Germany’s real estate market is one of the most stable in Europe, attracting both domestic and international buyers. Whether you’re looking for a personal residence, a vacation home, or an investment property, understanding the legal and financial aspects is crucial.

Buying property in Germany differs from other countries, with specific regulations, costs, and procedures that you need to be aware of.

In this guide, we will cover the 10 essential things to know before buying property in Germany. By understanding these key factors, you can avoid costly mistakes and ensure a smooth purchasing process.

This article provides expert insights, practical advice, and current market data to help you make an informed decision.

Understanding the German Property Market

Before diving into the specifics, it’s essential to grasp the fundamentals of the German real estate market. Germany has a strong, well-regulated property sector, with relatively stable prices and a high demand for housing. Here are some key points:

- Major cities like Berlin, Munich, and Hamburg have high property demand and rising prices.

- The market is more regulated than in many other countries, ensuring buyer protection.

- Unlike other European nations, the majority of Germans prefer renting over owning.

- Interest rates for mortgages remain relatively low, making buying property in Germany a viable long-term investment.

- Regional variations exist, with property prices significantly lower in smaller cities compared to metropolitan areas.

Market Trends Table

| City | Average Price per sqm (€) | Rental Yield (%) | Demand Level |

| Berlin | 5,500 – 8,500 | 3.0 – 4.5 | High |

| Munich | 8,000 – 12,000 | 2.5 – 3.5 | Very High |

| Hamburg | 6,000 – 9,000 | 3.5 – 4.8 | High |

| Leipzig | 3,500 – 5,500 | 4.0 – 5.5 | Medium |

1. Can Foreigners Buy Property in Germany?

One of the first things to know before buying property in Germany is that there are no restrictions on foreign ownership. Unlike some countries that impose strict property laws on non-residents, Germany allows anyone, regardless of nationality, to purchase real estate.

However, while foreigners can buy property freely, getting financing as a non-resident might be more challenging.

Many German banks require proof of income, creditworthiness, and residency status before approving mortgage loans.

If you plan to buy property as a non-EU citizen, it’s essential to understand the documentation and financial requirements beforehand.

Key Considerations Table

| Factor | Details |

| Residency Requirement | No residency requirement for property purchase |

| Mortgage Eligibility | Depends on financial stability and credit history |

| Property Taxes | Same as German citizens |

| Legal Restrictions | No legal restrictions for foreigners |

2. Understanding Property Ownership Types

In Germany, there are two main types of property ownership:

- Freehold (Eigentumswohnung or Einfamilienhaus) – The buyer owns both the building and the land. This is the most common type of ownership, providing full control over the property.

- Leasehold (Erbbaurecht) – The buyer owns the property but leases the land for a long-term period (typically 99 years). This option is less common but may be more affordable upfront.

Ownership Type Comparison

| Ownership Type | Pros | Cons |

| Freehold | Full ownership, No land rent | Higher upfront cost |

| Leasehold | Lower initial investment | Ongoing lease payments, Less control |

3. Costs Involved in Buying Property

One of the most important things to know before buying property in Germany is the additional costs beyond the purchase price. Buyers should budget for the following expenses:

| Cost Type | Estimated Percentage of Property Price | Description |

| Property Transfer Tax (Grunderwerbsteuer) | 3.5% – 6.5% (varies by state) | Paid to the government upon purchase |

| Notary Fees & Registration | 1.5% – 2% | Covers legal documentation and registration |

| Real Estate Agent Fee | 3% – 7% + VAT (if applicable) | Typically split between buyer and seller |

| Mortgage Fees (if applicable) | Varies by lender | Covers loan processing and interest rates |

4. Financing Options for Property Buyers

Financing is another crucial aspect to consider when buying property in Germany. Some key financing options include:

- Bank Mortgages – Local banks provide loans with competitive interest rates (typically 1.5% – 3%).

- Foreign Buyer Loans – Some international lenders offer mortgage solutions for non-residents.

