Are taxes eating your investment gains like hungry mice? Many people watch their nest egg shrink when they cash out stocks. They dread a big capital gains tax bill.

Here is a fact. Tax-deferred accounts let you delay income tax until you take money out. This post on Tax-Deferred Investment Strategies For Long-Term Growth will guide you. You will learn to use 401(k) plans, mutual funds, and IRAs to cut tax bites.

Keep reading.

Key Takeaways

- Max out tax-deferred and tax-free retirement accounts.Put up to $6,500 a year (or $7,500 if you’re 50+) into a traditional IRA and $22,500 (plus $7,500 catch-up at 50+) into a 401(k) to defer federal tax until you withdraw.Or fund a Roth IRA/401(k) with after-tax dollars, then take tax-free withdrawals after age 59½ and five years.Required minimum distributions begin at age 73.

- Use HSAs and 529 plans for extra tax breaks.HSA contributions are tax-deductible, grow tax-deferred, and pay no tax when used for qualified medical costs.A 529 plan grows tax-deferred, and withdrawals for college or K-12 tuition stay tax-free, with many states offering an extra deduction.

- Defer real estate gains and earn tax-free income with bonds.A 1031 exchange lets you swap like-kind properties and push capital gains tax down the road.Municipal bond interest stays federal tax-exempt, making it a solid choice in a taxable account.

- Place assets and choose tax-smart funds.Keep high-yield assets (corporate bond funds, REITs) in IRAs or HSAs to dodge current tax, and hold stock ETFs or growth funds in taxable or Roth accounts to tap lower capital gains rates.Use tax-managed mutual funds and ETFs to limit turnover.

- Harvest losses and hold long term.Sell losing positions to offset gains (up to $3,000 a year against ordinary income) and avoid wash-sale rules.Hold investments over one year to qualify for 15%–20% long-term capital gains rates instead of higher short-term rates.

Maximize Contributions to Traditional IRAs and 401(k)s

Each dollar you sock away in a traditional IRA may cut your federal taxable income. The IRS caps contributions at $6,500 in 2023, or $7,500 if you are 50 or older. A workplace 401(k) lets you stash up to $22,500 in 2023, and you add another $7,500 catch-up when you hit 50.

Those pre-tax contributions shrink ordinary income now, and fuel tax-deferred growth later.

Your money grows inside tax-deferred accounts until you withdraw it at retirement. Think of this account as a snowball; the sooner you feed it, the bigger it gets. Required minimum distributions begin the year you turn 73 under SECURE Act rules.

Participation in a workplace retirement plan can limit your IRA deduction above certain AGI levels.

Utilize Roth IRAs for Tax-Free Growth

Roth IRAs rank among top tax-advantaged accounts. You contribute after-tax money. The account offers tax-free growth once you satisfy IRS rules. You must wait until age 59.5 and hold the plan five years.

The IRS caps contributions each year and phases out eligibility at high incomes. A Roth 401(k) uses the same tax perks but lets you sock away more.

Your earnings escape ordinary income tax and rates on long term capital gains. You skip required minimum distributions, so you steer your income in retirement. Tax-exempt withdrawals give you budget room when you retire.

Use mutual funds, index funds or exchange traded funds to build your nest egg. Chat with a financial advisor to pick the right mix, and start early to let compound interest work its magic.

Invest in Health Savings Accounts (HSAs)

After you boost a Roth IRA, shift focus to a health savings account. Contributions qualify for a tax deduction, which lowers your taxable income, and funds grow with tax-deferred growth.

You can plug money into a brokerage account inside an HSA. Pick from index funds, mutual funds or exchange-traded funds for tax-efficient investing.

Qualified medical expenses lead to tax-free withdrawals for doctor visits, hospital stays or prescription drugs. Funds never expire, so you keep the balance from year to year, unlike flexible spending accounts.

After age 65, you can tap HSA cash for other costs, paying just ordinary income tax, with no penalty.

Leverage 529 Plans for Education Savings

A 529 Plan lets families save for college or K-12 tuition. It works as a tax-advantaged account where contributions grow tax-deferred, free of federal income tax until you take them out.

Many states offer tax deductions or credits on contributions, cutting state income tax bills. You get tax-free withdrawals for qualified costs if you use the money for tuition, fees, books, or room and board.

You can invest in mutual funds and exchange-traded funds inside this account, chasing growth without a heavy capital gains tax bite. It fits into a bigger asset allocation strategy alongside IRAs and municipal bonds.

Savers dodge ordinary income tax on earnings when they tap the funds for education. Anyone can open an account online or with a financial advisor, making tax-efficient investing easy.

Use Deferred Annuities for Retirement Income

After saving for school with a 529 plan, you can turn to deferred annuities for retirement income. A deferred annuity stands as a contract with a life insurance company. It offers tax-deferred growth and death benefits.

You pay premiums or a lump sum. The insurer credits interest income at a fixed rate or ties it to an index. The cash value remains in a tax-deferred account until you take payouts.

