A House subcommittee hearing branded “Dawn of the New Nuclear Era” is significant now because US electricity demand is rising, fuel supply chains are fragmenting, and Washington is testing whether nuclear can scale fast enough to serve climate goals, AI growth, and national security without breaking budgets or public trust.

How We Got Here

The Subcommittee on Energy under the House Committee on Energy and Commerce scheduled its January 7, 2026 hearing on “American Energy Dominance: Dawn of the New Nuclear Era” around a practical question: can the US license and deploy nuclear fast enough to matter in the 2020s, and can it do so inside the constraints of cost, fuel availability, and regulation.

This framing did not come out of nowhere.

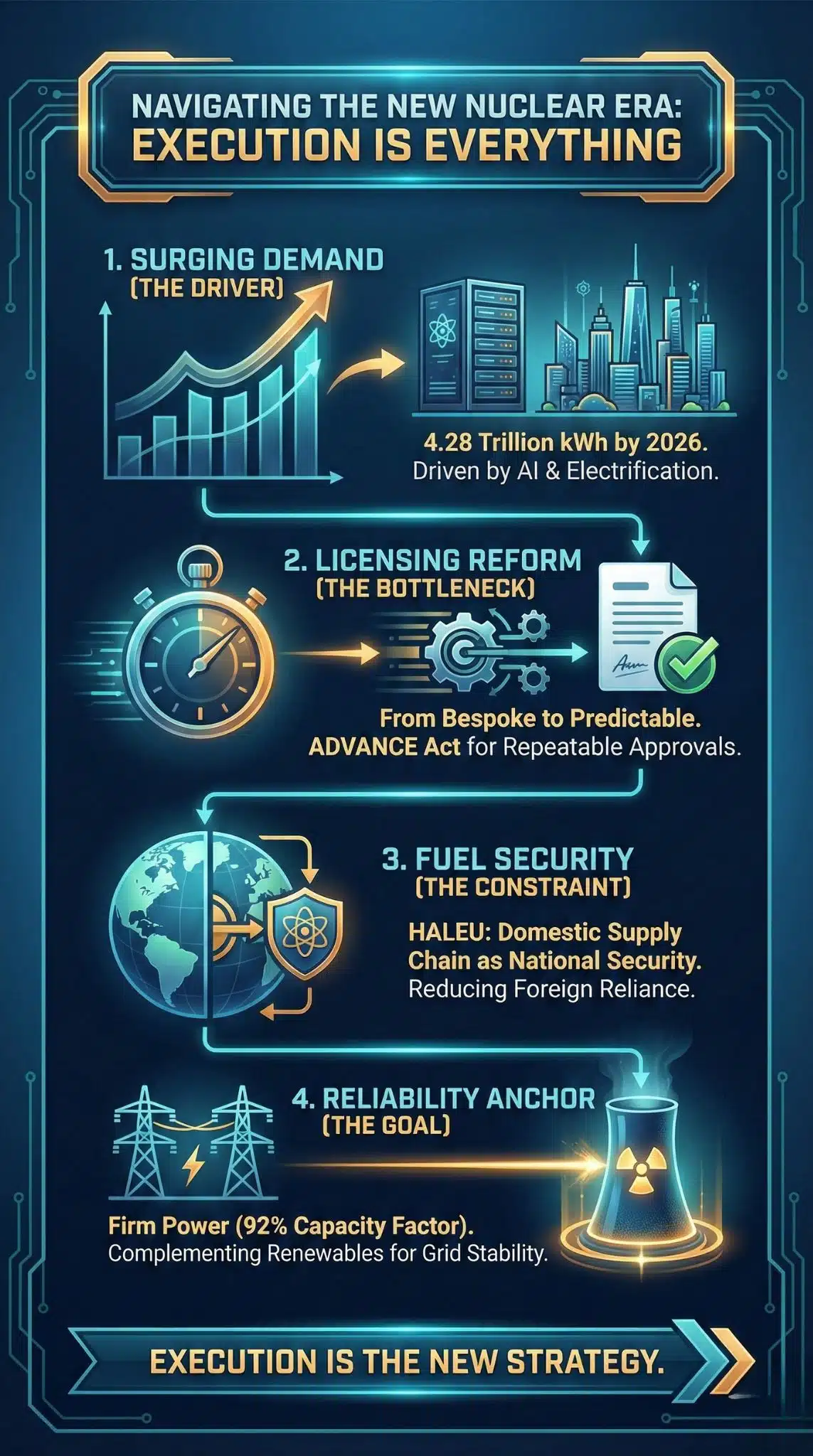

First, demand is shifting. US electricity consumption is expected to hit record levels in 2025 and again in 2026, driven by electrification and fast-growing loads like data centers. Public forecasts and reporting citing the Energy Information Administration (EIA) point to 2026 demand rising to around 4.28 trillion kWh. When the demand curve rises, reliability stops being a talking point and becomes a political pressure.

Second, nuclear is back in the legislative spotlight. “Energy dominance” language tells you how lawmakers want to sell nuclear: not only as clean energy, but as industrial strategy. In that framing, reactors are infrastructure, not just generation assets.

Third, fuel and regulation are tightening simultaneously. In the past, US nuclear debates focused heavily on safety and economics. Now the supply chain is a central concern. Restrictions on Russian uranium products and the scramble to create a domestic HALEU pipeline mean that nuclear’s future is linked to geopolitics and manufacturing capacity in a way wind and solar are not.

In short, this hearing is less about whether nuclear is “good” and more about whether the US can execute. That distinction is the heart of the new nuclear era.

Key Statistics That Explain Why Nuclear Is Back

- US nuclear generation was about 782 TWh in 2024, slightly above 2023 levels, based on EIA reporting.

- The US nuclear fleet operated around a 92% capacity factor in 2024, one reason nuclear is repeatedly framed as a reliability resource.

- EIA-linked forecasts reported widely in major media project record US electricity demand in 2026, near 4,284 billion kWh.

- Uranium prices have remained elevated compared with pre-2021 norms, with widely tracked market indicators hovering around the low $80s per pound in early January 2026.

