You face money troubles every day. Bills pile up, debt weighs you down, and you wonder how to break free. Many people search for answers to these problems. They ask, “who is dave ramsey,” hoping to find real help.

Dave Ramsey built his wealth through hard work and smart choices, not loans. He turned his own financial mess into a path for success. This post explores his life story, key tips, and lasting impact.

It gives you tools to manage your money better. Keep reading for the full scoop.

Early Life and Education

Dave Ramsey entered the world as David Lawrence Ramsey III on September 3, 1960. He grew up in Tennessee, where he learned early lessons in money management. His path shaped him into a key figure in personal finance.

Ramsey pursued a degree in finance at the University of Tennessee. This education laid the groundwork for his future as a financial expert.

By age 26, Ramsey earned a quarter of a million dollars each year. He also managed a $4 million real estate portfolio. These early wins came from hard work in real estate. Yet, challenges soon hit, teaching him about debt and financial planning.

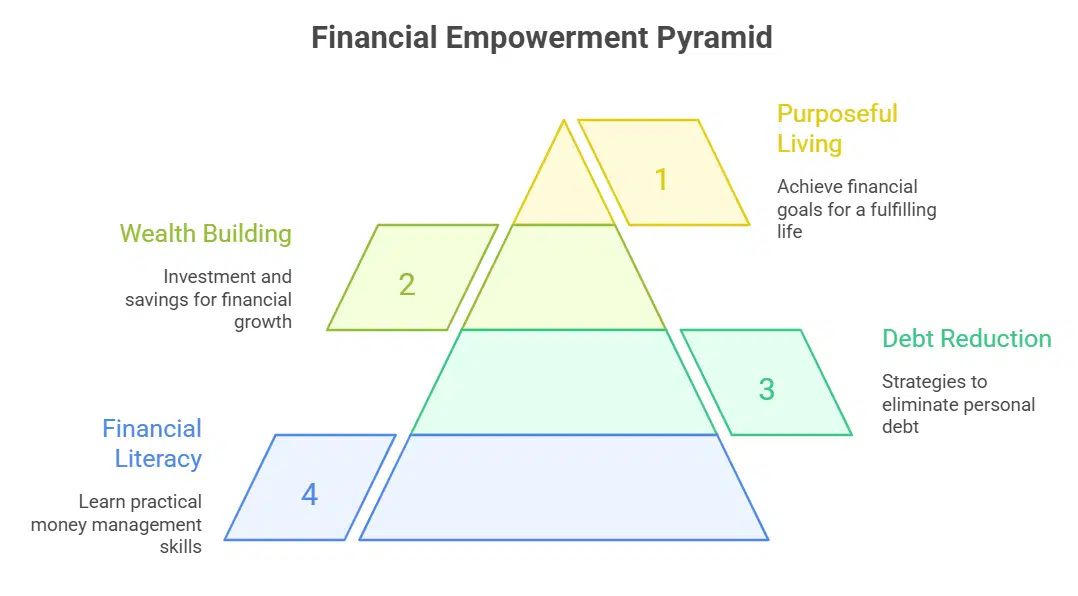

His story inspires many to focus on budgeting and wealth building. Ramsey turned those experiences into advice on financial literacy and debt reduction.

Career Beginnings

Imagine Dave Ramsey in his twenties, entering real estate with bold moves. He built a strong start through smart investment strategies and sheer grit. At just 26 years old, Ramsey earned a quarter of a million dollars each year.

He also managed a $4 million real estate portfolio, showcasing his early knack for wealth building. This phase taught him key lessons in money management and financial planning. You can see how his direct experience shaped his future advice on budgeting and debt reduction.

Ramsey achieved this financial stability through hard work and discipline, steering clear of debt. His journey highlights the power of personal finance and economic education. Readers, take note of how he turned ambition into real results.

This foundation set the stage for his role as a trusted voice in financial literacy. His story motivates you to pursue your own path to wealth building with intention.

Founding Ramsey Solutions

Dave Ramsey started Ramsey Solutions in 1992. He built the company to help folks take control of their money and lives. As founder and CEO, Dave drew from his own ups and downs in personal finance.

Picture his journey, he earned a quarter of a million dollars a year at age 26. He also managed a $4 million real estate portfolio back then. Hard times hit, and he learned tough lessons about debt and money management.

Dave turned those experiences into a mission for financial literacy and wealth building. His company offers tools for budgeting, debt reduction, and smart investment strategies. You can see his drive in action, he promotes debt-free living through hard work and discipline.

Ramsey Solutions stands as a hub for practical financial advice. People flock to it for economic education and real change in their lives.

Key Teachings and Philosophy

Dave Ramsey shares simple ideas that change how you handle money, drawing from his own ups and downs to guide you. Dive deeper into his core methods in the full blog to start your path to financial freedom.

The Baby Steps Method

Dave Ramsey created the Baby Steps method to help people gain control over their money. This simple plan guides you through personal finance with clear actions for debt reduction and wealth building.

