The “Ponzi” era of gaming is officially dead. As we settle into January 2026, a quiet revolution has taken hold: the “financialization of fun” has been replaced by the “ownership of experience.” With major studio releases like Off The Grid and Audiera finally stabilizing the market and wallet friction vanishing, blockchain is no longer the main character—it’s the invisible engine powering a new standard of digital property rights.

The Great Cleanse: How the “Crypto Winter” Purged the Speculators?

To understand the landscape of 2026, we must analyze the “Great Cleanse” that occurred over the last 18 months. The 2021-2022 cycle, dominated by the simplistic “Play-to-Earn” (P2E) model, promised players a living wage for mundane tasks. It was an economic mirage that collapsed under inflationary tokenomics and a lack of genuine gameplay loops.

By late 2025, the data painted a stark picture of this correction. Funding for blockchain gaming plummeted to just $293 million in 2025—a massive drop from the staggering $4 billion seen in 2021. This was not a death knell, but a necessary maturation event. The “easy money” dried up, forcing a mass extinction of projects that relied on hype rather than product.

High-profile shutdowns and retreats in 2025 signaled the end of the speculative cycle. However, from these ashes emerged Web3 Gaming 2.0. This new era is defined not by “earnings” but by “retention.” The survivors—studios like Gunzilla Games and established giants like Nexon—spent the downturn building complex, narrative-driven worlds. The industry has shifted from how much can I earn? to is this fun enough to play for free? This pivot, often termed “Play-and-Own,” uses blockchain to facilitate ownership, but relies on gameplay to drive the economy.

The Evolution from Cycle 1 to Cycle 2

| Feature | Play-to-Earn (The “Ponzi” Era: 2021-2023) | Web3 Gaming 2.0 (The “Quality” Era: 2026) |

| Primary Incentive | Financial ROI (Income Replacement) | Narrative & Entertainment (Fun First) |

| Asset Value | Driven by New User Inflows (Ponzi structure) | Driven by Utility, Rarity, & Social Status |

| Graphics/Engine | Basic 2D / Browser-based / Low Fidelity | Unreal Engine 5 / AAA Fidelity / Mobile Native |

| Onboarding | Requires Wallet/Crypto Knowledge | Social Login / Invisible Wallets / No Gas Fees |

| Economic Model | Hyper-Inflationary (Dual Token) | Circular Economy / Asset Sinks / Skill-Based |

The “Invisible” Blockchain: Infrastructure & Account Abstraction Dominance

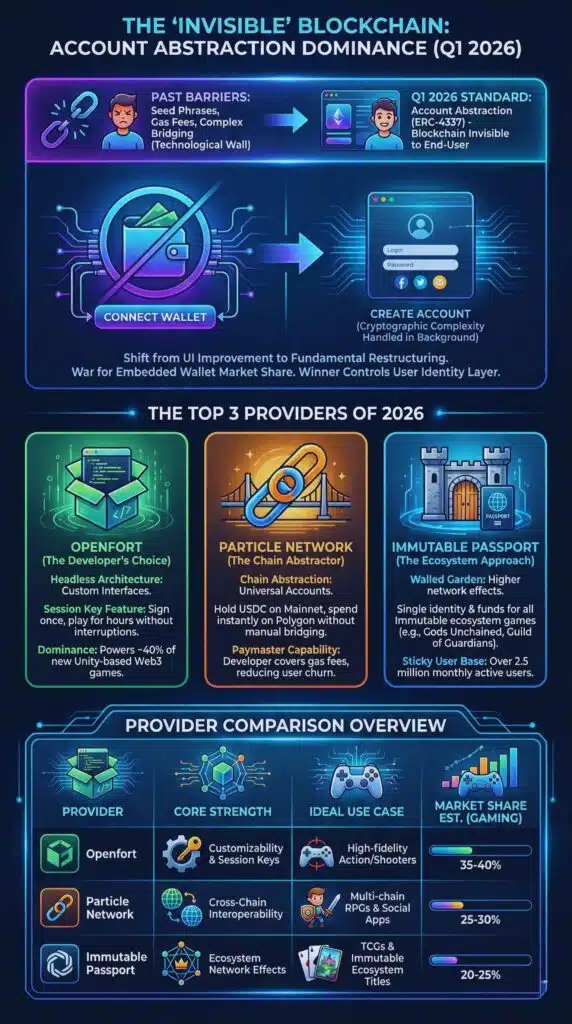

For years, the greatest barrier to entry for Web3 games was the “technological wall”: seed phrases, gas fees, and complex bridging mechanisms. In Q1 2026, the industry standard has shifted entirely to Account Abstraction (ERC-4337), effectively making the blockchain invisible to the end-user.

