Navigating the complexities of real estate taxation in Brazil can be challenging. Without a strategic approach, investors may find themselves overpaying in taxes, reducing their overall profitability. Whether you’re a local investor or a foreigner looking to enter the Brazilian real estate market, understanding the tax-saving mechanisms is crucial.

This comprehensive guide provides essential tax-saving tips for real estate investors in Brazil, helping you optimize your investment returns while staying compliant with local regulations.

With the right strategies, investors can legally reduce tax burdens, maximize their earnings, and build long-term financial growth.

Why Tax Planning Matters for Real Estate Investors in Brazil

Tax planning is not just about reducing liabilities; it is a crucial strategy to increase investment profitability and safeguard assets. Understanding the tax landscape in Brazil allows real estate investors to make informed decisions, optimize deductions, and utilize tax incentives effectively.

Understanding Brazil’s Tax System for Property Investments

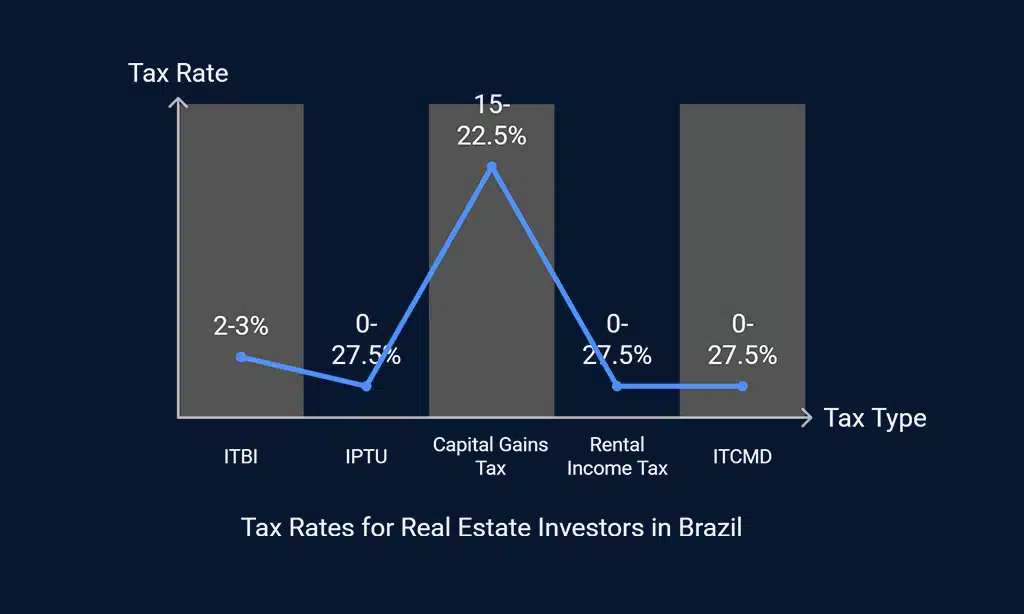

Before diving into the best tax-saving tips for real estate investors in Brazil, it is crucial to grasp the fundamental taxes applicable to property investments:

| Tax Type | Description | Rate/Percentage |

| ITBI (Imposto de Transmissão de Bens Imóveis) | A transfer tax paid when purchasing a property. | 2% – 3% of property value |

| IPTU (Imposto Predial e Territorial Urbano) | An annual property tax based on the assessed value of the property. | Varies by municipality |

| Capital Gains Tax | Tax on profits from selling a property. | 15% – 22.5% |

| Rental Income Tax | Tax applied to rental income. | Progressive rates up to 27.5% |

| Inheritance and Gift Tax (ITCMD) | A tax applied when transferring property through inheritance or as a gift. | Varies by state |

Benefits of Smart Tax Planning

- Maximizing Investment Returns: Strategic tax-saving measures can significantly increase net profits.

- Ensuring Legal Compliance: Avoid penalties and fines by following proper tax regulations.

- Creating Long-Term Wealth: Effective tax planning allows for reinvestment and long-term wealth accumulation.

Essential Tax-Saving Tips for Real Estate Investors in Brazil

Successfully reducing tax liabilities in real estate investments requires strategic planning and a deep understanding of available incentives, legal structures, and deductions.

Investors who take the time to structure their investments wisely and leverage Brazil’s tax policies can optimize returns while remaining compliant with all legal requirements.

Whether you are a domestic or foreign investor, knowing the right tax-saving strategies will not only maximize your profits but also protect your assets from unnecessary taxation. Below are some of the most effective ways to minimize tax burdens and enhance financial efficiency.

1. Choose the Right Legal Structure for Your Investments

Selecting the appropriate legal structure is one of the most effective tax-saving tips for real estate investors in Brazil.

