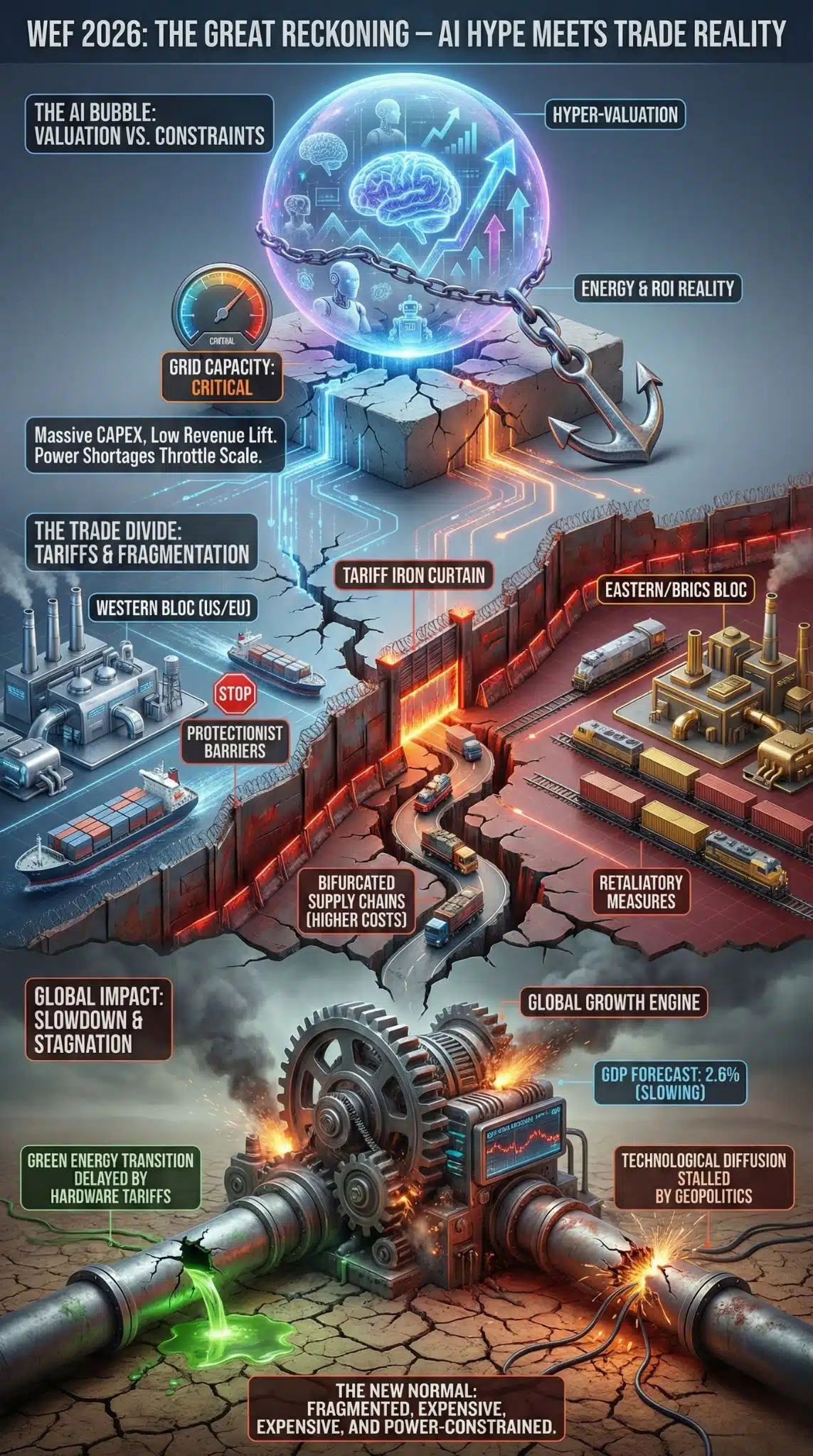

Why This Matters Now: As global leaders convene in Davos this week for the 2026 World Economic Forum (WEF), the global economy faces a rare “dual shock.” The theoretical trillions promised by the Generative AI boom are colliding with the physical reality of energy shortages and a fracturing global trade system.