- The US government has moved from strategy to spending on enrichment capacity, with widely reported federal awards totaling $2.7 billion to expand domestic capabilities and reduce reliance on Russia.

What The US Nuclear Energy Hearings Reveal About The Real Bottlenecks

Licensing Reform Is Now The Center Of Gravity

If you strip the rhetoric from “Dawn of the New Nuclear Era,” the real story is the licensing pipeline. Nuclear does not scale by announcement. It scales by predictable, repeatable approvals.

Two policy tracks are reshaping that pipeline:

Legislation (ADVANCE Act implementation). The Nuclear Regulatory Commission (NRC) has publicly described the ADVANCE Act as requiring actions to improve efficiency and timeliness in licensing new reactors and fuels while keeping safety and security central. The political bet is that the licensing system built for bespoke large reactors can be adapted for standardized designs.

Executive pressure to shorten timelines. The federal government has also pushed a more aggressive narrative about reforming licensing speed and cost. Supporters argue the US cannot compete if licensing takes too long. Critics warn that pushing timelines can risk regulator independence and public trust.

Why this matters: Advanced reactor developers sell a story of standardization. Standardization only works if regulators accept it. The hearing’s emphasis on “implementation” signals Congress understands the gating item is often not physics, it is process.

What comes next: Expect lawmakers to push for clearer review timelines, lower licensing costs for repeat designs, and more NRC staffing capacity for novel fuels and reactor technologies. The risk is that speed goals, handled poorly, can trigger backlash and litigation that slows deployment later.

The Economic Debate Has Moved From “Can It Work” To “Who Pays”

Nuclear’s revival runs into the same wall it always has: capital cost.

The Vogtle expansion in Georgia is now both proof the US can still build and a warning about cost and schedule risk. It strengthened one argument and weakened another. The argument strengthened is that the US can complete new large reactors. The argument weakened is that it can do so with predictable budgets in a modern environment.

This is why the new nuclear era is centered on financial architecture:

- Support for the existing fleet. The federal production tax credit for existing nuclear generation (Section 45U) is structured to reduce closure risk. That matters because keeping today’s reactors online is the fastest way to preserve firm, low-carbon electricity without waiting for new builds.