This shift is not just a UI improvement; it is a fundamental restructuring of how players interact with digital assets. We are witnessing a war for the “embedded wallet” market share, where the winner controls the user identity layer of the metaverse. The focus has moved from “connecting a wallet” to “creating an account,” with the cryptographic complexity handled entirely in the background.

The Top 3 Account Abstraction Providers of 2026

- Openfort (The Developer’s Choice): Openfort has emerged as the silent giant of 2026, primarily because of its “headless” architecture. Unlike competitors that force a specific UI, Openfort allows game studios to build completely custom interfaces while handling complex session key management in the background. Their dominance is driven by the “Session Key” feature, which allows a player to sign a transaction once at login and play for hours without interruptions. In Q1 2026, Openfort powers approximately 40% of all new Unity-based Web3 games.

- Particle Network (The Chain Abstractor): While Openfort dominates the wallet experience, Particle Network has cornered the market on “Chain Abstraction.” In 2026, games are often spread across multiple subnets. Particle’s “Universal Accounts” allow a player to hold USDC on Ethereum Mainnet and instantly spend it on a sword in a Polygon-based game without manually bridging. This “Paymaster” capability—where the developer covers gas fees—has been the single biggest factor in reducing user churn.

- Immutable Passport (The Ecosystem Approach): Immutable has taken a “walled garden” approach. Their Passport solution is less flexible than Openfort but offers higher network effects. A player with a Passport for Gods Unchained automatically has their identity and funds available for Guild of Guardians. This vertical integration has created a sticky user base of over 2.5 million active monthly users who refuse to leave the Immutable ecosystem.

Account Abstraction Provider Comparison

| Provider | Core Strength | Ideal Use Case | Market Share Est. (Gaming) |

| Openfort | Customizability & Session Keys | High-fidelity Action/Shooters | 35-40% |

| Particle Network | Cross-Chain Interoperability | Multi-chain RPGs & Social Apps | 25-30% |

| Immutable Passport | Ecosystem Network Effects | TCGs & Immutable Ecosystem Titles | 20-25% |

Economic Analysis: The Top 3 Performing Gaming Tokens of Q1 2026

The market of 2026 rewards utility and user acquisition over whitepaper promises. The top-performing tokens of the first quarter are not those with the highest APY staking rewards, but those attached to games that people are actually playing. We are seeing a divergence between “Infrastructure Tokens” (which are stable but slow) and “Hit-Driven Tokens” (which function like equity in a blockbuster movie).

1. Audiera (BEAT) – The Viral Breakout

- Performance: +31.5% in December 2025; continued momentum in Jan 2026.

- The Narrative: Audiera is the Dance Dance Revolution of the Web3 era. It successfully captured the casual mobile market by integrating AI-generated music that adapts to player skill.

- Why it’s winning: The tokenomics are deflationary by design. Players burn BEAT to generate custom AI tracks or “mint” their high-score dances as NFTs to sell to other players. The “burn-to-create” model has linked token price directly to Daily Active Users (DAU), creating a sustainable demand loop.

2. Off The Grid (GUNZ) – The AAA Standard

- Performance: Steady growth, effectively becoming the “USD of Shooters.”

- The Narrative: As the first true AAA blockchain shooter on PlayStation and Xbox, Off The Grid normalized crypto for console gamers.

- Why it’s winning: The GUNZ token operates on a dedicated Avalanche subnet, meaning it handles millions of micro-transactions (skin trades, looting) with zero gas cost to the user. In Q1 2026, GUNZ is outperforming traditional gaming ETFs because it is viewed as a proxy for the entire “Extraction Shooter” genre in Web3.

3. Immutable (IMX) – The Infrastructure King

- Performance: +15% YTD, low volatility compared to small caps.

- The Narrative: Immutable is the “App Store” of Web3 gaming. Even if individual games fail, the platform succeeds.

- Why it’s winning: With the rollout of the zkEVM mainnet in late 2025, Immutable solved the liquidity fragmentation issue. The IMX token is now required for a portion of protocol fees on every game in its massive ecosystem. As Gods Unchained and Guild of Guardians hit their stride in 2026, the volume of trading fees flowing back to IMX stakers has reached an all-time high.

