Investing in real estate has always been a strong way to build wealth. One of the most promising strategies is investing in multi-family homes. These properties can generate steady income, build long-term equity, and offer tax advantages. But like any investment, success depends on making smart, informed decisions.

In this article, we’ll explore 12 key things to consider when investing in multi-family homes. Whether you’re a beginner or an experienced investor, understanding these factors will help you make better choices and maximize your return on investment.

Why Multi-Family Homes Are a Popular Investment Choice

Multi-family homes, which include duplexes, triplexes, and apartment complexes, have several advantages over single-family properties:

| Feature | Multi-Family Homes | Single-Family Homes |

| Income Potential | Higher due to multiple rental units | Limited to one rental income |

| Risk Diversification | Lower risk—vacancy in one unit isn’t critical | High risk—vacancy means no income |

| Management Efficiency | Easier to manage multiple units in one place | Spread-out properties are harder |

| Financing Benefits | May qualify for commercial loans | Traditional loans only |

Investors are drawn to multi-family properties for these reasons, especially in growing urban areas.

1. Location and Neighborhood Quality

The location of your property is the number one factor that affects its profitability. Good neighborhoods attract reliable tenants and ensure long-term appreciation.

A well-connected location increases rental income potential and tenant satisfaction. Neighborhoods with good schools, hospitals, and transport hubs often have higher demand and lower vacancy rates. Additionally, areas with future development plans can offer better appreciation over time.

| Factors to Evaluate | Why It Matters |

| Proximity to jobs and transit | Increases tenant demand and rent potential |

| School quality | Attracts families and long-term renters |

| Crime rates | Affects property value and tenant safety |

| Nearby amenities | Boosts tenant satisfaction and retention |

Use tools like Zillow, Redfin, and AreaVibes to analyze these data points before buying.

2. Property Condition and Age

Older properties can be affordable, but they often come with hidden repair costs. Newer properties may cost more upfront but offer fewer maintenance headaches.

The age of the building affects everything from plumbing to roofing systems. An older home may need significant updates like electrical rewiring or HVAC replacement. On the other hand, newer homes usually meet current codes and are more energy efficient.

| Feature | Older Property | Newer Property |

| Upfront Cost | Lower purchase price | Higher purchase price |

| Maintenance Requirements | High, often needs upgrades | Low, fewer immediate repairs |

| Energy Efficiency | May lack insulation or HVAC upgrades | Likely meets modern standards |

Always schedule a thorough inspection before making an offer.

3. Market Trends and Economic Indicators

Understanding the local real estate market helps you estimate potential income and future value.

Following economic trends allows you to identify high-growth areas before prices peak. Rising employment rates usually bring higher rental demand and better tenant quality. Tracking appreciation rates helps you project future property values.

| Key Indicators | What They Tell You |

| Job growth | Higher job rates = more renters |

| Rental demand | High demand means fewer vacancies |

| Property appreciation rates | Indicates future resale value |

| Population trends | Growth means long-term rental success |

You can find this data on city economic reports, Realtor.com, or Census.gov.

4. Cap Rate and Cash Flow Projections

The capitalization rate (cap rate) shows how much return you can expect on your investment. It’s calculated by dividing your net operating income (NOI) by the property price.

A strong cap rate can indicate a high-performing asset, but extremely high rates may signal hidden risks. Understanding your cash flow helps you plan for ongoing expenses and loan repayments. These numbers are essential for evaluating the financial viability of a property.

| Metric | Formula | Purpose |

| Net Operating Income (NOI) | Income – Expenses | Shows property profitability |

| Cap Rate | NOI / Property Price | Evaluates return potential |

| Cash-on-Cash Return | Annual Cash Flow / Cash Invested | Measures actual cash earnings |

Aim for a cap rate between 5% and 10%, depending on your market.

5. Financing Options and Mortgage Rates

Your financing decision directly affects your cash flow. Compare loan types and rates before deciding.

