friend. Many folks jump into cryptocurrencies hoping for big gains, only to trip over confusing terms like yield farming.

It’s like trying to solve a puzzle without all the pieces, right?

Well, here’s a little insight to consider: yield farming is a popular trend in decentralized finance, or DeFi, where you can earn rewards just by lending out your digital coins. Pretty neat, huh? In this post about “5 Things You Should Know About Yield Farming In Crypto,” we’ll break it down into bite-sized chunks.

We’ll cover what it is, how it works with liquidity pools, and even the risks like impermanent loss. Stick with me, and let’s clear up the confusion together! Ready to learn?

Key Takeaways

- Yield farming in crypto lets you earn rewards by lending digital coins on DeFi platforms like PancakeSwap.

- You can get high annual percentage yields (APY), sometimes in triple digits, on platforms like Yearn.Finance.

- Risks include impermanent loss and smart contract flaws that can lead to losing funds.

- Liquidity pools, like a BNB/CAKE pool, are key to earning fees and tokens as a liquidity provider.

- Governance tokens give you voting power in DeFi projects and are often the main reward in yield farming.

What Is Yield Farming in Crypto?

Let’s talk about yield farming in crypto, a cool way to earn rewards. It’s part of decentralized finance, or DeFi, where you put your digital assets into a protocol. Think of it like planting seeds to grow a money tree.

By doing this, you help the system run smoothly and get crypto rewards in return. Often, these come as governance tokens, which are like a say in how things work.

This process, also called liquidity mining, means you add your assets to a DeFi protocol. In exchange, you snag tokens and can reinvest them for even more gains. It’s a neat trick to make passive income with your crypto stash.

Ready to see the nuts and bolts of it? Let’s move on to how yield farming actually works.

How Does Yield Farming Work?

Hey there, readers, let’s chat about yield farming in crypto. It’s a cool way to earn rewards, but how does it actually happen?

- First off, yield farming starts when you pick a platform like PancakeSwap in the decentralized finance (DeFi) space. You join this world by choosing a protocol that fits your goals. These platforms use smart contracts to handle everything, making sure it’s all automatic and secure.

- Next up, you provide liquidity to a pool on a decentralized exchange. This means you deposit two different crypto assets, like in a BNB/CAKE pool, to help with trading. In return, you get a special item called an LP token as proof of your contribution.

- After that, you stake your LP token in a yield farm on the platform. By doing this, you lock up your tokens and start earning crypto rewards. These often come as transaction fees or extra tokens, based on the annual percentage yield (APY).

- Also, know that smart contracts run the show behind the scenes. They lock your tokens safely and dish out rewards when you meet certain rules. It’s like having a robot banker who never sleeps.

- Finally, understand that your locked tokens might be lent out to others. This can create interest rates for you or support liquidity on automated market makers (AMMs). It’s a neat trick to make your crypto work harder while you kick back.

Benefits of Yield Farming

Moving on from how yield farming works, let’s chat about why it’s worth a look. You might find some sweet perks in this crypto space!

- Earn Passive Income Easily: Yield farming lets you make money without lifting a finger. By being a liquidity provider, you add your crypto to liquidity pools on decentralized exchanges. Then, you get crypto rewards or transaction fees as a thank you. It’s like planting a money tree, seriously!

- Score High Yields: Want returns that beat old-school investments? Yield farming can offer interest rates from just a few points to wild triple-digit annual percentage yields (APY). Some platforms in the DeFi ecosystem, like Yearn.Finance, help you snag those high yields. It’s a chance to grow your stash fast.

- Support the DeFi World: When you join in as a liquidity provider (LP), you’re helping decentralized finance (DeFi) thrive. Your funds keep liquidity pools full, making trades smooth on platforms using automated market makers (AMM). Think of it as being the backbone of this new financial system.

- Grab Extra Perks with Tokens: Many yield farming setups give out governance tokens to folks who pitch in. These tokens let you vote on changes in the DeFi project, plus they might grow in value. It’s like getting a bonus prize for playing the game.

- Flex Your Crypto Power: Yield farming opens doors to use your cryptocurrency tokens in fresh ways. Instead of letting them sit idle, toss them into a BNB/Cake pool or similar setups. You’re not just holding coins; you’re making them work for you in the blockchain networks.

Risks Involved in Yield Farming

Now that we’ve explored the sweet perks of yield farming, let’s switch gears and talk about the bumpy side of this crypto journey. Yield farming in the decentralized finance (DeFi) space can be a wild ride, and it’s not all high yields and passive income.