Clients keep them in retirement accounts for guaranteed income, like fixed income securities. A death benefit can protect heirs. The IRS waits until you receive payments to tax gains.

Taking money before age 59 triggers a 10 percent penalty. Required minimum distributions start at age 72. Consult a financial advisor and use an annuity calculator or a Monte Carlo tool to compare options.

Consider 1031 Exchanges for Real Estate Investments

Swap a rental home for another and kick capital gains taxes down the road. This property swap, called a 1031 exchange, stays within IRS rules on like-kind properties. Investors use this move to fuel tax-deferred growth and delay long-term capital gains taxes.

A CPA guides sale timing and helps find similar assets. Year-round tax planning cuts surprises in a high tax bracket.

CPA teams with a financial advisor to map out next steps. They use tax software to track sale dates and 45-day rules. This tag team helps clients dodge ordinary income spikes from big gains.

It feels like a relay race, handing off profits to the next hold. Smart investors ask a tax professional before listing to sync growth goals with tax law shifts.

Invest in Municipal Bonds for Tax-Exempt Income

Investors buy municipal bonds to earn federal tax-exempt interest. These bonds fit well inside brokerage accounts. Tax-free income also avoids net investment income tax.

Distributions from Traditional IRAs or 401(k) plans count as ordinary income. Municipal payouts stay tax-free only when from a Roth account. Some bonds still face AMT rules. States and local areas often tax bond interest.

Choose Tax-Managed Funds and ETFs

After you lock in tax-free income from municipal bonds, try funds that curb taxable events. Tax-managed mutual funds, index funds, and exchange-traded funds limit turnover and cut short-term capital gains tax.

They aim for long-term capital gains, to boost tax efficiency and net asset value gains.

Merrill Edge Self-Directed offers unlimited free online stock, ETF, and options trades; fees apply per contract. You can hold these funds in an investment account and run tax-loss harvesting strategies.

This move trims your income tax rate on qualified dividends and shields you from extra net investment income tax.

Strategically Place Assets in Tax-Deferred Accounts

Place corporate bond funds and real estate investment trust shares inside traditional IRAs, 401(k)s, or HSAs to dodge federal income taxes on interest and dividends. This tactic shields gains until withdrawal and pads retirement savings as interest rates climb.

Shift stock ETFs or growth mutual funds into taxable accounts so you tap long-term capital gains rates on qualified dividends and net investment income.

Stick slow-turnover assets, like small cap index funds, in Roth IRAs to grab tax-free withdrawals down the road. Let municipal bonds live in brokerage accounts, since their yields already dodge federal income taxes.

Watch required minimum distributions after age 73 to plan around ordinary income tax rates. Talk with a financial advisor and test scenarios on a retirement calculator to nail your allocation.

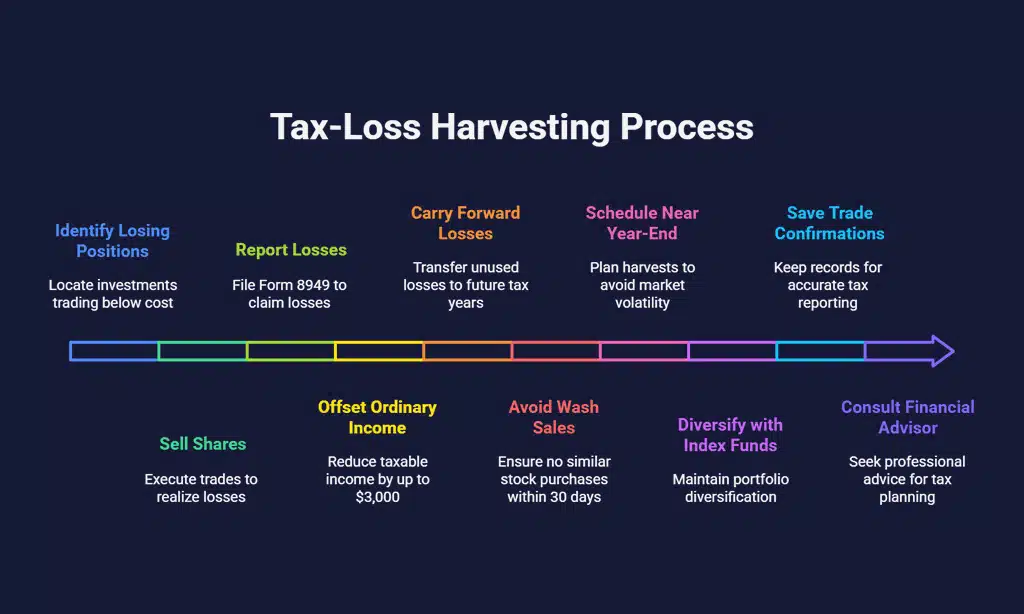

Harvest Tax Losses to Offset Gains

Harvesting tax losses can cut your tax bill. It uses short-term trading losses to offset gains.

