Figuring out what kind of finance to take when you need a loan or credit card can be a challenging experience. With so many different credit cards and loans available, it can become challenging to know what the best option is.

Many people, when taking out a financial agreement for a loan, know what they need it for. A loan could be for one large purchase or many little things, and your reasons only need to be shared with the company you are going to use for your loan and your financial advisor if you have one.

At some point in most people’s lives, they will look into their borrowing options. The available borrowing options could be a loan, a credit card, or even a mortgage. If you have a financial advisor, it is always advisable to speak with them before making a big financial decision, such as taking out a loan.

If you have a financial advisor, it is in your best interest to follow their advice regarding the type of loan or borrowing options you use. However, if you do not have a financial advisor, the type of loan you take will depend on several different factors, such as how much you wish to borrow and for how long.

Credit Score

Many people will know their credit score, but others may not even know how important this information is. Your credit score starts as soon as you are at legal age to manage your financial agreements.

At some point in life, some people will take a mobile phone contract and forget to pay or will skip a bill so they can use the money for something else. This information is stored and used to show how well you manage your money and financial commitments.

Because the importance of your credit score is not made completely clear at a young age, many people will enter adulthood and negatively affect their credit score unknowingly. A negative credit score is not irreversible. Most of the poor financial agreements and defaults on payments will stay on your credit score for a maximum of 5 years before they will stop having an impact.

What this means is that if you have a poor credit rating, you need to work on it. You can do this with a credit card or a small loan. Most banks will still take a risk when looking at affordability. However, you will often find that your interest rates will be higher than those of someone with a good credit score because you are seen as a high-risk borrower for a loan.

Improving your credit score can be done quickly and easily over a period of time. If you know you have a poor credit score, it could be a good idea to speak with a financial advisor to determine if you can afford a credit card or loan.

A financial advisor can also discuss the options to help build your score before looking at being able to låne penger uten sikkerhet. Your credit score may affect your interest rates more, with collateral included, but this will depend on the company you are making the loan agreement with.

Large Loans

If you are considering taking a large loan, it could be for home repairs or a family holiday. Most loans without collateral have an upper limit of around 600,000 NOK. If you need a larger loan, you should look into a loan with collateral.

Regardless of why you want the loan or if you have a financial advisor you see regularly, it is advisable to see a financial adviser for large loans. A financial adviser will be able to look at how much you want to borrow, alongside what you have that could be collateral to see if the risk of worthwhile for you.

If you are planning to use your house for collateral, for example, this would depend on your house’s value and the current financial agreement for your house. A loan with collateral could take longer to apply for because you will need to show the collateral you are using and give the bank or loan company time to review your request.