For the first time, the optimism of the “Fourth Industrial Revolution” is being held hostage by a new era of protectionist tariffs and a looming valuation correction in the tech sector. This summit isn’t about celebration; it is about damage control.

Key Takeaways:

- The ROI Reality Check: After three years of massive CAPEX spending, 2026 is the year investors demand to see profitable use cases for AI, triggering fear of a market correction.

- The “Tariff Iron Curtain”: New protectionist policies from the US and EU have slowed global growth to just 2.6%, creating a distinct split between “Western” and “Global South” supply chains.

- Energy as the Bottleneck: The AI sector’s energy demand has outpaced grid capacity, leading to a unique crisis where digital growth is throttled by physical power constraints.

- Geopolitical Fragmentation: The theme “A Spirit of Dialogue” betrays the reality of the hallways—deep distrust between major powers is reshaping alliances into competing economic blocs.

The Collision of Hype and Hardware

The road to Davos 2026 has been paved with contradictions. Since the explosion of Generative AI in 2023, the world has operated on the assumption that technology would indefinitely drive productivity, regardless of geopolitical friction. That assumption effectively died in late 2025.

We have arrived at a moment where the “digital economy” (AI) and the “real economy” (trade and energy) are at odds. The 56th Annual Meeting’s theme, “A Spirit of Dialogue,” attempts to bridge a chasm that has widened significantly over the last twelve months. The aggressive decoupling of US-China supply chains, compounded by the European Union’s carbon border mechanisms, has created a drag on the very hardware—chips, GPUs, and rare earth minerals—required to sustain the AI boom.

The “AI Bubble”: From CAPEX to Crisis

For the past two years, the narrative was simple: buy the hardware, and the revolution will follow. By January 2026, the narrative has shifted to “Show me the money.” The “AI Bubble” fears dominating Davos corridors aren’t about the technology not working; they are about the economics not adding up.

The Valuation vs. Revenue Gap

Tech giants have poured hundreds of billions into data centers, yet the revenue lift for non-tech enterprise sectors remains stubbornly low. Analysts at Capital Economics and S&P Global have warned that 2026 could see a “valuation unwind” similar to the dot-com burst if corporate adoption doesn’t immediately translate to bottom-line productivity.

The issue is twofold: Diminishing Returns and Physical Constraints.

The “Bubble” isn’t just financial; it’s physical. The sheer inability of power grids to service new gigawatt-scale data centers has put a hard cap on how fast AI can actually scale in 2026.

The AI Landscape – Hype (2024) vs. Reality (2026)

| Metric | 2024 Expectation | 2026 Reality |

| Market Sentiment | “Buy at any price” (FOMO) | “Show me the ROI” (Skepticism) |

| Energy Impact | Marginal concern | Systemic constraint (Grid delays of 3-5 years) |

| Corporate Adoption | “Pilot programs everywhere” | “High abandonment rate” for non-essential tools |

| Hardware Costs | Expected to drop rapidly | Remained high due to tariffs on Asian components |

This “Reality Gap” is the primary anxiety for the tech delegations at Davos. If the stock market reprices AI assets to reflect these physical and financial limits, we could see a liquidity shock that ripples through the broader economy.