- Identify losing positions in your investment platform that trade below cost, and mark shares to sell.

- Sell those shares to lock in short-term losses, which directly offset short-term capital gains.

- Report your losses on Form 8949, and cut your capital gains tax and net investment income tax.

- Offset up to $3,000 of losses against ordinary income each year, and track this IRS limit.

- Carry any extra losses into future years, reducing tax on future gains or income in taxable accounts.

- Steer clear of wash sale rules by avoiding buys of similar stock within thirty days before or after a sale.

- Schedule loss harvesting near year-end to dodge market swings and secure your loss in the right tax year.

- Blend tax-loss harvesting with index funds or ETFs to stay diversified in taxable accounts.

- Save all trade confirmations in your Bank of America investment account, or any brokerage, for accurate records.

- Consult a financial advisor to sync harvests with RMDs, salary boosts, or shifts in ordinary income.

Hold Investments Long-Term to Reduce Tax Liabilities

Moving beyond tax-loss harvesting, hold investments over a year to cut your capital gains tax. Brokerage accounts at Fidelity, Schwab or Vanguard track holding periods for exchange traded funds, stock funds, index funds and mutual funds.

This move triggers long-term capital gains rates. The IRS charges 15% for most. Top earners pay 20%. It adds a 3.8% net investment income tax on gains above certain thresholds. Short-term gains tax applies at ordinary income rates.

You bypass that.

Keep positions inside individual retirement accounts (IRAs) or 401(k)s for tax deferred growth. These tax deferred accounts also delay required minimum distributions, letting money compound.

You build a larger nest egg without an upfront tax hit. Inside taxable accounts, this approach trims capital gains tax. Talk to a financial advisor for state and local tax tips. Smart steps today can yield big wins in retirement.

Monitor and Adjust Strategies Regularly

Tax laws evolve, and market trends shift. You must check your holdings in tax-deferred accounts often.

- Schedule annual checkups to scan tax law changes, like net investment income tax hikes.

- Compare fund performance in your mutual funds and exchange-traded funds (ETFs), watch NAV swings.

- Examine your asset placement across tax-advantaged accounts, taxable accounts, and retirement accounts.

- Track required minimum distributions from IRAs and 401(k)s after age 72 to avoid penalties.

- Evaluate capital gains tax projections on long-term capital gains and qualified dividends.

- Rebalance portfolio holdings between index funds and municipal bonds for tax-efficient investing.

- Adjust contributions regularly in HSAs, 529 plans, and traditional IRA to meet limits.

- Consult Bank of America advisers or your CPA to review alternative minimum tax exposure.

- Monitor brokerage accounts and tax-managed funds for tax-loss harvesting opportunities.

Takeaways

Your toolkit shines with moves like maxing a Roth IRA, picking municipal bonds, and using an S&P 500 index fund. You can use a 1031 exchange to swap property without a tax hit. A tax-loss harvesting strategy can chew up short-term losses and cut capital gains bills.

Hold your REIT shares for years, avoid big taxes, then smile at a fatter nest egg. Review allocations each year and tweak them before RMDs kick in. These steps help your savings ride tax-deferred growth all the way home.

FAQs

1. What are tax-deferred accounts and how do they help with tax-deferred growth?

Tax-deferred accounts, like a traditional IRA or a retirement account, let you stash money before tax. They delay capital gains tax and net investment income tax until you take money out. That delay helps your money grow, tax-free now.

2. How do traditional IRA and Roth IRA differ in contributions and withdrawals?

In a traditional IRA, you make pre-tax contributions, then your withdrawals count as ordinary income. In a Roth IRA, you use after-tax contributions, and qualified distributions mean you enjoy tax-free withdrawals later.

3. How do municipal bonds, funds, and trusts lower my tax bills?

You can buy municipal bonds, ETFs, index funds, mutual funds, or real estate investment trusts in a taxable or tax-advantaged account. Many pay qualified dividends, they offer tax benefits, and you can watch net asset value, or NAV, to track your investment returns. They also help you spread risk, and use tax diversification.

4. What is tax-loss harvesting and how does it work in taxable accounts?

Tax-loss harvesting means you sell at a loss to cut taxable income on short-term capital gains or long-term capital gains. You then buy a similar asset after 30 days, to follow IRS rules. This trick trims your capital gains tax and tames your taxable income.

5. What are RMDs and qualified distributions in retirement accounts?

RMDs, or required minimum distributions, force you to take money from tax-deferred accounts once you hit a set age. Qualified distributions, like from a Roth IRA, follow special rules for tax-free withdrawals. It feels like breaking open a piggy bank when you need cash.

6. Do I need an advisor for my tax-advantaged investment decisions?

A financial advisor or investment adviser can guide you on tax-advantaged accounts, risk management, and the tax implications of state and local taxes. They help you pick the right brokerage accounts or bank options, and steer your investment decisions toward long-term growth.