Many people struggle with money problems every day. They face high debts, unexpected bills, and stress from living paycheck to paycheck. This leaves them feeling stuck and worried about their future.

You might wonder, “What are the 7 steps of Dave Ramsey?” to find a way out. These steps offer a clear path to take control of your finances.

Dave Ramsey created this plan to help folks get out of debt and build wealth. One key fact is that his 7 Baby Steps form a simple roadmap for financial peace. This post breaks down each step with easy tips and real examples.

It shows you how to apply them in your life for lasting success. Keep reading to start your journey.

Who is Dave Ramsey?

Dave Ramsey stands out as a top expert in personal finance. He created the 7 Baby Steps, a clear money management plan that guides people out of debt and toward wealth building. This approach simplifies financial planning into easy steps for debt reduction and savings strategy.

Ramsey wrote several books on budgeting and money management. His own net worth shows his success in this field.

People from all walks of life use his plan to gain financial security. Singles apply these steps to master their finances and reach financial peace. You can download the plan in PDF format for free, complete with worksheets to track progress.

Follow his roadmap to eliminate debt with methods like the debt snowball. Join the many who build wealth through this proven path.

Baby Step 1: Save $1,000 for a Starter Emergency Fund

Start your journey with Dave Ramsey’s 7 Baby Steps, a money management plan that helps you get out of debt, save money, and build wealth. These steps guide you in order, leading from debt and stress to a life of saving and giving.

They form a proven plan for paying off debt, saving money, and building wealth. This structured approach simplifies personal finance into manageable goals. Focus first on saving $1,000 for an emergency fund.

Think of it like a safety net that catches unexpected costs, such as car repairs or medical bills. You can apply these Baby Steps as a single person to master your finances and achieve financial success.

Join others who use this roadmap for financial stability, getting out of debt, and building wealth. Download the plan in PDF format for free; it includes worksheets to track your progress.

Dave Ramsey wrote several books on personal finance and budgeting. His net worth shows his success in this field. Cut back on extras like dining out to hit that $1,000 mark fast. Sell items you no longer need.

Pick up side gigs for quick cash. Track every dollar with budgeting to build this starter emergency fund. This step kicks off your path to financial security and personal finance mastery.

Many face the challenge of no savings when emergencies hit, causing more debt. Solve this by prioritizing your savings strategy right now. Use money management to set aside small amounts daily.

Watch your emergency fund grow to $1,000. Feel the relief of having that buffer. You build momentum for the next steps, like paying off all debt except the house with the debt snowball method, then saving 3 to 6 months of expenses in a fully funded emergency fund.

These actions progress you through debt elimination, saving, investing, and wealth building. Stay motivated; you join a community achieving financial peace. Keep pushing; success waits.

Baby Step 2: Pay Off All Debt Except the Mortgage Using the Debt Snowball Method

Tackle your debt head-on with Dave Ramsey’s proven plan. List all your debts from smallest to largest, ignoring interest rates. Pay minimums on everything, then throw extra cash at the smallest debt first.

Knock it out fast, and feel that win. Roll that payment into the next debt, building momentum like a snowball rolling downhill. This debt snowball method simplifies debt reduction and keeps you motivated in your financial planning journey.

Dave Ramsey designed this step to lead you out of debt and stress, into a life of saving and giving. His structured approach turns personal finance into manageable goals, perfect for singles or anyone mastering money management.

Many face overwhelming debt as a big challenge. Attack it with focus and grit. Use the debt snowball to eliminate debts one by one, except your mortgage. Track progress with free worksheets from the PDF download of the 7 Baby Steps.

This builds financial security and sets you up for wealth building. Join others who achieve financial freedom through this roadmap. Dave Ramsey’s books on budgeting show his success, with a net worth that proves the plan works.

Overcome setbacks by staying committed, and watch debt vanish as you gain control over your finances.

Baby Step 3: Save 3–6 Months of Expenses in a Fully Funded Emergency Fund

Build a strong safety net now that you have paid off debt. Focus on saving 3 to 6 months of expenses in a fully funded emergency fund. This step follows the $1,000 starter fund and debt payoff using the debt snowball method.

Think of it like a sturdy shield against life’s surprises, such as job loss or car repairs. Use budgeting and money management to add cash each month. Track progress with free worksheets from Dave Ramsey’s plan, available in PDF format.

