WEF Global Risks Report 2026 Analysis reveals a world standing at a historic crossroads, where the “Global Village” of the past thirty years has been replaced by a fractured “Age of Competition.”

As global leaders convene in Davos for the 56th Annual Meeting of the World Economic Forum (WEF), the release of the 21st edition of the Global Risks Report has sent shockwaves through the corridors of power. The central takeaway is unmistakable: we have entered a period of “Geoeconomic War,” where trade, investment, and technology are no longer just tools of prosperity, but the primary weapons of strategic confrontation.

Key Takeaways: WEF Global Risks Report 2026

The WEF Global Risks Report 2026 Analysis signals the official end of the era of global cooperation, ushering in a fractured “Age of Competition.” Here are the critical insights:

- Geoeconomic War as the #1 Risk: For the first time, “Geoeconomic Confrontation” (the weaponization of trade, tariffs, and export controls) is the top short-term threat, jumping 8 positions in one year.

- The Death of Globalism: Only 6% of experts believe the post-WWII rules-based order can be revived. 68% expect a “multipolar and fragmented” world defined by “friend-shoring.”

- The AI Information Crisis: Misinformation and disinformation remain the #2 risk, powered by AI-generated deepfakes that threaten election integrity and social trust.

- Environmental Oversight: While Extreme Weather is #3, other climate risks have dropped in short-term priority. The WEF warns this is a “dangerous distraction” from long-term existential threats.

