Starting a business in the UAE offers numerous advantages, from tax-free zones to a business-friendly regulatory environment.

Additionally, startups should consider tax optimization strategies such as deferring income, restructuring operations to maximize tax benefits, and engaging with professional tax advisors who understand the UAE’s evolving tax framework.

Moreover, case studies indicate that startups that adopt structured tax planning strategies experience better financial stability and fewer compliance issues.

Reviewing industry trends, expert recommendations, and legal frameworks ensures businesses make informed decisions. Establishing tax-efficient operations from the outset can significantly impact long-term growth and profitability. By implementing these advanced strategies, businesses can better manage tax obligations, reduce financial strain, and maintain long-term growth.

However, effective tax planning is crucial to ensure compliance and optimize financial resources. Understanding tax laws and leveraging strategic tax planning can help startups reduce liabilities, enhance profitability, and maintain financial stability.

With evolving tax regulations, startups must stay informed about their tax obligations and leverage available incentives. Proper planning ensures businesses maximize profits while maintaining compliance. In this comprehensive guide, we will explore 7 Tax Planning Strategies for Startups in UAE, helping entrepreneurs navigate the complex taxation landscape and make informed decisions.

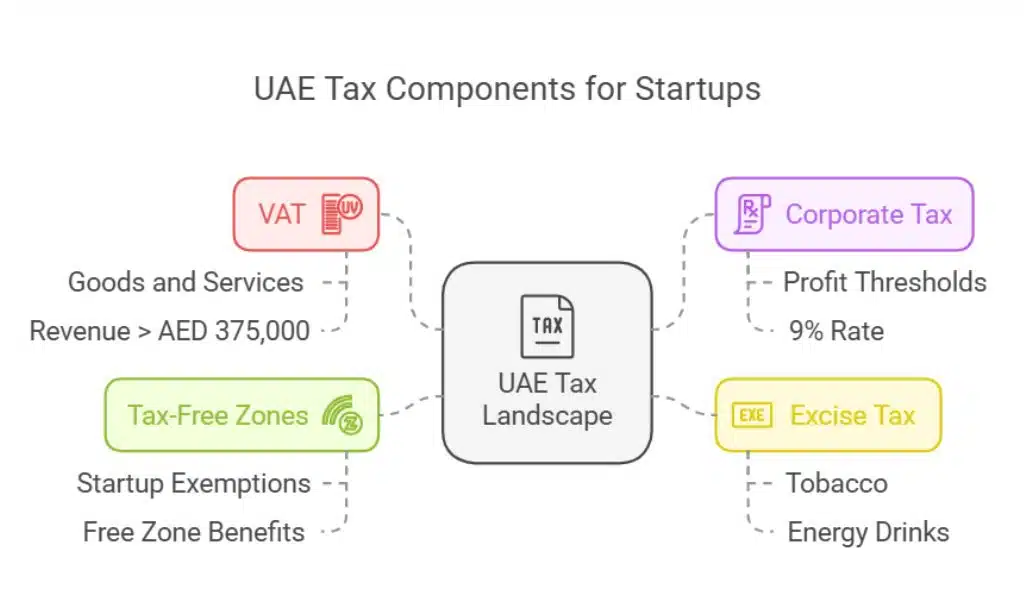

Understanding the UAE Tax Landscape for Startups

The UAE has long been known for its tax-friendly policies, but with the introduction of VAT and corporate tax, businesses must adhere to new compliance requirements. Key tax components include:

| Tax Type | Description | Applicability |

| VAT (5%) | Applies to goods and services transactions. | Revenue > AED 375,000 |

| Corporate Tax (9%) | Applies to businesses exceeding profit thresholds. | Profit > AED 375,000 |

| Excise Tax | Levied on specific goods like tobacco, and energy drinks. | Industry-Specific |

| Tax-Free Zones | Special zones with exemptions from corporate taxes. | Free Zone Startups |

Understanding these components is essential for structuring a startup’s tax strategy effectively.

7 Tax Planning Strategies for Startups in UAE

Effective tax planning is a crucial aspect of running a successful startup in the UAE. By implementing the right strategies, businesses can reduce their tax liabilities, ensure compliance, and optimize financial performance.

The UAE offers various tax benefits and incentives, making it essential for startups to take advantage of these opportunities. Whether choosing the right business structure, managing VAT efficiently, or leveraging cross-border taxation, the right tax strategy can provide significant financial advantages.

1. Choosing the Right Business Structure for Tax Benefits

The structure of your business significantly affects tax obligations. The UAE offers two primary options:

a) Free Zone Companies

- 100% foreign ownership.

- Exempt from corporate tax (subject to meeting substance requirements).

- No customs duty on imports and exports.

- Restrictions on operating directly in the UAE mainland.

- Ideal for businesses focused on international trade and digital services.

b) Mainland Companies

- Subject to corporate tax if profits exceed AED 375,000.

- Must have a local sponsor (for certain business types).

- Full access to the UAE market and no limitations on local trade.

- Suitable for businesses targeting the UAE consumer market.

| Business Structure | Ownership | Tax Benefits | Restrictions |

| Free Zone Company | 100% Foreign | Tax Exemptions, Customs Benefits | Limited Mainland Trade |

| Mainland Company | Local Sponsor Needed | Full UAE Market Access | Corporate Tax Applies |

📌 Tip: If your startup qualifies, setting up in a Free Zone can help reduce tax burdens and operational costs.

2. Registering for VAT and Ensuring Compliance

If your startup’s revenue exceeds AED 375,000 annually, VAT registration is mandatory. Here’s how to manage VAT efficiently:

- Timely VAT Registration: Avoid penalties for late registration.