- Step one starts with building a small emergency fund of $1,000, which protects you from life’s surprises and sets a strong base for financial literacy.

- Step two focuses on paying off all your debt except the house using the debt snowball method, where you tackle smallest debts first to build momentum in money management.

- Step three involves saving three to six months of expenses in a full emergency fund, giving you peace during tough times and reinforcing budgeting habits.

- Step four calls for investing 15% of your household income into retirement accounts, a key move in investment strategies that Dave Ramsey promotes for long-term wealth building.

- Step five encourages saving for your children’s college fund, aligning with financial planning to avoid future debt and promote economic education in your family.

- Step six pushes you to pay off your home mortgage early, a core part of debt-free living that Dave stresses through hard work and discipline, not borrowing.

- Step seven invites you to build wealth and give generously, embodying the Legacy Journey’s idea of financial peace through purpose and intentionality in your financial advice journey.

Debt-Free Living

Ramsey achieved financial stability and wealth through hard work and discipline, not debt. He teaches people to live debt-free for true financial peace. You can break free from debt’s grip.

Follow his simple 7-step process, known as the Baby Steps, to get out of debt and build wealth. This method starts with saving a small emergency fund. Then, you pay off all debt except your house using the debt snowball approach.

Picture your own journey: you face money struggles, apply discipline, and emerge stronger in personal finance. This builds financial literacy and empowers you in money management.

Ramsey’s philosophy stresses debt elimination as key to wealth building. He shares his story of earning a quarter of a million dollars a year at age 26, yet facing bankruptcy from bad debt.

Learn from that. You gain control by budgeting every dollar and avoiding new debt. His advice promotes financial planning without loans. Embrace this for economic empowerment. Readers, you hold the power to create a debt-free life full of purpose.

Ramsey Solutions guides you there since 1992.

The Ramsey Show

Dave Ramsey hosts The Ramsey Show as a national radio personality. He shares financial advice to help you take control of your money. This program started after he founded Ramsey Solutions in 1992.

Listeners call in with questions on personal finance, budgeting, and debt reduction. Dave draws from his own story of building wealth through hard work, not debt. You can tune in to learn practical steps for financial literacy and money management.

His show motivates people to build wealth with discipline. Dave offers tips on investment strategies and savings plans. As a media personality, he reaches millions with economic education.

The program reinforces his brand of debt-free living and financial planning. You gain empowerment to create a life of purpose. Hear real stories of folks who overcame money struggles.

Criticism and Controversies

You might hear debates about this financial expert’s views and life. People often question his open support for Trump, which sparks strong opinions in personal finance circles. Critics say his political stance mixes with his money management advice, creating divides among followers.

His Baby Steps method draws fire too, as some argue it ignores real struggles in debt reduction and wealth building. They point out that not everyone starts from the same place in financial planning.

Supporters push back, praising how he built his success through hard work, not debt. At age 26, he earned a quarter million dollars a year and ran a $4 million real estate portfolio.

That story fuels both admiration and skepticism in economic education talks. Readers like you search for his net worth and how he made his money, often leading to heated discussions on financial literacy.

His teachings on budgeting and savings plans inspire many, yet they invite scrutiny from those who see gaps in his approach.

Public curiosity brings up odd rumors that test his legacy in financial advice. Folks ask if he is paralyzed in real life, a mix-up that spreads online and stirs confusion. This stems from name similarities with actor David Ramsey, but the finance guru remains active and healthy.

Such myths highlight challenges in his public image as a radio personality and author. He founded Ramsey Solutions in 1992 to help people with debt-free living and investment strategies.

Yet controversies arise when people dig into his family life and age. Born on September 3, 1960, he shares insights on creating purposeful lives through books like Financial Peace and More Than Enough.

His national radio show, The Ramsey Show, amplifies his philosophy on economic empowerment. Listeners debate his emphasis on discipline over quick fixes in money management. These talks keep his influence alive in wealth building conversations.

Personal Life and Family

Dave Ramsey lives a life rooted in family values and personal finance wisdom. He was born David Lawrence Ramsey III on September 3, 1960, and he turned 63 that year. Readers often ask about his family, and he shares insights on building strong bonds through financial literacy and debt-free living.

His journey shows how hard work leads to wealth building without relying on loans. People wonder about his net worth, which grew from earning a quarter million dollars a year at age 26, while managing a $4 million real estate portfolio.

He achieved this success through discipline, not debt, inspiring many in money management and budgeting.

Curiosity surrounds Dave’s support for Trump, reflecting his views on economic empowerment and financial planning. Folks also search if David Ramsey is paralyzed in real life, but he is not; that mix-up comes from an actor with a similar name.

His story motivates you to focus on family and wealth building. Dave emphasizes creating a legacy of purpose, like in his book The Legacy Journey. Through it all, he teaches that financial advice starts at home, with savings plans and investment strategies for everyone.