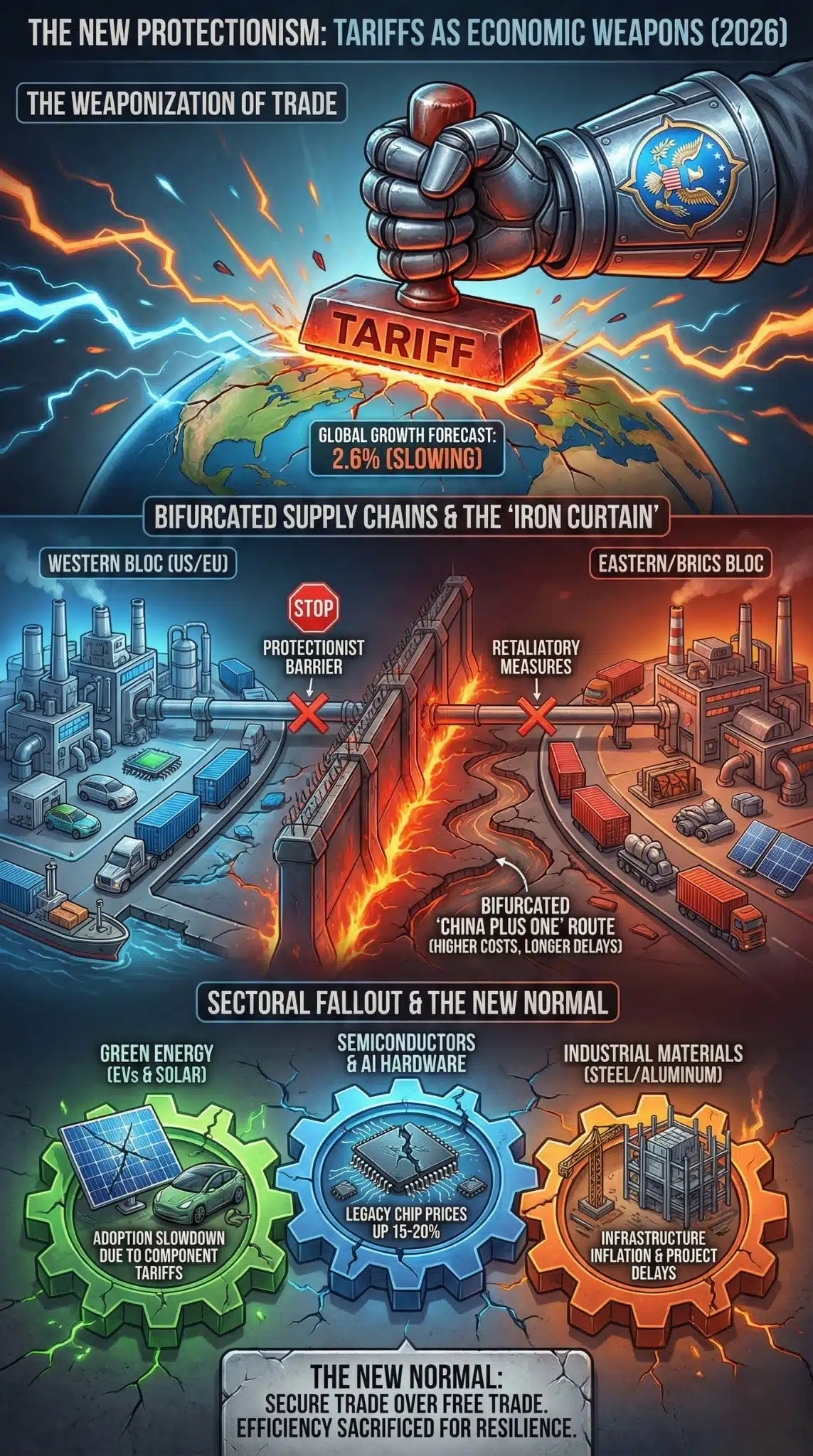

The New Protectionism: Tariffs as Weapons

While the tech sector worries about bubbles, the industrial sector is worrying about barriers. 2026 has cemented a shift from “Free Trade” to “Secure Trade.” The resurgence of tariffs—led by the United States and reciprocated by key trading partners—has fundamentally rewired global commerce.

