Before choosing a Term insurance policy, it is important to understand what is term insurance. Term insurance is an easy and affordable method of securing your loved ones financially in case of your untimely demise. It provides you with a sense of security that your loved ones will be in a position to cover bills, meet expenses, and sustain their way of life even when you are no longer there to support them.

Term insurance pays out for a term, known as the policy term. If the insured person passes away during this term, the insurance company settles the lump sum amount and gives the death benefit to the nominee. Nothing is paid out if the sum insured outlives the term. Since it does not involve life cover or any investment element, term insurance is generally much less costly in comparison with other forms of life insurance.

What is Term Insurance?

Term insurance pays a death benefit for a policy term. If the sum insured dies during this term, the insurance company pays the lump sum and offers the death benefit to the nominee. Nothing is paid out if the sum insured lives beyond the term. Since it does not have the life cover or any investment element, term insurance is comparatively much lower in price than other life insurance plans.

Key Features of Term Insurance

Term insurance also offers a number of features, like:

- Fixed Policy Term: You have the flexibility to choose the policy term according to your requirement, typically 10 to 40 years.

- Low Premiums: It offers only life cover, and premiums are very low compared to other insurance.

- High Coverage Amount: It allows you to take a high amount of sum assured to completely secure your dependents.

- No Survival Payment: No payment in the event of survival of the policy term.

- Optional Riders: You can add additional covers, like accidental death benefit, critical illness, or waiver of premium, to provide increased security.

How Does Term Insurance Work?

The term insurance is simple to use. You choose a sum assured and a term of the policy. You pay periodic premiums for the term. If you pass away during the term, your nominee will get the entire sum assured. If you live longer than the term, the policy terminates, and nothing is returned except in the event you have chosen a policy with a return of premium option.

Here is an example to understand:

Suppose a newly married man in his 30s wants to secure his family’s well-being even if something adverse were to happen to him. He buys a term insurance plan for 30 years and a sum assured of ₹50 lakh. His annual premium comes to ₹6,000.

If he dies during these 30 years, his nominee will get ₹50 lakh as the death benefit. They can use this amount to manage household expenses, pay back any loans, and save for the future. However, if the sum insured outlives the entire 30-year term, the policy will lapse without any payment (unless they had chosen a return of premium plan).

Why Should You Consider Term Insurance?

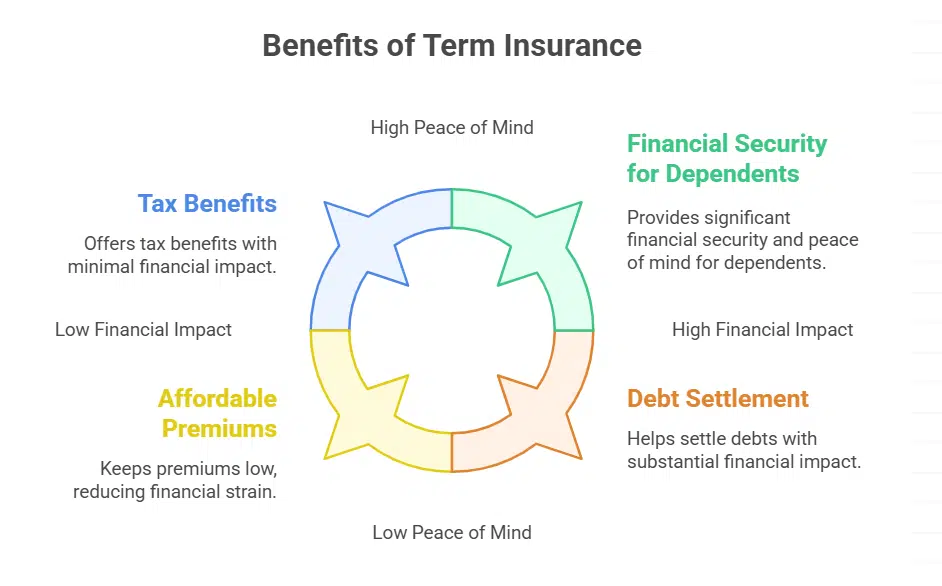

Term insurance provides an affordable and easy way to secure your loved one’s financial future. If you have dependents like a spouse, children, or aged parents, term insurance provides them with financial security in case something untoward happens to you. Its biggest plus point is that it has a low premium when compared to other forms of life insurance, providing you with a sum assured at an affordable premium.

This extensive coverage can assist your family in settling debts, taking care of household expenses, and funding future objectives such as a child’s education or marriage. In addition, term insurance is a safety net that provides peace of mind, with the certainty that your dependents will never be financially burdened. Further, the premium one contributes towards term insurance is deductible under Section 80C (applicable only under the old tax regime) of the Income Tax Act. Whereas, the death benefit the nominee receives is usually exempt from income tax, adding some more financial gains to it.

Types of Term Insurance Plans

There are various term insurance plan to meet different protection requirements:

- Level Term Insurance: The sum assured is fixed for the entire policy term, so your family gets a specific amount if something untoward happens to you.

- Increasing Term Insurance: The sum assured goes up each year by a fixed percentage, so your cover keeps pace with inflation and increasing financial responsibilities.

- Return of Premium Term Plan: If you outlive the policy term, the total premiums paid by you (excluding taxes and charges) are returned to you. It provides a balance between savings and protection.

Do You Receive Any Payout If You Outlive Your Policy Term?

The most recurring question asked is whether you can recover your money if the term insurance policy matures. Under a regular term insurance plan, no payment is paid if you live past the policy term. Term insurance pays for financial protection, not return or savings.

There are some insurers, like Axis Max Life Insurance, that sell Return of Premium (ROP) term plans. In such policies, if you survive the policy term, the insurer refunds all the premiums you have paid (after deducting taxes and other costs). In the event of your death within the term, the sum assured is given to your nominee. However, return-of-premium plans are very expensive in terms of premiums compared to pure term insurance. Overall, purchasing a pure term plan and separately investing the remaining amount might yield improved financial returns.

Factors to Consider While Deciding Your Term Insurance Coverage

Some of the points to keep in mind while determining the amount of cover are as follows:

- Income Replacement: Opt for a cover of at least 10 to 15 times your income so that your dependents are left with the same standard of living.

- Existing Loans: Add outstanding loans such as housing loans, personal loans, or educational loans on which your dependents would need to repay interest.

- Future Financial Objectives: Save for major investments such as your children’s education or your wedding.

- Day-to-Day Expenses: Consider your household’s day-to-day expenditures on essential items a couple of years from now.

- Inflation: Account for inflation during the policy duration, as living and educational costs may escalate significantly.

- Health & Age: Younger policyholders will want more coverage because they anticipate greater financial burdens in the future.

Conclusion

Term insurance is one of the simplest and most efficient methods of ensuring financial security for your loved ones. It gives high coverage at a low cost, ensuring your loved ones are not burdened financially in case of your untimely demise. Even if it does not leave any maturity benefits in the majority of cases, its major advantage is the peace of mind you get. By choosing the right term plan at a young age, you can enjoy long-term cover at a low premium, making you and your family members more prepared for life’s uncertainties.