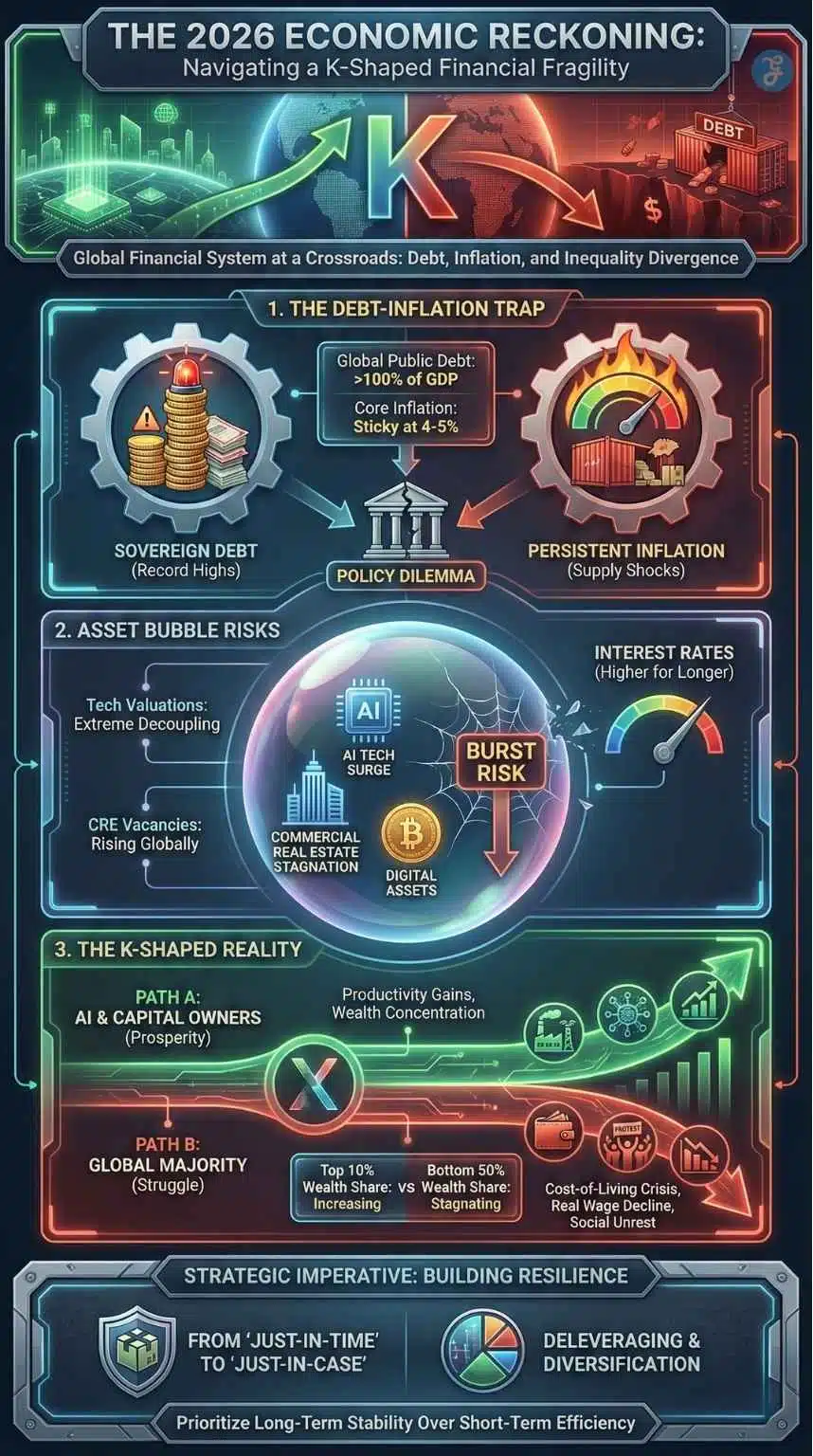

- A “K-Shaped” Economic Reckoning: Persistent inflation and record-high sovereign debt are creating a widening gap between the wealthy and the vulnerable, fueling Societal Polarization (#4).

The Dawn of the “Age of Competition”

The year 2026 marks a definitive break from the post-Cold War era. According to the World Economic Forum (WEF), the global outlook has darkened significantly. Over 50% of the 1,300 experts surveyed now anticipate a “turbulent” or “stormy” outlook for the next two years, a staggering 14-percentage point increase from 2025.

This transition is not just a temporary dip in cooperation; it is a structural shift. The report describes a “new competitive order” where major powers are no longer seeking to optimize global growth but are instead focused on securing their own spheres of interest and resilient supply chains, even at the cost of efficiency.

The “Stormy” Outlook Statistics:

- 2-Year Horizon: 50% expect turbulence/storms (up from 36% last year).

- 10-Year Horizon: 57% foresee a fragmented and stormy world.

- The Calm Factor: Only 1% of respondents anticipate a “calm” or “stable” global environment in 2026.

Understanding “Geoeconomic Confrontation” [#1 Risk]

For the first time in the report’s history, Geoeconomic Confrontation has surged to the absolute top of the risk register for the short-term (2026–2028). Climbing eight positions in a single year, it has surpassed both “Extreme Weather” and “State-based Armed Conflict” in terms of perceived severity.

Defining the New Warfare

Geoeconomic confrontation is defined as the “deployment of economic levers by global or regional powers to reshape economic interactions between nations.” In 2026, this manifests in several aggressive ways:

- Tariff Escalation: The aggressive use of import duties as political leverage (e.g., the 60% tariffs on China and universal 10-20% duties recently implemented by the U.S.).

- Export Controls: Restricting access to critical minerals (lithium, cobalt) and high-end semiconductors to cripple a rival’s industrial capacity.

- Sanction Overreach: Moving beyond individual targets to whole-sector sanctions that disrupt global markets.

- Investment Screening: Unprecedented levels of “Outbound Investment Reviews” that prevent capital from flowing into “adversarial” tech sectors.

The Escalation Ladder of Geoeconomic War

The report warns that the world is moving beyond simple trade disputes into a “full-scale economic war.” This isn’t just about higher prices; it’s about structural blockades. According to the WEF’s 2026 findings, we are seeing a three-stage escalation:

- Stage 1: Defensive Protectionism: Traditional tariffs and “Buy National” subsidies (currently the global norm).