- Loan-to-Value (LTV) Ratio – Most German banks require at least 20% – 30% down payment for foreigners.

Mortgage Terms Comparison

| Loan Type | Interest Rate (%) | Down Payment (%) | Repayment Period |

| German Bank Mortgage | 1.5 – 3.0 | 20 – 30 | 10 – 30 years |

| International Loan | 3.0 – 5.0 | 30 – 50 | 10 – 20 years |

5. The Role of Notaries and Contracts

A notary (Notar) plays a crucial role in German real estate transactions. Unlike in some countries where a lawyer handles contracts, in Germany:

- The notary drafts and certifies the sale agreement.

- They ensure both parties understand the legal implications.

- The transaction is only legally binding after notarization.

- The notary verifies property registration and ownership details.

Notary Fees Table

| Service | Estimated Cost (%) | Description |

| Contract Drafting | 0.5 – 1% | Covers legal documentation |

| Property Registration | 0.5% | Ensures official ownership transfer |

| Legal Verification | Included | Confirms legal status of property |

6. Property Taxes and Ongoing Costs

Owning property in Germany comes with ongoing financial responsibilities that extend beyond the initial purchase price.

Property owners are required to pay an annual property tax (Grundsteuer), which varies by municipality and generally ranges from 0.26% to 1.0% of the property’s assessed value.

If you plan to rent out the property, any rental income will be subject to progressive income tax rates, ranging between 14% and 45%, depending on your total earnings.

Additionally, if you decide to sell the property within 10 years of purchase, you may be liable for capital gains tax (Spekulationssteuer), unless the property was used as your primary residence for the entire period.

Tax Comparison Table

| Tax Type | Rate (%) | Applies to |

| Property Tax | 0.26 – 1.0 | All property owners |

| Rental Income Tax | 14 – 45 | Earnings from rental income |

| Capital Gains Tax | 25 (if applicable) | Sale within 10 years (unless primary residence) |

7. Legal Due Diligence and Property Inspection

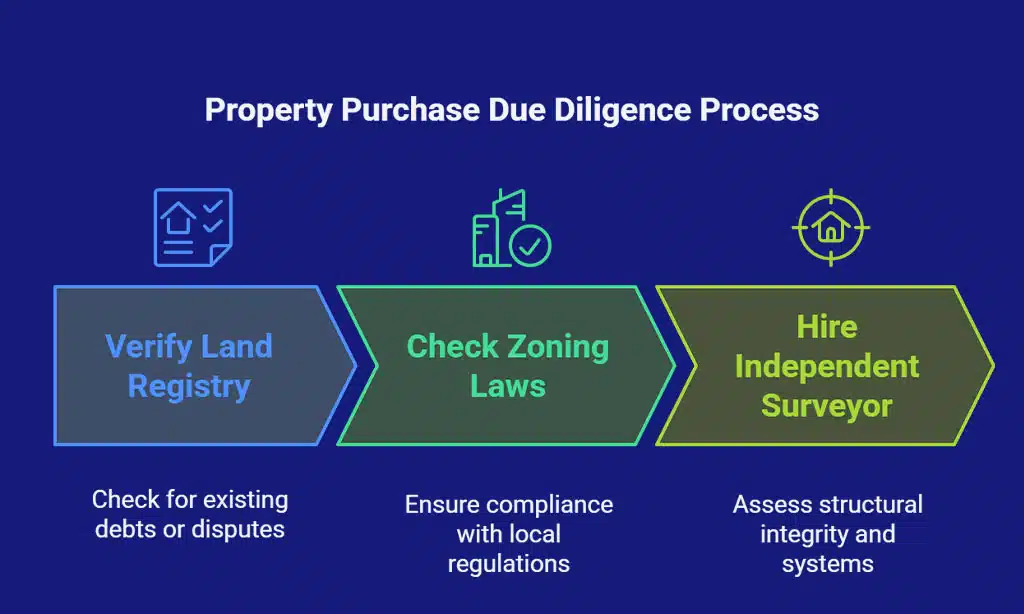

Before proceeding with a property purchase, it’s essential to conduct a thorough due diligence process to avoid legal or structural issues in the future.