The type of loan you choose can significantly impact your monthly obligations and long-term ROI. FHA and DSCR loans are great for beginners and investors, respectively. Shop around to compare offers and find the best fit for your goals.

| Loan Type | Benefits | Considerations |

| Conventional Mortgage | Lower interest, fixed terms | Requires strong credit |

| FHA Loan | Low down payment (3.5%) | Must live in the property initially |

| DSCR Loan | Based on property income | Great for investors |

| Private Lending | Fast approval, flexible | Higher rates, more risk |

Get pre-approved and consult with a mortgage broker to explore your best option.

6. Property Management Strategy

Managing a multi-family home can be time-consuming. Decide if you’ll handle it yourself or hire a property manager.

A good property manager can save you time and legal headaches by handling rent collection, repairs, and tenant disputes. However, their fees can cut into your profits. Weigh the cost of hiring help against the stress of self-managing.

| Option | Pros | Cons |

| DIY Management | Saves money | Time-consuming, stress |

| Property Management Firm | Professional tenant handling | Costs 8% – 12% of rental income |

| Hybrid Approach | Use tech tools for part automation | Requires regular monitoring |

Platforms like Buildium, AppFolio, or Rentec Direct can help with automated management.

7. Legal Compliance and Zoning Regulations

Make sure the property is zoned correctly and complies with local laws.

Failure to comply can lead to hefty fines or even lawsuits. Zoning laws may limit how many units you can rent or what upgrades you can make. Understanding the legal side protects your investment and your rights as a landlord.

| Compliance Area | Key Concerns |

| Zoning Laws | Property must be legally rentable |

| Building Codes | Electrical, plumbing, fire safety |

| Fair Housing Act | No discrimination in tenant screening |

| Lease Agreement Laws | Understand state-specific rules |

Consult a local real estate attorney to avoid legal issues.

8. Tenant Turnover and Vacancy Rates

High turnover means more costs for cleaning, advertising, and lost rent.

Happy tenants are more likely to renew their leases, reducing vacancy risk. Offering good service, maintaining the property, and keeping rents reasonable can build long-term relationships. Reducing turnover improves your cash flow and lowers stress.

| Strategy | Benefit |

| Screen tenants carefully | Reduce risk of eviction or damage |

| Offer lease renewal perks | Encourages long-term stays |

| Competitive rent pricing | Attracts tenants faster |

Aim for vacancy rates below 5% for consistent income.