Smaller Loans

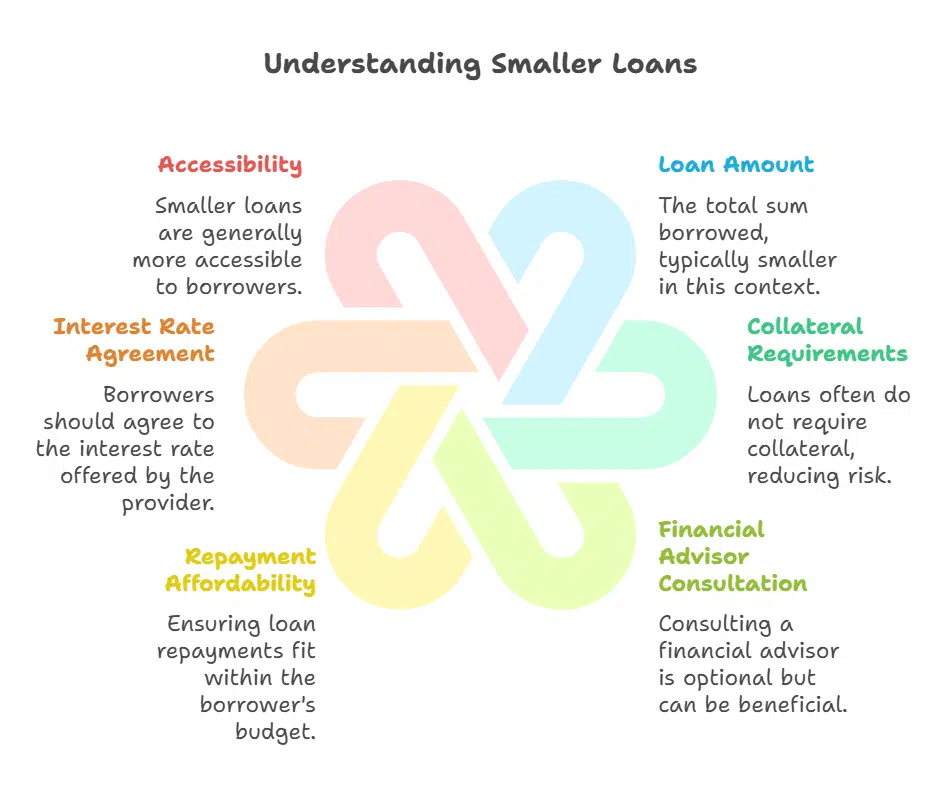

Smaller loans can vary depending on how much you are borrowing. It is not a good financial decision to have many smaller loans. However, if you only need a small, short-term loan to cover the costs of a moving van, for example, having one or two may not be too detrimental.

As these are smaller, you can get a loan without collateral. A loan without collateral could be a safer option if you do not need to borrow as much money and do not want to risk your home for a financial agreement.

You can consult with a financial advisor if you like when looking at a smaller loan, but it is not as necessary. It is important that you know you can afford the repayments within your budget and have checked and agreed to the interest rate offered by the loan provider. If you need to låne penger nå, a smaller loan can be more easily accessible to most.

Collateral or Not?

In many cases, most people will take a loan without collateral. The only exception for this tends to be if the loan is needed to make large repairs or renovations on a home or other property because you can get a much larger loan with collateral.

If you get a loan with collateral, you also risk losing the item you have placed as collateral if you default on your payments or fail to pay back the loan.

Whether this is your house, your car, or some other valuable item, if you fail to make repayments within the terms of your loan, you will be notified of the default, and your collateral will be used to complete payment for your loan. Many people will only use collateral if it cannot be avoided.

If you are considering taking a loan without collateral, you will still have to make the repayments, but the side effects of defaulting are not as severe. You will lose your home if you do not make repayments. However, if you do default entirely and fail to pay back your loan as agreed within the terms, you may find that you are contacted by a debt collection agency.

If a debt collection agent visits you, you may find that items, including your car, can be removed from your home as a form of payment to cover the remaining balance on your loan.

Risks

As with any financial agreement, there are risks to taking out a loan. These risks are similar to any other financial agreement you may take, whether to pay for your mortgage or a mobile phone contract.

When signing a loan agreement, you agree in a legally binding way that you can afford to pay back the money you are borrowing or give the company the right to take legal action against you.

If you know any changes are imminent in your life that may change whether you can pay for your loan, it is a good idea to wait until this time has passed before taking out the loan. Changes could include changing your job or home or even expanding your family.

It is advisable to wait so that you do not find yourself in a situation where you need to refinance your loan too soon after taking it. Also, you should not put yourself in a position where you have to default on a payment.

As your credit score helps companies determine whether you are a good financial risk, you must do what you can to keep your credit score healthy or look for ways to improve it. If you are using a small loan to do this, ensure you have checked your affordability before applying.

You should do the same if you are considering a credit card to improve your credit score. Ensure you can make minimum repayments and do not default. Defaulting will affect your credit score for five years and can affect interest on any other financial agreement you make.

When taking a loan, the risks are not only to the company but also to you. The loan company can take you to court if you default; however, defaulting also affects your chance of getting a loan or credit card in the future. Is taking one too soon worth the risk?

Summary

Loan agreements and financial agreements are not to be taken lightly. However, when considering the risks and how you can decide what kind of loan you need, remember if you do not need a large loan, it might not be worth risking your house or car to borrow with collateral.

Låne penger nå with a loan agreement without collateral. Ensure you can make your repayments for the entire loan length and can give the loan company a reason for your loan.

It is not always necessary, but it can help if the person assessing your loan knows why you are applying. Borrowing less and repaying on time will also help your credit score if you need a larger loan in the future. Protect your interest rates and be smart with your loans.