There are real dangers lurking, so let’s break them down in plain terms.

First up, watch out for impermanent loss, a sneaky trap when token price fluctuations hit hard. Your deposited tokens in a liquidity pool might lose value compared to just holding them, even if you earn crypto rewards.

Then, there’s the threat of smart contract vulnerabilities; these flaws can open doors to hackers stealing your funds. Add to that, market volatility in the cryptocurrency world messes with both your rewards and token values.

Plus, yields aren’t steady, they swing based on supply and demand in the DeFi ecosystem. Tread carefully, folks, this isn’t a game without risks!

The Role of Liquidity Pools in Yield Farming

Dive right into the core of yield farming, folks, and you’ll spot liquidity pools as the beating heart. These pools are like giant piggy banks in the DeFi ecosystem, where folks called liquidity providers stash their crypto coins.

Think of depositing BNB and CAKE into a BNB/CAKE pool. You toss in your assets, and bam, you get an LP token as proof of your share. This token is your ticket to earning sweet crypto rewards.

Without these pools, decentralized exchanges couldn’t swap tokens smoothly, so they’re super vital.

Heck, let’s chat about why these pools matter so much for your gains. Liquidity providers, that’s you, help keep trades flowing by adding funds to the mix. In return, you snag transaction fees and other perks when you stake that LP token in a yield farm.

But watch out, okay, because liquidity pool fluctuations can mess with your returns. Slippage might sneak in, cutting down what you earn. Stick around, though, as we jump into governance tokens next and why they’re a big deal.

Governance Tokens and Their Importance

Hey there, let’s chat about governance tokens in yield farming. These little gems in the DeFi ecosystem do more than just sit pretty in your wallet. They incentivize you, the user, to stick around and help shape the platform.

Imagine having a say in a cool club; with governance tokens, you get to vote on big decisions for the project. Plus, most rewards in yield farming come as these tokens, so they’re often your main crypto rewards.

Think of governance tokens as your ticket to influence. Their stability can make or break your profits in this decentralized finance game. If the token’s value holds strong, your earnings look sweet.

But, if it flops, well, your gains might shrink. Many users also pick shorter locking periods with these tokens, so they can jump into hotter, high-yield chances fast. Now, let’s move on to smart ways for boosting those yield farming returns.

Strategies for Maximizing Yield Farming Returns

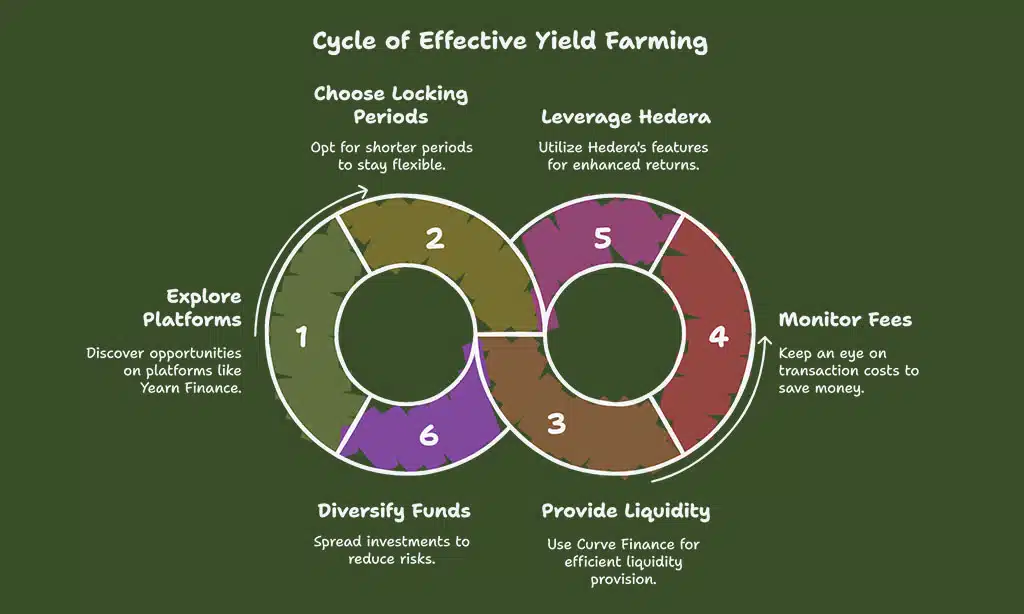

Moving from the power of governance tokens, let’s turn our attention to maximizing your profits in yield farming. I’ve got some useful tips to share with you!

