Money problems can hit anyone. Maybe you need cash fast for an emergency or bills that won’t wait. That’s where viva payday loans come in handy. They offer quick money, which sounds great at first.

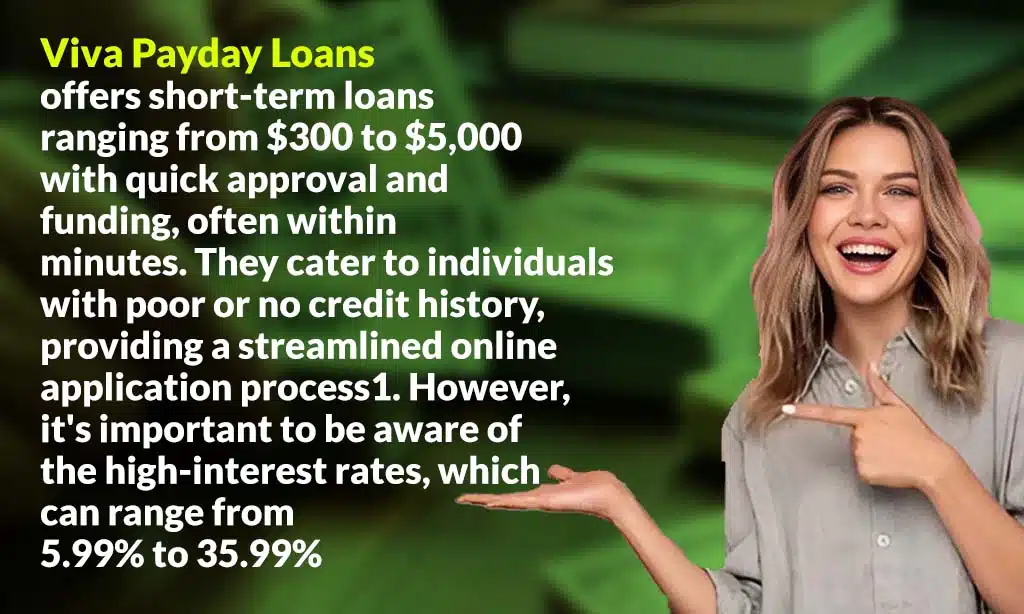

One fact to know is that borrowers can get from $100 to $5,000 with these loans. This post will show the good and bad sides of getting a loan from them. You’ll understand how it works and what to watch out for.

Keep reading to learn more!

What Are Viva Payday Loans?

Viva Payday Loans offer a quick way to get money before your next paycheck. They check if you’re eligible, then you apply online and might get the cash fast.

Overview of the loan process

Applying for a payday loan can seem daunting, but Viva makes it easy. With just a few steps, you can get the money you need fast.

- Start by deciding how much money you need. Borrowers can choose from $100 to $5,000.

- Next, think about when you can pay back the loan. Terms vary from 2 to 24 months.

- Fill out an online form with your personal details. It takes about 2 minutes.

- Show proof of how much money you make. This helps Viva decide if they can lend to you.

- Wait for Viva to review your application. This process is quick!

- If they approve your loan, you’ll get the cash soon after. Sometimes, funds arrive as early as 10:44 AM on the same day.

- Make sure to repay the loan on time to avoid extra charges.

This simple process makes getting a payday loan less scary and quite straightforward!

Eligibility requirements

After learning how Viva Payday Loans work, let’s look at what you need to get one. To apply, some requirements must be met.

You must be 18 or older. This is the first thing they check. A regular income of more than $1,000 per month is needed too. They want to see that you can pay back the loan.

Have a place where you live all the time. They use this information to contact you.

Owning a bank account with direct deposit is also a must. This is where they send your money. They ask for these things to make sure you’re ready for a loan. It helps them and helps you too.

Features of Viva Payday Loans

Viva Payday Loans stand out with their quick and easy online system. They offer a chance for money in a snap, without needing any property as security.

Flexible loan amounts

You can choose how much money you need with Viva Payday Loans. The amounts go from $100 to $5,000. This makes it easy to find the right amount for your needs, whether small or big.

You don’t have to borrow more than what’s necessary. This helps keep your debts manageable.

Each person picks a loan size that fits their situation best. Whether it’s $300 for an unexpected bill or up to $5,000 for a larger need, there is flexibility. After deciding on the loan amount, the next step is understanding the quick approval process.