The UN Trade and Development (UNCTAD) report released just prior to the summit projects global growth slowing to 2.6% this year, largely driven by these trade frictions. The “fragmentation” predicted in 2024 is now a measurable GDP loss.

The Fragmentation of Value Chains

Multinational corporations are no longer optimizing for efficiency; they are optimizing for survival. The “China Plus One” strategy has evolved into a “Bifurcated Supply Chain” reality. Companies are running two distinct operation stacks: one for the Western bloc and one for the Global South/BRICS bloc.

The Tariff Impact on Key Sectors (2026 Estimates)

| Sector | Primary Tariff Driver | Impact on Consumer/Business |

| Semiconductors | National Security (US/EU) | High Costs: Legacy chip prices up 15-20% due to restricted sourcing. |

| Green Energy (EVs) | Anti-Dumping / Protectionism | Adoption Slowdown: Western EV adoption lags forecasts due to tariffs on cheaper Chinese models. |

| Agriculture | Retaliatory Measures | Volatility: Food prices in import-dependent nations are seeing double-digit variance. |

| Steel/Aluminum | Industrial Policy | Construction Inflation: Infrastructure projects (including data centers) face rising material costs. |

The Hidden Link: Energy, AI, and Trade

The most insightful analysis emerging from Davos 2026 is the intersection of these two crises. The AI boom requires massive amounts of energy. However, the energy transition required to supply that power is being slowed down by the trade war.

Tariffs on solar panels, wind turbines, and battery components (often sourced from China) have increased the capital cost of renewable energy projects in the West. Simultaneously, AI data centers are demanding power now.

- The Result: A resurgence in fossil fuel demand to bridge the gap, or a “capacity ceiling” where data centers simply cannot be built.

- The Irony: The very protectionism designed to secure “energy independence” is causing an energy shortage that threatens the “technological dominance” of the West.

Expert Perspectives: The Davos Divide

To understand the mood, one must look at the conflicting viewpoints emerging from the sessions:

- The Tech Optimists (Silicon Valley Delegation): They argue that the “bubble” talk is premature. They point to the rollout of “Agentic AI” (AI that takes action, not just generates text) in late 2025 as the catalyst that will finally unlock productivity.

- Counter-point: “Agentic AI” is even more energy-intensive than previous models, exacerbating the power grid crisis.

- The Macro-Realists (IMF & Central Bankers): They view the high-interest-rate environment as the pin waiting to pop the balloon. With inflation sticking above 2.5% in tariff-imposing nations, central banks cannot cut rates fast enough to bail out over-leveraged tech firms.

- The Global South (Non-Aligned Leaders): For leaders from Brazil, India, and Indonesia, the US-China trade war is an opportunity. They are positioning themselves as the “connector economies”—the only places where Eastern hardware and Western capital can still meet, albeit at a premium.

Future Outlook: What Comes Next?

As the 2026 World Economic Forum concludes later this week, we should not expect a grand consensus. The era of global unity is effectively over. Instead, watch for these milestones in the remaining quarters of 2026:

- Q2 2026 – The Earnings Test: The moment of truth for AI. If the “Hyperscalers” (major cloud providers) report slowing growth in AI revenue, the stock market correction could be swift and severe.

- The “Green Tariff” Retaliation: Expect emerging economies to challenge EU and US carbon tariffs at the WTO, potentially leading to a new round of supply chain disruptions in late 2026.

- Nuclear Renaissance: Expect a flurry of announcements regarding Small Modular Reactors (SMRs) funded by tech giants.6 This is the only long-term fix for the energy bottleneck, though it won’t solve the 2026 crunch.

Final Thoughts

The “AI Bubble” and “Trade Tariffs” are not separate stories; they are the same story of limits. We have hit the limits of hype without results, and the limits of global integration without trust. Navigating 2026 requires ignoring the noise of the “next big thing” and focusing on the fundamentals: cash flow, energy security, and supply chain resilience.