You work hard to hit your financial goals. Yet hidden fees and rising interest rates on credit cards can knock you off track. Payday loans and car title loans can dig you deeper into debt.

Many people feel stuck in a cycle they can’t break.

More than one in ten Americans fall 90 days behind on credit card payments, says the Federal Reserve Bank of New York. In this post, you will spot the eight worst debt traps, from payday loans to home equity line of credit.

You will get tips on building an emergency fund, tracking spending, and using debt consolidation. Ready to break free?

Key Takeaways

- Over one in ten Americans fall 90 days behind on credit card payments (Federal Reserve Bank of New York); issuers can charge $39 late fees, 2–4% cash-advance fees, 5% balance-transfer fees, and up to $695 annual fees, while minimum payments barely cut the principal.

- Payday loans tack on a brutal 521% APR for a two-week $100 advance, and car title loans charge near 300% APR, risk your vehicle title on one missed payment.

- Rent-to-own deals often push total costs hundreds of dollars above fair-market value; subscription traps start at $25 monthly after free trials; no-money-down plans hide 20–30% APR; timeshares add rising maintenance fees and steep exit costs.

- Adjustable-rate mortgages reset after 3–10 years and can spike monthly payments; HELOCs offer 5–10-year draw periods, variable rates, and inactivity fees; missing one payment can put your home at risk.

- Build a $1,000 starter emergency fund, track spending with a budget app, use debt-consolidation calculators, set SMART repayment goals, and seek advice from a certified planner (e.g., Christine Moriarty at MoneyPeace.com or Financial Peace University).

Credit Card Debt

After discussing how debt can sneak up on you, we tackle credit card debt next.

Card issuers heap on fees and interest rates. They charge up to $39 for late payments. Advance fees hit 2-4% of the amount borrowed, and they start right away. Issuers levy 5% on balance transfers.

Annual fees can reach $695. More than one in 10 Americans lag 90 days behind, says the Federal Reserve Bank of New York. This debt trap can crush your credit score fast.

Minimum payments barely chip at the principal. Interest charges mount like a snowball. Borrowers can try a debt consolidation loan or build an emergency fund. A clear repayment plan keeps that snowball small.

Talk to a credit card company or a certified planner for help.

Payday Loans

Credit card debt leaves many folks gasping for cash, so payday lenders hand out a $120 check for a $100 loan over two weeks. That fee bites hard. Rolling the loan over three times tacks on $60 in extra charges.

That math spells a brutal 521 percent APR on a tiny cash advance. Predatory lenders smile at you, while they spin you deeper into a cycle of debt. Many borrowers hit default when they chase minimum payments.

Borrowers hunt that quick fix and tie up their next paycheck. Collateral stays safe, but sky-high interest rates bleed wallets dry. People hurt credit scores when they miss due dates.

They feel trapped, as if loan sharks circle every bill. Instead of grabbing another cash advance, pause small bills, tap a rainy day fund, or use debt consolidation. Installment plans cost way less than a payday trap.

Experts call that smart financial planning.

Car Title Loans

Many shops lend up to half your car’s value by holding your vehicle title. They set interest rates near 300% in this debt trap. Interest charges climb fast. A single late payment can cost you your vehicle.

These high-interest loans can blow a hole in your budget. Use a budget planner or interest calculator before signing, and stash cash in an emergency fund.

Rent-to-Own Agreements

Local shops rent TVs, sofas, and laptops under rent-to-own plans. These installment plans hit consumers with steep interest rates. Total payments often exceed fair-market value by hundreds of dollars.

One missed payment leads to forfeiting the item with no refund.

A budget spreadsheet and a cost calculator show the true price and yank you from a debt trap. You can buy used or open-box items at outlet centers or online marketplaces. These moves slice high-interest loan fees and save your credit score.

You dodge a pricey consumer credit deal and avoid major financial pitfalls.

Adjustable-Rate Mortgages (ARMs)

Adjustable-rate mortgages start with a fixed interest rate. That rate locks in for a 3, 5, 7 or 10 year term. Lenders use a rate index to track market shifts after that. Rate caps limit how much your monthly bill can jump at each reset.

A loan math tool can display how your balance and debt change over time.