- First-of-a-kind de-risking for new designs. New reactor projects are sensitive to financing costs. The longer permitting takes, the more interest accumulates. Every month of uncertainty is expensive. In that sense, licensing reform and cost of capital are intertwined.

Why this matters: If the new nuclear era happens, it will look less like a classic utility buildout and more like a blended market: federal credits, federal procurement, regulated utility recovery, and corporate offtake agreements stitched together.

What comes next: Watch whether Congress prioritizes keeping the current fleet online, accelerating first-of-a-kind advanced projects, or doing both. The sequencing matters. Keeping plants online delivers near-term reliability. New builds determine whether nuclear grows.

Fuel Is Becoming A National Security Constraint, Not A Commodity Detail

Advanced nuclear designs create a new problem: fuel is not interchangeable.

Many next-generation reactors rely on HALEU. The Department of Energy’s HALEU Availability Program has publicly framed its goal as using purchases and limited government assets to jump-start a private fuel ecosystem.

At the same time, US policy has moved toward restricting Russian uranium imports and shrinking exposure to a supply chain the US no longer views as dependable. This is not a minor procurement issue. It changes reactor deployment timelines.

A reactor license without fuel is a paper victory.

| Fuel Layer | Why It Matters For Deployment | Current Pressure Point |

| Uranium supply (mining) | Long lead times and global competition | Tight supply narrative and higher prices |

| Conversion and enrichment | Required for LEU and critical for HALEU | Russia exposure and need for domestic scaling |

| Advanced fuel forms | Needed for many SMRs and microreactors | Limited commercial-scale capacity today |

Why this matters: Fuel supply is now strategic infrastructure. It influences which reactor designs are viable, how fast they can be deployed, and whether the US can claim “energy dominance” with credibility.

What comes next: Expect more scrutiny on enrichment buildout schedules, HALEU allocation rules, and the nonproliferation tradeoffs raised by higher-assay fuels. This debate will become louder as more projects move from concept to construction planning.

Grid Reliability, AI Load Growth, And The Return Of “Firm Power” Politics

Nuclear’s strongest argument in 2026 is not “zero carbon.” It is “firm power.”

The US nuclear fleet’s high capacity factor is frequently used as evidence that nuclear delivers reliability at scale. Meanwhile, the electricity demand outlook has shifted. Growth in data centers and electrification pushes planners to think in terms of adequacy, not only affordability.

That shift changes how policymakers judge nuclear:

- In a flat-demand world, nuclear adds capacity that mainly displaces something else.

- In a rising-demand world, nuclear can be framed as additive, enabling electrification while reducing reliability risk.

The hearing’s “energy dominance” framing aligns with a broader political pivot. Energy policy is being recast as competitiveness policy. In that language, electricity is strategic infrastructure.

Why this matters: Once reliability is framed as national competitiveness, nuclear tends to gain bipartisan room, even when parties disagree on renewables.

What comes next: The tension is timing. Solar plus storage can be faster to deploy in many markets. New nuclear often has longer lead times. The policy question becomes whether the US wants a portfolio where fast-build resources cover near-term growth while nuclear is positioned as a firm anchor for the 2030s.

Nuclear’s Relationship With Renewables Is Evolving From “Competition” To “System Design”

The old argument is nuclear versus wind and solar. The more useful argument is system design.

Renewables have speed and cost advantages in many regions. Nuclear has firm output and long operating lifetimes. Grid planners increasingly treat the question as: what combination yields reliability under extreme weather, constrained transmission, and faster demand growth.

This is where a real nuclear comeback would land. Not as a replacement for renewables, but as a structural complement.

| Grid Need | Nuclear Strength | Renewable Strength | Policy Tension |

| Firm capacity | High availability and stable output | Depends on storage duration and weather | Who gets priority support |

| Speed of deployment | Often slower, especially first-of-a-kind | Often faster to build | Speed versus permanence |

| Price stability | Low fuel cost sensitivity once built | Very low marginal cost | Upfront financing risk |

Why this matters: The new nuclear era, if real, is not guaranteed to be “nuclear replaces renewables.” It may become “nuclear plus renewables,” with flexible generation and demand response filling gaps.

