In 2025, millennials are redefining how wealth is built—and much of this transformation is fueled by fintech tools. With traditional financial models falling short of addressing modern needs, millennials are turning to innovative digital solutions to manage money, invest, save, and plan for the future.

From AI-powered budgeting apps to cryptocurrency platforms, fintech is making wealth-building smarter, faster, and more accessible.

In this article, we explore 10 ways fintech tools are helping millennials build wealth smartly and reshape their financial futures with in-depth insights, practical strategies, and expert-backed trends.

1. The Fintech Revolution: How Millennials Are Redefining Wealth

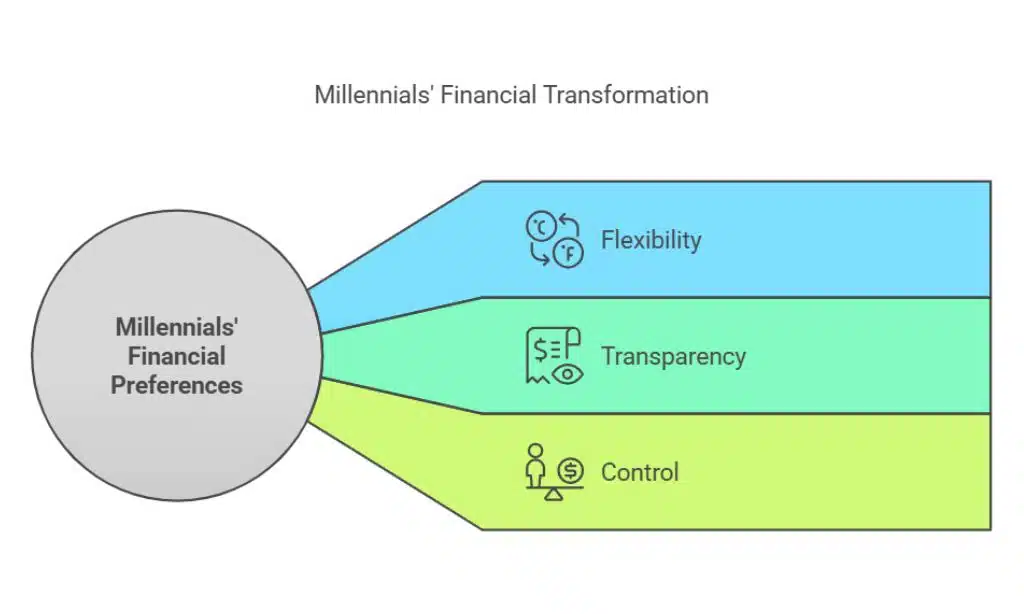

Millennials’ approach to money is vastly different from that of previous generations. Unlike baby boomers, who largely relied on traditional banks, pensions, and fixed savings accounts, millennials prefer digital-first solutions that provide flexibility, transparency, and control. Fintech has given them the ability to take charge of their financial destiny without relying solely on traditional banking systems.

Key Trends Driving the Fintech Revolution:

| Trend | Impact on Millennials |

| Mobile Banking & Digital Wallets | Enables seamless, on-the-go financial management |

| AI & Automation | Helps in smart budgeting, investing, and debt reduction |

| Cryptocurrency & Blockchain | Offers alternative investment options and decentralized finance |

| Neobanks & Alternative Lending | Eliminates reliance on traditional banking with lower fees |

By leveraging these fintech tools, millennials are breaking free from outdated financial norms and embracing strategies designed for the digital age.

2. AI-Powered Budgeting Apps for Smarter Money Management

One of the most effective ways fintech tools are helping millennials build wealth smartly is through AI-powered budgeting apps. These applications not only track expenses but also use predictive analytics to suggest savings strategies and highlight unnecessary expenditures.

Top Budgeting Apps in 2025:

| App Name | Key Features | Benefits |

| YNAB (You Need a Budget) | Zero-based budgeting, goal tracking | Helps eliminate debt and build savings |

| Mint | Automatic expense categorization, bill tracking | Provides a clear snapshot of financial health |

| PocketGuard | AI-driven spending limits | Ensures users don’t overspend |

| Empower | AI-driven personal finance coach | Offers real-time insights into financial habits |

Why It Matters:

By using AI-powered budgeting tools, millennials can automate the tedious aspects of financial management, freeing up time and energy to focus on long-term wealth-building strategies.

3. Robo-Advisors: Making Investing Accessible to Everyone

Investing has traditionally been seen as complex and intimidating. However, robo-advisors are democratizing access to investment opportunities by offering low-cost, automated portfolio management. These digital advisors eliminate the need for human financial planners and make investment strategies accessible to all income levels.

How Robo-Advisors Work:

| Feature | How It Benefits Millennials |

| Automated Portfolio Rebalancing | Ensures a diversified and risk-adjusted portfolio |

| Tax-Loss Harvesting | Minimizes tax liabilities and maximizes returns |

| Personalized Investment Plans | Adjusts asset allocation based on goals and risk tolerance |

Popular robo-advisors like Betterment, Wealthfront, and Ellevest make it easy for millennials to start investing with as little as $100.

Key Benefits:

- Low Fees: Robo-advisors charge significantly lower fees compared to traditional financial advisors.

- Diversification: Automated portfolios include a mix of stocks, bonds, and other assets to reduce risk.

- Goal Tracking: Users can set specific financial goals, such as retirement or buying a home, and track their progress in real time.

Robo-advisors are undoubtedly one of the top ways fintech tools are helping millennials build wealth in 2025 by making investing both affordable and approachable.