Quick approval process

After choosing how much money they need, borrowers find the quick approval process a big help. They hear back in just 2 minutes online. This means no waiting around to see if they get the cash they need.

It’s all fast and simple.

Lenders use electronic checks for credit, but this won’t slow things down. Even people who don’t have great credit scores can get through quickly. And if everything checks out, the loan moves forward at speed.

The best part? Money often comes within a day. So, for anyone needing cash fast, this system works well. It makes sure there’s no long wait or hassle to get through.

Online application system

Filling out an online form for a Viva Payday Loan is quick. It takes about 2 minutes. You pick how much money you need, provide some personal info, and send in your application. This system makes it easy for people who need cash fast.

They don’t have to visit a store or wait in line.

This method is very user-friendly. People with any type of credit history can apply without stress. The process does not require a lot of financial papers or visits from the bank staff.

Next, we will talk about why you might want a Viva Payday Loan despite high-interest rates and short payback times.

No collateral required

People like Viva Payday Loans because you don’t need to use your things as security. This means you can get a loan without offering your car or house to back it up. It’s good news, especially if you have a lower FICO score and might not own much.

This setup works well for those in a tight spot who need money fast but don’t want the risk of losing their belongings. With no collateral needed, more people can apply. They feel safer knowing they won’t lose something important if they run into trouble paying back the loan.

Pros of Viva Payday Loans

The good parts of choosing Viva Payday Loans include getting money quickly, a simple online form for all types of credit, help for short-term money needs, and clear loan details. Keep reading to find out more about how these benefits can work for you.

Fast access to cash

Getting money fast is a big plus with Viva Payday Loans. People can get funds as early as 10:44 AM the same day they apply. This quick cash helps in emergencies or when money is tight before payday.

It’s simple and fast, making it a good choice for urgent needs.

Same-day funding within 24 hours makes life easier for many. You don’t have to wait long periods for loan approval or cash arrival. Just fill out an online form, meet some basic requirements, and you might get your money quickly.

Next up, let’s talk about how easy applying can be for all types of credit scores.

Easy application for all credit types

Viva Payday Loans accept people with all FICO scores. This means you can apply even if your credit isn’t great. The loan application process is online, making it simple and fast. You don’t need to visit a bank or wait in long lines.

This helps everyone, including those who are unemployed.

You only need to provide some personal details and proof of income. They won’t ask for collateral like a house or car. This is good news for folks who need cash but don’t own much.

Plus, the privacy policy keeps your financial information safe.

So, applying for Viva Payday Loans is easy, no matter what your credit score looks like. It opens doors for many looking for quick money without the hassle of traditional banking processes.

Short-term financial solution

After talking about the easy application process for all credit types, it’s crucial to highlight how Viva Payday Loans serve as a short-term financial fix. These loans offer quick cash that can bridge the gap until your next paycheck.

You might need money for an urgent car repair or a sudden medical bill. Here, payday loans step in to help. With repayment terms from 2 to 24 months and options for weekly, biweekly, or monthly repayments, they fit small emergency needs well.

But remember, these are temporary fixes not long-term solutions. It’s easy to apply and get money fast even with different amounts of income or credit history issues like lower scores that other lenders shy away from.

However, planning is key to make sure you’re using them smartly—covering immediate expenses without falling into debt traps that are hard to escape from later on.

Transparent lending process

Viva Payday Loans makes the loan process clear. They tell you everything about your loan, like how much it will cost and when you need to pay it back. You get all the details up front.

This helps you avoid surprises later.

They use a simple online system for this. You can see how much interest you’ll pay from the start. The rates range from 5.99% to 35.99%. Also, they let you know if you’re approved fast—within just 2 minutes online.

Cons of Viva Payday Loans

Viva Payday Loans can be a quick way to get cash, but there’s a downside. High fees and fast repayment demands might lead you into more financial trouble.

High-interest rates

Payday loans have high interest rates. This means you pay back a lot more than you borrowed. Interest rates can be from 5.99% to 35.99%. Loans like these are costly ways to get money.

The higher costs come because these loans are easy to get and fast. They don’t need good credit scores or collateral. But, the APRs (Annual Percentage Rates) make it hard for many people to pay back on time.

Paying a lot in interest adds up quickly, making it tough for borrowers. If someone borrows too often, they might fall into a cycle of debt that’s hard to break free from.

Short repayment periods

Viva Payday Loans have short repayment times. They range from 2 to 24 months. This means you must pay back the money fast. It can be hard if you don’t have much cash each month. You might struggle to cover the loan plus interest.