You join millions who achieve financial security this way. Face common hurdles like unexpected bills head-on; cut extra spending to boost savings fast. Stay motivated, you create real financial peace here.

Push forward in this proven money management plan. Dave Ramsey’s 7 Baby Steps guide you through debt elimination, saving, investing, and wealth building. Apply this as a single person or family to master personal finance.

Set clear goals for your savings strategy. Watch your emergency fund grow into a key part of financial planning. Feel the empowerment of financial freedom building. Overcome doubts by celebrating small wins along the roadmap to financial stability.

Baby Step 4: Invest 15% of Your Household Income for Retirement

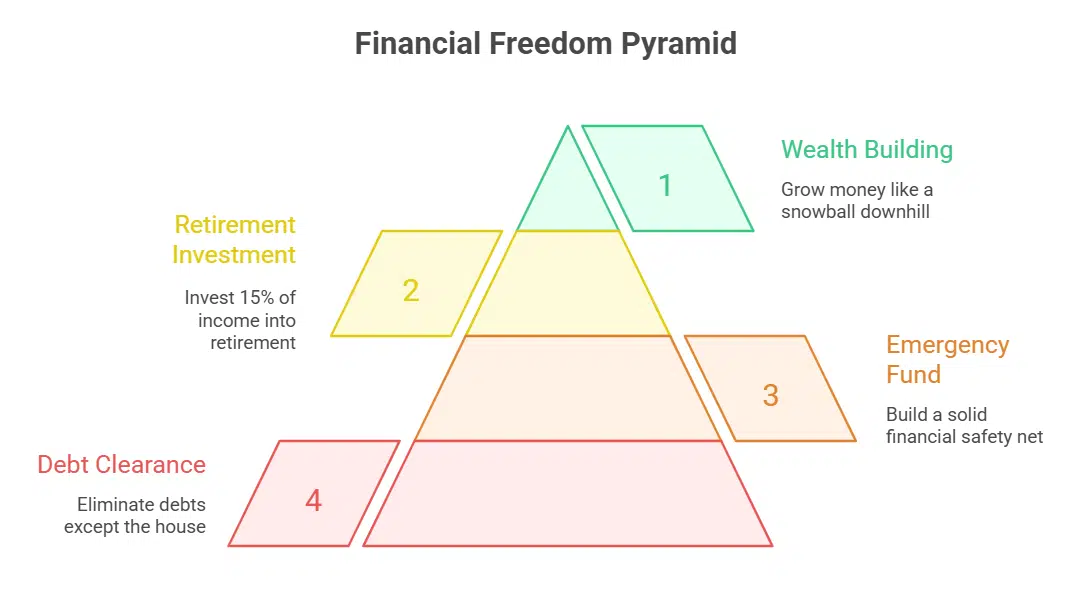

You have cleared your debts except the house and built a solid emergency fund. Now focus on your future. Start investing 15% of your household income into retirement accounts. Pick good growth stock mutual funds for steady growth.

Dave Ramsey’s 7 Baby Steps guide you here, turning personal finance into simple goals. This step builds wealth over time. Imagine your money growing like a snowball rolling downhill, picking up speed.

You gain financial security and peace. Follow this after step three to keep momentum. The plan simplifies money management and budgeting. Invest consistently to secure retirement.

Many face doubts about starting investments. Push past that fear. Use Roth IRAs or 401(k)s with employer matches. This boosts your savings strategy. Dave Ramsey’s approach leads to financial freedom and wealth building.

You join others who achieve stability through these steps. Track progress with free worksheets from his plan. Stay committed, and watch your net worth grow. The roadmap eliminates debt first, then shifts to investing for long-term success.

Baby Step 5: Save for Your Children’s College Fund

Move to Baby Step 5 after you secure your emergency fund and start retirement investments. Focus on saving for your children’s college fund. This step fits into Dave Ramsey’s proven plan for paying off debt, saving money, and building wealth.

Use a structured approach to set aside funds each month. Pick tax-advantaged accounts like 529 plans to grow your savings faster. Think of this as planting seeds for your kids’ future, much like building a strong foundation for a house.

Parents, tackle common challenges like high tuition costs by starting small and staying consistent. Follow the baby steps in order to move from debt elimination to wealth building.