4. Cryptocurrency and Blockchain: The Future of Wealth Accumulation

Cryptocurrency and blockchain technology continue to disrupt traditional finance, offering millennials new ways to accumulate wealth. Unlike conventional assets, cryptocurrencies like Bitcoin and Ethereum provide decentralized, borderless investment opportunities. The introduction of tokenized assets and smart contracts has further expanded the fintech landscape.

Key Advantages of Crypto Investments:

| Advantage | Description |

| High Potential Returns | Crypto assets have historically outperformed traditional investments, albeit with higher risk. |

| Diversification | Adding cryptocurrencies to a portfolio can enhance diversification. |

| Decentralized Finance (DeFi) | DeFi platforms offer services like lending, staking, and yield farming, allowing users to earn passive income. |

Current Trends in Crypto Investments:

- NFT Marketplaces – Digital asset ownership is creating new investment opportunities.

- Crypto Index Funds – Managed funds that reduce the risk of investing in a single token.

- Stablecoins & CBDCs – Bridging the gap between traditional and digital currencies.

With the right strategy, crypto investments can be one of the most exciting ways fintech tools are helping millennials build wealth.

5. Digital-Only Banks: Hassle-Free Banking with High Savings Yields

Neobanks, also known as digital-only banks, are reshaping the banking landscape by offering user-friendly, fee-free services. These fintech banks often provide higher savings yields than traditional banks, making them a popular choice for millennials.

Popular Neobanks in 2025:

| Bank | Key Features | Benefits |

| Chime | No overdraft fees, early direct deposit | Helps manage money with fewer fees |

| Revolut | Multi-currency accounts, crypto trading, budgeting tools | Provides global financial access |

| N26 | Seamless mobile banking with real-time notifications | Enhances spending transparency |

By eliminating unnecessary fees and offering competitive interest rates, digital-only banks are empowering millennials to grow their savings faster.

6. Micro-Investing Apps: Turning Spare Change into Wealth

Micro-investing apps make it easy for millennials to start investing with minimal effort. By rounding up everyday purchases and investing the spare change, these apps help users build wealth over time.

Top Micro-Investing Apps:

| App | Investment Model | User Benefit |

| Acorns | Rounds up purchases and invests automatically | Helps passive investors start with small amounts |

| Stash | Allows fractional share investing | Provides flexibility in stock market entry |

| Robinhood | Offers commission-free stock and crypto trading | Enables cost-effective trading options |

Micro-investing may seem small, but over time, it can significantly contribute to wealth accumulation—especially when combined with the power of compounding.

7. Peer-to-Peer (P2P) Lending: Earning Returns Beyond Traditional Banks

Peer-to-peer lending platforms connect borrowers directly with investors, bypassing traditional banks. For millennials seeking alternative investment opportunities, P2P lending can offer attractive returns.

How It Works:

| Platform | Lending Model | Investment Risk |

| LendingClub | Consumer & business loans | Moderate risk, decent returns |

| Prosper | Unsecured personal loans | Higher risk, higher interest rates |

| Funding Circle | Small business lending | Diversified investment options |

By participating in P2P lending, millennials can generate passive income and diversify their wealth-building strategies.

8. Buy Now, Pay Later (BNPL): Smart or Risky for Millennials?

Buy Now, Pay Later (BNPL) services like Affirm, Klarna, and Afterpay are helping millennials manage cash flow by allowing them to split purchases into interest-free installments.

Pros and Cons of BNPL:

| Pros | Cons |

| Interest-free financing | Risk of overspending |

| Helps manage cash flow | Late payment fees |

| No impact on credit score (if paid on time) | Potential debt accumulation |

When used responsibly, BNPL can be a smart tool for managing short-term expenses without falling into debt.

9. Automated Savings Tools: Effortless Wealth Growth

Automated savings tools help millennials save money without even thinking about it. By setting up automatic transfers, users can gradually build an emergency fund, save for a vacation, or invest in long-term goals.

Popular Automated Savings Apps:

| App | Functionality | Why Millennials Love It |

| Digit | Uses AI to analyze spending and save daily | Encourages effortless savings habits |

| Qapital | Customizable savings rules and goals | Makes saving engaging and goal-driven |

| RoundUp | Rounds up transactions and saves difference | Helps save small amounts without noticing |

Automating savings is one of the easiest ways fintech tools are helping millennials build wealth smartly, as it eliminates the need for constant decision-making.

10. Financial Education Platforms: Empowering Millennials with Knowledge

Financial literacy is a critical component of wealth-building. Fortunately, fintech has made it easier than ever for millennials to access high-quality financial education.

Top Financial Education Platforms:

| Platform | Content Focus | Best For |

| Coursera | Online courses on investing, personal finance | Structured learning from experts |

| Finimize | Daily financial news and insights | Quick and easy financial updates |

| YouTube & Podcasts | Free video and audio financial education | Engaging and accessible learning |

By equipping themselves with financial knowledge, millennials can make smarter decisions and avoid common pitfalls.

With traditional financial models falling short of addressing modern needs, millennials are turning to innovative digital solutions to manage money, invest, save, and plan for the future. From AI-powered budgeting apps to cryptocurrency platforms, fintech is making wealth-building smarter, faster, and more accessible.

In this article, we explore 10 ways fintech tools are helping millennials build wealth smartly and reshape their financial futures with in-depth insights, practical strategies, and expert-backed trends.

Takeaways

In 2025, fintech tools are at the forefront of helping millennials build wealth smartly. From AI-driven budgeting apps to decentralized finance platforms, these innovative solutions are making financial management more accessible, efficient, and rewarding.

By leveraging the right fintech tools, millennials can take control of their finances, achieve their goals, and secure a prosperous future.

The key is to stay informed, use these tools wisely, and continuously adapt to the ever-evolving financial landscape. As fintech continues to evolve, the opportunities for millennials to build wealth smartly will only grow stronger.