This setup often leads people into a cycle of debt. They take another loan to pay off the first one. Short repayment periods push borrowers to act quickly without thinking about long-term effects or exploring lower-cost options for their financial troubles.

Risk of debt cycle

Taking out payday loans can lead to a debt cycle. This means people keep borrowing more money to pay off the first loan. High-interest rates make this worse. They add up fast, making it hard to pay back the money.

People often borrow again when they can’t cover their costs or the high loan repayment amounts. This cycle of borrowing and repaying with new loans keeps going. It makes getting free from debt very hard for many people.

Limited loan amounts

Moving from the risk of a debt cycle, we see another challenge: limited loan amounts. Viva Payday Loans offers money ranging from $100 to $5,000. This range seems wide but might not cover larger needs.

Think about big bills or emergency costs that go beyond $5,000. In those cases, these loans won’t help much.

Also, the specific amounts available—like $100, $300, or up to $1,000—are helpful for small expenses. Yet, they may fall short for bigger financial goals or emergencies. People needing more substantial sums will have to look elsewhere.

This limit affects how useful these loans can be for significant investments or solving major financial crises.

Types of Viva Payday Loans

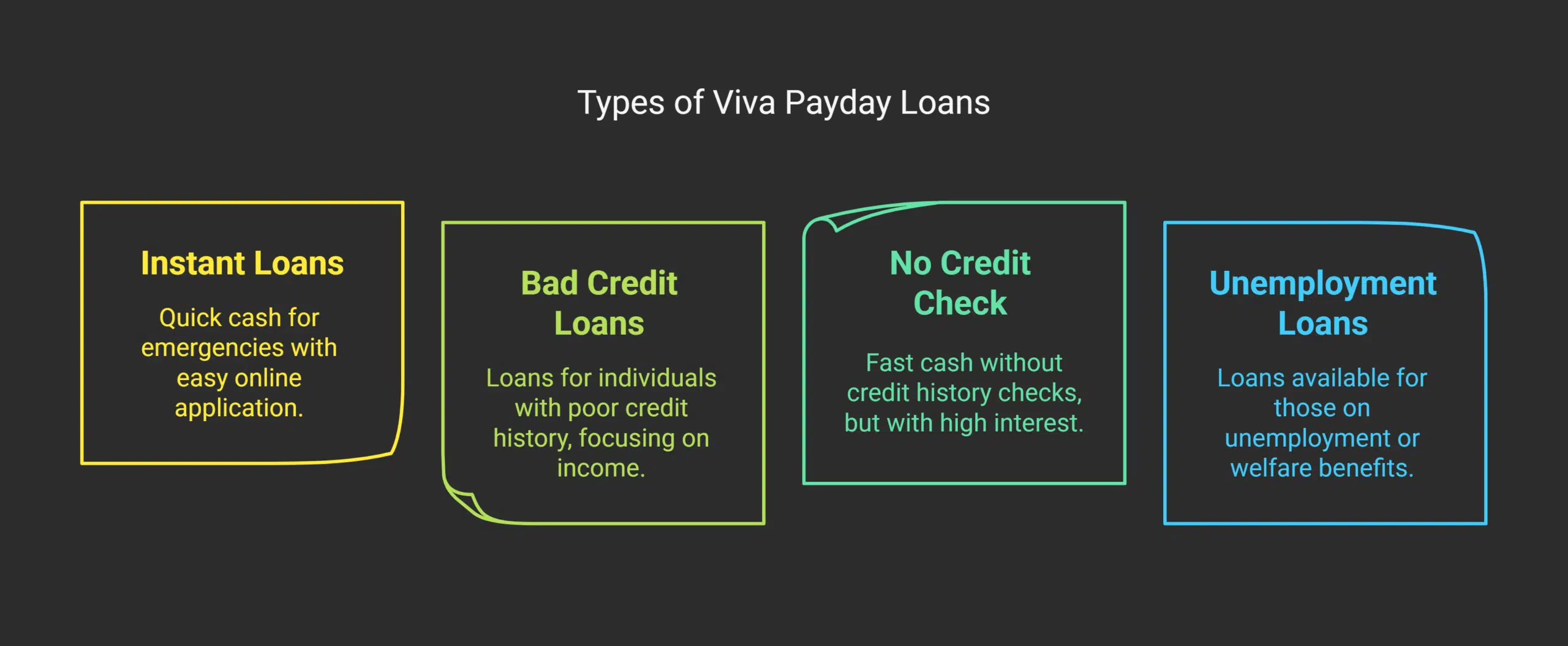

Viva Payday Loans offers different kinds to meet your needs. From instant options that get you cash fast to loans that don’t peek at your credit history, they have something for everyone.

