Buying or selling a home is exciting, but one wrong move can wipe out your savings. Many people make real estate mistakes that cost them thousands without even realizing it.

A common error? Skipping the home inspection to save money. This often leads to pricey repairs later. In this post, you’ll learn the 7 biggest real estate mistakes that will cost you thousands—and how to avoid them.

Keep reading before you regret it.

Mistake #1: Skipping Market Research

Skipping market research is like driving blindfolded—you’re bound crash into costly errors fast! Many sellers set prices based on emotions instead hard data (like comparative market analysis).

This leads overpricing which scares buyers away fast!

Ignoring local property values trends hurts too! Homes priced wrong sit unsold longer forcing price cuts later costing thousands extra! Smart investors check interest rates debt-to-income ratios upfront avoiding nasty surprises down road! A solid broker helps navigate these details saving time money stress-free sale process ahead time crunch hits harder later stages closing deals smoothly without hiccups along way forward progress made easier smarter choices early-on pays off big-time returns end game plan success story waiting happen right now today folks get moving already!!

Mistake #2: Ignoring Property Inspections

Property inspections are your safety net. Skipping them is like buying a car without checking under the hood. A home inspector can spot hidden issues, from leaky pipes to faulty wiring, saving you from costly surprises later.

Overpaying for a house with unseen problems hurts your wallet and peace of mind.

An inspection is cheap compared to the cost of fixing major defects after you buy.

Curb appeal might trick buyers, but a home inspector sees beyond fresh paint. Problems like mold or foundation cracks often go unnoticed without professional eyes. Buyers who skip inspections risk foreclosure if repairs drain their savings.

Smart investors always budget for a thorough check before closing the deal.

Mistake #3: Overestimating Your Budget

Buying a home without crunching the numbers can burn through your savings fast. Many buyers stretch their budget, only to struggle with mortgage payments later. Variable rates or unexpected costs pile up quickly.

Picking the wrong loan type hurts too. Some choose high monthly payments, ignoring future repairs or taxes. Over-improving for the neighborhood won’t pay off either—you won’t recoup that fancy kitchen if nearby homes sell for less.

A tight budget leaves no room for surprises like a leaky roof or rising capital gains taxes after selling.

Smart financing means planning ahead. Work with mortgage lenders to find stable rates that fit your tax bracket and income comfortably—so you don’t end up house-rich but cash-poor!

Mistake #4: Choosing the Wrong Financing Option

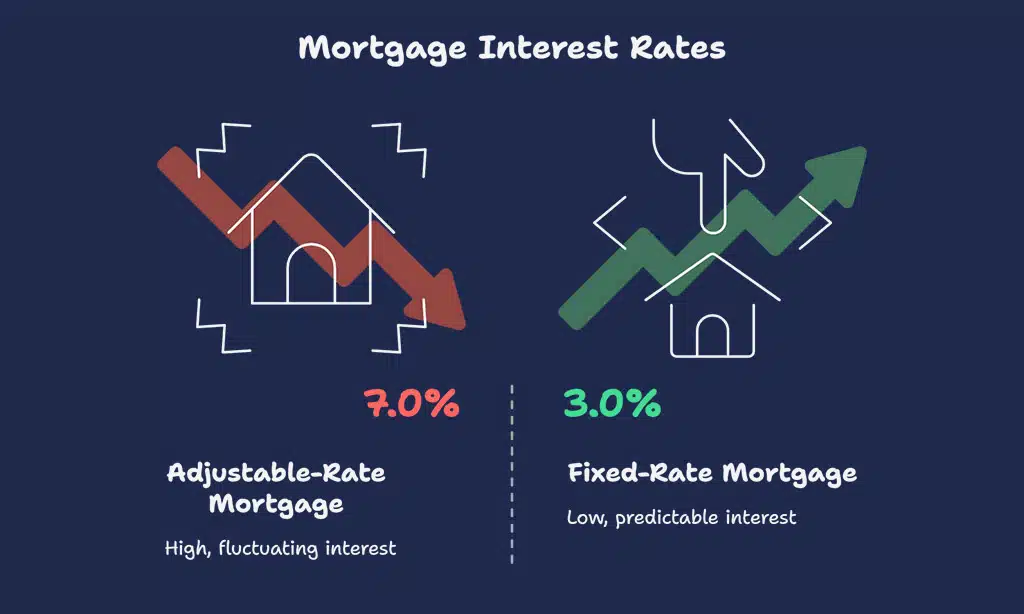

Picking the wrong mortgage can drain your wallet fast. Many buyers jump at the first loan offer without comparing rates. Some grab adjustable-rate loans when fixed terms suit them better.

Others fall into traps like balloon payments or prepayment penalties that hurt later.

Flipping houses seems glamorous, but bad financing crushes profits. High-interest hard money loans eat into returns faster than termites in wood. Investors forget to factor closing costs, title insurance, and renovation expenses into their budgets.

The bank isn’t your friend here – read every line of that contract before signing.

Consider how long you’ll own the property when choosing loans. Short-term flips need different financing than rental properties building equity over years. Every percentage point in interest adds up to thousands lost across a 30-year mortgage term.

Mistake #5: Neglecting to Negotiate Properly

Many sellers lose thousands by pricing their home based on emotion, not market value. A house listed too high scares buyers away, forcing price drops later. Agents see this often—homes sit for months, losing curb appeal and buyer interest.

The right price from the start pulls in offers fast.