Start by verifying the Land Registry (Grundbuch) to ensure that there are no existing debts, mortgages, or legal disputes tied to the property. Additionally, it’s important to check zoning laws and building permits to confirm that the property complies with local regulations.

Unlike in some countries, Germany does not require mandatory home inspections, but hiring an independent surveyor to assess the property’s structural integrity, plumbing, and electrical systems is highly recommended. This helps prevent unexpected repair costs after the purchase.

Due Diligence Checklist

✔ Review the Grundbuch for existing mortgages, debts, or liens.

✔ Verify building permits and confirm compliance with zoning laws.

✔ Hire an independent surveyor to assess structural integrity.

✔ Check energy efficiency certificates (Energieausweis) for heating costs.

8. The Property Purchase Timeline

The process of purchasing property in Germany can take anywhere from three to six months, depending on factors such as financing, legal paperwork, and negotiation timelines.

The journey starts with property research and selection, which typically takes between one to three months, depending on your preferences and market conditions.

After agreeing on a price, a notary (Notar) drafts the official sales contract, which must be signed in person by both parties, usually within two to four weeks. If financing is required, the mortgage approval process can take another four to eight weeks, depending on your lender.

Once the final payment is made, ownership transfer and property registration are completed within four to six weeks, officially making you the new owner.

Estimated Timeline for Buying Property

| Step | Estimated Timeframe |

| Property Search | 1 – 3 months |

| Offer & Negotiation | 1 – 2 weeks |

| Notary & Contract | 2 – 4 weeks |

| Mortgage Processing | 4 – 8 weeks |

| Final Payment & Transfer | 4 – 6 weeks |

9. Renting Out Your Property

If you plan to rent out your property in Germany, it’s important to be aware of the country’s strict tenant protection laws, which favor long-term tenants over landlords. Rent increases are heavily regulated, and in cities like Berlin, Munich, and Hamburg, rent control measures (Mietpreisbremse) limit the amount landlords can raise rent annually.

Evicting tenants without legal grounds is also highly difficult, meaning rental agreements must be carefully structured.

If you are considering short-term rentals through platforms like Airbnb or Booking.com, be sure to check local regulations, as some German cities have strict laws restricting short-term rentals to protect the housing market.

Rental Strategy Tips

✔ Focus on long-term rentals for stable income and fewer legal risks.

✔ Research rent control laws in your city to ensure compliance.

✔ Check short-term rental permits before listing on Airbnb or similar platforms.

✔ Consider furnished rentals to attract expats and business travelers.

10. Exit Strategy and Selling Property in Germany

When planning to sell your property in Germany, having a well-thought-out exit strategy can help you maximize profits and avoid unnecessary taxes. If you hold the property for at least 10 years, you will be exempt from capital gains tax (Spekulationssteuer).

However, if you sell earlier, a flat 25% capital gains tax applies unless you have used the property as your primary residence for at least two consecutive years before selling.

Additionally, real estate agent fees in Germany range from 3% to 7%, often shared between the seller and buyer. Understanding market trends and selling during peak demand periods can help you secure a higher price.

Selling Cost Breakdown

| Expense | Estimated Cost (%) | Description |

| Agent Commission | 3 – 7% | Typically split between buyer and seller |

| Capital Gains Tax | 25% (if applicable) | Applies if sold within 10 years |

| Notary & Registration Fees | 1 – 2% | Covers official property transfer |

Takeaways

Buying property in Germany can be a rewarding investment if done correctly. Understanding the legal process, financial requirements, and potential pitfalls is essential.

By following these 10 things to know before buying property in Germany, you can make an informed decision and secure a profitable investment.

Whether you’re a first-time buyer or an experienced investor, taking the time to research, plan, and seek professional advice will help you navigate Germany’s property market with confidence.