Instant payday loans

Instant payday loans offer quick cash. People with bad credit find it helpful. They get money fast for emergencies. These loans are easy to apply for online. Users with prepaid cards also get guaranteed approval.

This type of loan helps when you need money right away. It does not take long to apply or to get the money. Even those on welfare can apply. But these loans have high interest rates and short payback times.

Loans for bad credit

Loans for bad credit are special. They help people who have trouble getting loans from banks. These loans do not need a good credit score. Instead, lenders look at your ability to pay back now.

This means they check how much money you make and if you can pay the loan on time.

Getting these loans is quick and easy online. You just choose how much money you need and give some info about yourself. They do not always check your credit history deeply. This is great for people who need cash fast but have had money troubles before.

Payday loans with no credit check

Payday loans with no credit check offer a fast way to get cash. They let people borrow money without the lender looking at their credit history. Interest rates for these loans are between 5.99% and 35.99%.

This makes it easier for those with bad or no credit to get help in emergencies.

These loans work well for quick needs but remember, they come with high costs. High interest can make paying back hard if you’re not careful. It’s best to think about how much you really need before taking one of these loans.

Next, we look at payday loans for unemployment or welfare benefits…

Payday loans for unemployment or welfare

Many people who do not have jobs or get help from the government can still get payday loans. These are called quick online payday loans for unemployed individuals or fast payday loans on welfare (TANF).

This means if someone needs money right away and they don’t have a regular paycheck, they might still be able to borrow some cash. People can apply for these loans even if their only income comes from unemployment benefits or welfare.

The process is simple. Someone fills out an application online and provides details about their income source, even if it’s from supplemental security income (SSI) or temporary assistance for needy families (TANF).

Then, the lender looks at this information to decide if they will give out the loan. This way, people who really need money and do not work in a traditional job have a chance to get help when they need it most.

How to Apply for Viva Payday Loans

Applying for Viva Payday Loans is simple—just select how much money you need and for how long, fill in some personal information, show how you make your money, and then wait a bit to get approved and receive your funds.

Ready to see if a payday advance fits your needs? Read on to learn more.

Choose the loan amount and term

Picking the right loan amount and how long you have to pay it back is key. You can pick from $100 to $5,000. Also, decide if you want to pay over 2 months or stretch it up to 24 months.

This choice affects your monthly payment size and interest.

Next step involves thinking about how much cash you really need and for how long. If you borrow more than necessary, you might pay extra in interest. A shorter term means less interest but bigger payments each month.

So, choose wisely based on your income and what you can afford to repay without stress.

Provide necessary personal details

To apply for Viva Payday Loans, one must fill out a quick online form. This form asks for personal and money details. You need to be 18 years or older and have a lasting place to live.

The process is simple—enter your name, address, age, and other key info. They check these details to see if you fit their rules for getting a loan.

You also add your job info and how much you make. This helps them understand if you can pay back the money borrowed. It’s important to give correct data to avoid any problems with your application.

Sharing this information takes only a few minutes but is a big step in getting fast cash help.

Submit proof of income

Showing you make more than $1,000 each month is key. This shows you can pay back the loan. For this, use your recent pay stubs or bank statements where your income goes in. Make sure these papers clearly show your name and how much money you get often.

Your job or benefits might be where the cash comes from. Just ensure that it adds up to at least $1,000 per month after taxes. Using direct deposit into a checking or savings account helps too.

This makes everything easier and faster for both sides.

Receive approval and funds

Getting approval takes no time. You will know if you get the loan within 2 minutes. This is fast and easy. If all goes well, the money can land in your bank by 10:44 AM on the same day you apply.

This means quick help when you really need it.

You just fill out the form, wait a bit, and then see money in your account. It’s designed to be smooth and hassle-free. For anyone needing cash fast, this process cuts down waiting times and gets things moving quickly.

