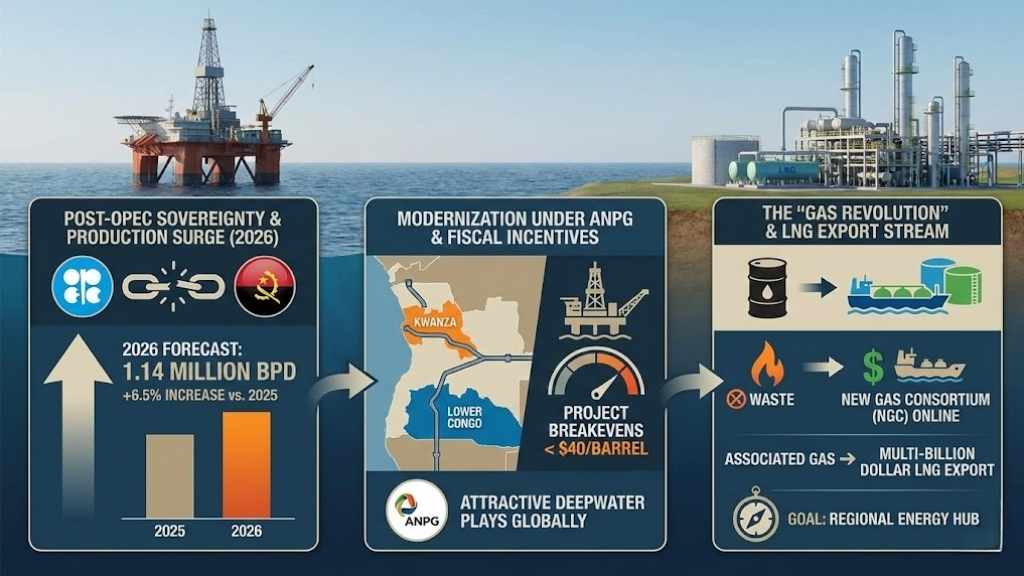

Angola has officially entered a new era. Following its strategic exit from OPEC in late 2023, the nation has reclaimed its sovereign right to set production targets, triggering a massive wave of fresh investment. As of 2026, Angola’s oil production is forecast to rise to 1.14 million barrels per day (bpd), a 6.5% increase over last year.

For investors, job seekers, and industry analysts, the landscape is shifting. The “Big Five” supermajors are now being challenged by massive local joint ventures and a aggressive push into natural gas. This report breaks down the top 10 oil companies operating in Angola leading energy resurgence in 2026.

The Landscape of the Angolan Oil Industry in 2026

The industry is no longer just about “digging for crude.” Under the guidance of the National Agency for Petroleum, Gas and Biofuels (ANPG), the sector has modernized. New fiscal incentives have lowered project breakevens to below $40 per barrel, making the Kwanza and Lower Congo basins some of the most attractive deepwater plays globally.

Shift from Crude to Natural Gas & LNG

While oil remains king, 2026 marks the year of the “Gas Revolution.” The New Gas Consortium (NGC) is finally coming online, turning previously “wasted” associated gas into a multi-billion dollar LNG export stream. This transition is crucial for Angola’s goal of becoming a regional energy hub.

Top 10 Oil & Gas Operators in Angola

Below is the definitive list of the major players based on current production capacity, operated blocks, and active 2026 projects.

1. Azule Energy (BP & Eni Joint Venture)

Azule Energy is the story of the decade. Formed as a 50/50 joint venture between BP and Eni, it is now the largest independent producer in Angola.

- 2026 Outlook: Aiming for 250,000 bpd.

- Key Asset: The Agogo Full Field Development (Block 15/06), which utilized a rapid subsea tie-back strategy to bring production online months ahead of schedule.

- Strategy: They are the leading force behind the New Gas Consortium (NGC), which is set to boost Angola LNG production to over 1 billion standard cubic feet per day this year.

2. TotalEnergies

The French giant remains a cornerstone of the Angolan economy, operating nearly 40% of the country’s total output through its various blocks.

- Current Focus: The Kaminho Deepwater Project (Blocks 20 and 21). This $6 billion investment is TotalEnergies’ seventh FPSO project in Angola.

- Key Blocks: Block 17 (the “Golden Block”), Block 32 (Kaombo), and Block 20/11.