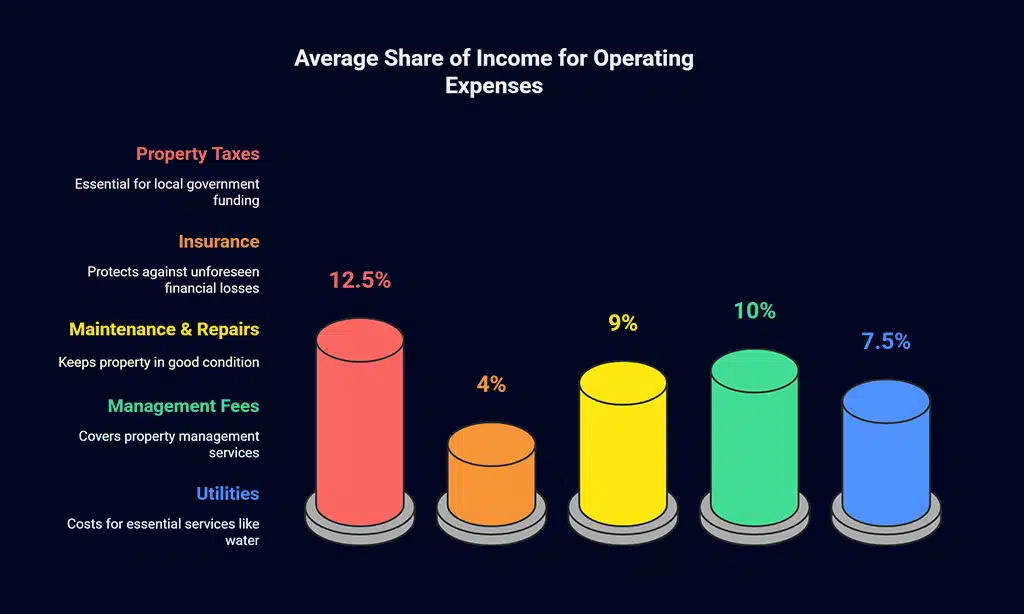

9. Operating Expenses and Maintenance Budget

Operating expenses include everything from taxes to utilities. Budget wisely to avoid cash flow problems.

Underestimating expenses is a common rookie mistake. Always factor in property taxes, repair costs, and management fees. A well-prepared budget helps you stay profitable and handle unexpected costs.

| Expense Category | Average Share of Income (%) |

| Property Taxes | 10% – 15% |

| Insurance | 3% – 5% |

| Maintenance & Repairs | 8% – 10% |

| Management Fees | 8% – 12% |

| Utilities (if landlord pays) | 5% – 10% |

Keep an emergency fund of at least 3-6 months’ worth of expenses.

10. Exit Strategy and Resale Value

Always have an exit strategy. You might plan to hold the property long-term, refinance, or sell.

The right exit plan can help you maximize profit or reinvest in better opportunities. Whether you want to generate passive income or flip for a quick gain, knowing your end goal helps shape your investment strategy.

| Strategy | Description |

| Buy-and-Hold | Collect rent and let equity grow |

| Fix-and-Flip | Renovate and resell at profit |

| 1031 Exchange | Defer taxes by reinvesting in new property |

Review recent sales of similar properties to gauge future value.

11. Tax Implications and Investment Structure

Multi-family investing comes with tax advantages but also requires understanding of tax rules.

Owning property through an LLC can protect your personal assets and offer tax flexibility. Deducting expenses like mortgage interest, maintenance, and depreciation helps reduce your taxable income. Speak to a tax advisor for the best structure for your goals.

| Tax Element | Impact |

| Depreciation | Deduct property value over time |

| Mortgage Interest Deduction | Save on interest payments |

| LLC Structure | Protects personal assets, tax flexibility |

| Capital Gains Tax | Owed upon sale unless using 1031 Exchange |

Work with a CPA familiar with real estate tax strategies.

12. Risk Assessment and Backup Planning

Investing comes with risk. Prepare for worst-case scenarios to stay afloat.

Think ahead about what could go wrong and how you’d handle it. Have a backup plan for vacancies, economic downturns, or tenant issues. Being proactive reduces stress and protects your investment in the long run.

| Risk Factor | Protection Strategy |

| Economic downturn | Keep cash reserves |

| Natural disasters | Adequate insurance |

| Unexpected repairs | Maintenance fund |

| Tenant non-payment | Strict screening, eviction policy |

Consider investing in landlord insurance for added protection.

Expert Tips for First-Time Multi-Family Home Investors

- Start small with a duplex or triplex.

- Use real estate platforms like BiggerPockets to connect with experienced investors.

- Attend local real estate meetups or webinars.

- Learn about landlord-tenant laws in your state.

Frequently Asked Questions

What is a good cap rate for multi-family properties?

Typically, 5% to 10% depending on location and risk level.

Can I invest in multi-family homes with no money down?

Options like FHA loans or seller financing may help, but it’s rare without some capital.

How do I find profitable multi-family deals?

Use MLS listings, real estate agents, or platforms like LoopNet, Roofstock, and Mashvisor.

Takeaways

Investing in multi-family homes can be a rewarding path to financial freedom. But it requires research, planning, and sound decision-making. From analyzing cap rates to planning exit strategies, each step matters.

By understanding these 12 critical factors, you’ll be better equipped to make profitable and low-risk investments in the real estate market. Remember, success is built on knowledge—so keep learning, stay informed, and invest wisely.