Q1 2026 Token Performance Snapshot

| Token | Ticker | Sector | Q1 Trend | Key Catalyst |

| Audiera | $BEAT | Mobile / Music | Aggressive Buy | “Burn-to-Create” AI music feature launch. |

| Gunzilla | $GUNZ | AAA Shooter | Steady Growth | Console adoption & Battle Pass volume. |

| Immutable | $IMX | Infrastructure | Long-term Hold | zkEVM fee sharing & Ecosystem dominance. |

Strategic Forecast: The Regulatory Minefield of Q3 2026

While the technology and economics of Web3 gaming are thriving, a regulatory storm is brewing. We are currently in the “implementation phase” of the post-2025 regulatory reset. Q3 2026 (July-September) looms as the industry’s “Judgement Day.” This is when the grace periods for the EU’s MiCA regulation officially expire and the US courts are expected to deliver a final verdict on the “Consumptive Intent” doctrine.

1. The “MiCA Cliff” (EU) – July 2026

The final expiration of the “Grandfathering Clause” for legacy crypto-asset service providers (CASPs) under the Markets in Crypto-Assets (MiCA) regulation will occur in July. Up until now, many Web3 games operated in Europe under national transitional rules. Come July, the “passporting” system becomes mandatory. We predict a mass delisting of “Dual-Token” governance tokens from European exchanges. Regulators will likely enforce a strict separation between “Utility Tokens” (in-game currency) and “E-Money Tokens” (stablecoins).

2. The US “Consumptive Use” Doctrine – August 2026

The anticipated ruling in the SEC v. Coinbase appeal or similar circuit court cases will define “investment contracts” for digital assets. The industry is betting on a “Safe Harbor” for assets with “Consumptive Intent”—meaning tokens bought primarily to be used (e.g., to buy a skin) rather than held for profit. We forecast a split ruling: in-game currencies sold at a fixed price by the developer are NOT securities, but secondary market royalties distributed to token holders ARE securities. This effectively kills the “Revenue Share” model for passive token holders.

3. The Asian “Travel Rule” Expansion – September 2026

South Korea and Japan are expected to harmonize their “Virtual Asset Service Provider” (VASP) definitions, specifically targeting “Hosted Wallets” in games. Following South Korea’s blocking of foreign exchanges on Google Play in Jan 2026, the focus has shifted to “in-game wallets.” Regulators will demand that any in-game transaction over $1,000 (equivalent) triggers a KYC (Know Your Customer) check, even if the asset never leaves the game ecosystem.

The “Safe” vs. “Risky” Models of late 2026

| Feature | Safe Harbor Model (Low Regulatory Risk) | Securities Risk Model (High Regulatory Risk) |

| Token Purpose | Used to craft, repair, or customize items. | Used to vote on DAO proposals or claim fees. |

| Price Stability | Pegged or stabilized by game treasury. | Free-floating, marketed as “going to the moon.” |

| Secondary Market | Peer-to-Peer trading of items (NFTs). | Liquidity Pools (LPs) incentivized with yield farming. |

| Region Strategy | Geo-fenced economies (EU ver vs. Asian ver). | Global liquidity pool (Illegal in EU/Korea). |

Future Outlook: What Comes Next in 2027?

As we look toward the remainder of 2026 and into 2027, the trajectory of Web3 Gaming 2.0 points toward three distinct milestones.

First, we anticipate the “Mobile” Explosion via Telegram & TON. While AAA console games grab the headlines, the “Tap-to-Play” revolution on Telegram is quietly onboarding the widest user base. The simple “tapper” games of 2024 have evolved into complex, mid-core strategy games embedded directly in chat apps, lowering user acquisition costs to near zero.

Second, True Interoperability will finally be realized. We are seeing the early stages of “Universal Assets”—items that move between chains. The vision for 2027 is the “Hyper-Market”: a player looting a sword in a dungeon crawler on Avalanche, and selling it to a collector on Ethereum who uses it as a decorative item in a different metaverse platform.

Finally, the “Creator Economy” Merger will blur the line between “player” and “developer.” Tools like Shrapnel’s map editor allow players to mint their own levels as NFTs. In 2027, we expect the top 10% of gamers to earn more from creating content for games than playing them, fundamentally altering the labor economics of the digital world.

Web3 Gaming 2.0 has successfully shed the dead weight of the “Play-to-Earn” gold rush. The industry has realized that you cannot financialize a game that nobody wants to play. The winners of 2026—Audiera, Off The Grid, and the resilient infrastructure of Openfort and Immutable—are those that prioritized the “game” over the “fi.” They have proven that when the technology becomes invisible, and the story becomes paramount, blockchain becomes what it was always meant to be: a digital rights layer that empowers the player, not just the speculator.