- Stage 2: Precision Weaponization: Targeted export restrictions on “choke-point” technologies (like HBM memory chips or rare earth magnets) designed to paralyze a rival’s military and AI development.

- Stage 3: Total Fragmentation: The report identifies “theoretical” risks becoming “material” in 2026, including physical port blockades, the forced cancellation of long-term sovereign contracts, and comprehensive capital controls that prevent companies from repatriating profits.

The Death of Multilateralism: Why the WTO is Faltering

The 2026 report paints a bleak picture of international institutions. For decades, the World Trade Organization (WTO) and the UN served as the referees of global interaction. Today, those referees are being ignored.

The data is startling: only 6% of respondents believe the post-WWII international order can be revived. The remaining 94% see a future of “Multipolarity without Multilateralism.”

The Fragmentation of Global Rules

As nations prioritize national security over economic integration, the “Rules-Based Order” is being replaced by “Transactional Diplomacy.” This means trade deals are increasingly “bilateral” (one-on-one) or “minilateral” (small groups of allies), leading to a “spaghetti bowl” of conflicting regulations that make it nearly impossible for global businesses to operate seamlessly.

Economic Reckoning: The 2026 Financial Fragility

While the geopolitical headlines are dominated by conflict, the underlying economic engine is sputtering. The WEF Global Risks Report 2026 Analysis identifies a “K-shaped” economic reality that is becoming entrenched.

The Debt-Inflation Trap

Global sovereign debt has reached levels that many experts consider “unsustainable” in a high-interest-rate environment.

- Sovereign Debt Crisis: Nearly 50% of experts are concerned about debt crises in emerging markets, with 33% fearing the same for advanced economies.

- Asset Bubble Risks: One of the fastest-rising risks this year is the “Asset Bubble Burst” (up 7 places). Experts are specifically watching the AI-driven tech stock surge and the stagnant commercial real estate market.

- Global Growth: UNCTAD projections for 2026 suggest global growth will struggle to hit 2.6%, well below the historical average.

The “K-Shaped” Fragility: Inequality as a Macro-Risk

The WEF has identified Inequality as the most interconnected risk for the second year in a row. It is no longer just a social issue; it is a “macro-economic detonator.”

- The Squeeze: In 2026, the report highlights the “K-shaped” recovery, where the top 10% benefit from AI-driven productivity while the bottom 50% face a “Cost of Living 2.0” crisis driven by trade-war-induced inflation.

- The Debt Spiral: As nations prioritize defense and industrial subsidies over social protection, the “social contract” is fraying. This fuels Societal Polarization (#4), making it impossible for governments to pass necessary economic reforms.

Geopolitics & State-Based Armed Conflict [#2 Risk]

Though geoeconomic tools are the primary weapons, “kinetic” war remains a top-tier threat, ranking #2 for 2026. The report warns that the line between “economic war” and “armed conflict” is blurring.

The Weaponization of Connectivity

Physical conflicts are now strategically designed to hit economic chokepoints.

- Maritime Blockades: Ongoing tensions in the Red Sea and the South China Sea are no longer just about territory; they are about controlling the flow of the world’s $25 trillion in annual trade.

- Infrastructure Sabotage: Undersea cables and energy pipelines are now legitimate targets in “Hybrid Warfare.”

The AI Factor: Disinformation and “AI at Large”

Technology is the “force multiplier” of every other risk. In 2026, AI has moved from a speculative threat to a daily disruption.

Information Integrity under Siege

Misinformation and Disinformation rank as the #2 risk over a two-year horizon. AI-generated deepfakes have become so sophisticated that they are used not just to influence elections, but to trigger flash-crashes in stock markets and incite localized social unrest.

The “Cyber Insecurity” Nexus

For the first time, Adverse Outcomes of AI has entered the Top 10 short-term risks. The report highlights:

- Automated Cyberattacks: AI is being used to find and exploit vulnerabilities in critical infrastructure faster than humans can patch them.