Singles can adapt this step or skip it if you lack kids, yet the entire money management plan still leads to financial security. Stay motivated; you join a community achieving financial peace through budgeting and savings strategies.

Overcome setbacks with simple tracking tools from Dave Ramsey’s free worksheets.

Baby Step 6: Pay Off Your Mortgage Early

Take charge of your home loan now. Attack that mortgage with extra payments each month. Use the money you freed up from earlier steps, like debt reduction and building your emergency fund.

Picture your house as truly yours, free from bank ties. This step fits into Dave Ramsey’s proven plan for financial planning and wealth building. Follow it in order to escape debt stress and step into a life of saving and giving.

Singles can apply these Baby Steps too, to master money management and achieve financial success. Dave Ramsey’s books on personal finance and budgeting show his own success in this field.

Face common hurdles like high interest rates head-on. Boost your income with side jobs or cut unnecessary spending through smart budgeting. Stay motivated by tracking progress on worksheets from the free PDF plan.

This structured approach simplifies personal finance into clear goals. You build real financial security here, as part of the roadmap to debt elimination and long-term wealth. Keep pushing; success comes from consistent action in this money management strategy.

Baby Step 7: Build Wealth and Give Generously

Reach the peak of Dave Ramsey’s 7 Baby Steps, and you start to build wealth while you give generously. Follow this step after you clear your debts, fund emergencies, invest for retirement, save for college, and pay off your home.

Use the structured plan to turn your money management into a force for good. Grab the free PDF download with worksheets; they help you track progress on this wealth building journey.

Dave Ramsey’s books on personal finance show his own success; his net worth proves the plan works. Apply these steps as a single person or with family; they guide you to financial security and a life of giving.

Face common hurdles like staying motivated, but push through with small wins in budgeting and savings strategies. Picture your finances like a growing tree; each baby step adds strong roots for lasting wealth.

Join others who achieve financial freedom through this proven roadmap. Eliminate debt stress, and embrace a future of abundance. Inspire your circle by sharing your story; generosity multiplies the impact.

Stay committed, and watch your personal finance transform into true prosperity.

Benefits of Following Dave Ramsey’s 7 Baby Steps

Follow Dave Ramsey’s plan, and you gain true financial freedom that lets you live without money worries, while building long-term wealth that secures your future and inspires those around you.

Dive deeper into these steps to transform your finances today.

Financial Freedom

Dave Ramsey’s 7 Baby Steps guide you to true financial freedom. This proven plan helps you escape debt and build lasting security. Start with a $1,000 emergency fund, then tackle debt using the debt snowball method.

Save 3 to 6 months of expenses next. Invest 15% of your income for retirement, fund college for kids, pay off your mortgage early, and finally build wealth to give generously. Picture debt as a heavy chain; break it link by link with this structured approach.

You gain control over your money, reduce stress, and live with peace.

Many face money worries that steal joy. Dave Ramsey’s steps solve this by simplifying personal finance into clear goals. His books and free PDF worksheets track your progress. Singles and families alike achieve success.

Join the movement of people who now enjoy financial peace. Build your savings plan, eliminate debt, and watch wealth grow. This roadmap leads to a life of giving and freedom.

Long-term Wealth Building

Follow Dave Ramsey’s 7 Baby Steps to build wealth over time. This proven plan helps you pay off debt, save money, and create lasting riches. Start with saving $1,000 for an emergency fund.

Then tackle debt elimination using the debt snowball method. Move on to save 3 to 6 months of expenses in a fully funded emergency fund. Invest 15% of your household income for retirement next.

Save for your children’s college fund after that. Pay off your mortgage early in step six. Reach step seven to build wealth and give generously. These steps provide a structured approach that simplifies personal finance into manageable goals.

They guide you from debt and stress to a life of saving and giving. Singles can apply this roadmap too, and achieve financial success. Dave Ramsey has written several books on personal finance and budgeting.

His net worth shows the plan’s power. Download the free PDF with worksheets to track your progress. Picture your finances like a snowball rolling downhill, it gains speed as you eliminate debt and build savings.

Join others who gain financial security through this money management plan. Overcome common hurdles with steady effort in financial planning and budgeting. Stay committed to see long-term wealth grow.

Common Challenges and How to Overcome Them

People often hit roadblocks in financial planning, like sudden expenses that derail their emergency fund goals. Dave Ramsey’s 7 Baby Steps tackle this head-on with a structured approach.