The choice of structure influences tax rates, liability, and overall financial efficiency. The two primary options are:

- Owning Property as an Individual: This approach is straightforward but often results in higher income tax rates on rental earnings. Individual owners may face progressive tax brackets, making it less favorable for large-scale investments.

- Owning Property Through a Legal Entity (Pessoa Jurídica): This option offers lower corporate tax rates, increased deductions, and more flexibility, making it ideal for those managing multiple properties or engaging in frequent transactions.

Choosing between these structures depends on the investor’s financial goals, the scale of investments, and the desire to minimize tax liabilities while ensuring compliance with Brazilian regulations.

- Owning Property as an Individual: Simpler but subject to high income tax rates on rental income.

- Owning Property Through a Legal Entity (Pessoa Jurídica): Offers lower tax rates, better deductions, and more flexibility for multiple investments.

Tax Comparison: Individual vs. Legal Entity

| Tax Aspect | Individual Ownership | Legal Entity (Pessoa Jurídica) |

| Rental Income Tax | Up to 27.5% | 11% (Presumed Profit System) |

| Capital Gains Tax | 15% – 22.5% | 6.73% – 14.53% |

| Deductible Expenses | Limited | More flexible |

2. Take Advantage of Real Estate Tax Incentives

Brazil offers various tax incentives that real estate investors can use to reduce tax liability. Understanding and leveraging these incentives can significantly impact an investor’s bottom line, improving cash flow and overall profitability.

These incentives range from government programs aimed at affordable housing to tax reductions for sustainable construction projects.

By strategically investing in these tax-advantaged areas, investors can optimize their portfolios while contributing to economic and environmental sustainability.

Available Tax Incentives for Real Estate Investors

| Incentive | Description | Eligibility |

| Minha Casa Minha Vida Program | Government-subsidized housing program offering tax benefits. | Investors in affordable housing projects. |

| Sustainable Construction Incentives | Tax benefits for properties with green certifications. | Investors in eco-friendly developments. |

| Rural Property Tax Exemptions | Lower taxes for investments in agricultural real estate. | Investors in rural land. |

3. Optimize Depreciation and Deductible Expenses

Depreciation is a powerful tool that reduces taxable income by accounting for the wear and tear of a property. Investors can claim depreciation annually, allowing them to lower their taxable income while maintaining cash flow.

The Brazilian tax system permits real estate investors to depreciate commercial and residential properties over a defined period, with different rates applying depending on the property type and usage.

Additionally, deductible expenses such as property maintenance, management fees, insurance, and loan interest payments can further lower tax liability, making it crucial for investors to keep detailed records and optimize their tax strategies.

Common Deductible Expenses for Real Estate Investors

| Deductible Expense | Description |

| Property maintenance and repairs | Regular upkeep and renovations. |

| Property management fees | Fees paid to property managers or rental agencies. |

| Mortgage interest payments | Interest on loans taken for property investment. |

| Legal and administrative costs | Fees paid for legal services and paperwork. |

4. Leverage Capital Gains Tax Strategies

When selling a property, minimizing capital gains tax is essential for maximizing profits. Understanding the nuances of capital gains tax laws and strategically planning your sale can significantly impact your bottom line.

The Brazilian tax system applies varying capital gains tax rates depending on the length of property ownership, the transaction value, and applicable deductions. Investors should also explore exemptions and deferral strategies to optimize their tax positions.

Key Strategies to Reduce Capital Gains Tax:

| Strategy | Description | Potential Benefits |

| Holding Property for More Than 5 Years | Properties held longer may qualify for reduced capital gains tax rates. | Lowers tax burden over time. |

| Reinvesting in Another Property | Using gains to buy another property within 180 days may qualify for exemptions. | Defers or eliminates immediate tax liability. |

| Structuring Sales Under a Legal Entity | Selling through a company rather than as an individual can result in lower tax rates. | Minimizes taxable gains and maximizes deductions. |

| Offsetting Gains with Losses | Using losses from other property sales to reduce taxable income. | Reduces overall tax liability. |

| Making Use of Tax Treaties | International investors may leverage treaties to avoid double taxation. | Enhances tax efficiency for global investors. |

By applying these strategies, real estate investors in Brazil can strategically reduce their capital gains tax burden and enhance overall profitability.

- Holding Property for More Than 5 Years: Properties held longer may qualify for reduced capital gains tax rates.

- Reinvesting in Another Property: Using gains to buy another property within 180 days may qualify for exemptions.

- Structuring Sales Under a Legal Entity: This often results in lower capital gains tax rates compared to individual ownership.

5. Utilize Brazil’s Real Estate Investment Funds (FIIs)

Real Estate Investment Funds (FIIs) are a tax-efficient way for real estate investors to diversify their portfolios without direct property ownership. These funds operate similarly to mutual funds, pooling capital from multiple investors to invest in a portfolio of income-generating properties such as commercial buildings, shopping centers, and rental apartments.