Rising payments can hit borrowers hard once the fixed term ends. Missing a payment can hurt your credit score and stability. Some owners end up house poor fast, stuck with high interest charges.

They often chase lower deals with refinancing, but new terms can spawn fresh debt traps. Choosing a 15 year fixed rate loan can guard against surprise hikes.

Home Equity Loans and Lines of Credit (HELOCs)

Taking out a second mortgage or a home equity line of credit locks in your house as collateral. Banks like Nevada State Bank may offer a fixed interest rate or a HELOC with variable interest rates.

The draw period can run five to ten years and agreements may tack on inactivity fees if you leave the line untouched. Some folks tap this credit line for debt consolidation, but they often face higher bills down the road.

Skipping even one payment can put your home on the foreclosure block. That risk makes a HELOC a serious debt trap. Now, onto subscription traps.

Subscription Traps

After paying down HELOC balances, subscription traps can bite your wallet. Deceptive free trials morph into $25 monthly charges. You must read the terms to dodge hidden fees. Fake emails and pop-ups use behavioral advertising to trick you into paying for prizes that do not exist.

Unwanted charges add up fast and can wreck your financial management plan. Tracking every subscription with EveryDollar or a personal finance app puts control back in your hands. This simple step can protect your emergency fund, boost your credit score, and tame those debt traps.

No-Money-Down Plans

Salespeople lure you in with no-money-down plans. They let you take home a new TV or car with zero cash. These deals hide sky high interest rates and fees. Many loans charge 20 to 30 percent APR.

You might pay double the sticker price over time. That makes these schemes a prime debt trap. Buyers lose ground fast when items like electronics lose value. They keep paying when they owe more than the prize is worth.

That cycle can sink someone in consumer debt quick. A smart budget and solid financial management will show how steep those fees can get.

Saving even a small emergency fund stops these pitfalls. A stack of three to six months of living costs gives real breathing room. Ramsey Solutions and personal finance pros preach this rule.

An emergency stash covers unexpected expenses, so you skip high interest loans. You can use installment plans with zero down if you already have cash saved. Bigger purchases make sense when you have money set aside.

Buying a used car cuts costs yet meets your goals. The next section takes a look at Timeshare Purchases.

Timeshare Purchases

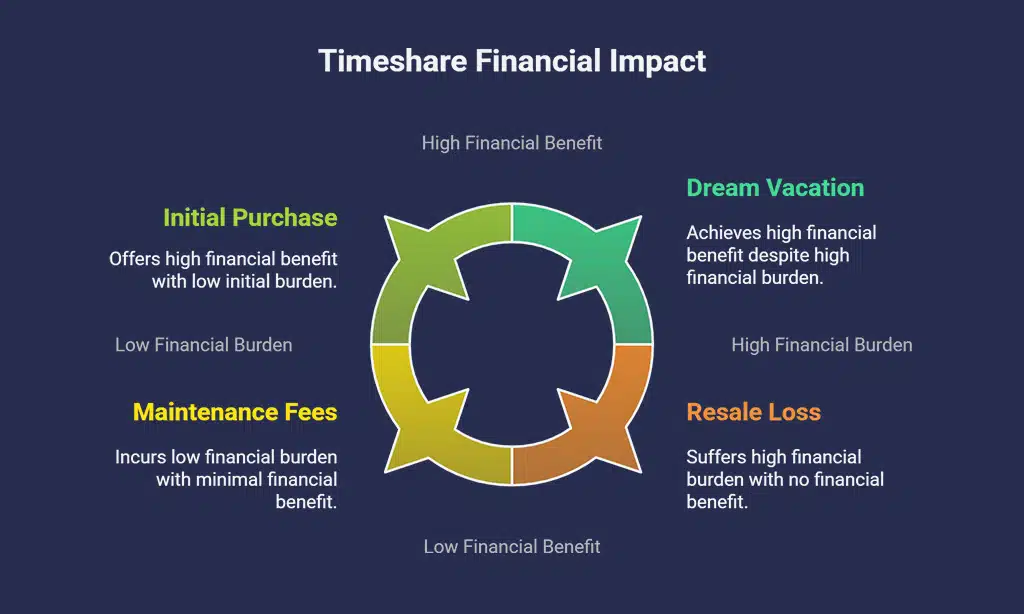

After no-money-down plans, some buyers chase dream vacations via timeshares. Reps lure them with free vacation promos. They sign a vacation property contract on an installment plan, with steep interest charges and hidden fees.