What comes next: Expect renewed focus on permitting reform beyond nuclear. If transmission and interconnection delays persist, firm local generation becomes politically more attractive by default.

Waste, Safety, And Public Trust Are The Quiet Veto Players

Congress can change statutes. It cannot legislate trust.

Nuclear skepticism persists around waste, safety culture, and proliferation risk. Any push to accelerate licensing will face a credibility test: can the system move faster while remaining transparent and independent.

This is where hearings matter. They shape the boundaries of reform. If lawmakers push speed without building guardrails and transparency, the backlash can slow deployment through litigation and local opposition.

Why this matters: Nuclear projects are uniquely exposed to delay cascades. A single high-profile controversy can affect timelines nationwide.

What comes next: Watch for proposals that pair faster licensing with clearer transparency measures, emergency planning clarity, and community benefit models, especially for siting at retired coal plants or existing nuclear sites.

A Winners And Losers Snapshot

No transition is neutral. A nuclear push reallocates advantage across industries and regions.

| Likely Winners | Why | Likely Losers | Why |

| Existing nuclear operators | Credits and policy support reduce closure risk | Aging fossil plants without retrofit plans | Higher pressure to retire or convert |

| Enrichment and fuel firms | Federal support accelerates domestic scaling | Russia-linked supply chains | Decoupling and restrictions |

| Coal transition regions | Potential sites for repowering and jobs | Ratepayers in first-of-a-kind projects | Cost overrun exposure risk |

| Data center corridors | Stronger access to firm power narratives | Pure intermittent strategies in tight grids | Higher integration requirements |

Expert Perspectives: Where The Case For Nuclear Is Strongest, And Where It Is Weakest

To stay objective, separate near-term credible claims from longer-term hopes.

The stronger case (credible near-term):

- Keeping existing reactors operating longer is a fast lever for reliability and emissions goals. It avoids the long lead times of new construction.

- Fuel security is a legitimate strategic concern. If advanced nuclear depends on fuels the US cannot reliably supply, deployment becomes a geopolitical story as much as an energy story.

The weaker case (still uncertain):

- Large-scale deployment of advanced reactors depends on multiple bottlenecks moving at once: fuel supply, licensing timelines, construction supply chains, and financing.

- Cost discipline remains the key question. Without consistent cost performance, nuclear growth becomes dependent on continuous policy support, which can be politically fragile.

The hearing’s subtext is that Congress wants to force clarity: if nuclear is going to be central, it must become buildable again as a repeatable product.

The Look Ahead: What To Watch After The Hearing

The hearing matters less for soundbites and more for follow-through. Here are the milestones that will show whether this is rhetoric or regime change.

A Measurable Licensing Clock

If lawmakers extract commitments around predictable review timelines, especially for repeat designs and standardized applications, that can reduce financing costs by shrinking regulatory duration risk.

HALEU Availability Moves From Allocation To Delivery

Developers need real deliveries aligned to construction schedules. Policy wins mean little if fuel arrives late.

The “First Three” Advanced Reactors Narrative Gets Stress-Tested

US political messaging has leaned into ambitious timelines for demonstrating advanced reactors. Whether those timelines hold will shape investor confidence.

The Market Picks A Few Designs

A real buildout will narrow to a small set of designs with regulator familiarity, supply chain traction, and financing support. Many concepts will not survive this selection process.

Community Siting And Benefit Models Mature

If nuclear expands, it expands somewhere. Acceptance will depend on credible governance, visible local benefits, and clear safety communication.

Final Thoughts

The phrase “Dawn of the New Nuclear Era” is marketing. The reality is a test of state capacity. Can the US modernize licensing without undermining trust, rebuild fuel supply chains during geopolitical fragmentation, and create financing models that do not repeat the cost shocks of past megaprojects.

If the answer is yes, nuclear becomes a durable pillar in an electrified, AI-driven economy because it solves a hard systems problem: firm, low-carbon power at scale. If the answer is no, the hearing still matters because it clarifies what nuclear cannot do quickly and forces policymakers to lean harder on transmission, storage, demand management, and faster-build generation to meet near-term load growth.

Either way, this is the shift: Washington is no longer debating nuclear as an idea. It is debating nuclear as execution.