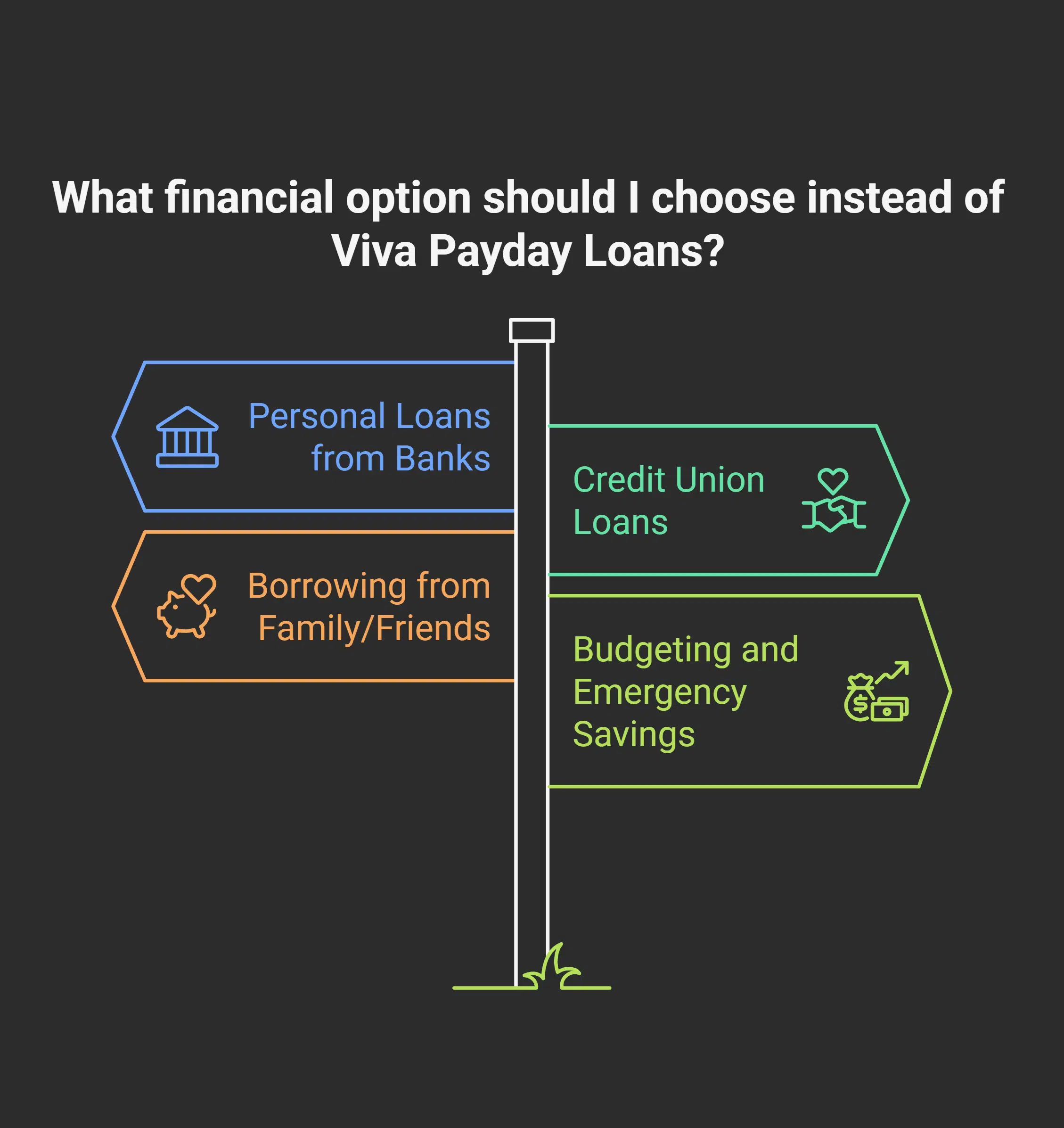

Alternatives to Viva Payday Loans

If Viva Payday Loans don’t seem right for you, there are other paths to explore. You might find a solution that fits your financial situation better without the high costs.

Personal loans from banks

Banks offer personal loans. These are for people who need money for things like fixing their homes or paying off debt. Banks check your credit history before they give you a loan. They want to make sure you can pay back the money.

Getting a loan from a bank might take some time because of all the checks they do.

Personal loans from banks have different interest rates and repayment plans. The better your credit score, the lower your interest rate might be. This means the loan costs less over time.

Some banks also let you pick how long you want to take to pay back the loan, which can help fit your budget.

You need to fill out an application for a bank loan. This includes giving them information about your job, income, and debts. Banks use this info to decide if they will give you a loan and how much they will lend you.