Owners face rising maintenance fees each year. They often struggle to resell, so they sell at a loss. They keep paying, even if they skip a trip. They may miss payments, then face hefty interest charges and credit score drops.

Those ongoing dues can wreck an emergency fund. A debt consolidation plan or a budget tracker may ease bills, but exit fees keep them trapped.

Strategies to Avoid Debt Traps

Plot your spending on a simple spreadsheet or a budget app, and watch the red flags pop up before you slip into a hole. Lock in a sturdy emergency fund, run your debt consolidation options through a loan calculator, then march toward a healthier credit score.

Budget and track your spending

Take out paper or open a budget planner app. List your income and all your bills. Track every coffee and snack like a hawk, so no surprise pops up. Use Pay Off Credit Card or Credit Card Optimizer to compare interest rates and spot high-interest loans.

Read your card agreement to find hidden fees. Mark due dates on a calendar, so you make timely bill payments, boost your credit score, and dodge big interest charges.

Create SMART goals for debt repayment, so you hit specific targets on time. Aim to pay more than the minimum payments to shrink your credit card balance faster. Check your bank and credit card statements each week, to watch your spending habits.

Catch odd fees quickly and avoid a debt trap. Then you can build an emergency fund to stay safe.

Build an emergency fund

Tracking your spending lays the path to a sturdy emergency fund. Open a bank savings account and aim for a $1,000 starting balance. Car repairs, broken appliances, or emergency vet bills can spring up as unexpected expenses and push you into debt traps like payday loans or credit cards with steep interest rates and extra fees.

That fund acts like an umbrella in a storm of bills.

Use a spreadsheet or banking app to funnel money on each payday. Small amounts add up fast in your rainy day reserve. Debt consolidation schemes can hurt your credit score if you swipe paid-off cards again.

Seek Professional Financial Advice

Christine Moriarty at MoneyPeace.com urges readers to stop debting and tackle money monsters head on. A certified financial planner spots rising interest charges and steers you from loan sharking.

Join Financial Peace University for nine lessons on spending habits, debt consolidation, and emergency fund basics. Use a debt consolidation calculator with budget software to check interest rates and payments.

Endorsed pros help with home buying, insurance, retirement plans, and taxes. These experts guide you through a home equity line of credit. They add value and protect your credit score.

Book a session with a financial adviser to set real financial goals. A planner maps out a plan for debt management, minimum payments, and repayment strategies.

Takeaways

Debt traps hide like quicksand around every corner. You can swap high-interest loans for a solid budget, and keep an emergency fund ready. You know payday lenders and title loans can chip away at your wallet.

Build your credit score, skip the minimum payment trap, and set clear financial goals. Use debt consolidation to tame wild interest charges, and track spending each day. Take control now, walk away from baited hooks, and protect your future.

The next time a flashy deal lures you, you will spot the debt trap, and steer clear for good.

FAQs on Worst Debt Traps to Avoid

1. What makes payday loans a debt trap?

Payday loans charge sky-high interest rates, they zap your emergency fund fast, and you face fees when you miss minimum payments. You borrow quick cash, then you dive deeper into debt.

2. How can buy now pay later plans bite you?

Buy now pay later, or BNPL, sounds handy, but missed installment plans and hidden interest charges can trash your credit score. It sneaks up like quicksand on your spending habits.

3. Why is a home equity line of credit risky?

A home equity line of credit uses your house as collateral. You get low rates at first, but they can jump, and missed payments risk foreclosures. It’s a heavy tool for unexpected expenses.

4. How do credit card rewards hide a debt trap?

Rewards points or cash back can feel like free money, but high-interest credit cards can bleed you dry. If you only make minimum payments, interest charges pile up and your credit score will squeak.

5. How can student loan debt derail my goals?

Student loan debt can stretch for decades, it locks you into high-interest loans, and it steals cash you need for home loans or personal loans. A clear debt repayment strategy helps you avoid this financial pitfall.