Starting a business in Texas presents exciting opportunities, but it also requires understanding the legal steps necessary to operate smoothly. One such step is registering an Assumed Name Certificate, commonly known as a DBA—short for “Doing Business As.” Whether you’re a sole proprietor, LLC, or corporation, filing a DBA is essential if you plan to do business under a name different from your legal entity name.

In this blog, we break down everything Texas entrepreneurs need to know about how to file a DBA in Texas, why it’s necessary, and how it benefits your business.

What Is an Assumed Name Certificate?

An Assumed Name Certificate is a legal document that permits a business to operate under a name other than its registered business name. For example, if John Doe runs a sole proprietorship but wants to conduct business as “Doe’s Lawn Services,” he needs to file a DBA for that name.

In Texas, a DBA is called an “Assumed Name” and is required by law if you plan to accept payments, advertise, or conduct business under a name that’s not your official registered name. This applies to sole proprietors, partnerships, LLCs, and corporations.

Why File a DBA in Texas?

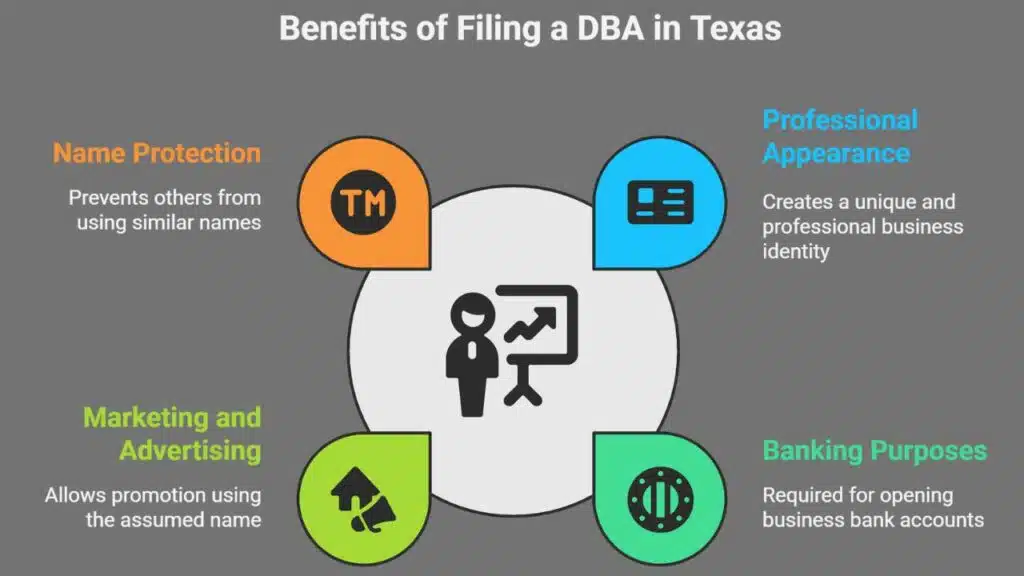

There are several benefits to filing a DBA in Texas:

- Professional Appearance: It allows you to create a unique, professional business identity without forming a new legal entity.

- Banking Purposes: Most banks require a certified copy of your DBA to open a business bank account.

- Marketing and Advertising: You can promote your business using your assumed name across digital and print media.

- Name Protection: Although a DBA doesn’t confer trademark rights, registering it prevents others from using the same or a similar name within the state or county.

Who Needs to File an Assumed Name Certificate?

The need to file depends on your business type:

- Sole Proprietors: If you’re operating a business without forming an LLC or corporation and using a name that isn’t your legal name, you must file a DBA.

- LLCs and Corporations: You must file a DBA if your business wants to use a name that doesn’t exactly match the name registered with the Texas Secretary of State. This also applies if you want to operate multiple businesses under one legal entity.

Steps on How to File a DBA in Texas

Filing a DBA involves several important steps. Here’s a quick guide on how to file a DBA in Texas:

Decide if You Need a DBA

Start by evaluating your business structure. Are you operating under a name different from your registered one? If so, you likely need to file an assumed name.

Choose Your Business Name Carefully

Your chosen name must be unique and not deceptively similar to any existing business names in Texas. Avoid using terms like “Inc.” or “LLC” unless you are legally structured as such. A quick online search and a name availability check through the Secretary of State’s SOSDirect system can help confirm your name is available.

Determine the Right Filing Office

Where you file depends on your business structure:

- Sole proprietors and partnerships usually file at the county clerk’s office where the business is located.

- LLCs, corporations, and nonprofits must file with the Texas Secretary of State.

Make sure you verify where to file based on your entity type to avoid delays.

Complete and Submit the Assumed Name Certificate

The form requires you to provide:

- Your chosen DBA name

- Legal business name and structure

- Secretary of State file number (if applicable)

- Principal business address

- The duration the name will be used (up to 10 years)

- Counties where the name will be used

Submit the form either by mail or in person, depending on the county or state office. The filing fee varies, but at the state level, it’s typically $25.

Keep Proof of Filing

Once approved, keep a copy of the certificate for your records. You may need it for banking, contracts, and compliance. Some counties may require public notice or renewal, so check local rules.

Common Mistakes to Avoid

- Skipping the name availability check: Filing a name already in use will result in rejection.

- Not renewing: Texas DBAs expire after 10 years unless renewed.

- Incorrect filing location: Filing with the wrong agency can delay approval.

- Assuming it’s a trademark: A DBA only gives permission to use a name, not trademark rights. Consider trademark protection separately.

Final Thoughts

Filing an Assumed Name Certificate is a simple but crucial step for Texas entrepreneurs who want to operate under a business name different from their legal name. Whether you’re looking to create a brand identity, open a business bank account, or expand into new services, a DBA offers the flexibility to grow without forming a new entity.

If you want to avoid the paperwork and ensure your filing is done correctly, companies like MyCorporation can handle the DBA registration process for you. With expert support and quick turnaround, we make it easy for Texas business owners to get up and running under their desired name.