- Accurate VAT Filing: Maintain error-free invoices and transaction records.

- Claim Input VAT Deductions: Reduce net tax payable by claiming back VAT on business expenses.

- Utilize VAT-Free Zones: Certain Free Zones have zero VAT on transactions.

| VAT Compliance Checklist | Requirement |

| VAT Registration | Mandatory for revenue > AED 375,000 |

| VAT Filing | Quarterly returns required |

| Input VAT Claims | Applicable for eligible business expenses |

| VAT Exemptions | Some Free Zones and designated areas |

🔎 Common Mistake: Many startups fail to maintain VAT-compliant records, leading to fines and legal issues.

3. Leveraging Tax Incentives and Exemptions

The UAE government offers various tax benefits to encourage entrepreneurship:

✅ Small Business Relief: Businesses earning below AED 375,000 annually are exempt from corporate tax.

✅ Free Zone Tax Benefits: Some Free Zones provide tax holidays ranging from 15 to 50 years.

✅ No Personal Income Tax: Business owners are not taxed on personal income.

✅ Research & Development Incentives: Certain sectors receive government grants and tax credits for innovation.

| Tax Incentive | Eligibility | Benefit |

| Small Business Relief | Revenue < AED 375,000 | Corporate Tax Exemption |

| Free Zone Tax Exemptions | Free Zone Entities | Long-Term Tax Holidays |

| R&D Grants | Innovative Sectors | Tax Credits & Funding |

📌 Tip: Always check Free Zone-specific tax policies, as they vary by jurisdiction.

4. Efficient Bookkeeping and Financial Record Management

Proper bookkeeping ensures startups meet compliance requirements and optimize tax deductions.

📂 Use Accounting Software – Tools like Zoho Books and QuickBooks automate tax calculations.

📂 Hire a Tax Consultant – A professional ensures accurate tax filings and regulatory compliance.

📂 Keep Detailed Expense Records – Helps in VAT claims and reduces taxable income.

| Best Practices for Bookkeeping | Reason |

| Digital Accounting Software | Automates tax filing and expense tracking |

| Outsourcing Accounting | Reduces errors and ensures compliance |

| Proper Invoice Management | Necessary for VAT deductions |

🔎 Pro Tip: The UAE mandates businesses to maintain financial records for at least five years.

5. Reducing Tax Liability Through Allowable Deductions

Startups can lower tax burdens by leveraging allowable business deductions:

- Office Rent & Utilities – Eligible for VAT refunds if registered.

- Employee Salaries & Benefits – Deductible under corporate tax laws.

- Marketing & Advertising Expenses – Can be deducted if incurred for business purposes.

- Professional Services & Consultancy Fees – Legal and tax advisory costs are deductible.

| Deductible Expense | Tax Benefit |

| Office Rent | VAT Refundable |

| Employee Salaries | Corporate Tax Deductible |

| Marketing Expenses | Deductible Business Expense |

📌 Tip: Keeping proper receipts and invoices is crucial to justify tax deductions during audits.

6. Managing Cross-Border Taxation for International Transactions

Many UAE startups engage in international trade, making cross-border taxation crucial. Key considerations include:

- Double Taxation Avoidance Agreements (DTAs): The UAE has treaties with over 100 countries to prevent double taxation.

- Transfer Pricing Compliance: Transactions between related entities must follow market rates to avoid tax penalties.

- Withholding Tax Exemptions: The UAE generally does not impose withholding tax on outbound payments.

| Key Cross-Border Taxation Considerations | Details |

| Double Taxation Agreements | Prevents taxation in multiple jurisdictions |

| Transfer Pricing Regulations | Ensures fair pricing between related entities |

| Withholding Tax Exemptions | No tax on outbound payments in most cases |

🔎 Common Mistake: Failing to structure international transactions correctly may lead to unexpected tax liabilities.

7. Planning for Corporate Tax (Upcoming Regulations)

With corporate tax now in effect, startups should prepare by:

✅ Assessing Corporate Tax Applicability – If annual profits exceed AED 375,000, corporate tax applies.

✅ Maintaining Accurate Financial Statements – Proper accounting ensures compliance with tax laws.

✅ Structuring Business Operations for Tax Efficiency – Free Zone operations may help minimize tax burdens.

✅ Seeking Professional Tax Advice – Expert consultants can optimize tax planning.

| Corporate Tax Planning Strategies | Implementation Steps |

| Profit Assessment | Regular financial reviews to check tax liability |

| Tax-Efficient Structuring | Choosing Free Zones or exemptions where applicable |

| Professional Tax Advisory | Consulting experts to ensure compliance and savings |

📌 Tip: Implement tax-efficient strategies early to avoid hefty corporate tax liabilities.

Common Tax Mistakes UAE Startups Should Avoid

❌ Late VAT registration and incorrect filings.

❌ Poor bookkeeping and inadequate financial records.

❌ Overlooking tax exemptions and deductions.

❌ Ignoring corporate tax compliance under the new regime.

🔎 Key Insight: Tax mistakes can lead to fines, penalties, or even business closure.

Takeaways

Effective tax planning is crucial for UAE startups to optimize profits and maintain regulatory compliance. By leveraging 7 Tax Planning Strategies for Startups in UAE, businesses can reduce liabilities, take advantage of tax incentives, and ensure sustainable growth.

To navigate the UAE’s evolving tax landscape, startups should stay updated on regulatory changes and consult tax experts when necessary. Proactive tax planning today will secure long-term financial success!

Want to stay ahead with the latest tax planning insights? Subscribe to our newsletter for expert tips!