Dave Ramsey’s Family Insights

Dave Ramsey shares valuable lessons from his own family life that tie into personal finance and money management. He stresses the role of family in building wealth and achieving debt-free living.

Readers often ask about his family, drawn to how he applies his Baby Steps financial plan at home. Born on September 3, 1960, Dave has built a strong family foundation through discipline and smart budgeting.

His journey shows you can create financial stability for your loved ones with hard work, not debt. Think about your own family goals; Dave’s story motivates you to start today.

Some folks search if David Ramsey is paralyzed in real life, but that’s not the case for this financial expert. Dave stays active in his work at Ramsey Solutions, helping families with financial literacy and wealth building.

He lives with purpose, focusing on intentional family time amid his radio show and books like Financial Peace. You can draw from his insights to empower your household, turning challenges into growth.

His family reflects the core of economic empowerment, proving anyone can thrive with the right strategies.

Selected Works and Publications

Dave Ramsey has penned key books that guide you in personal finance and financial literacy. His works stress budgeting, debt elimination, and wealth building to empower your money management.

- Financial Peace stands as one of Dave Ramsey’s New York Times best-selling books, and it teaches you core lessons on gaining control over your finances through discipline and smart choices.

- More Than Enough serves as another New York Times best-seller from Ramsey, where he shares insights on building a life beyond just money, focusing on purpose and intentional living.

- The Legacy Journey forms the heart of Dave Ramsey’s philosophy, and it explains how financial peace leads to a purposeful life, encouraging you to create intentional habits for long-term economic empowerment.

Influence on Financial Education

Dave Ramsey shapes financial education through his work at Ramsey Solutions. He started the company in 1992 to help people control their money and lives. His radio show reaches millions with practical financial advice.

Listeners learn about budgeting and debt reduction every day. Ramsey’s books, like Financial Peace and More Than Enough, top New York Times best-seller lists. They teach money management and wealth building.

He stresses hard work and discipline over debt for true financial stability. People turn to his Baby Steps method, a simple 7-step process, to get out of debt and build wealth. This approach empowers you to create a life of purpose and intentionality, just as in The Legacy Journey.

His influence sparks interest in personal finance topics. Fans search for his net worth, how he built his money, and his Baby Steps financial plan. They ask about his age, born on September 3, 1960, and his family life.

Some even wonder if David Ramsey faces paralysis in real life, but he stays active as a national radio personality. Ramsey’s early success at age 26, earning a quarter million dollars a year with a $4 million real estate portfolio, inspires many.

He shares stories of his own journey from riches to rags and back. This motivates you to embrace financial literacy and economic empowerment. His teachings on investment strategies and savings plans change lives across the country.

Legacy and Impact on Personal Finance

Dave Ramsey leaves a strong mark on personal finance through his work at Ramsey Solutions. He started the company in 1992, and guides people to control their money and lives. Readers, you see his impact in financial literacy and debt reduction strategies that millions use today.

His journey from earning a quarter million dollars a year at age 26, with a $4 million real estate portfolio, to facing setbacks shows real growth. He built wealth through hard work and discipline, not debt, and shares this path in books like Financial Peace and More Than Enough, both New York Times best-sellers.

This approach empowers you in money management and budgeting. His core belief in The Legacy Journey centers on financial peace for a life of purpose and intentionality. You gain tools for wealth building and investment strategies from his advice.

His simple 7-step process, the Baby Steps, helps you get out of debt and build wealth step by step. As a national radio personality on The Ramsey Show, he offers financial advice that boosts economic education.

People often search for his net worth, how he made his money, his support for Trump, his Baby Steps financial plan, his family, and his age. Some even ask if David Ramsey is paralyzed in real life, but that’s not true.

Born on September 3, 1960, as David Lawrence Ramsey III, he stands as a key figure in financial planning. You feel his influence in everyday economic empowerment and savings plans.

His teachings inspire you to take action in your own financial journey.

Takeaways

Ramsey inspires millions with his story of rags to riches. You can apply his baby steps to gain financial freedom today. His legacy shapes how people build wealth and live with purpose.

FAQs

1. Who is Dave Ramsey?

Dave Ramsey stands as a top financial expert who guides people toward debt-free lives. He started his journey after facing bankruptcy himself, and that tough time pushed him to help others avoid the same pitfalls. You can learn from his story, take control of your money, and build a stronger future.

2. What shaped Dave Ramsey’s path to success?

His early real estate deals crashed hard, leading to deep debt and loss. But he bounced back, turned those failures into lessons, and now shares them through books and radio shows to empower you.

3. How does Dave Ramsey inspire financial freedom?

He teaches simple steps like the debt snowball method to pay off what you owe fast. Millions follow his advice in Financial Peace University, finding hope and real change in their budgets. Remember, you hold the power to rewrite your money story, just like he did.

4. What marks Dave Ramsey’s lasting legacy?

His legacy shines in helping families escape debt and build wealth through smart choices. He reinforces his brand with motivational talks that stress discipline and growth.