Credit union loans

Moving from bank personal loans, credit union loans offer a different path. Credit unions are like banks but more community-focused. They often give better rates on loans than banks.

This is because they’re not-for-profit entities. Their goal is to serve members, not make money off them.

Credit unions check your credit history when you apply for a loan. But they might be more willing to work with you if your credit isn’t great. They look at your whole financial situation, not just your credit score.

You need to join the credit union to get a loan, which usually means living in a certain area or working for certain employers.

These places also help with debt consolidation and financial advice. Since they know the community well, their tips are often very helpful. Plus, being part of a credit union can feel like being part of a small family that wants to help you succeed financially.

Borrowing from family or friends

Borrowing money from relatives or buddies can be easier on your wallet. They often don’t charge high fees like payday loans do. This way, you might not have to deal with the tough spots those expensive loans can put you in.

Also, they usually let you pay back in a way that works better for you.

Getting help from those close to you is smart when money gets tight. You only take what you need, and comparing their terms with other lenders could save you more. Support from family or friends tends to last longer than what payday loans offer during hard financial times.

Budgeting and emergency savings

Moving on from getting help from family or friends, creating a budget and building emergency funds stand out as smart moves. Setting up a budget helps you track where your money goes each month.

It makes sure there’s enough for your needs, wants, and savings too. With a plan, you can set aside money for unexpected events without having to rely on things like payday loans.

Emergency savings act as a safety net when life throws surprises at you. Whether it’s a car repair or medical bill, having funds ready keeps stress away. Starting small is okay; what matters is the habit of saving regularly.

Over time, this fund grows and offers peace of mind knowing you’re prepared for whatever comes next.

Tips for Borrowers

When thinking about borrowing money, it’s smart to look at your whole financial picture first. See if you really need the loan and how you’ll pay it back. Before signing anything, make sure you understand all the terms—like interest rates and repayment schedules.

This way, you don’t end up in a tough spot later on. Also, think about other ways to get what you need without going into debt. Maybe there’s a cheaper option out there!

Evaluate your financial situation

Look at your money closely. Know how much comes in and goes out every month. This means checking your bank statements, bills, and any cash you spend. It helps to write everything down or use an app to track it.

Think about what you owe. List all debts like credit card debt, loans, and anything else you have to pay back. Also, figure out how much it costs to live each day—rent, food, and gas for the car.

Knowing this stuff lets you see if a payday loan can fit without trouble. It’s important because these loans cost a lot and need quick payback. Plus, knowing can help avoid borrowing too many times or looking for cheaper ways to get money when needed.

Understand loan terms and conditions

After you’ve looked at your finances, it’s time to get familiar with the loan terms and conditions. It means knowing how much you need to pay back, when, and what happens if you can’t.

The APR for Viva Payday Loans goes from 5.99% to 35.99%. Repayment times are between 2 and 24 months. These details matter because they affect how much you’ll spend in the end.

Knowing these facts helps avoid surprises later on. You should also check if there are extra fees or rules about paying early or late. Reading through this information makes sure you know what you’re agreeing to before saying yes.

This step is crucial for keeping your credit score safe and managing your money well.

Avoid repeat borrowing

Once you understand the loan terms and conditions, think twice about borrowing again. It might seem easy to get more money fast, but this can lead to trouble. High-interest rates make it hard to pay back what you owe.

This means you could be stuck in a cycle of debt.

It’s not just about today’s needs. Think about tomorrow too. If you keep taking out loans, your credit worthiness could drop. This makes financial freedom harder to reach. So, try not to take out another loan unless it’s really necessary.

Look for other ways to handle money problems first.

Explore lower-cost options

Avoiding repeat borrowing leads us to explore cheaper ways to borrow money. Personal loans from banks might be a better choice if you have good credit. These loans often have lower interest rates than payday loans.

Credit union loans are another option. They’re known for having great rates and flexible terms.

Borrowing money from family or friends can also save you from high costs. It’s a personal way to solve your money problems without dealing with banks or loan companies. Lastly, setting up an emergency fund is wise.

This way, you can cover unexpected costs without any loan.

Credit Counselling Canada offers advice on managing money and debts wisely. Talking to them could help avoid the need for quick cash in the future.

Takeaways

Viva Payday Loans give quick cash. They accept most credit types and offer fast money. But, they have high fees and short payback times. There are many loan types to fit different needs.

Other options exist if these loans don’t work for you. Remember, choosing wisely helps avoid debt traps.