- First, check out platforms like Yearn Finance to increase your annual percentage yield, or APY. These sites compile the best yield farming opportunities for you. They help you secure high returns without needing to monitor constantly. Imagine it as a guide leading directly to riches in the DeFi ecosystem.

- Next, choose shorter locking periods for your crypto assets. Users often favor this to quickly seize better opportunities. It’s like keeping your options open for the next exciting chance in decentralized finance. Staying adaptable can result in greater crypto gains.

- Also, explore Curve Finance for excellent liquidity provision. This platform employs unique strategies to make your funds more effective. It reduces impermanent loss while you serve as a liquidity provider. Think of it as having a savvy advisor for your investments.

- Then, pay attention to transaction fees across blockchains. High costs can diminish your returns like a hidden drain. Always review fees before entering a liquidity pool or staking on a decentralized exchange. Saving a little here can make a big difference over time.

- Another suggestion is to leverage Hedera for yield farming benefits. It provides impressive features like EVM smart contracts and native tokenization. Plus, its staking choices can enhance your returns. View it as a versatile tool for your crypto collection.

- Lastly, distribute your funds across various liquidity pools and platforms. Don’t risk everything in one place, folks. Diversifying reduces dangers like rug pulls or smart contract issues. Stay secure while pursuing those attractive APRs in the DeFi space.

Common Pitfalls to Avoid in Yield Farming

Hey there, let’s chat about some traps in yield farming. Falling into these can hurt your crypto gains, so listen up!

- Watch out for rug pulls in the DeFi ecosystem. These scams happen when project creators take your funds and vanish, leaving you with worthless tokens. It’s like lending your bike to a stranger who rides off forever. Always check the team behind a project before jumping into any decentralized finance deal.

- Don’t ignore smart contract vulnerabilities. Many yield farming platforms rely on smart contracts, but flaws in the code can lead to hacks or losses. Think of it as a leaky bucket; your crypto rewards just slip away. Stick to platforms with audited contracts to keep your funds safer.

- Be cautious of liquidity pool fluctuations. When you become a liquidity provider, price swings can cause slippage and lower returns. It’s like betting on a shaky horse; you might not get the payout you expect. Monitor market conditions closely to avoid getting stuck with reduced gains.

- Avoid locking tokens in low-reward pools. Some liquidity pools offer tiny annual percentage yields (APY), wasting your time and money. Imagine planting seeds in barren soil; you won’t see much growth. Hunt for pools with high yields, but balance that with risk tolerance.

- Stay alert to impermanent loss as a liquidity provider (LP). This happens when the value of your tokens in a pool drops compared to holding them outside. It’s like trading apples for oranges, only to find oranges are worth less now. Understand this risk before joining any automated market maker (AMM) setup.

Takeaways

Well, folks, yield farming in crypto is a wild ride worth exploring. It offers a shot at solid rewards, like passive income through DeFi platforms. But, watch your step, since risks like impermanent loss can sneak up fast.

Keep learning about tools like PancakeSwap to stay ahead. Stick with it, and you might just grow your stash!

FAQs on Yield Farming in Crypto

1. What exactly is yield farming in the crypto world?

Hey, think of yield farming as planting seeds in the decentralized finance (DeFi) garden to grow passive income. It’s all about using your cryptocurrency coins in liquidity pools on a decentralized exchange to earn high yields or crypto rewards. So, you’re basically a liquidity provider, helping out with liquidity provision and snagging some sweet annual percentage yield (APY) in return.

2. How do liquidity pools tie into yield farming?

Well, liquidity pools are the heart of this game in the DeFi ecosystem. As liquidity providers (LPs), you toss your crypto tokens into a pool, like a BNB/Cake pool, and get LP tokens as proof of your stake.

3. What’s the deal with risks like impermanent loss in yield farming?

Listen up, impermanent loss is a sneaky little gremlin in decentralized finance (DeFi). It creeps up when the price of your cryptos in a liquidity pool shifts, costing you more than if you’d just held onto them. Watch out for market conditions, as they can turn your expected annual return into a sour lemon.

4. Are smart contracts safe for yield farming on platforms like Yearn.Finance?

Buddy, smart contracts power the whole show with automated market makers (AMM), but they’re not foolproof. Smart contract vulnerabilities or flaws can lead to nasty surprises, like losing your funds to rug pulls or flash loans gone wrong.

5. Can I earn big with governance tokens through liquidity mining?

Oh yeah, governance tokens can be your golden ticket in crypto staking or liquidity mining. They often come as extra perks for liquidity providers, letting you have a say in the platform while boosting your interest rates or annual percentage rate (APR).