- Job Displacement: Estimates suggest that by late 2026, the first wave of large-scale white-collar job displacement will be visible, further fueling Societal Polarization (#4 risk).

Regional Deep Dives: Winners and Losers

The “Age of Competition” does not affect everyone equally. The WEF Global Risks Report 2026 Analysis highlights divergent paths for major regions:

| Region | Primary Risk | Economic Outlook |

| United States | Societal Polarization | Resilience through protectionism, but high inflation risk. |

| China | Geoeconomic Isolation | Struggling with “The Second China Shock” and export barriers. |

| India | Cyber Insecurity | Strongest growth (6.6%), but vulnerable to digital disruption. |

| European Union | De-industrialization | High energy costs and “squeeze” between US and China. |

| Global South | Debt Distress | Facing “collateral damage” from the US-China trade war. |

The India & South Asia Perspective: A Digital Frontier at Risk

For your Bengali-speaking and South Asian audience, the 2026 report offers a specialized warning. While India remains a global growth engine (projected 6.6% GDP), its vulnerability is unique:

- Cyber Insecurity as the #1 Risk: Unlike the global average, India’s top risk is not trade war but Cyber Insecurity. With deep dependence on digital governance (UPI, Aadhaar) and a burgeoning fintech sector, AI-powered state-sponsored attacks are the primary threat.

- The “Double Burden”: South Asia faces the highest risk of “collateral damage” from the US-China geoeconomic war, as regional nations are forced to choose between Western technology standards and Chinese infrastructure financing.

The “Environmental Oversight” Warning

One of the most controversial findings in the 2026 report is the relative drop in the ranking of environmental risks. While Extreme Weather is #3 in 2026, other environmental threats like “Biodiversity Loss” have fallen out of the short-term Top 10.

The “Dangerous Distraction”

The WEF warns that this is an “Environmental Oversight.” Because world leaders are so preoccupied with trade wars and AI, they are ignoring the “tipping points” of the Earth’s systems.

- Long-term Reality: When looking at the 10-year horizon (2036), environmental risks still occupy the top 4 spots.

- The Risk: By the time we solve the “Geoeconomic War,” the damage to the climate may be irreversible.

The 10-Year Pivot: Why Today’s Distraction is Tomorrow’s Disaster

The report uses a “Temporal Conflict” framework to explain why 2026 is dangerous.

- The 2-Year Mirage: Leaders are currently “blinded” by the immediate threat of geoeconomic war and AI disruption. This has caused a “Climate Reprioritization” where green energy transitions are being delayed to fund military readiness.

- The 10-Year Cliff: By 2036, the top three risks are Extreme Weather, Biodiversity Loss, and Critical Changes to Earth Systems. The report warns that by the time the geoeconomic wars of 2026 settle, the window to prevent “Systemic Earth Collapse” may have closed entirely.

Strategic Implications for Businesses

For the global CEO, the “New Playbook” requires a fundamental shift in strategy. The report suggests that the era of “Global Efficiency” is over.

From JIT to JIC

The transition from “Just-in-Time” to “Just-in-Case” supply chains is now a survival requirement. Companies are diversifying their manufacturing to “Trusted Circles” (Friend-shoring), even if it increases the cost of goods by 15-20%.

Final Words: Rebuilding Trust in a Fragmented World

The WEF Global Risks Report 2026 Analysis serves as a stark warning: the era of global cooperation is on life support. The “Geoeconomic War” is not a future possibility; it is the current reality.

However, the report concludes with a message of “Agency.” These risks are not foregone conclusions. The Davos 2026 theme, “A Spirit of Dialogue,” emphasizes that even in an age of competition, “pragmatic cooperation” on shared threats like AI safety and climate change is the only way to prevent a total global collapse.

2026 will be defined by how nations navigate the friction between national security and economic survival. For the digital-first world, the message is clear: protect your data, diversify your sources, and prepare for a decade of turbulence.