- Unique Signal: TotalEnergies is leading the “zero routine flaring” initiative, using gas reinjection to lower the carbon intensity of their Angolan barrels.

3. Sonangol E&P

The state-owned giant has transitioned from being the “regulator” to a pure-play “operator.”

- 2026 Outlook: Net entitlement of approximately 200,000 bpd.

- Key Role: Sonangol holds a minimum 10–20% stake in almost every major concession, but they are increasingly operating their own fields to build local technical capacity.

- Diversification: They are partnering with Azule on renewable projects, like the Caraculo solar plant, to balance their carbon footprint.

4. Chevron (Cabinda Gulf Oil Company – CABGOC)

Chevron’s presence in the enclave of Cabinda is legendary. They operate Block 0 and Block 14, which have provided steady production for decades.

- 2026 Strategy: Focus on the Sanha Lean Gas Connection (SLGC). This project is vital for feeding gas to the Angola LNG plant in Soyo.

- Exploration: Chevron recently secured new exploration acreage, signaling a long-term commitment despite the maturity of their current fields.

5. ExxonMobil

Operating the prolific Block 15, ExxonMobil has produced over 2.2 billion barrels since 2003.

- Key Asset: The Kizomba complexes (A, B, and C).

- 2026 Tech: Exxon is utilizing high-pressure subsea technology to extend the life of “brownfield” assets, squeezed more oil out of maturing reservoirs.

6. Somoil (Somaïl)

As the largest 100% privately owned Angolan oil company, Somoil is the champion of “Local Content.”

- Growth: In recent years, they have acquired interests from TotalEnergies and Galp.

- Market Position: They focus on onshore and shallow-water blocks, proving that local firms can compete with global majors in operational efficiency.

7. Equinor

The Norwegian firm is a critical partner in the “Golden Block” 17 and Block 15.

- Market Share: They hold roughly 10–13% equity in most major deepwater blocks.

- 2026 Focus: Equinor is heavily involved in the Bacalhau-style subsea optimizations, bringing Norwegian efficiency to Angolan waters.

8. Petronas

The Malaysian national oil company has expanded its footprint significantly by taking a 40% stake in TotalEnergies’ Kaminho project.

- Strategic Move: Their 2026 focus is on the ultra-deepwater Kwanza Basin, marking a shift from their traditional South China Sea strongholds to African frontier basins.

9. Sinopec

Representing Chinese interests, Sinopec (often through the Sonangol-Sinopec JV) remains a major buyer and producer.

- Current Status: They provide much of the “patient capital” required for long-cycle deepwater developments.

10. Shell

After a period of absence, Shell’s re-entry into Angola in late 2024 is now bearing fruit.

- 2026 Activity: Currently in the high-impact exploration phase in the Lower Congo Basin. Their return signals global confidence in Angola’s post-OPEC regulatory environment.

Top Operators (2026 Forecast)

| Company | Estimated Net Production (bpd) | Major Operated Block | Focus for 2026 |

| Azule Energy | 250,000 | Block 15/06 | New Gas Consortium (NGC) |

| TotalEnergies | 210,000* | Block 17 | Kaminho Project FID |

| Sonangol | 200,000 | Various | Operational Efficiency |

| Chevron | 105,000 | Block 0 | Sanha Lean Gas |

| ExxonMobil | 100,000 | Block 15 | Brownfield Life Extension |

Note: Figures represent net entitlement/equity production.

Major Offshore Projects Driving Growth in 2026

If you are looking for where the money is flowing this year, keep an eye on these three “Mega-Projects”:

- The Kaminho Project: Angola’s first large-scale deepwater development in the Kwanza Basin. It uses a converted Very Large Crude Carrier (VLCC) as an FPSO.

- Agogo Full Field Development: A masterclass in subsea engineering, connecting dozens of wells to a single floating hub.

- Northern Gas Complex: The backbone of Angola’s domestic power strategy, providing the fuel needed to industrialize the northern provinces.

Final Thoughts

The “Top 10” in Angola are no longer just extracting resources; they are building an integrated energy economy. Whether it is Azule’s gas push or TotalEnergies’ deepwater innovations, the sector is more dynamic in 2026 than it has been in decades. For those looking to enter the market, the message is clear: Angola is open for business, and the blocks are busier than ever.