One of the biggest advantages of FIIs is their tax exemption on rental income when distributed to individual investors, making them an attractive option for those looking to earn passive income.

Additionally, investing in FIIs allows for better liquidity compared to traditional real estate investments, as shares can be easily bought and sold on the stock exchange. Moreover, FIIs are professionally managed, which reduces the burden on investors regarding property management and legal compliance.

As a result, FIIs offer a practical alternative for those seeking exposure to the real estate market without the complexities of direct ownership.

Benefits of Investing in Real Estate Investment Funds (FIIs)

| FII Benefit | Description |

| Exemption from rental income tax | Individual investors in FIIs enjoy tax-free rental income. |

| Lower capital gains tax rates | FIIs offer reduced capital gains tax rates compared to direct ownership. |

| Easier liquidity | Investors can buy/sell fund shares rather than entire properties. |

6. Structure Rental Income for Maximum Tax Efficiency

Another effective tax-saving tip for real estate investors in Brazil is optimizing rental income to reduce taxes. Proper structuring of rental agreements, leveraging deductions, and choosing the right rental type can significantly impact tax obligations.

Investors should consider whether to rent properties as short-term or long-term rentals, as tax rates can vary between these categories.

Additionally, keeping meticulous records of rental-related expenses, such as property maintenance, utility costs, and management fees, can provide significant tax deductions. Another strategy is to distribute rental income among multiple owners to lower individual tax brackets, reducing the overall tax burden.

By taking these approaches, investors can enhance their profitability while staying compliant with tax regulations.

Best Practices for Structuring Rental Income

| Best Practice | Benefit |

| Use a Legal Entity | Taxed at lower corporate rates compared to individual ownership. |

| Split Rental Income | Dividing rental income among multiple owners to stay in lower tax brackets. |

| Offer Furnished Rentals | Tax benefits exist for renting out fully furnished properties. |

7. Understand Tax Treaties and International Investment Strategies

For foreign investors in Brazil and Brazilian investors abroad, tax treaties play a critical role in preventing double taxation and ensuring tax efficiency. These treaties establish clear guidelines on how income and capital gains are taxed across jurisdictions, helping investors avoid paying taxes on the same income in two different countries.

Brazil has tax treaties with several nations, including Portugal, Japan, and the United Kingdom, which provide benefits such as reduced withholding tax rates on rental income, exemptions on capital gains in certain cases, and credits for taxes paid abroad.

By strategically utilizing these treaties, investors can structure their investments in a way that minimizes tax burdens, enhances financial predictability, and ensures compliance with both domestic and international tax regulations.

Consulting with a tax advisor who specializes in international taxation is essential to fully leverage these agreements and maximize tax savings.

Important Considerations for International Investors

| Key Consideration | Impact |

| Check tax treaties | Avoids double taxation for foreign investors. |

| International investment structures | Helps optimize taxation and avoid excessive tax liabilities. |

| Foreign exchange regulations | Ensures compliance when transferring money across borders. |

8. Work with a Tax Advisor to Stay Compliant

Hiring a professional tax advisor ensures that investors comply with Brazilian tax laws while maximizing deductions. A knowledgeable tax consultant can provide personalized strategies tailored to an investor’s portfolio, helping them navigate the complex and ever-changing tax regulations.

Additionally, tax advisors can assist in structuring real estate transactions for maximum tax efficiency, ensuring that deductions are fully leveraged, and guiding investors through potential audits or legal issues.

They can also help investors take advantage of international tax treaties, minimize capital gains tax, and optimize rental income structuring. By working with an experienced tax professional, real estate investors can not only reduce their tax liabilities but also ensure full compliance with all relevant Brazilian tax regulations, ultimately leading to greater profitability and financial security.

Advantages of Working with a Tax Advisor

| Benefit of Hiring a Tax Advisor | Impact |

| Identifies best tax strategies | Helps optimize investments and deductions. |

| Keeps investors updated on tax laws | Ensures compliance and avoids penalties. |

| Ensures proper tax filings | Prevents fines and legal complications. |

Takeaways

By applying these tax-saving tips for real estate investors in Brazil, investors can significantly enhance their profitability while staying compliant with tax regulations. A comprehensive tax strategy not only helps in reducing financial liabilities but also paves the way for sustainable and scalable real estate investments.

From choosing the right legal structure to leveraging tax incentives, deductions, and capital gains tax strategies, a well-planned approach ensures long-term financial growth. Furthermore, understanding international tax treaties, optimizing rental income structures, and seeking professional tax advice can play a pivotal role in maximizing returns.

By staying informed and proactive, real estate investors in Brazil can navigate the complexities of taxation effectively and build a profitable, tax-efficient investment portfolio.