Start by saving that first $1,000 for a starter emergency fund to handle surprises without stress. Debt reduction feels overwhelming when bills pile up, but the debt snowball method simplifies it.

List debts from smallest to largest and knock them out one by one. This builds momentum, just like rolling a snowball downhill. Readers face motivation dips during long-term wealth building, yet the plan’s easy-to-follow steps lead to financial peace.

Grab the free PDF with worksheets to track progress and stay on course. These tools make budgeting and money management feel achievable.

Temptations to spend pull many off track in savings strategy phases. Combat this by focusing on the proven roadmap that gets you out of debt and into saving. Picture your life with financial security, free from money worries.

Singles apply these steps to master personal finance and achieve success. Challenges in investing for retirement arise from confusion, but invest 15% of household income as step four guides.

Books by Dave Ramsey offer extra tips on financial management and debt elimination. His net worth shows the plan works. Stay committed through small wins, and build that fully funded emergency fund of 3-6 months’ expenses.

This creates a buffer against setbacks and empowers you to give generously in the end.

Tips for Staying Committed to the Plan

Dave Ramsey’s 7 Baby Steps offer a proven plan for paying off debt, saving money, and building wealth. Follow these steps in order to move out of debt and stress, and into a life of saving and giving.

- Track your progress with the free PDF download of the plan, which includes worksheets to monitor your money management journey, and know that this structured approach simplifies personal finance into manageable goals for financial security.

- Read Dave Ramsey’s books on personal finance and budgeting to stay motivated, as his net worth shows the success of this roadmap for achieving financial stability and long-term wealth building.

- Apply the Baby Steps as a single person or individual to master your finances, since the plan works for anyone aiming for financial success through debt elimination and savings strategy.

- Start with Baby Step 1 by saving $1,000 for a starter emergency fund, and use this quick win to build momentum in your financial planning efforts.

- Tackle Baby Step 2 to pay off all debt except the mortgage using the debt snowball method, which focuses on small debts first to create a sense of accomplishment in debt reduction.

- Build a fully funded emergency fund in Baby Step 3 by saving 3 to 6 months of expenses, providing a safety net that supports your entire savings plan and reduces financial stress.

- Invest 15% of your household income for retirement in Baby Step 4, as this step progresses you toward wealth building and financial peace.

- Save for your children’s college fund in Baby Step 5, integrating this into your budgeting to ensure future financial management for your family.

- Pay off your mortgage early in Baby Step 6, accelerating your path to debt-free living and stronger personal finance habits.

- Reach Baby Step 7 to build wealth and give generously, embracing the inspirational message that this proven plan leads to financial freedom for everyone who commits.

Takeaways

Take these 7 Baby Steps, and watch your finances transform into a strong foundation for freedom. You hold the power to crush debt and build lasting wealth with steady effort. Start today; join the many who live with financial peace and generous hearts.

To learn more about the financial guru behind these transformative steps, visit our page on who is Dave Ramsey.

FAQs

1. What are Dave Ramsey’s 7 steps for mastering your finances?

Dave Ramsey’s 7 baby steps offer a clear path to financial freedom, starting with building a small emergency fund, then paying off all debt using the debt snowball method, and moving on to save three to six months of expenses. Next, invest fifteen percent of your income for retirement, save for your kids’ college, pay off your home early, and finally build wealth while giving generously. You can do this; join the millions who have transformed their lives with these steps.

2. How does the debt snowball method work in Dave Ramsey’s plan?

List your debts from smallest to largest, ignoring interest rates, and attack the smallest one first with extra payments while keeping minimums on others. This builds momentum, like a snowball rolling downhill, gaining speed as you knock out each debt. Feel the victory; it motivates you to keep going.

3. Why start with an emergency fund in Dave Ramsey’s steps?

Life throws curveballs, like car repairs or job loss, so save one thousand dollars fast to cover surprises without borrowing. This fund acts as your financial shield, protecting your progress.

4. How can I stay motivated through Dave Ramsey’s 7 steps?

Track your wins, no matter how small, and surround yourself with supportive people who cheer your journey. Remember, every step solves a real problem, from debt stress to future worries, leading to true peace. You belong to a community crushing financial goals; keep pushing forward.