Skipping negotiation hurts your real estate investment badly. Buyers push for lower prices if inspections find issues like leaks or cracks. Always counter bids instead of accepting the first offer blindly.

Smart negotiating saves money on closing costs and repairs too, boosting your annual return in the long run. Don’t let excitement rush you into a bad deal—slow down and talk terms that work for you.

Mistake #6: Failing to Plan for Maintenance and Repairs

Skipping repairs and ignoring maintenance can drain your wallet fast. Over-improving for the neighborhood or neglecting curb appeal hurts resale value. A leaky roof or broken HVAC system could cost thousands if left unchecked.

Homes need regular upkeep, just like cars. Without a budget for fixes, small issues become expensive disasters. Some sellers rush to market without fixing obvious problems, losing money in the long run.

Plan for repairs upfront, or pay the price later.

Mistake #7: Not Hiring the Right Real Estate Professional

Hiring the wrong real estate professional can drain your wallet fast. Many agents make common mistakes, like mishandling contracts or setting the wrong price based on emotion instead of market value.

A bad agent might overprice your home, leaving it to sit unsold for months. Worse, they could skip important details during negotiations.

A good agent knows how pricing works and avoids emotional decisions that cost you money. They help with home improvements that boost curb appeal without overspending for the neighborhood.

The right expert also guides you through picking the best financing option, so you don’t get stuck with a bad mortgage type or fall into an overpayment trap. Whether buying or selling, don’t gamble on an inexperienced pro—your investments depend on it.

How to Avoid These Costly Mistakes

Smart buyers start with research and expert advice. A good agent and solid facts can save you big money down the road.

Conduct thorough research

Buying or selling a home without reviewing the real estate market is like driving blindfolded. Overpricing your house scares buyers away, costing you thousands. A study found sellers who set emotional prices instead of market-based ones lose money fast.

Check recent sales of similar homes nearby before listing yours.

Skip inspections, and hidden problems become expensive surprises later. Always hire a pro to check the roof, plumbing, and foundation. Research mortgage options too—refinance rates change often.

Choosing unfavorable loans or skipping cost comparisons drains your wallet over time. Analyze the numbers carefully before committing to anything significant in real estate investing.

Mistakes here hit harder than overlooking curb appeal.

Consult with experienced professionals

An experienced real estate agent can save you from costly errors. They know how to avoid overpricing, spot hidden issues in home inspections, and pick the right mortgage type. Skipping their advice could mean losing thousands on a bad deal.

Agents help set realistic prices based on market value, not emotion. They’ll warn you about over-improving for the neighborhood or listing too soon. Their knowledge of contracts and curb appeal keeps your investment safe.

Don’t gamble with DIY research—get expert help early.

The Importance of Proper Due Diligence

Buying or selling real estate without doing homework is like driving blindfolded. You could lose thousands. Overpricing a home scares away buyers, while underpricing leaves money on the table.

Skipping a home inspection might save a few bucks now but lead to costly repairs later. A house with bad curb appeal can sit for months, forcing price cuts.

Picking the wrong mortgage type or ignoring market value hurts your budget long-term. Some sellers rush to list before fixing major flaws—bad move. Others over-improve for the neighborhood and never recoup costs.

Contracts have fine print that traps careless buyers or agents who skim details. Smart decisions start with research, not emotions or guesswork and that’s where due diligence pays off every time!

Tips for Making Informed Real Estate Decisions

Smart choices save money in real estate. Avoid costly errors with these tips.

- Research local market trends before buying or selling. Overpricing scares buyers and costs you cash fast.

- Get a home inspection every time. Hidden problems drain your wallet later if missed now.

- Stick to a clear budget plan. Overestimating leads to debt that’s hard to shake off.

- Compare mortgage rates and loan types carefully. Picking wrong financing burns thousands over time.

- Negotiate like a pro—don’t accept first offers blindly leaving money on the table hurts profits badly

6 . Plan for repairs upfront—maintenance sneaks up fast without warning draining emergency funds dry

7 . Hire agents with proven track records—bad advice from amateurs leads straight into financial pitfalls

8 . Boost curb appeal cheaply before listing—poor first impressions slash sale prices dramatically overnight

9 . Skip emotional pricing—use hard data instead letting feelings guide numbers guarantees losses

10 . Avoid over-improving houses beyond neighborhood standards—fancy upgrades rarely pay back what they cost

11 . Check contracts thoroughly—missing small print risks big legal fees down road unexpectedly

Takeaways

Real estate mistakes can drain your wallet fast. Skipping research, ignoring inspections, or picking bad loans will hurt you. Plan for repairs and hire pros to avoid pitfalls. Smart choices save cash and stress in the market.

Check facts, ask experts, and think before you buy. Now go make moves that keep money in your pocket!

FAQs

1. What are the biggest real estate investing mistakes?

Skipping a home inspection is a big one. So is ignoring curb appeal. Both can cost you thousands in the long run.

2. How can bad credit hurt my real estate market chances?

Low credit scores mean higher interest rates. That adds up fast, eating into your down payment savings.

3. Why is home improvement risky before selling?

Overdoing upgrades can backfire. Not all renovations add value, and some might even turn buyers away.

4. Should I use a credit card for real estate deals?

No. High interest on credit cards makes them a bad choice for funding property purchases or bonds.

5. What liability risks come with real estate investing?

Cutting corners to save money can lead to lawsuits. Always follow local laws to avoid expensive legal trouble.